Is Guohuijinrong safe?

Business

License

Is Guohuijinrong Safe or Scam?

Introduction

Guohuijinrong, a financial brokerage based in China, has entered the foreign exchange (forex) market with promises of transparency and customer-centric services. As forex trading continues to attract a vast number of traders globally, the importance of evaluating the legitimacy and safety of brokers cannot be overstated. Traders must exercise caution, as the forex market is rife with scams and unregulated entities that can jeopardize their investments. This article investigates whether Guohuijinrong is a safe investment option or a potential scam, utilizing a comprehensive evaluation framework that includes regulatory status, company background, trading conditions, customer feedback, and risk assessment.

Regulation and Legitimacy

Regulation is a cornerstone of trust in the financial services industry, ensuring that brokers adhere to strict guidelines designed to protect investors. Unfortunately, Guohuijinrong does not appear to be regulated by any major financial authority, which raises significant red flags regarding its legitimacy. A lack of regulation can indicate a higher risk of fraud and malpractice.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulatory oversight means that Guohuijinrong operates in a grey area of the financial market. This lack of regulation can lead to a lack of accountability, making it difficult for traders to seek redress in case of disputes. Additionally, negative feedback from users and reports of fraudulent activities associated with similar brokers further suggest that caution is warranted when dealing with Guohuijinrong. Overall, the lack of regulation is a significant indicator that IS Guohuijinrong safe is a question that remains unanswered positively.

Company Background Investigation

Guohuijinrong was established with the intent to provide a transparent and user-friendly trading experience. However, the companys history is somewhat opaque, with limited information available regarding its ownership structure and management team. This lack of transparency can be concerning for potential investors, as it raises questions about the credibility and reliability of the firm.

The management team‘s background is crucial in assessing the company’s trustworthiness. Unfortunately, detailed information on their qualifications and experience is scarce. A robust management team with a proven track record in finance could instill confidence in traders, but without this information, one cannot help but wonder about the competence and integrity of those at the helm.

Furthermore, the companys communication regarding its operations and policies is minimal, which is another indicator of potential risks. Without clear and accessible information, it is challenging for traders to make informed decisions. Consequently, the overall lack of transparency and information about Guohuijinrong leads to skepticism regarding its safety as a trading platform.

Trading Conditions Analysis

When considering whether IS Guohuijinrong safe, one must examine the trading conditions offered by the broker. Guohuijinrong presents a tiered account system with varying minimum deposits, which may appeal to different types of traders. However, the overall cost structure is not clearly outlined, and traders may encounter hidden fees that could affect their profitability.

| Fee Type | Guohuijinrong | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unknown | 1-3 pips |

| Commission Model | Unknown | Varies |

| Overnight Interest Range | Unknown | 0.5-1.5% |

The lack of clarity regarding spreads, commissions, and other trading costs can be a significant concern. Traders often rely on transparent fee structures to gauge the overall cost of trading, and the absence of this information from Guohuijinrong may indicate potential pitfalls. Furthermore, any unusual fees or policies could be a tactic to maximize profits at the expense of traders.

In summary, while the account types may seem appealing, the ambiguity surrounding trading costs raises questions about the broker's integrity and whether it truly provides a safe trading environment.

Customer Funds Security

An essential aspect of evaluating any broker is understanding how they safeguard customer funds. Guohuijinrong claims to prioritize the security of client funds, but without concrete details on their practices, it is difficult to ascertain the level of protection offered.

The broker's website does not provide sufficient information regarding fund segregation, investor protection schemes, or negative balance protection policies. These are critical components that help ensure clients' investments are secure. For example, reputable brokers often maintain client funds in segregated accounts to protect them from operational risks and insolvency.

Moreover, any historical incidents involving fund security or disputes would also be relevant. However, there is little information available regarding Guohuijinrong's track record in this area. This lack of transparency leads to concerns about whether IS Guohuijinrong safe for traders looking to protect their investments.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. In the case of Guohuijinrong, reviews from users reveal a mixed bag of experiences, with several complaints surfacing regarding withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Lack of Transparency | Medium | Minimal engagement |

| Poor Customer Support | High | Unresolved queries |

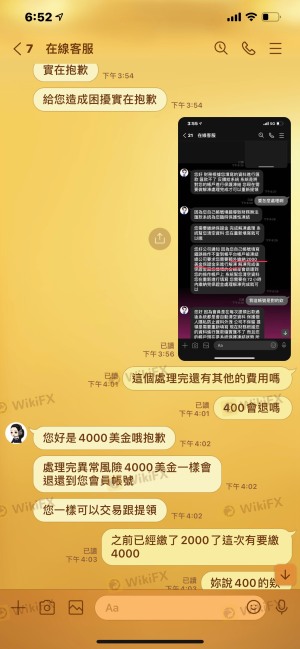

Common complaints include difficulties in withdrawing funds, which is a significant red flag for any broker. If a broker makes it challenging for clients to access their money, it raises concerns about their business practices and financial health. Additionally, the slow response time to customer queries indicates a lack of commitment to customer service, which can further frustrate traders.

Two notable case studies illustrate these issues: One trader reported being unable to withdraw funds for several weeks, leading to frustration and distrust. Another user noted that their inquiries about account details went unanswered for extended periods, highlighting the communication gap between the broker and its clients.

Platform and Trade Execution

A broker's trading platform is critical to the overall trading experience. Guohuijinrong offers a trading platform that claims to be user-friendly and efficient. However, user reviews suggest that the platform may experience stability issues, leading to concerns about order execution quality.

Traders have reported instances of slippage, where the execution price deviates from the expected price, as well as instances of order rejections. Such occurrences can significantly impact trading performance, especially for those employing scalping strategies or high-frequency trading methods.

Moreover, any signs of platform manipulation, such as artificially widening spreads during volatile market conditions, could further erode trust in the broker. Overall, while Guohuijinrong may present itself as a legitimate trading platform, the reported issues regarding execution quality raise questions about its safety and reliability.

Risk Assessment

The overall risk associated with using Guohuijinrong can be significant, especially given its lack of regulation and transparency. Traders must consider several factors when evaluating this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential for fund mismanagement |

| Operational Risk | Medium | Platform stability issues |

Given these risks, it is advisable for traders to approach Guohuijinrong with caution. To mitigate potential losses, traders should consider starting with a small investment, thoroughly reviewing all terms and conditions before committing funds, and ensuring they have a clear exit strategy.

Conclusion and Recommendations

In conclusion, the evidence suggests that Guohuijinrong may not be a safe option for forex trading. The lack of regulation, transparency, and numerous customer complaints raise substantial concerns about its legitimacy. Therefore, traders should exercise extreme caution and consider alternative brokers that are well-regulated and have a proven track record of reliability.

For those seeking safer trading environments, consider brokers regulated by reputable authorities such as the FCA or ASIC. These brokers typically offer better investor protections, clearer fee structures, and more reliable customer service. Ultimately, the question of whether IS Guohuijinrong safe leans towards a cautious "no," and traders are advised to explore more trustworthy options in the forex market.

Is Guohuijinrong a scam, or is it legit?

The latest exposure and evaluation content of Guohuijinrong brokers.

Guohuijinrong Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Guohuijinrong latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.