GLFXM 2025 Review: Everything You Need to Know

Executive Summary

GLFXM operates as an unregulated forex broker. This creates big investment risks for potential traders who might want to work with them. This comprehensive glfxm review shows that the company claims to offer multiple trading account types, but there's a major problem. The lack of regulatory oversight from recognized financial authorities raises serious concerns about trader protection and fund safety, which are essential for any legitimate trading operation.

GLFXM has not gotten approval from any major financial regulatory bodies like the FCA, ASIC, or CySEC. This regulatory gap means traders don't have the standard protections that licensed brokers typically provide. These protections include compensation schemes and segregated client funds that keep trader money safe. Some user feedback suggests relatively good security scores, though the company doesn't share specific details about their safety measures.

The broker targets traders who care about security features. However, the absence of regulatory compliance goes against this positioning and creates a contradiction in their marketing approach. Without proper oversight, traders face higher risks including potential fund security issues and limited options if disputes arise. The company requires direct contact with customer support to get detailed information about account types, trading conditions, and platform specifications. This shows a lack of transparency in their public communications.

Important Notice

Cross-Regional Entity Differences: GLFXM operates as an unregulated broker without approval from major financial regulatory authorities. Investors should be extremely careful when considering this broker because the absence of regulatory oversight significantly increases investment risks and reduces trader protections.

Review Methodology: This evaluation uses publicly available information and user feedback from various sources. These sources include broker comparison websites and industry databases that track broker performance. Due to limited official documentation from GLFXM, some sections rely on general industry standards for comparison purposes.

Rating Framework

Broker Overview

GLFXM operates under the entity name "Glfxm Global Forex Limited." However, specific information about when it was established and who founded it remains hidden from public view. The company's background information is very limited, with most operational details requiring direct contact with their customer support team. This lack of transparency about basic company information raises initial concerns about the broker's commitment to openness with potential clients.

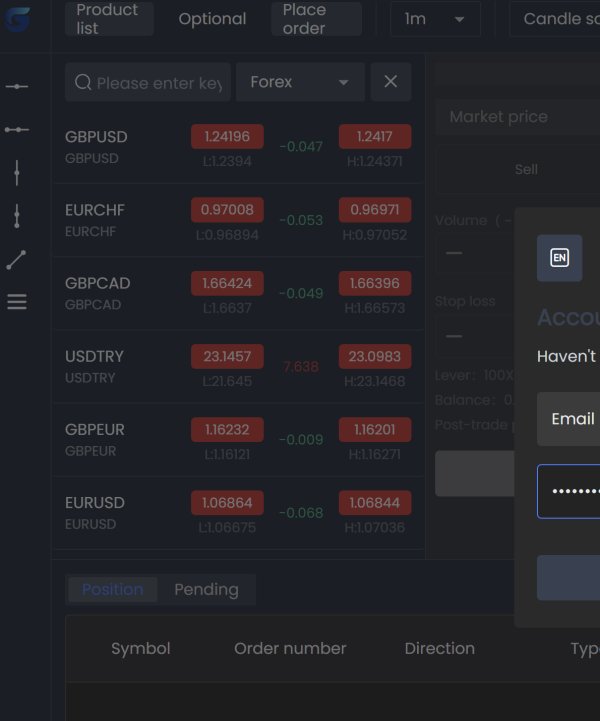

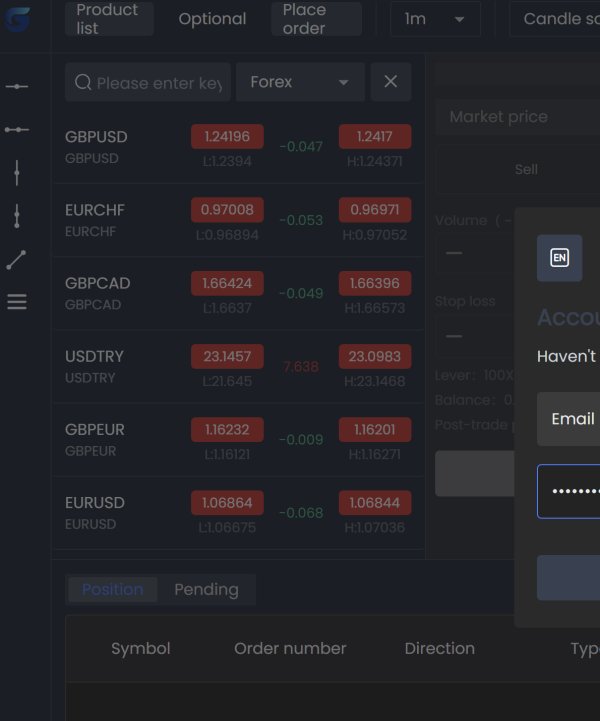

The broker's business model focuses on forex and CFD trading. However, detailed information about their service structure, execution methods, and revenue models is not available through public channels. According to WikiBit and other broker review platforms, GLFXM says it offers multiple trading account types, but traders need to consult with their support team individually to learn about the specific characteristics and benefits of these accounts.

GLFXM has not publicly detailed which trading platforms they support or the full range of tradeable instruments. The company mentions offering forex and CFD trading opportunities, but that's where the public information ends. Traders seeking specific information about currency pairs, commodity CFDs, index CFDs, or other financial instruments must contact customer support directly. Most importantly, GLFXM has not obtained regulatory approval from any recognized financial authorities and operates as an unregulated broker in the competitive forex market.

Regulatory Status: GLFXM operates without regulatory oversight from major financial authorities. These authorities include the FCA, ASIC, CySEC, and other recognized regulatory bodies that protect traders. This unregulated status means traders don't have standard protections including compensation schemes, segregated client funds, and regulatory dispute resolution mechanisms.

Deposit and Withdrawal Methods: The broker hasn't disclosed specific information about funding options, processing times, and associated fees in available materials. Traders must contact customer support to get details about payment methods and transaction procedures.

Minimum Deposit Requirements: GLFXM has not publicly shared minimum deposit amounts for different account types. This forces potential clients to inquire directly for this basic information that most brokers display openly.

Bonus and Promotions: No information about welcome bonuses, trading incentives, or promotional offers appears in reviewed sources. This suggests either no current promotions or very limited marketing transparency from the company.

Tradeable Assets: GLFXM mentions offering forex and CFD trading but doesn't provide a complete list of available instruments. Traders need to contact customer support directly to learn about available currency pairs, commodities, indices, and other financial instruments.

Cost Structure: The broker hasn't publicly disclosed critical pricing information including spreads, commissions, swap rates, and other trading costs. This creates transparency concerns for cost-conscious traders who need to know these details before opening accounts.

Leverage Ratios: Maximum leverage levels and margin requirements for different account types and asset classes are not specified in available documentation. This information is crucial for risk management and trading strategy development.

Platform Options: GLFXM hasn't detailed the specific trading platforms they support in accessible sources. This includes whether they offer MetaTrader versions or proprietary solutions that traders might prefer.

Geographic Restrictions: Information about restricted countries or regional limitations for account opening and trading activities is not available in reviewed materials. This makes it difficult for international traders to know if they can use the service.

Customer Support Languages: The range of languages supported by customer service teams has not been specified in available documentation. This could be important for non-English speaking traders who need support in their native language.

This comprehensive glfxm review reveals significant information gaps that potential traders should consider when evaluating this broker option.

Detailed Rating Analysis

Account Conditions Analysis

GLFXM's account conditions receive a moderate score due to significant transparency issues regarding fundamental trading parameters. The broker mentions offering multiple account types but fails to provide essential details about account specifications, minimum deposit requirements, or trading conditions that traders need to make informed decisions. This lack of publicly available information forces potential clients to contact customer support for basic account details that most regulated brokers readily display on their websites.

The absence of clear information about spreads, commissions, and fee structures creates uncertainty for traders. Traders attempting to evaluate the true cost of trading with GLFXM face significant challenges without this basic pricing information. Without published spread tables or commission schedules, traders cannot effectively compare GLFXM's pricing against industry standards or competitor offerings. This information gap is particularly concerning for algorithmic traders and scalpers who require precise cost calculations for strategy development and profitability analysis.

Account opening procedures and verification requirements remain completely undisclosed. This prevents potential clients from understanding the onboarding process complexity or documentation requirements they might face. The lack of information about special account features, such as Islamic accounts for Sharia-compliant trading, further limits the broker's appeal to diverse trader demographics who might have specific religious or cultural requirements. Additionally, no information is available about account maintenance fees, inactivity charges, or other ongoing costs that could significantly impact long-term trading profitability.

The requirement for direct customer support contact to obtain basic account information suggests either incomplete website development or intentional information restriction. This approach contrasts sharply with industry standards where transparent pricing and account details are considered fundamental for building trader trust and enabling informed decision-making in any legitimate glfxm review assessment.

GLFXM's tools and resources receive a moderate rating based on very limited available information about their trading infrastructure and support materials. While the broker mentions providing multiple account types, specific details about trading tools, analytical resources, and educational materials require direct customer support contact which limits transparency. This approach significantly limits traders' ability to evaluate the platform's capabilities before going through the account opening process.

The absence of publicly available information about trading platforms raises serious questions about technology infrastructure and tool sophistication. Most established brokers prominently feature their platform offerings, including MetaTrader versions, proprietary solutions, or web-based interfaces that traders can review before signing up. GLFXM's lack of platform disclosure prevents proper assessment of charting capabilities, technical indicators, automated trading support, or mobile application features that modern traders expect.

Research and analytical resources appear to be either underdeveloped or completely unpublicized, with no evidence of market analysis, economic calendars, or trading signals. Educational materials, which are absolutely crucial for trader development, are not mentioned anywhere in available sources. This absence of learning resources may particularly disadvantage novice traders who rely heavily on broker-provided education for skill development and market understanding.

The broker's approach to customer information gathering through direct support contact could indicate personalized service delivery. However, it equally suggests potential information control or incomplete service development that doesn't meet modern standards. Without clear documentation of available tools and resources, traders cannot adequately assess whether GLFXM's offerings align with their specific trading requirements and experience levels.

Customer Service and Support Analysis

GLFXM's customer service receives a below-average rating due to limited publicly available information about support channels, service quality, and accessibility. The broker's heavy reliance on direct customer contact for basic information suggests either a consultation-based approach or insufficient online resource development that doesn't meet current industry standards. However, the lack of clear communication about support availability, response times, and service standards creates significant uncertainty for potential clients who need reliable assistance.

Contact methods, including phone numbers, email addresses, live chat availability, and support hours, are not clearly specified in any reviewed materials. This major information gap prevents traders from understanding how to reach support teams or when assistance is actually available during trading hours. The absence of multilingual support information further limits accessibility for international traders who may require native language assistance for complex trading issues.

Response time expectations and service level commitments remain completely undisclosed. This makes it very difficult for traders to anticipate support quality during critical trading situations when quick assistance is essential. The lack of user testimonials or service quality reviews prevents any objective assessment of actual support performance in real-world scenarios. Additionally, no information about specialized support for different account types or specific trading issues is available to help traders understand what kind of help they can expect.

The broker's approach of requiring support contact for basic information could indicate personalized service delivery that some traders might appreciate. However, it may also suggest inadequate self-service resources or information transparency issues that could frustrate users. Without clear support documentation, traders cannot evaluate whether GLFXM's customer service standards meet their requirements for reliable assistance during important trading activities.

Trading Experience Analysis

GLFXM's trading experience receives a moderate rating based on very limited available information about platform performance, execution quality, and user satisfaction. While some sources mention relatively good security scores, specific details about trading conditions, platform stability, and execution speeds are not readily available to potential users. This significant information scarcity prevents any comprehensive assessment of the actual trading environment quality that traders would experience.

Platform stability and performance data, including uptime statistics, latency measurements, and system reliability during high-volatility periods, are not disclosed anywhere. Order execution quality metrics, such as slippage rates, requote frequency, and fill ratios, remain completely unspecified by the company. These technical performance indicators are absolutely crucial for traders, particularly those employing scalping or high-frequency strategies where execution precision significantly impacts overall profitability and trading success.

The absence of information about trading platform features, including charting capabilities, technical analysis tools, and automated trading support, severely limits evaluation of the trading environment's sophistication. Mobile trading experience, which is increasingly important for modern traders who need flexibility, is not documented in any available sources. Additionally, no user reviews specifically addressing trading experience quality are available for reference, making it impossible to get real user perspectives.

Market access details, including available trading sessions, instrument availability, and liquidity provision, require direct inquiry with customer support. This lack of transparency about fundamental trading conditions creates significant uncertainty for traders attempting to evaluate whether GLFXM's environment suits their specific trading strategies and requirements in this glfxm review analysis.

Trust and Reliability Analysis

GLFXM's trust and reliability score reflects very significant concerns stemming from its unregulated status and limited transparency across multiple areas. The broker's operation without approval from recognized financial regulatory authorities such as the FCA, ASIC, or CySEC creates substantial trust deficits that cannot be ignored. Regulatory oversight provides essential trader protections, including fund segregation requirements, compensation schemes, and dispute resolution mechanisms that are completely absent with unregulated brokers like GLFXM.

The lack of regulatory compliance means GLFXM operates without any external oversight of its business practices, financial stability, or client fund handling procedures. This absence of regulatory protection significantly increases trader risk exposure, particularly regarding fund security and recovery options in case of broker insolvency or serious operational issues. Additionally, unregulated status often correlates with limited legal recourse for traders experiencing disputes or service problems, leaving them with few options if things go wrong.

Company transparency issues extend far beyond regulatory status to include limited disclosure of corporate structure, ownership details, and operational history. The absence of published financial statements, audit reports, or corporate governance information prevents any meaningful assessment of the company's financial stability and operational integrity. This opacity contrasts very sharply with regulated brokers who must maintain transparent reporting standards and regular financial disclosures.

Industry reputation and third-party validation are notably absent, with very limited independent reviews or industry recognition available from credible sources. The broker's approach of requiring direct contact for basic information further compounds existing transparency concerns. This suggests either incomplete service development or intentional information restriction that significantly undermines trust-building efforts with potential clients who expect openness and transparency.

User Experience Analysis

GLFXM's user experience receives a moderate rating based on very limited available feedback and the broker's unusual approach to client interaction. While specific user satisfaction data is quite scarce, the requirement for direct customer support contact to obtain basic information suggests either a personalized service model or potential accessibility challenges that could frustrate users. The lack of comprehensive online resources may significantly impact user convenience and self-service capabilities that modern traders expect.

Website usability and information architecture appear to have substantial room for improvement, given the very limited publicly available details about services, pricing, and account features. Modern traders typically expect transparent, easily accessible information about trading conditions, costs, and platform capabilities without having to contact support. GLFXM's approach of directing most inquiries to customer support may frustrate users seeking immediate information access, especially those who prefer to research independently before making decisions.

Account registration and verification processes remain completely undocumented. This prevents any assessment of onboarding experience quality and time requirements that new users would face. The absence of user testimonials or experience reviews severely limits understanding of actual client satisfaction levels and common user journey challenges that might arise. Additionally, no information about user interface design, navigation ease, or mobile experience is available for evaluation, making it impossible to assess the quality of the user interface.

The broker's positioning toward security-conscious traders suggests some awareness of user priorities in the current market environment. However, specific security measures and user protection features are not detailed anywhere in available materials. Without comprehensive user feedback or documented experience standards, potential clients cannot adequately assess whether GLFXM's service delivery aligns with their expectations for modern online trading platforms and customer experience quality.

Conclusion

This comprehensive glfxm review reveals a broker operating with significant transparency limitations and serious regulatory concerns that potential traders must carefully consider. GLFXM's unregulated status represents the most critical issue, exposing traders to elevated risks without any of the standard regulatory protections that legitimate brokers provide. The company's very limited disclosure of essential trading information, including costs, platforms, and account conditions, further compounds concerns about operational transparency and creates additional red flags for potential users.

GLFXM may potentially suit traders who prioritize personalized customer service and are comfortable with consultation-based information gathering rather than transparent online resources. However, the security benefits mentioned in some user feedback require thorough verification through direct broker contact before any decisions are made. However, the complete absence of regulatory oversight makes this broker unsuitable for risk-averse traders or those requiring standard client protection measures that regulated brokers must provide.

The primary advantages include mentioned security scoring and multiple account type availability, though these benefits are not well-documented or verified. The significant disadvantages encompass regulatory absence, severely limited transparency, and insufficient publicly available information about basic trading conditions that traders need. Potential clients should exercise extreme caution and thoroughly investigate all aspects of GLFXM's services before considering account opening. The elevated risks associated with unregulated broker relationships make this a particularly important consideration for anyone thinking about using their services.