Is Greenpay-Investmentpty safe?

Business

License

Is Greenpay Investment Pty Safe or a Scam?

Introduction

Greenpay Investment Pty is a relatively new player in the forex market, positioning itself as a global investment fund institution that claims to offer secure and trusted capital investment services. With the rapid growth of online trading platforms, traders must exercise caution and conduct thorough evaluations of any broker they consider. The potential for fraud in the forex market is significant, with many platforms lacking proper regulation and transparency. This article aims to explore whether Greenpay Investment Pty is safe or a scam by analyzing its regulatory status, company background, trading conditions, customer fund safety, user experiences, and overall risk factors.

Regulation and Legitimacy

Understanding the regulatory environment is crucial when assessing the safety of any trading platform. Regulation serves as a protective measure for traders, ensuring that brokers adhere to specific standards and practices. Greenpay Investment Pty's regulatory status is concerning, as it lacks oversight from reputable financial authorities.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulatory oversight raises significant red flags. A lack of regulation often indicates that a broker may not be held accountable for its actions, potentially leading to fraudulent activities. Traders should be wary of platforms that operate without proper licensing, as these brokers may not have the necessary safeguards in place to protect client funds and ensure fair trading practices. Given that is Greenpay Investment Pty safe is a critical question, the lack of regulation suggests a higher risk for potential investors.

Company Background Investigation

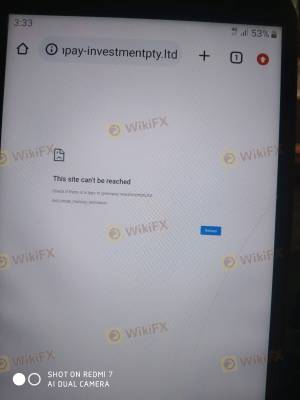

Greenpay Investment Pty was established in November 2022, making it a relatively young entity in the forex trading landscape. The company claims to provide a wide range of investment services, including forex trading, commodities, and cryptocurrency investments. However, the lack of detailed information regarding its ownership structure and management team raises concerns about its transparency.

The website does not disclose the identities of its owners or key management personnel, which is a common practice among legitimate brokers. Transparency is essential in building trust with potential clients, and the absence of this information may indicate an attempt to obscure the company's true nature. Furthermore, the company's brief history and limited online presence may suggest that it is not well-established, leading to questions about its reliability and operational stability.

Trading Conditions Analysis

When evaluating any broker, understanding the trading conditions they offer is vital. Greenpay Investment Pty presents a variety of investment plans with varying returns, which may seem enticing at first glance. However, the overall fee structure appears to be opaque, with limited information available regarding spreads, commissions, and overnight interest rates.

| Fee Type | Greenpay Investment Pty | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clear information on trading costs is concerning. Legitimate brokers typically provide detailed breakdowns of their fees, allowing traders to make informed decisions. The absence of such transparency could lead to unexpected costs, further complicating the trading experience. This lack of clarity prompts further investigation into whether is Greenpay Investment Pty safe for potential traders.

Customer Fund Safety

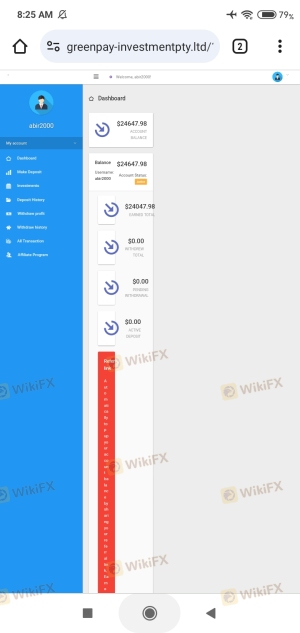

The safety of customer funds is paramount when choosing a trading platform. Greenpay Investment Pty claims to implement measures to protect client funds, such as segregating accounts and offering investor protection. However, without regulatory oversight, the effectiveness of these measures is questionable.

Traders should be aware of the importance of fund segregation, which ensures that client funds are held separately from the broker's operating funds. Additionally, negative balance protection can safeguard traders from losing more than their initial investment. The absence of documented policies on these critical safety measures raises concerns about the overall security of funds held with Greenpay Investment Pty.

Customer Experience and Complaints

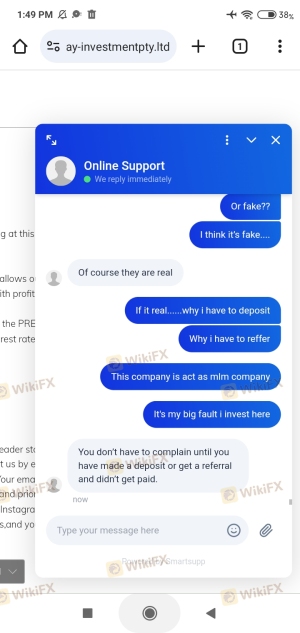

User feedback is a valuable resource when evaluating the reliability of a trading platform. Reviews and testimonials regarding Greenpay Investment Pty are predominantly negative, with many users expressing dissatisfaction with their experiences. Common complaints include difficulty withdrawing funds, lack of customer support, and unclear trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inconsistent |

| Transparency Concerns | High | Nonexistent |

Several users have reported being unable to access their funds after making deposits, which is a significant warning sign for potential investors. Additionally, the company's response to complaints appears to be lacking, further eroding trust. These patterns of user experience raise serious questions about whether is Greenpay Investment Pty safe for traders.

Platform and Execution

The performance and reliability of a trading platform are critical factors for traders. Greenpay Investment Pty offers a trading platform that claims to be user-friendly, but there are reports of technical issues, including slow execution times and slippage. Such problems can significantly impact trading outcomes, particularly for those employing high-frequency or scalping strategies.

Traders have also raised concerns about the possibility of order manipulation, which can occur when brokers interfere with trade executions. This issue further complicates the assessment of Greenpay Investment Pty's legitimacy and raises the question of whether traders can trust their platform.

Risk Assessment

Using Greenpay Investment Pty involves various risks that potential traders should consider. The absence of regulation, negative user experiences, and unclear trading conditions contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from reputable authorities |

| Fund Safety Risk | High | Lack of transparency regarding fund protection |

| Execution Risk | Medium | Reports of slippage and technical issues |

Potential traders must weigh these risks carefully and consider their risk tolerance before engaging with Greenpay Investment Pty. It is essential to remain vigilant and conduct thorough research to mitigate potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Greenpay Investment Pty carries significant risks for potential traders. The lack of regulatory oversight, negative user experiences, and unclear trading conditions raise serious concerns about the platform's safety and legitimacy. Therefore, it is crucial for traders to approach this broker with caution.

If you are considering investing in forex, it may be wise to explore alternative options that are regulated and have a proven track record of reliability. Brokers with established reputations and transparent trading conditions can provide a safer trading environment. Always prioritize due diligence to ensure that your trading experience is secure and trustworthy.

Ultimately, the question of whether is Greenpay Investment Pty safe leans towards a negative answer, and potential investors should exercise extreme caution before engaging with this broker.

Is Greenpay-Investmentpty a scam, or is it legit?

The latest exposure and evaluation content of Greenpay-Investmentpty brokers.

Greenpay-Investmentpty Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Greenpay-Investmentpty latest industry rating score is 1.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.