Is GLFXM safe?

Business

License

Is GLFXM Safe or a Scam?

Introduction

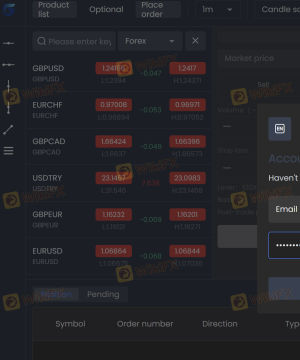

GLFXM is a relatively new player in the forex trading market, positioning itself as a platform for trading commodities, forex, CFDs, energy, and cryptocurrencies. Given the rapid growth of online trading and the increasing number of forex brokers, it is crucial for traders to conduct thorough evaluations of any broker before investing their hard-earned money. This is especially true in an industry that has seen its fair share of scams, regulatory failures, and customer complaints.

In this article, we will assess whether GLFXM is a safe trading option or a potential scam. Our investigation is based on a comprehensive analysis of the broker's regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk assessment. We will utilize various sources, including user reviews and regulatory databases, to provide a balanced view of GLFXM.

Regulation and Legitimacy

Regulatory oversight is a critical factor in determining the safety of any forex broker. A regulated broker is required to adhere to specific standards that protect traders interests, including the segregation of client funds and transparency in operations. Unfortunately, GLFXM appears to lack the necessary regulatory oversight that would typically assure clients of its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | United Kingdom | Not Authorized |

| MSB | N/A | Canada | Not Authorized |

The lack of a valid license from reputable regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK, raises significant red flags regarding GLFXM's operations. According to various sources, the broker claims to be regulated but fails to provide any verifiable information that substantiates these claims. This absence of regulatory oversight means that traders' funds are not protected, making it a risky choice for potential investors.

The quality of regulation is paramount; brokers that operate without regulatory oversight are more likely to engage in unethical practices, including misappropriating client funds. Therefore, it is essential to consider GLFXM's unregulated status seriously when evaluating whether GLFXM is safe.

Company Background Investigation

GLFXM is owned by GLFXM Group Limited, which claims to be based in the United Kingdom. However, the lack of transparency regarding the company's ownership structure and the absence of a physical address raise concerns about its legitimacy. The company was incorporated in February 2023, making it a relatively new entrant in the forex market.

Management Team Background

The management teams expertise and experience can significantly impact a broker's operations. Unfortunately, there is little publicly available information regarding the qualifications and backgrounds of GLFXM's management team. This lack of transparency can be a warning sign, as reputable brokers typically disclose information about their leadership to build trust with potential clients.

Transparency and Information Disclosure

In terms of transparency, GLFXM has not provided adequate information about its operations, which is essential for building trust with clients. The absence of detailed information about its regulatory status, management team, and financial practices raises questions about the company's commitment to ethical trading practices. This level of opacity further contributes to the skepticism surrounding whether GLFXM is safe for traders.

Trading Conditions Analysis

When evaluating a forex broker, it is imperative to analyze the trading conditions they offer, including fees, spreads, and commissions. GLFXM advertises competitive spreads and a variety of trading instruments, but there are concerns regarding the clarity of their fee structure.

| Fee Type | GLFXM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | 1.0 pips |

| Commission Model | TBD | $0.00 |

| Overnight Interest Range | TBD | Varies |

The lack of specific information regarding GLFXM's spreads and commissions can be problematic. Traders often rely on transparent fee structures to make informed decisions, and the ambiguity surrounding GLFXM's costs can lead to unexpected expenses. Furthermore, if the broker imposes hidden fees or unfavorable withdrawal conditions, it can significantly impact traders' profitability.

In assessing whether GLFXM is safe, potential clients should be wary of any unusual fees that could indicate a lack of integrity in the broker's practices.

Client Funds Safety

The safety of client funds is paramount in any financial trading environment. GLFXMs website does not provide clear information about its policies for safeguarding client funds.

Fund Safety Measures

Typically, regulated brokers are required to maintain client funds in segregated accounts to protect them in the event of insolvency. However, GLFXM's lack of regulation raises questions about whether it adheres to such practices. Without proper segregation of funds, clients risk losing their investments if the broker encounters financial difficulties.

Investor Protection and Negative Balance Protection

Additionally, the absence of investor protection schemes, such as those provided by the Financial Services Compensation Scheme (FSCS) in the UK, further complicates the safety assessment. Clients of unregulated brokers like GLFXM may find themselves without recourse in the event of a dispute or financial loss.

Given these concerns, it is crucial for potential traders to consider the implications of investing with a broker that does not prioritize fund safety. This leads us to question whether GLFXM is safe for investors.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Analyzing user experiences can reveal common issues and the company's responsiveness to complaints.

Common Complaint Patterns

Many reviews of GLFXM highlight significant concerns, particularly regarding withdrawal issues and poor customer service. Customers have reported difficulties in accessing their funds, which is a major red flag in evaluating the broker's integrity.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| Customer Support Quality | Medium | Inconsistent |

Case Studies

- Withdrawal Denial: One user reported that after making a profit, their withdrawal request was denied without explanation, leading to frustration and a sense of betrayal.

- Lack of Support: Another trader noted that attempts to contact customer support were met with long wait times and unhelpful responses.

- Avoid investing large sums: Start with a small amount that you can afford to lose.

- Research alternatives: Look for regulated brokers that offer better security and customer service.

- Stay informed: Regularly check for updates and reviews about GLFXM and similar brokers.

These complaints contribute to the growing perception that GLFXM is not safe for traders, as unresolved issues can lead to significant financial losses.

Platform and Trade Execution

A broker's trading platform is crucial for executing trades efficiently. GLFXM claims to offer a proprietary trading platform, but user reviews suggest that it may not perform as well as established platforms like MetaTrader 4 or 5.

Performance and Stability

Users have reported issues with platform stability, including outages and slow execution times. Such issues can severely impact a trader's ability to capitalize on market opportunities and could lead to financial losses.

Order Execution Quality

Additionally, instances of slippage and rejected orders have been noted, which can be detrimental in volatile market conditions. If traders cannot rely on the platform for timely execution, it raises further questions about whether GLFXM is safe to use.

Risk Assessment

Using GLFXM presents a variety of risks that potential traders should consider carefully.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Financial Risk | High | Potential loss of funds. |

| Operational Risk | Medium | Platform instability and execution issues. |

Risk Mitigation Suggestions

To mitigate these risks, traders should consider the following strategies:

Conclusion and Recommendations

In conclusion, our investigation into GLFXM raises significant concerns about its safety and legitimacy. The lack of regulatory oversight, transparency issues, and numerous customer complaints suggest that GLFXM is not safe for traders.

For those considering entering the forex market, it is advisable to seek out regulated brokers with a proven track record of reliability and customer satisfaction. Alternatives such as brokers regulated by the FCA, ASIC, or other reputable authorities should be prioritized to ensure a safer trading environment.

Ultimately, the evidence presented indicates that potential investors should exercise caution and consider other options before engaging with GLFXM.

Is GLFXM a scam, or is it legit?

The latest exposure and evaluation content of GLFXM brokers.

GLFXM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GLFXM latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.