Regarding the legitimacy of Grand International forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is Grand International safe?

Business

License

Is Grand International markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

Clone FirmLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Grand International Futures Co., Limited

Effective Date:

2017-10-03Email Address of Licensed Institution:

lby@ydf.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.ydfgroup.com.hkExpiration Time:

--Address of Licensed Institution:

香港上環文咸西街57號餘慶大廈9樓D室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Grand International Safe or a Scam?

Introduction

Grand International Futures is a financial services firm based in Hong Kong, specializing in futures trading across various financial instruments, including foreign exchange, commodities, and indices. Established in 2016, the broker has positioned itself as a player in the forex market, catering to both individual and corporate clients. However, as the forex trading landscape continues to evolve, traders must exercise caution when selecting a broker. The potential for scams in the industry necessitates a thorough evaluation of any trading platform before committing funds. This article aims to provide a comprehensive analysis of Grand International, addressing its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation draws on multiple credible sources, including reviews and regulatory data, to assess whether Grand International is indeed safe or if it poses risks to traders.

Regulation and Legitimacy

The regulatory environment is crucial for assessing the safety of any forex broker. Grand International is regulated by the Securities and Futures Commission (SFC) of Hong Kong, which is known for its stringent oversight of financial institutions. Regulation by a reputable authority like the SFC adds a layer of credibility and protection for traders, ensuring that the broker adheres to strict operational standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | BJQ 086 | Hong Kong | Verified |

The SFC requires brokers to maintain client fund segregation, regular financial reporting, and robust risk management practices. This regulatory framework is designed to protect investors from fraudulent activities and provides a legal recourse in case of disputes. However, it is essential to consider the historical compliance of the broker. While Grand International is regulated, it has faced some scrutiny in the past regarding its operations and customer complaints.

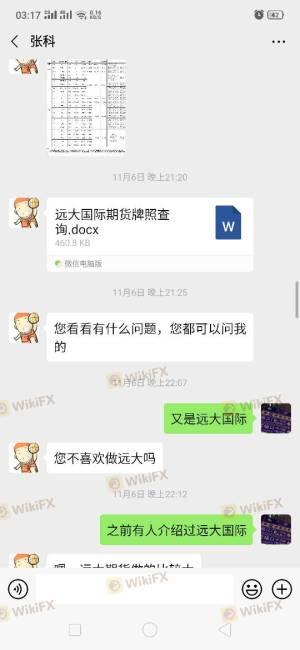

Company Background Investigation

Grand International Futures was founded in 2016 and has since established its headquarters in Sheung Wan, Hong Kong. The company focuses on providing tailored financial services, particularly in futures trading. The ownership structure is not explicitly disclosed, which raises some questions about transparency. However, the management team comprises professionals with backgrounds in finance and trading, contributing to the company's operational expertise.

The company appears to prioritize client needs, offering a diverse range of trading instruments and straightforward account opening processes. Despite this, the lack of detailed information on the companys ownership and management team may lead to concerns about transparency. A broker's transparency is vital for building trust with clients, and Grand International could improve in this area by providing more detailed disclosures about its leadership and operational practices.

Trading Conditions Analysis

When evaluating whether Grand International is safe, it is crucial to analyze its trading conditions, including fees and commissions. The broker offers a variety of trading instruments, but the overall cost structure is not entirely transparent.

| Fee Type | Grand International | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1-2 pips |

| Commission Model | Negotiable for large trades | Varies |

| Overnight Interest Range | Not specified | 0.5%-1.5% |

The absence of clear information on spreads and commissions can make it challenging for traders to assess the overall cost of trading with Grand International. Additionally, the negotiable commission model for large trades may benefit high-volume traders but could be a disadvantage for smaller traders who may not receive the same level of flexibility.

Customer Funds Safety

The safety of customer funds is a significant concern for any trader, and Grand International claims to have measures in place to protect client assets. The broker states that it practices fund segregation, ensuring that client funds are kept separate from company operational funds. This practice is critical for safeguarding investor capital and is a standard requirement for regulated brokers.

Moreover, the SFC's regulations require brokers to maintain a certain level of capital and adhere to strict financial practices. However, there have been historical complaints regarding withdrawal issues and difficulties faced by clients in accessing their funds. Such reports raise concerns about the broker's operational integrity and its commitment to safeguarding customer assets.

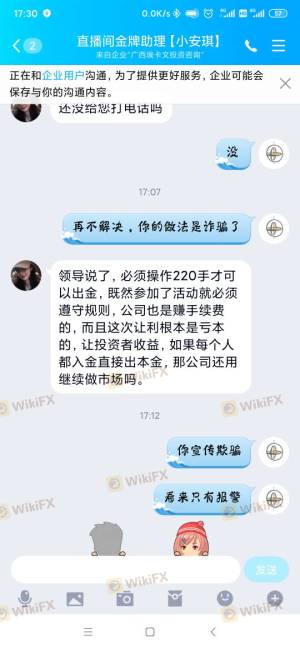

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews of Grand International reveal a mixed bag of experiences. While some users report positive trading experiences, others have expressed frustrations, particularly regarding withdrawal processes and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| Platform Issues | High | Unresolved |

Typical complaints involve clients experiencing delays in withdrawals and difficulties in contacting customer support. For instance, there have been cases where clients reported being unable to access their accounts or facing prolonged delays in fund withdrawals. Such issues can significantly affect a trader's experience and raise red flags about the broker's operational practices.

Platform and Trade Execution

The performance of a trading platform is crucial for successful trading. Grand International utilizes the Yisheng Polar Star 9.3 trading platform, which promises a user-friendly interface and efficient trade execution. However, user experiences indicate that there may be issues with order execution, including slippage and rejected orders.

Traders have reported instances of slippage during volatile market conditions, which can lead to unexpected losses. Furthermore, concerns about the platform's stability have been raised, with some users alleging that they faced difficulties logging in during critical trading times. These factors contribute to the overall risk profile of using Grand International.

Risk Assessment

When considering whether Grand International is safe, it is important to evaluate the associated risks.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Regulated but complaints exist |

| Customer Support | High | Slow response to issues |

| Withdrawal Process | High | Reports of delays and issues |

The risks associated with trading through Grand International include regulatory compliance concerns, customer support challenges, and potential issues with fund withdrawals. Traders should approach this broker with caution and consider these risks when deciding to engage in trading activities.

Conclusion and Recommendations

In conclusion, while Grand International is a regulated broker operating in the Hong Kong financial market, several factors raise concerns about its overall safety. The regulatory oversight by the SFC adds a layer of credibility, but the history of customer complaints, issues with fund withdrawals, and lack of transparency regarding management are significant red flags.

For traders considering using Grand International, it is essential to weigh these risks carefully. If you are a beginner or risk-averse trader, seeking a broker with a stronger reputation for customer service and operational integrity might be wise. Alternative options could include brokers with higher regulatory standards and proven track records of client satisfaction.

Ultimately, the question remains: Is Grand International safe? While it operates under regulation, potential clients should conduct thorough due diligence and consider the highlighted risks before proceeding.

Is Grand International a scam, or is it legit?

The latest exposure and evaluation content of Grand International brokers.

Grand International Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Grand International latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.