Regarding the legitimacy of Global Capital forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is Global Capital safe?

Risk Control

Software Index

Is Global Capital markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Global Capital Securities & Financial Services Ltd

Effective Date:

2003-05-12Email Address of Licensed Institution:

info@globalcapital.com.cySharing Status:

No SharingWebsite of Licensed Institution:

www.globalcapital.com.cyExpiration Time:

--Address of Licensed Institution:

50 Arch. Makarios C Avenue, Alpha House, 1st floor, CY-1065, NicosiaPhone Number of Licensed Institution:

35722710710Licensed Institution Certified Documents:

Is Global Capital A Scam?

Introduction

Global Capital is an online brokerage that positions itself within the forex and cryptocurrency markets. It claims to offer a range of trading services, including access to various financial instruments, appealing to both novice and experienced traders. However, the increasing number of scams in the forex industry necessitates that traders exercise caution when selecting brokers. The potential for fraud is high, especially with unregulated entities that may not have the best interests of their clients in mind. In this article, we will conduct a thorough investigation into Global Capital, focusing on its regulatory status, company background, trading conditions, customer safety, client experiences, and overall risk assessment. Our analysis is based on various credible sources and user feedback, ensuring a comprehensive evaluation of whether Global Capital is indeed safe or a potential scam.

Regulation and Legitimacy

Regulation is a crucial aspect of any brokerage firm, as it ensures that the company adheres to specific standards that protect investors. Global Capital's regulatory status has raised concerns among industry experts. Currently, it is not regulated by any top-tier financial authority, which significantly diminishes its credibility. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that Global Capital does not have to comply with the stringent requirements set forth by reputable financial authorities such as the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission). This lack of oversight can lead to questionable practices, including unfair pricing and lack of transparency. Furthermore, the FCA has previously warned against Global Capital due to its unauthorized operations, which raises significant red flags for potential investors.

Company Background Investigation

Global Capital has presented itself as a legitimate brokerage, but a closer look reveals a lack of transparency regarding its ownership and operational history. The company claims to be based in the United Kingdom; however, there is no verifiable information to support this claim. This obscurity raises questions about the company's legitimacy and operational practices.

The management team's background is also unclear, with little information available about their qualifications or experience in the financial industry. A reputable broker typically provides detailed information about its leadership and their professional backgrounds, which is essential for building trust with potential clients. Unfortunately, Global Capital does not meet these expectations, leading to further skepticism about its reliability.

Trading Conditions Analysis

When assessing whether Global Capital is safe, it is crucial to examine its trading conditions. The brokerage offers various account types, each with different minimum deposit requirements and promised returns. However, the promised yields are alarmingly high, which is often a tactic used by fraudulent brokers to lure in unsuspecting clients.

| Fee Type | Global Capital | Industry Average |

|---|---|---|

| Spread on Major Pairs | High | Medium |

| Commission Structure | None | Varies |

| Overnight Interest Range | High | Low |

The above table highlights that the spreads offered by Global Capital are higher than industry averages, which could significantly impact trading profitability. Additionally, the absence of a clear commission structure raises concerns about hidden fees that could be detrimental to traders. The overall cost structure appears to be less favorable compared to established brokers, which is another indicator that Global Capital may not be a safe choice for trading.

Client Funds Safety

The safety of client funds is paramount in any brokerage evaluation. Global Capital has provided limited information regarding its fund protection measures. There is no evidence of segregated accounts, which are essential for protecting client deposits from the broker's operational funds. Furthermore, the lack of investor protection schemes means that traders could potentially lose their entire investment without any recourse.

In terms of negative balance protection, there is no indication that Global Capital offers this feature, which is critical for ensuring that clients do not owe money to the broker after a loss. The absence of these safety measures is concerning and suggests that Global Capital may not prioritize the security of its clients' funds.

Customer Experience and Complaints

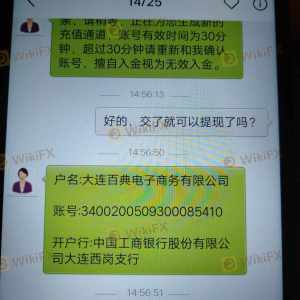

Analyzing customer feedback is crucial in determining whether Global Capital is a safe option for traders. Reviews indicate a pattern of complaints regarding withdrawal issues, high-pressure sales tactics, and lack of responsiveness from customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| High-Pressure Sales | Medium | Poor |

| Lack of Transparency | High | Poor |

Many users have reported difficulties in withdrawing their funds, often citing unexplained delays or outright refusals. Such practices are commonly associated with scam brokers, where the primary goal is to retain client funds rather than facilitate legitimate trading. Additionally, the company's response to complaints is generally poor, indicating a lack of commitment to customer service and satisfaction.

Platform and Trade Execution

The trading platform offered by Global Capital is another area of concern. User experiences suggest that the platform may suffer from performance issues, including slow execution times and occasional crashes.

Traders have reported instances of slippage, where the execution price differs from the expected price, leading to additional losses. Furthermore, there are allegations of potential manipulation, which is a serious accusation that could indicate fraudulent practices. A reliable broker should provide a stable trading environment with minimal disruptions, which does not appear to be the case with Global Capital.

Risk Assessment

When considering whether Global Capital is safe, it is essential to evaluate the overall risk associated with trading through this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Risk | High | High spreads, hidden fees |

| Operational Risk | Medium | Platform performance issues |

The combined risks suggest that trading with Global Capital could lead to significant financial losses, especially for inexperienced traders. It is advisable to proceed with caution and consider alternative brokers that offer better regulatory oversight and customer protection.

Conclusion and Recommendations

Based on the evidence presented, it is clear that Global Capital is not a safe broker. The lack of regulation, questionable trading conditions, and numerous customer complaints indicate that potential investors should exercise extreme caution.

For traders seeking a reliable and secure trading environment, it is recommended to consider established brokers regulated by reputable authorities. Such brokers provide necessary protections and transparency, ensuring a safer trading experience. In summary, Global Capital exhibits several characteristics commonly associated with scam brokers, and it is prudent for traders to avoid engaging with this entity.

Is Global Capital a scam, or is it legit?

The latest exposure and evaluation content of Global Capital brokers.

Global Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Global Capital latest industry rating score is 6.15, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.15 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.