Is Global FT Market safe?

Business

License

Is Global FT Market Safe or a Scam?

Introduction

Global FT Market positions itself as an international forex brokerage, claiming to offer a wide array of financial instruments to traders worldwide. Established in 2021, it operates from Saint Vincent and the Grenadines, a jurisdiction often scrutinized for its regulatory laxity. As the forex market continues to grow, the number of brokers has surged, making it imperative for traders to exercise caution when selecting a trading partner. This article aims to evaluate whether Global FT Market is a safe option for traders or if it raises red flags that suggest it may be a scam. The assessment is based on a thorough investigation of its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a brokerage is crucial in determining its safety and legitimacy. Global FT Market is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory framework. According to various sources, it lacks oversight from any major financial regulatory authority, which is a significant concern for potential investors. Below is a summary of its regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unregulated |

The absence of a valid regulatory license means that traders have limited recourse in case of disputes or issues with fund withdrawals. This lack of oversight raises questions about the broker's operational integrity and financial stability. Moreover, the high leverage ratios offered (up to 1:1000) are typically associated with unregulated brokers, further indicating a riskier trading environment. Historical compliance issues in offshore jurisdictions amplify these concerns, making it essential for traders to be diligent in their research.

Company Background Investigation

Global FT Market was established in 2021 and claims to have a presence in multiple countries, including Singapore, Poland, Brazil, and Dubai. However, the veracity of these claims remains questionable, as there is no substantiated evidence of regulatory licenses in these regions. The ownership structure of the brokerage is also unclear, which is a common trait among many offshore brokers. Transparency is a critical factor in assessing a broker's reliability, and Global FT Market does not provide sufficient information regarding its management team or their qualifications.

The company's website offers limited insights into its operational practices and corporate governance. This lack of transparency can be a red flag, as it may indicate that the brokerage is not fully committed to ethical business practices. Additionally, the absence of a robust customer support system can lead to further complications for traders seeking assistance. Overall, the company's lack of transparency and questionable ownership structure contribute to the skepticism surrounding its legitimacy.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is vital. Global FT Market claims to offer competitive trading conditions, including tight spreads and various account types. However, the minimum deposit requirement is notably high at $500, which is significantly above the industry average. Below is a comparison of core trading costs:

| Cost Type | Global FT Market | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 - 1.5 pips | 1.0 - 1.5 pips |

| Commission Model | $3 per lot (for some accounts) | $0 - $2 per lot |

| Overnight Interest Range | Varies by account | Varies by account |

While the spreads may seem competitive, the high minimum deposit and commission structure can deter novice traders. Furthermore, the lack of clarity regarding additional fees—such as withdrawal fees or inactivity charges—raises concerns. Many traders have reported difficulties in withdrawing funds, which is a common issue with unregulated brokers. This lack of transparency in fees can lead to unexpected costs, further complicating the trading experience.

Client Fund Security

The security of client funds is paramount when assessing a broker's safety. Global FT Market does not provide clear information on its fund security measures. The absence of segregated accounts and investor protection schemes is alarming. In regulated environments, brokers are often required to keep client funds in separate accounts to ensure that they are not misused. However, Global FT Markets operating jurisdiction does not impose such regulations, leaving client funds vulnerable.

Moreover, the broker does not appear to offer negative balance protection, which can expose traders to significant financial risks. Historical complaints about withdrawal issues and fund safety concerns have been reported by users, raising further questions about the broker's reliability. Without robust safety measures in place, traders are left with little assurance regarding the security of their investments.

Customer Experience and Complaints

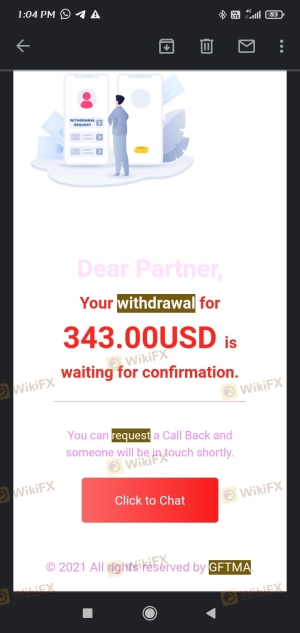

Customer feedback is often a reliable indicator of a broker's operational quality. Reviews for Global FT Market reveal a pattern of dissatisfaction among users, particularly regarding withdrawal processes and customer support. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delay | Medium | Average |

| Account Management | High | Poor |

Many users have reported being unable to withdraw their funds for extended periods, with some claiming to have waited months for their requests to be processed. The companys slow response to customer inquiries adds to the frustration, leading to a lack of trust among traders. These complaints highlight significant operational shortcomings and suggest that potential clients should approach Global FT Market with caution.

Platform and Execution

The trading platform offered by Global FT Market is the widely-used MetaTrader 4 (MT4), known for its robust features and user-friendly interface. However, the performance metrics related to order execution are critical for traders. Users have reported instances of slippage and order rejections, which can adversely affect trading outcomes. While MT4 is generally reliable, the broker's execution quality may not meet the expectations of all traders.

Additionally, the potential for platform manipulation is a concern, particularly with unregulated brokers. Traders should be wary of any signs that suggest their trades are not being executed as intended. Overall, while the platform itself is reputable, the broker's handling of execution may raise questions about its reliability.

Risk Assessment

Engaging with Global FT Market involves several risks that traders must consider. Below is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Withdrawal Risk | High | Reports of withdrawal issues and delays. |

| Transparency Risk | Medium | Lack of clear information about fees and operations. |

To mitigate these risks, traders are advised to conduct thorough due diligence before committing funds. Utilizing smaller amounts for initial trades, seeking regulated alternatives, and maintaining skepticism regarding promotional offers can help safeguard investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that Global FT Market raises significant concerns regarding its safety and legitimacy. The absence of regulation, coupled with reports of withdrawal issues and poor customer service, indicates that traders should exercise extreme caution. While the trading conditions may appear attractive at first glance, the underlying risks associated with this broker make it a questionable choice.

For traders seeking reliable alternatives, it is advisable to consider brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC. These brokers typically offer enhanced security measures, better customer service, and transparent trading conditions, making them safer options in the forex market. Overall, while Global FT Market may offer enticing features, the potential for fraud and operational issues far outweighs the benefits, making it essential for traders to seek safer, more trustworthy alternatives.

Is Global FT Market a scam, or is it legit?

The latest exposure and evaluation content of Global FT Market brokers.

Global FT Market Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Global FT Market latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.