Is Foptrade safe?

Business

License

Is Foptrade Safe or Scam?

Introduction

Foptrade is an online trading platform that positions itself within the competitive landscape of the forex market, offering a range of trading services and financial instruments. In an era where online trading has become increasingly popular, it is essential for traders to exercise caution and conduct thorough due diligence when selecting a broker. The forex market is notorious for its volatility and the presence of unregulated brokers, which can lead to significant financial losses for unsuspecting traders. This article aims to objectively evaluate the safety and legitimacy of Foptrade by analyzing its regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risk profile.

To conduct this investigation, we have utilized various online sources, including user reviews, regulatory databases, and expert analyses. Our assessment framework includes evaluating the broker's regulatory compliance, transparency, customer feedback, and the quality of trading conditions offered.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and the safety of client funds. Regulation ensures that brokers adhere to specific standards and practices that protect traders from fraud and malpractice. Unfortunately, Foptrade operates without any recognized regulatory oversight, which raises significant concerns regarding its trustworthiness.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of a regulatory license means that Foptrade is not subject to the stringent oversight that governs reputable brokers. Many regulatory bodies, such as the FCA in the UK or ASIC in Australia, impose strict requirements on brokers to ensure they maintain a certain level of capital, segregate client funds, and provide transparency in their operations. Without such regulation, Foptrade operates in a high-risk environment, which can lead to potential issues related to fund safety and withdrawal difficulties.

Moreover, the lack of a physical address and transparency about its operational framework further complicates the assessment of Foptrade's legitimacy. Traders are advised to approach unregulated brokers with extreme caution, as they may not provide adequate protection for client funds and could potentially engage in fraudulent activities.

Company Background Investigation

Foptrade claims to be associated with Turbo Trading Limited and is reportedly based in Vanuatu. However, the company's ownership structure and management team remain largely undisclosed, contributing to a lack of transparency. The absence of information regarding the company's history and development raises red flags about its credibility.

The management team's background is crucial in evaluating a broker's reliability. A well-experienced team with a proven track record in the financial industry can enhance a broker's legitimacy. However, Foptrade does not provide any information about its management team, making it difficult for potential clients to assess their expertise and professionalism.

Furthermore, the company's limited disclosure of operational information creates an environment of uncertainty. Traders should be wary of engaging with brokers that do not provide clear and accessible information about their business practices, as this could indicate a lack of accountability and reliability.

Trading Conditions Analysis

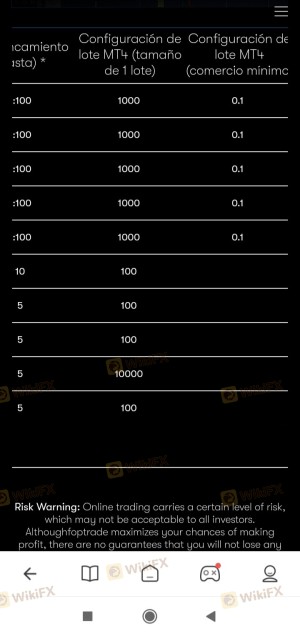

Understanding the trading conditions offered by a broker is essential for assessing its overall value proposition. Foptrade presents itself as a competitive option with various account types and attractive trading features. However, a closer examination of its fee structure reveals potential pitfalls.

Foptrade does not impose a minimum deposit requirement, which may seem appealing to new traders. However, this practice can also attract inexperienced traders who may not fully understand the risks involved in forex trading.

| Fee Type | Foptrade | Industry Average |

|---|---|---|

| Spread on Major Pairs | 3 pips | 1.5 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread on major currency pairs at Foptrade is notably higher than the industry average, which can significantly impact trading profitability. Additionally, the lack of clarity regarding commission structures and overnight interest rates raises concerns about hidden fees that traders may encounter.

Moreover, Foptrade imposes a $60 inactivity fee, which is substantially higher than what is typically charged by other brokers. Such fees can eat into a trader's profits, particularly for those who may not trade frequently. The overall fee structure, combined with the lack of transparency, suggests that traders should be cautious when considering Foptrade as their broker.

Client Fund Security

The safety of client funds is paramount when evaluating a broker's reliability. Foptrade's lack of regulatory oversight raises serious concerns about its fund security measures. Regulated brokers are typically required to maintain segregated accounts for client funds, ensuring that traders' money is protected in the event of the broker's insolvency.

Unfortunately, Foptrade does not provide any information regarding its client fund safety measures. The absence of investor protection policies, such as negative balance protection or compensation schemes, further exacerbates the risks associated with trading through this platform. Traders need to be aware that in the absence of such protections, they may be vulnerable to losing their entire investment without any recourse.

Historically, unregulated brokers have faced numerous complaints related to fund withdrawal issues, leading to significant losses for clients. The lack of transparency and accountability in Foptrade's operations raises concerns about the safety of client funds and the potential for financial disputes.

Customer Experience and Complaints

Analyzing customer feedback and experiences is crucial for understanding a broker's reputation. Reviews of Foptrade reveal a concerning trend, with numerous complaints regarding withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Inadequate |

| Customer Support | High | Slow |

Common complaints include delays in processing withdrawal requests, lack of communication from customer support, and inadequate responses to inquiries. Many users have reported feeling frustrated and helpless when attempting to retrieve their funds, which raises serious concerns about the broker's operational integrity.

For instance, one user reported that after making a withdrawal request, they faced months of delays, ultimately leading to the loss of their funds. Such experiences highlight the potential risks associated with trading on unregulated platforms like Foptrade.

Platform and Trade Execution

The trading platform's performance and execution quality are critical factors that can significantly impact a trader's success. Foptrade claims to offer the widely-used MetaTrader 4 platform, which is known for its user-friendly interface and robust trading features. However, the platform's performance has been a mixed bag according to user feedback.

Users have reported instances of slippage, delayed order executions, and even rejected orders, which can be detrimental to trading outcomes. These issues raise concerns about the broker's ability to provide a reliable trading environment and may indicate potential platform manipulation.

Traders need to be cautious when using platforms that do not demonstrate consistent performance and reliability. The combination of poor execution quality and high spreads can lead to significant losses, further emphasizing the need for careful evaluation of Foptrade's offerings.

Risk Assessment

Engaging with Foptrade presents various risks that traders should be aware of. The lack of regulation, combined with high fees and poor customer feedback, creates an environment fraught with potential pitfalls.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | High spreads and fees can impact profitability. |

| Withdrawal Risk | High | Numerous complaints regarding withdrawal issues. |

| Operational Risk | Medium | Potential platform manipulation and execution issues. |

To mitigate these risks, traders should consider using regulated brokers with a proven track record of reliability and customer service. Additionally, it is advisable to start with a demo account to familiarize oneself with the trading platform and assess its performance before committing real funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that Foptrade is not a safe trading option. The lack of regulation, combined with high fees, poor customer feedback, and numerous complaints regarding fund security and withdrawal issues, raises significant concerns about the broker's legitimacy.

Traders should be particularly cautious when dealing with unregulated brokers like Foptrade, as they may expose themselves to unnecessary risks and potential financial losses. For those seeking to engage in forex trading, it is advisable to consider regulated alternatives that provide better protection for client funds and more transparent trading conditions.

In summary, the answer to the question, "Is Foptrade safe?" is a resounding no. Traders are encouraged to conduct thorough research and choose brokers that are regulated and have a proven track record of reliability.

Is Foptrade a scam, or is it legit?

The latest exposure and evaluation content of Foptrade brokers.

Foptrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Foptrade latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.