Global Capital Review 1

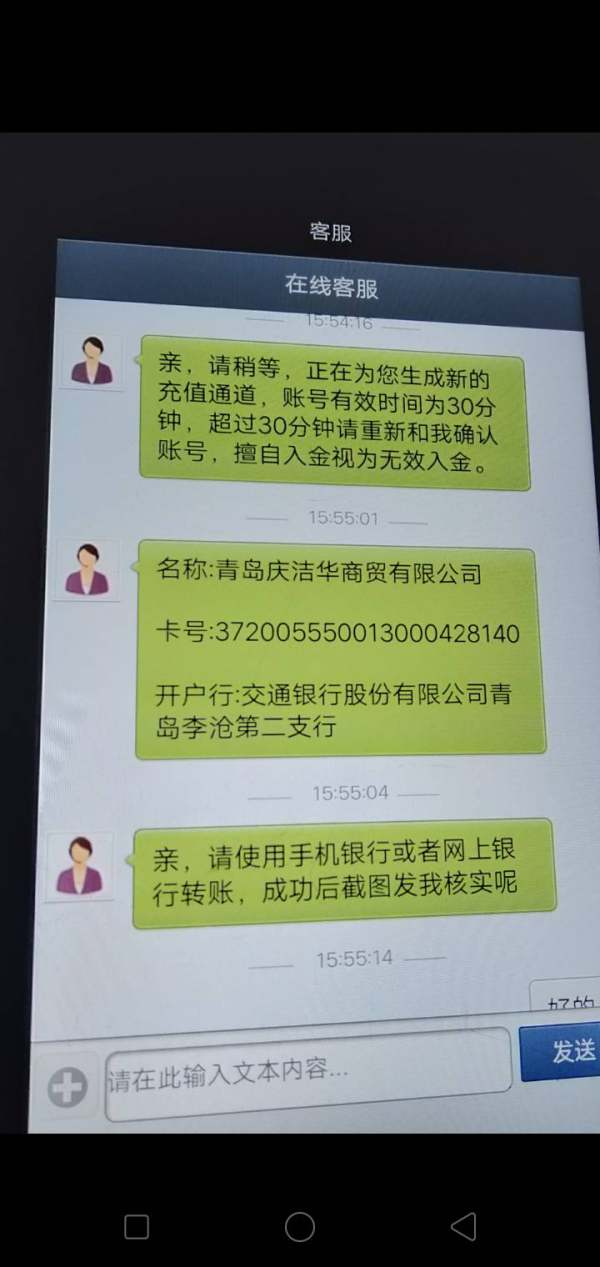

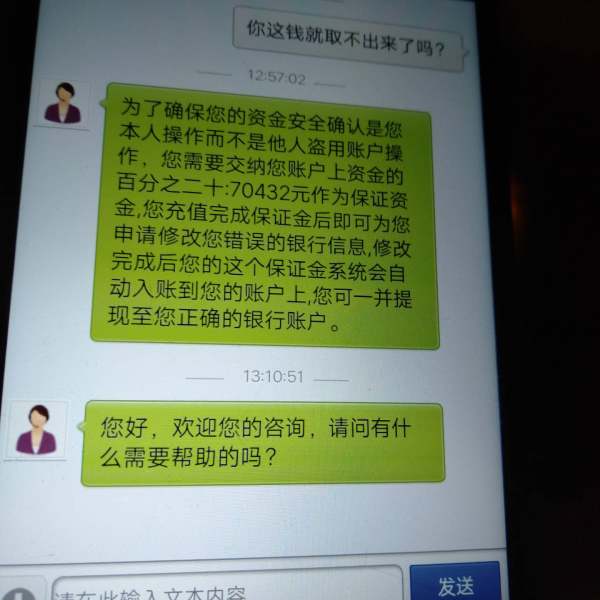

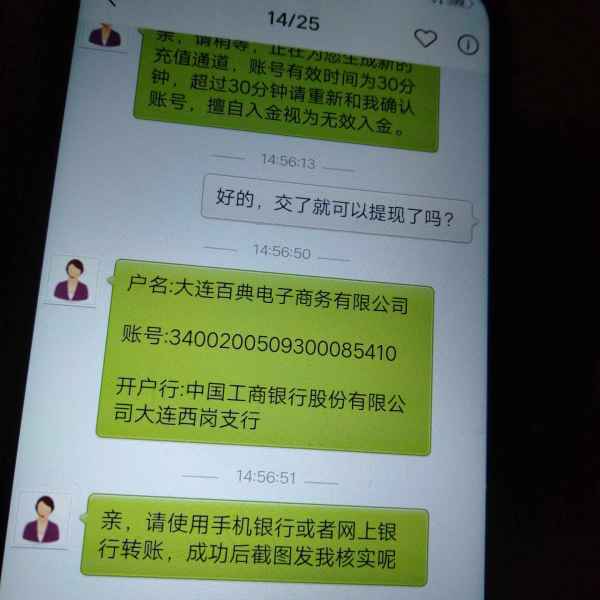

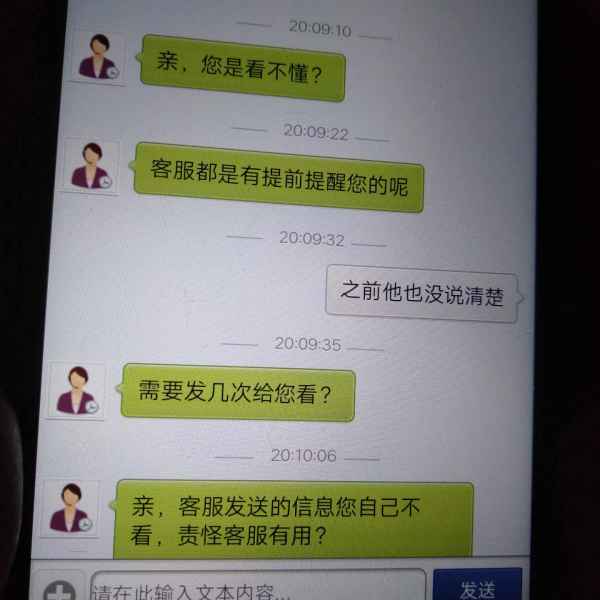

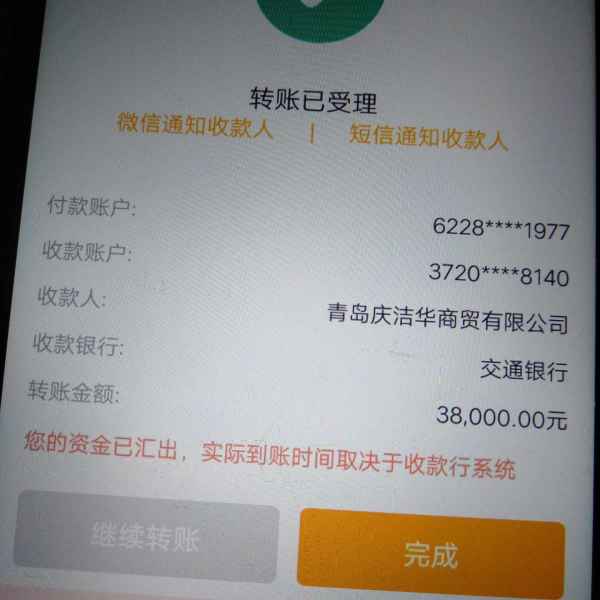

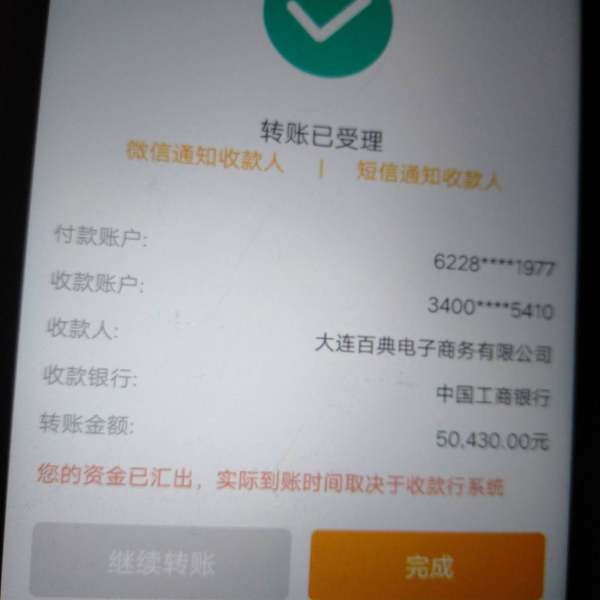

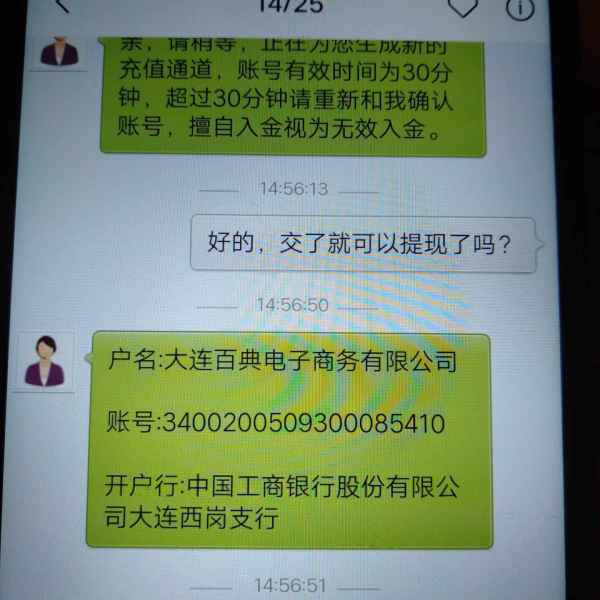

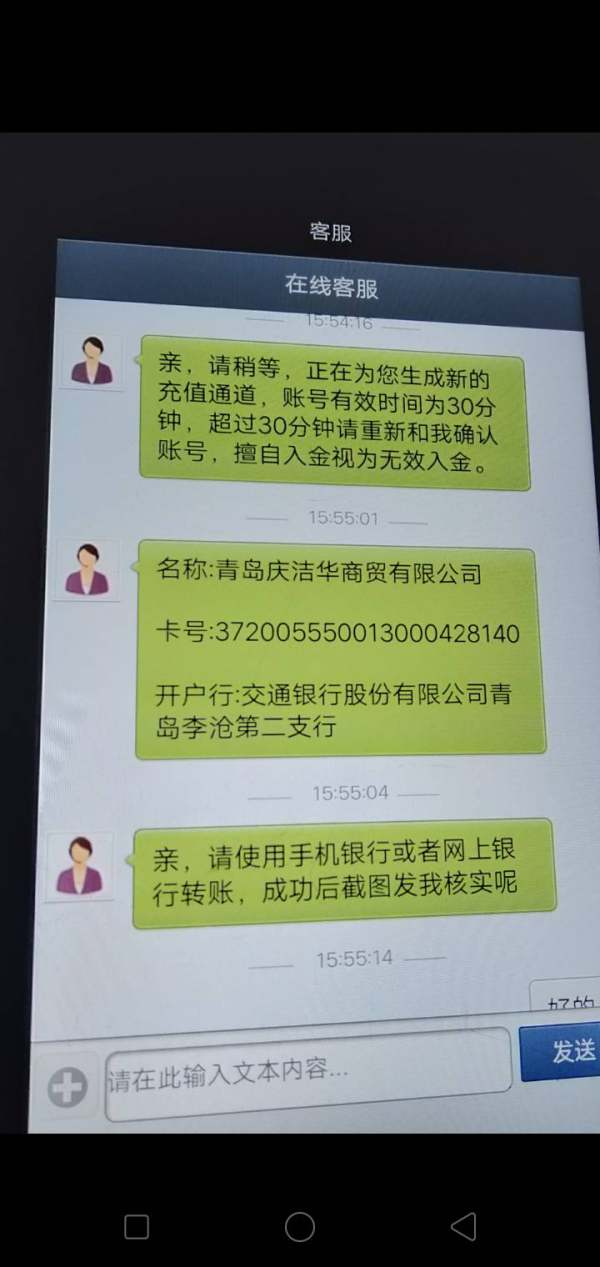

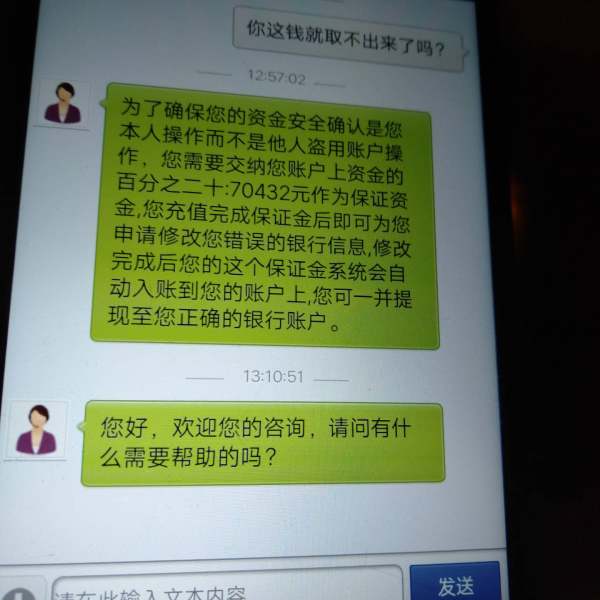

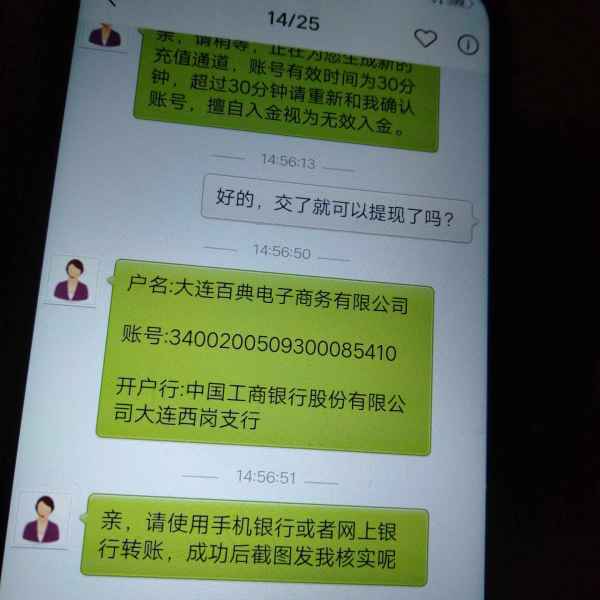

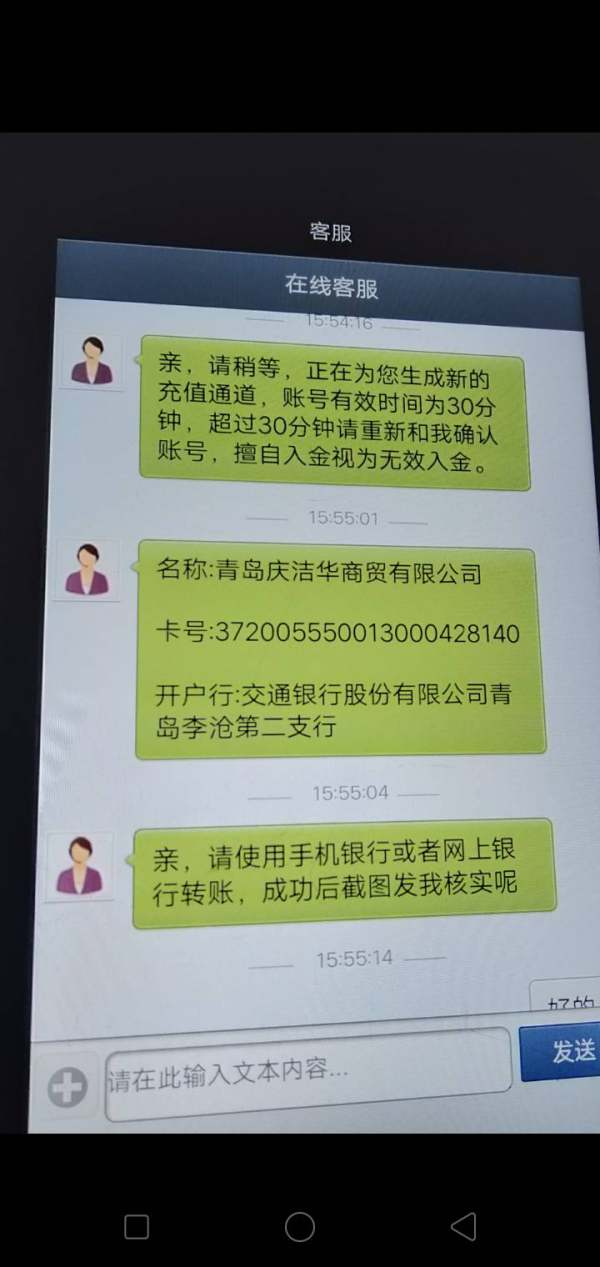

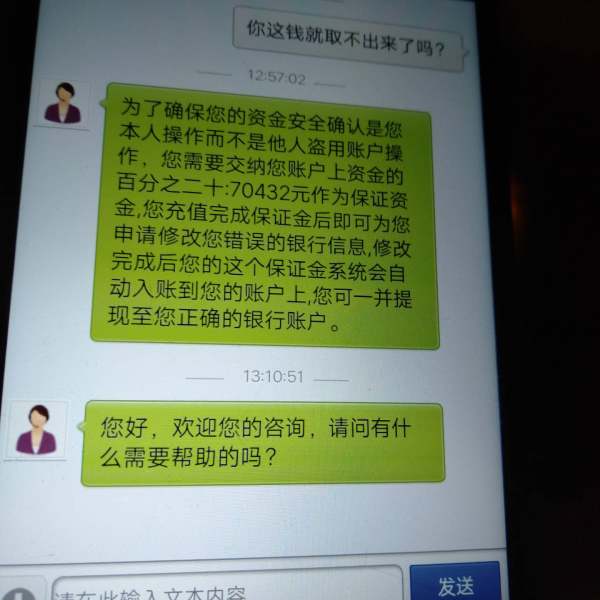

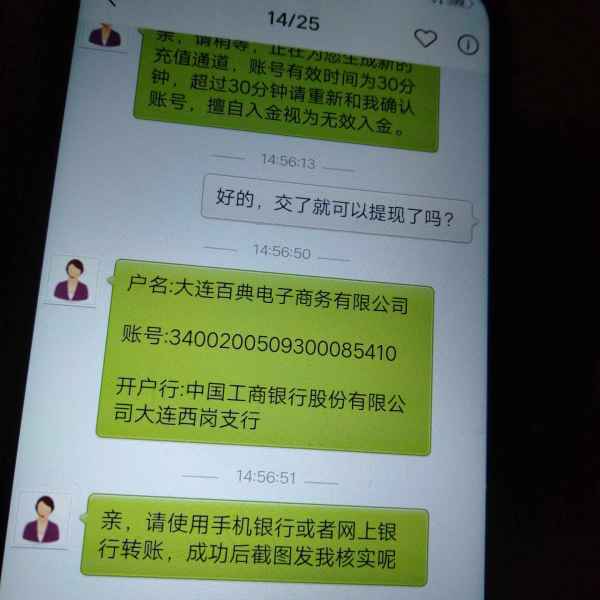

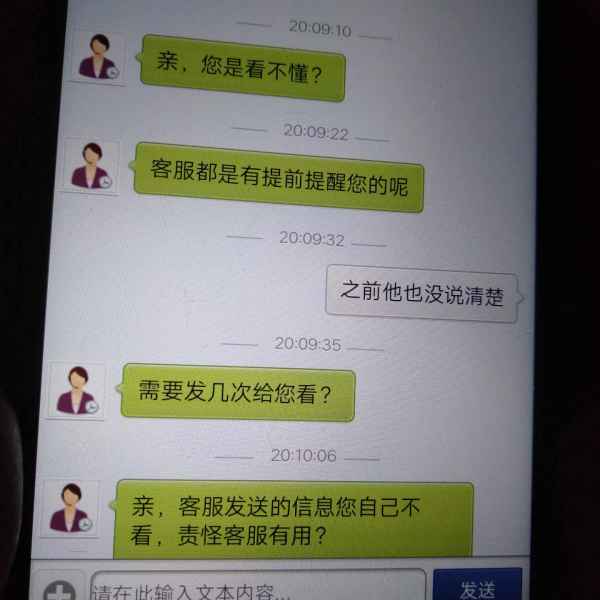

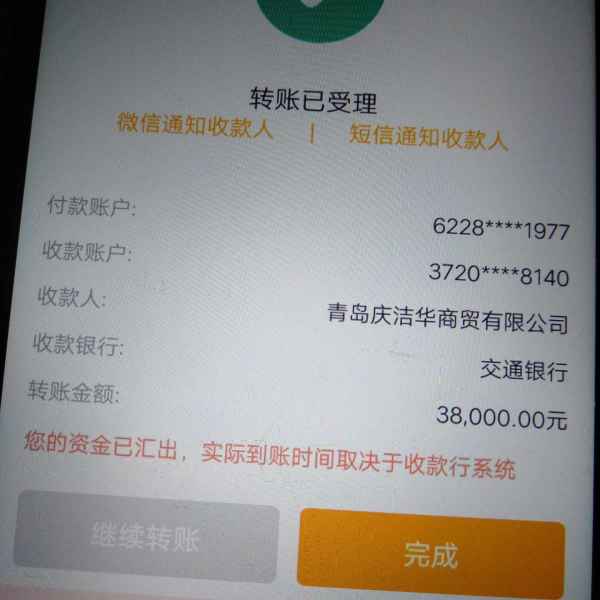

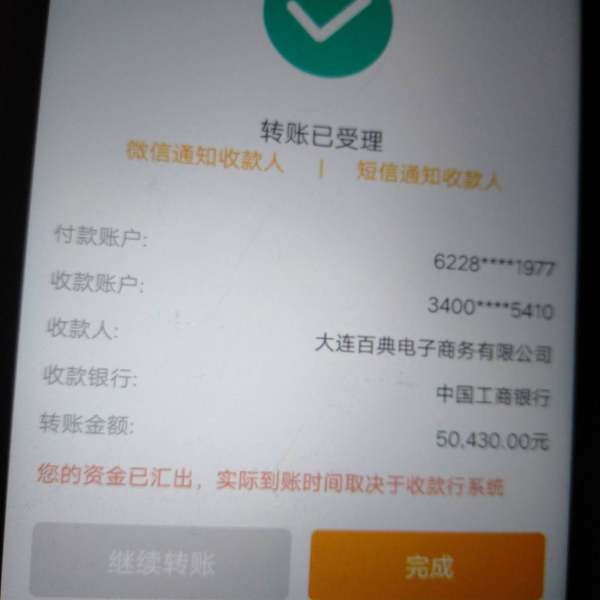

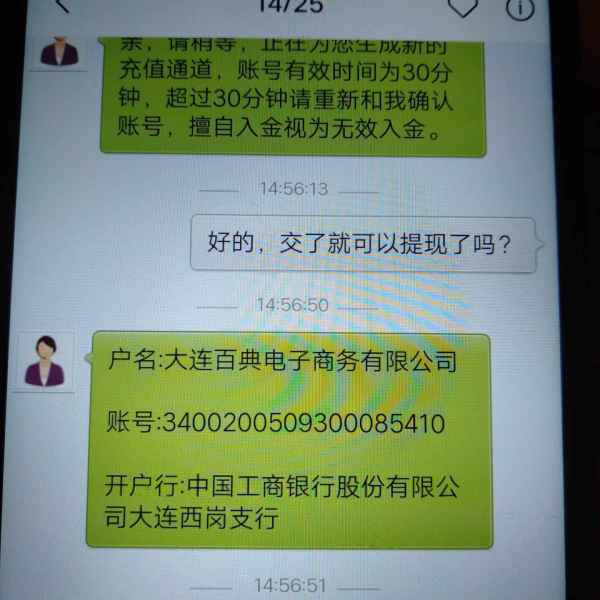

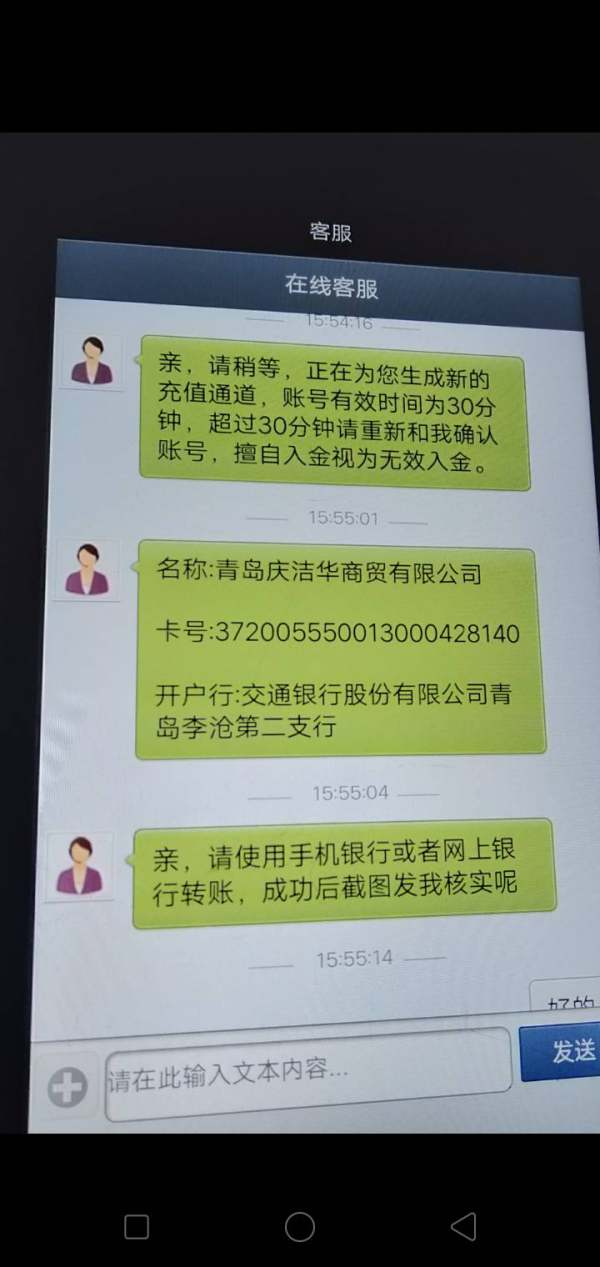

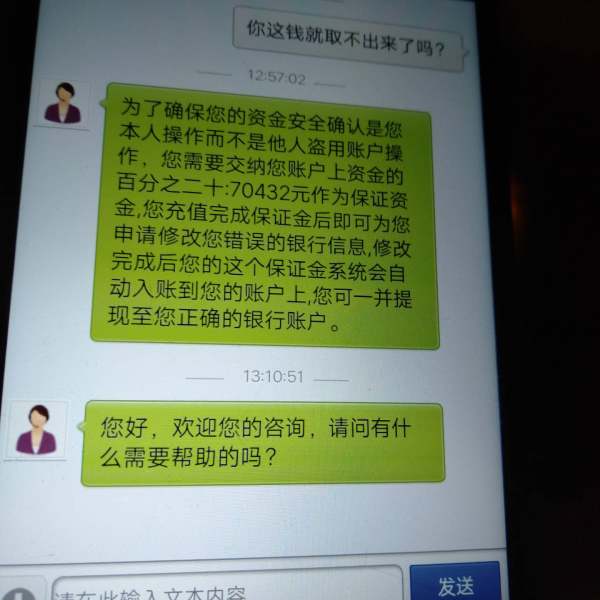

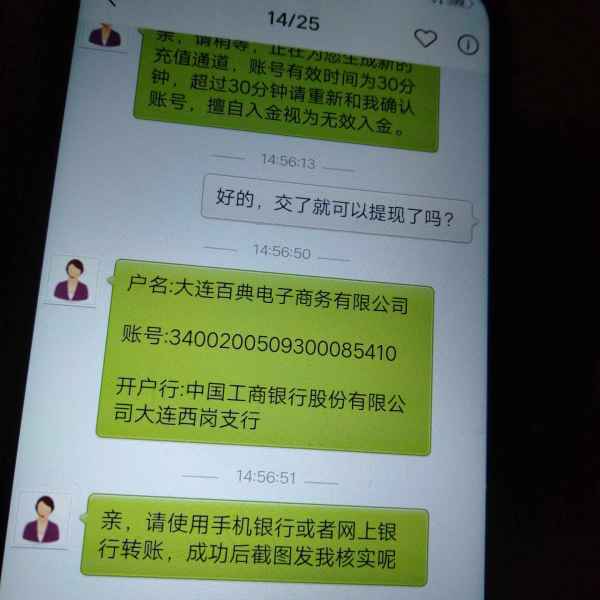

A 20% margin is asked before withdrawal. Give back my $15000 fund, fraud.

Global Capital Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Risk Control

Software Index

A 20% margin is asked before withdrawal. Give back my $15000 fund, fraud.

Global Capital presents a mixed proposition for traders seeking international market access in 2025. This global capital review shows a brokerage that offers competitive commission structures but faces big challenges in regulatory transparency and user trust based on available market information and user feedback. The broker charges commissions as low as 0.50% with a minimum fee of €5. It maintains a relatively accessible entry point with a €20 account opening fee. Global Capital provides access to multiple asset classes including mutual funds and offers various trading platforms such as Interactive Brokers, XNET, and Swissquote. However, the lack of clear regulatory oversight significantly impacts its trustworthiness rating. The platform appears most suitable for experienced traders who prioritize low-cost international market access over regulatory security. Potential users should exercise considerable caution given the transparency concerns surrounding the broker's operations.

This Global Capital review is based on publicly available information and user feedback as of 2025. Potential clients should note that regulatory information for Global Capital remains unclear in available documentation. This presents significant due diligence challenges. Our evaluation methodology incorporates user testimonials, fee structures, platform offerings, and available operational data. However, the absence of clear regulatory credentials means traders should conduct additional independent research before committing funds. Cross-regional entity differences may apply. Users in different jurisdictions should verify local compliance requirements independently.

| Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 5/10 | Average |

| Tools and Resources | 6/10 | Above Average |

| Customer Service | 4/10 | Below Average |

| Trading Experience | 5/10 | Average |

| Trustworthiness | 3/10 | Poor |

| User Experience | 4/10 | Below Average |

| Overall Score | 4.5/10 | Below Average |

Global Capital was established in 2003 and operates as an international brokerage firm headquartered in Cyprus. The company positions itself as a comprehensive financial services provider. It offers brokerage services, international market access, asset management, investment advisory, and corporate consulting services. With over two decades in operation, Global Capital has built its business model around connecting investors with global financial markets. The company particularly focuses on European and international trading opportunities.

The broker's primary business model centers on providing intermediary services between retail investors and institutional markets. This global capital review finds that the company emphasizes its role as a gateway to international investments. It offers access to multiple asset classes including mutual funds and various financial instruments. Global Capital supports several trading platforms including market orders through Interactive Brokers, XNET, and Swissquote. This provides clients with diverse technological options for executing their trading strategies. However, the available information lacks specific details about regulatory oversight. This raises important considerations for potential clients evaluating the broker's credibility and operational security.

Regulatory Status: Available documentation does not clearly specify Global Capital's regulatory jurisdictions or oversight bodies. This represents a significant transparency gap for potential clients.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees for deposits and withdrawals is not detailed in available materials.

Minimum Deposit Requirements: The broker requires a €20 account opening fee. This serves as the minimum entry requirement for new clients.

Bonus and Promotions: Current promotional offerings, welcome bonuses, or ongoing incentive programs are not specified in available documentation.

Tradeable Assets: Global Capital provides access to multiple asset classes. The broker offers confirmed availability of mutual funds and various international financial instruments across different markets.

Cost Structure: The broker operates on a commission-based model with rates starting at 0.50% per transaction. All transactions are subject to a minimum fee of €5. Specific spread information and additional trading costs are not detailed in available materials.

Leverage Ratios: Information regarding maximum leverage ratios and margin requirements is not specified in current documentation.

Platform Options: Clients can access markets through multiple platforms including Interactive Brokers, XNET, Swissquote, and direct market order systems. This provides technological flexibility for different trading styles.

Geographic Restrictions: Specific regional limitations or restricted territories are not clearly outlined in available information.

Customer Support Languages: Available language support for customer service is not specified in current documentation.

This global capital review identifies significant information gaps that potential clients should address through direct broker contact before proceeding with account opening.

Global Capital's account structure presents a mixed value proposition for traders. The €20 account opening fee represents a relatively low barrier to entry compared to many international brokers. This makes initial access affordable for new clients. The commission structure of 0.50% with a minimum €5 fee per transaction falls within competitive ranges for international market access. However, it may impact high-frequency trading strategies that rely on small, frequent trades.

This global capital review identifies several limitations in account offerings that affect the overall rating. The available documentation lacks specific information about different account tiers, special features for high-volume traders, or premium service options. The absence of detailed account type descriptions makes it difficult for potential clients to understand what services and benefits align with their trading needs. Additionally, the account opening process details, verification requirements, and timeline expectations are not clearly specified in available materials.

User feedback regarding account conditions appears neutral overall. There are no significant complaints about fee structures but also limited positive endorsements of special features or exceptional value propositions. The lack of comprehensive account information suggests that potential clients would need to engage directly with the broker to understand the full scope of available account options and associated benefits.

Global Capital demonstrates reasonable technological infrastructure through its support of multiple trading platforms including Interactive Brokers, XNET, and Swissquote. This multi-platform approach provides clients with flexibility to choose systems that align with their trading preferences and technical requirements. The availability of market order functionality across these platforms suggests adequate execution capabilities for standard trading operations. However, advanced features and proprietary tools remain unclear from available documentation.

The broker's asset class diversity, including mutual funds and various international instruments, indicates reasonable market access breadth for different investment strategies. This global capital review notes the absence of detailed information about proprietary research tools, market analysis resources, or educational materials that could enhance the trading experience. Advanced trading features such as algorithmic trading support, advanced charting tools, or specialized order types are not specifically documented in available materials. This limits the assessment of the platform's capabilities for sophisticated trading strategies.

User feedback on platform functionality appears moderate overall. There are no significant technical complaints but also limited enthusiasm about innovative features or superior technological capabilities compared to competitors. The reliance on established third-party platforms like Interactive Brokers suggests solid basic functionality for standard trading operations. However, it may limit unique competitive advantages in the tools and resources category that could differentiate Global Capital from other brokers.

Customer service represents a notable weakness in Global Capital's offering based on available user feedback and documented service options. Users report concerns about service quality and professional responsiveness. This indicates potential challenges in support delivery that could affect client satisfaction. The lack of clearly specified customer service channels, availability hours, or multilingual support options creates uncertainty about service accessibility. Traders need reliable support, especially when dealing with international markets and complex trading situations.

Response time concerns appear frequently in user feedback. This suggests that client inquiries may not receive timely attention when issues arise. Professional competency questions raised by users indicate potential training or expertise gaps in the support team that could affect problem resolution quality. The absence of documented service level agreements or support quality metrics makes it difficult to assess expected service standards. This creates uncertainty for potential clients about what level of support they can expect.

Communication effectiveness appears limited based on user reports. Users express frustration about problem resolution processes and unclear communication from support staff. The lack of specified contact methods, escalation procedures, or specialized support for different account types suggests a potentially underdeveloped customer service infrastructure. This may not meet the expectations of serious traders requiring reliable support for their trading activities and account management needs.

The trading experience with Global Capital receives moderate ratings based on available user feedback and platform offerings. The multi-platform approach through Interactive Brokers, XNET, and Swissquote provides technological options for different trading styles. However, specific performance metrics regarding execution speed, order accuracy, or platform stability are not detailed in available documentation. This makes it difficult to assess the actual quality of trade execution and platform reliability.

Commission costs at 0.50% with a €5 minimum create a predictable cost structure that traders can factor into their strategies. This global capital review notes that without comprehensive pricing transparency, traders cannot fully evaluate the total cost impact on their trading performance. The absence of execution quality statistics or slippage data makes it difficult to assess order fulfillment performance compared to industry standards. Spread information and additional trading costs also remain unclear, which affects cost transparency.

User feedback on trading experience appears neutral overall. There is no significant praise for exceptional execution quality but also limited complaints about major technical failures or system outages. The reliance on established third-party platforms suggests basic reliability for standard trading operations. However, unique competitive advantages in execution quality or trading environment features are not apparent from available information. This places Global Capital in the middle range for trading experience compared to other international brokers.

Trustworthiness represents Global Capital's most significant weakness, primarily due to the absence of clear regulatory information in available documentation. The lack of specified regulatory oversight bodies, license numbers, or compliance frameworks creates substantial transparency concerns for potential clients. Modern traders typically expect clear regulatory credentials as a fundamental requirement for broker selection in today's regulated financial environment. This regulatory opacity significantly impacts the broker's credibility and appeal to mainstream traders.

Fund safety measures, client protection protocols, and segregated account arrangements are not detailed in available materials. The absence of information about deposit insurance, compensation schemes, or regulatory protections leaves clients uncertain about asset security in case of broker insolvency or operational issues. Industry recognition, awards, or third-party certifications that might support credibility claims are also not documented. This lack of external validation further undermines confidence in the broker's operations and financial stability.

User feedback consistently highlights trust concerns throughout the trading community. Multiple references indicate that the broker is not considered trustworthy by experienced traders and industry observers. The combination of regulatory opacity and negative user sentiment regarding trustworthiness creates significant barriers for client acquisition and retention. This is particularly problematic in an increasingly regulated global trading environment where transparency and regulatory compliance are essential for broker credibility.

Overall user satisfaction with Global Capital appears moderate at best, with user ratings typically falling in the three-star range indicating average performance across various aspects. The user experience reflects the broader challenges identified in other evaluation categories, particularly around service quality and transparency concerns that affect client relationships. Users appear to have mixed experiences, with some finding basic functionality adequate for their needs while others express concerns about various operational aspects. The lack of consistently positive feedback suggests room for improvement in multiple areas.

Interface design and platform usability benefit from the established third-party platforms like Interactive Brokers, which provide familiar environments for experienced traders. However, the lack of proprietary interface innovations or user experience enhancements limits differentiation in the competitive brokerage landscape where user-friendly design is increasingly important. Registration and verification processes are not well-documented, creating uncertainty about onboarding efficiency. This can affect the initial client experience and first impressions of the broker's operational capabilities.

Common user complaints center around trustworthiness concerns and service quality issues rather than technical functionality problems. This suggests that while basic trading operations may function adequately for most users, the overall client relationship experience faces significant challenges in areas like communication, support, and transparency. The user base appears to consist primarily of price-sensitive traders willing to accept transparency limitations in exchange for competitive commission rates. However, this narrow appeal may limit the broker's growth potential in the broader retail trading market.

This global capital review reveals a brokerage that offers competitive pricing but faces significant challenges in regulatory transparency and user trust that limit its overall appeal. Global Capital's strengths include low commission rates starting at 0.50%, accessible €20 account opening fees, and multiple platform options through established providers like Interactive Brokers. The broker appears most suitable for experienced traders who prioritize cost efficiency over regulatory security and are comfortable conducting additional due diligence. However, these advantages are overshadowed by fundamental transparency issues that affect broker credibility.

The lack of clear regulatory oversight represents a fundamental weakness that limits the broker's appeal to mainstream traders in today's regulated environment. Combined with moderate user satisfaction ratings and service quality concerns, Global Capital faces substantial credibility challenges in the competitive brokerage market. Potential clients should exercise considerable caution and conduct thorough independent research before committing funds to this platform. The regulatory opacity and trust concerns make this broker unsuitable for traders who prioritize security and transparency over cost savings.

FX Broker Capital Trading Markets Review