Is FUBON safe?

Pros

Cons

Is Fubon Safe or Scam?

Introduction

Fubon Securities is a financial services firm based in Hong Kong, primarily known for its brokerage services in forex, commodities, and indices trading. With a history of around 11 years in the financial industry, Fubon positions itself as a reputable player in the forex market. However, as with any trading platform, potential investors need to exercise caution and perform thorough due diligence before engaging with the broker. The foreign exchange market is fraught with risks, and the choice of a broker can significantly influence a trader's experience and financial outcomes.

In this article, we will investigate whether Fubon is safe or a scam by evaluating its regulatory standing, company background, trading conditions, customer experiences, and overall risk profile. Our assessment is based on a review of multiple credible online sources, user feedback, and industry standards, aiming to provide a comprehensive overview of Fubon Securities.

Regulation and Legitimacy

Understanding a broker's regulatory status is crucial for assessing its legitimacy. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards of conduct and financial practices. Fubon is regulated by the Taipei Exchange (TPEX) for its securities dealings, which adds a layer of credibility. However, the broker's operations in Hong Kong are not under strict oversight from a major regulatory body, raising some concerns.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Taipei Exchange | Not disclosed | Taiwan | Regulated |

While Fubon Securities is regulated by TPEX, it is essential to note that the regulatory framework in Taiwan may not be as stringent as that of other jurisdictions like the UK or the US. The lack of a publicly disclosed license number further complicates the transparency of its regulatory status. Although TPEX regulation indicates that Fubon must comply with certain operational standards, traders should remain vigilant and consider the implications of trading with a broker that operates in a less-regulated environment.

Company Background Investigation

Fubon Securities was established in 2013 and is a subsidiary of Fubon Financial Holdings, one of the largest financial groups in Taiwan. The company has expanded its services to include a wide range of financial products, including forex trading, securities brokerage, and asset management. This backing lends some credibility to Fubon, as it operates under a well-established parent company with a solid reputation in the financial sector.

The management team at Fubon Securities comprises experienced professionals with backgrounds in finance and investment. However, the specific details regarding their qualifications and professional history are not extensively disclosed, which may raise concerns about transparency. A lack of comprehensive information about the management can hinder potential clients' ability to assess the company's reliability fully.

Fubon Securities has made efforts to enhance its transparency by providing customer support through various channels, including phone and email. However, the overall level of information disclosure regarding its operations and compliance history could be improved to foster greater trust among potential traders.

Trading Conditions Analysis

When evaluating whether Fubon is safe, it is essential to consider its trading conditions, including fees and spreads. Fubon Securities offers a competitive trading environment, but some aspects may raise eyebrows. The broker provides access to various trading instruments, including forex pairs, commodities, and indices, but there are concerns about the overall fee structure.

| Fee Type | Fubon Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1-2 pips |

| Commission Model | Not specified | Varies widely |

| Overnight Interest Range | Not specified | 0.5-1.5% |

The lack of transparency regarding spreads and commission structures can be a red flag for potential traders. While Fubon does not provide specific details about its fee structure, traders should be cautious of any hidden fees that could affect their trading profitability. Furthermore, the absence of a demo account option limits potential clients' ability to test the trading platform and conditions before committing funds, which is another factor to consider when questioning whether Fubon is safe.

Customer Funds Security

The safety of customer funds is paramount in any trading environment. Fubon Securities claims to implement various measures to protect client funds, including segregating client accounts from company funds. This practice is crucial as it ensures that traders' money is not misused or at risk in case of the company's financial troubles. However, specific details regarding investor protection policies, such as negative balance protection, are not readily available.

The broker does not provide substantial information on any historical security issues or disputes related to customer funds. This lack of transparency could make potential clients wary, as previous incidents could indicate underlying problems with fund management. While the regulatory oversight from TPEX adds a layer of security, traders should always be cautious and ensure that their chosen broker has robust security measures in place.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating whether Fubon is safe or a scam. Reviews from traders indicate a mixed experience, with some praising the platform's user interface and customer service, while others express concerns about withdrawal processes and fee transparency.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Fee Transparency | Medium | Limited clarity |

| Platform Stability | Low | Generally stable |

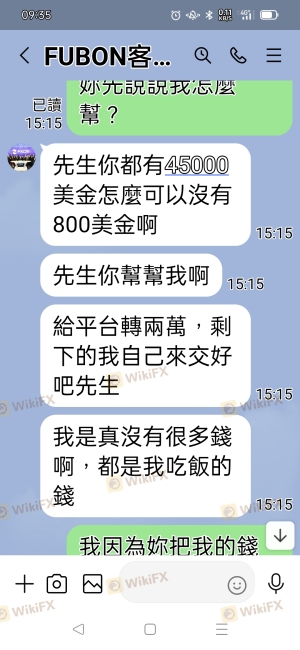

Common complaints revolve around withdrawal delays and unclear fee structures. Some users have reported that their withdrawal requests take longer than expected to process, which can be frustrating for traders looking to access their funds quickly. The company's response to these complaints has been noted as slow, which may exacerbate client dissatisfaction.

One notable case involved a trader who faced significant delays in withdrawing funds, leading to frustration and concerns about the broker's reliability. Such incidents can impact the overall perception of Fubon Securities and raise questions about whether it is a safe trading option.

Platform and Trade Execution

The trading platform offered by Fubon Securities, known as Fubon Transaction Treasure, has received mixed reviews regarding its performance and user experience. Traders have reported that the platform is user-friendly and provides essential trading tools, but there are concerns about order execution quality, including potential slippage and rejections.

The platform's stability is generally considered good, but any signs of manipulation or unfair practices could severely undermine trust in the broker. Traders should be aware of the execution quality and remain vigilant for any discrepancies that could indicate questionable practices.

Risk Assessment

Using Fubon Securities comes with inherent risks, as is the case with any trading platform. Traders should be aware of several key risk factors when considering whether Fubon is safe.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Limited oversight in Hong Kong |

| Fund Security Risk | Medium | Lack of transparency in fund management |

| Customer Service Risk | Medium | Slow response times to complaints |

To mitigate these risks, traders are advised to conduct thorough research before investing, utilize demo accounts when available, and maintain open communication with customer support to clarify any uncertainties.

Conclusion and Recommendations

In conclusion, while Fubon Securities has established itself as a player in the forex market, potential traders should approach with caution. The regulatory oversight from TPEX provides some assurance, but the lack of transparency regarding fees, withdrawal processes, and customer fund security raises concerns about the overall safety of the platform.

Based on the evidence gathered, it cannot be definitively stated that Fubon is a scam, but there are several areas of concern that warrant careful consideration. Traders looking for reliable brokers may want to explore alternatives with stronger regulatory frameworks and better customer feedback.

For those considering trading with Fubon, it is crucial to remain vigilant, conduct thorough research, and assess personal risk tolerance. If you are seeking more reliable options, consider brokers with robust regulatory oversight, transparent fee structures, and positive customer reviews, as this could significantly enhance your trading experience.

Is FUBON a scam, or is it legit?

The latest exposure and evaluation content of FUBON brokers.

FUBON Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FUBON latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.