Is FxMetaTraders safe?

Business

License

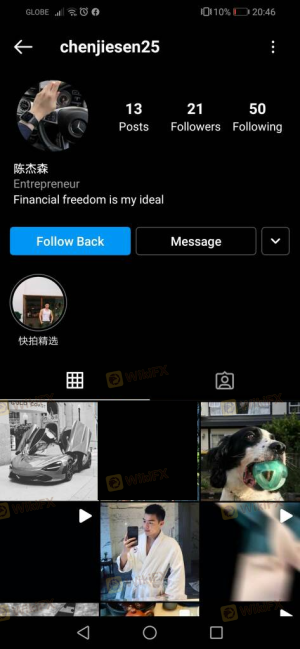

Is FxMetaTraders A Scam?

Introduction

FxMetaTraders is a forex broker that has garnered attention in the trading community, particularly for its claims of providing competitive trading conditions and a variety of account types. As the forex market continues to grow, traders are increasingly cautious about where they choose to invest their funds. The importance of carefully evaluating forex brokers cannot be overstated, as the potential for scams and fraudulent activities is prevalent in the industry. In this article, we will conduct a comprehensive investigation into FxMetaTraders, utilizing a variety of sources to analyze its legitimacy and safety. Our assessment framework will cover regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, risk evaluation, and ultimately, provide a recommendation based on our findings.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical aspect that determines its credibility and the safety of client funds. FxMetaTraders is currently unregulated, meaning it does not hold a license from any major financial authority. This lack of regulation raises significant concerns regarding the broker's operational practices and the protection of traders' investments.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that FxMetaTraders operates without oversight from any reputable authority, which could lead to potential issues when it comes to fund security and fair trading practices. Furthermore, there have been reports and complaints from users suggesting possible fraudulent activities associated with the broker. The lack of a regulatory framework can expose traders to risks such as difficulty in withdrawing funds and lack of recourse in case of disputes. Given these factors, it is crucial for traders to approach FxMetaTraders with caution.

Company Background Investigation

Understanding the background of a trading company is essential for evaluating its trustworthiness. FxMetaTraders appears to have been established within the last few years, but detailed information about its ownership and management team is scarce. The company's website lacks transparency and does not provide adequate information regarding its founders or key personnel.

The absence of a clear company structure and the lack of publicly available data on its management team raises red flags about its operational integrity. A reputable broker typically provides detailed information about its leadership and business model, which fosters trust among potential clients. In this case, the opacity surrounding FxMetaTraders may indicate a lack of accountability and could contribute to the perception that it is less trustworthy.

Trading Conditions Analysis

An essential aspect of evaluating any forex broker is to analyze the trading conditions they offer. FxMetaTraders claims to provide competitive spreads and various account types, but the specifics of their fee structure are not clearly disclosed on their website.

| Fee Type | FxMetaTraders | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Model | $1 per lot | $3 per lot |

| Overnight Interest Range | Varies | Varies |

While the advertised spreads seem attractive, the lack of transparency regarding commissions and potential hidden fees could lead to unexpected costs for traders. Moreover, the absence of a demo account limits traders' ability to test the platform and its conditions without risking real money. This lack of clear information on trading costs can be a significant drawback for potential clients considering whether FxMetaTraders is safe.

Client Fund Security

The security of client funds is paramount when selecting a forex broker. FxMetaTraders has not provided sufficient details regarding its fund security measures. Generally, reputable brokers segregate client funds from their operational funds, ensuring that clients' money is protected even in the event of the broker's insolvency.

Unfortunately, without regulatory oversight, there are no guarantees that FxMetaTraders adheres to such practices. Additionally, the absence of investor protection schemes, such as those provided by regulatory bodies like the FCA or ASIC, further exacerbates concerns about the safety of funds with this broker. Historical reports of fund security issues or disputes could not be substantiated, but the lack of information is alarming for potential investors.

Customer Experience and Complaints

Analyzing customer feedback is crucial in understanding a broker's reliability. Reviews of FxMetaTraders indicate a mix of experiences, with several users reporting difficulties in withdrawing funds and expressing concerns about customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| Customer Service Quality | Medium | Inconsistent |

| Transparency Concerns | High | Poor |

Common complaints highlight a pattern of withdrawal issues, suggesting that clients may face obstacles when trying to access their funds. Furthermore, the quality of customer service has been criticized, with reports of slow response times and unsatisfactory resolutions. These factors contribute to an overall negative perception of the broker's reliability, reinforcing the need for traders to exercise caution when considering FxMetaTraders.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for traders. FxMetaTraders claims to offer a user-friendly trading environment, but user reviews indicate potential issues with platform stability and order execution quality. Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes.

The lack of detailed information about the trading platform's technology and execution methods raises concerns about its effectiveness and reliability. A broker with a history of platform manipulation or unreliable execution could pose a significant risk to traders, further questioning whether FxMetaTraders is safe.

Risk Assessment

Engaging with FxMetaTraders entails various risks that potential clients should consider. The absence of regulation, coupled with reports of withdrawal issues and poor customer service, creates a precarious trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No regulation or oversight |

| Fund Security | High | Lack of transparency on fund safety |

| Customer Service | Medium | Inconsistent support responses |

| Platform Reliability | High | Reports of slippage and rejections |

To mitigate these risks, it is advisable for traders to thoroughly research and consider alternative brokers with established regulatory frameworks and positive user reviews.

Conclusion and Recommendations

Based on the comprehensive analysis, it is evident that FxMetaTraders raises several red flags regarding its legitimacy and safety. The lack of regulation, transparency, and consistent negative feedback from users suggest that this broker may not be a safe choice for traders.

For those contemplating trading with FxMetaTraders, it is crucial to consider alternative options that offer robust regulatory oversight and a proven track record of reliability. Brokers such as Fxtm, Pepperstone, and IC Markets are recommended alternatives, as they provide comprehensive regulatory frameworks, competitive trading conditions, and positive user experiences.

In summary, while FxMetaTraders may present attractive trading conditions, the associated risks and concerns indicate that it is wise for traders to exercise caution and seek out safer, more reliable trading options.

Is FxMetaTraders a scam, or is it legit?

The latest exposure and evaluation content of FxMetaTraders brokers.

FxMetaTraders Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FxMetaTraders latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.