Regarding the legitimacy of Fendatrade forex brokers, it provides MFSA and WikiBit, .

Is Fendatrade safe?

Business

License

Is Fendatrade markets regulated?

The regulatory license is the strongest proof.

MFSA Market Making License (MM)

Malta Financial Services Authority

Malta Financial Services Authority

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

ALCHEMY MARKETS LTD.

Effective Date: Change Record

2012-11-23Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://nsfx.com/, https://alchemymarkets.com/eu/, https://nsbroker.com/Expiration Time:

--Address of Licensed Institution:

SUITE 124, SIGNATURE PORTOMASO , VJAL PORTOMASO SAN GILJAN Malta PTM 01Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is FendaTrade Safe or a Scam?

Introduction

FendaTrade is an online brokerage firm that positions itself within the forex and cryptocurrency markets, claiming to provide a platform for traders to engage in various financial instruments. As the popularity of forex trading continues to rise, it becomes increasingly important for traders to conduct thorough evaluations of brokerage firms before committing their funds. This article aims to investigate whether FendaTrade is a legitimate and trustworthy broker or if it operates as a scam. The investigation will be based on a comprehensive analysis of regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

One of the most critical factors in determining whether FendaTrade is safe is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards that protect client funds and promote fair trading practices. Unfortunately, FendaTrade does not appear to be regulated by any recognized financial authority.

Heres a summary of the regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation raises significant concerns about the safety of funds deposited with FendaTrade. Legitimate brokers are typically registered with regulatory bodies that impose strict guidelines and oversight. Without such regulation, traders are exposed to potential risks, including the possibility of fraud and the inability to recover funds in case of disputes.

Company Background Investigation

FendaTrade's company background reveals a lack of transparency that is often associated with scam brokers. The firm claims to have been in operation for several years; however, the details regarding its history, ownership structure, and management team remain vague. A thorough investigation into the firms ownership reveals that it is linked to a company named Olino Energy B.V., which has no verifiable connection to the brokerage.

This lack of clarity regarding the companys history and management raises red flags about its legitimacy. A reputable brokerage would provide detailed information about its founders and management team, including their professional backgrounds and experience in the financial sector. In contrast, FendaTrade's website offers minimal information, which is a significant concern for potential investors.

Trading Conditions Analysis

When assessing whether FendaTrade is safe, it is essential to evaluate its trading conditions, including fees, spreads, and overall cost structure. Generally, brokers should provide transparent information about their fees, but FendaTrade's website lacks clear disclosures regarding trading costs.

Heres a comparison of core trading costs:

| Cost Type | FendaTrade | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear fee structures and the potential for hidden costs are significant concerns for traders. Many reviews indicate that brokers operating without transparency often impose unexpected fees, which can lead to substantial losses for traders. This lack of clarity makes it difficult to assess whether FendaTrade offers competitive trading conditions compared to industry standards.

Client Fund Safety

The safety of client funds is paramount when evaluating whether FendaTrade is safe. A key aspect of fund safety is the implementation of measures such as segregated accounts, investor protection schemes, and negative balance protection. Unfortunately, FendaTrade does not provide any information regarding these essential safety measures.

The lack of segregated accounts means that client funds may not be held separately from the broker's operating capital, posing a risk in the event of bankruptcy or fraudulent activity. Additionally, the absence of investor protection schemes leaves traders vulnerable to losing their deposits without recourse. Historical issues with fund safety, such as withdrawal problems and unresponsive customer service, have been reported by former clients, further underscoring the risks associated with this broker.

Customer Experience and Complaints

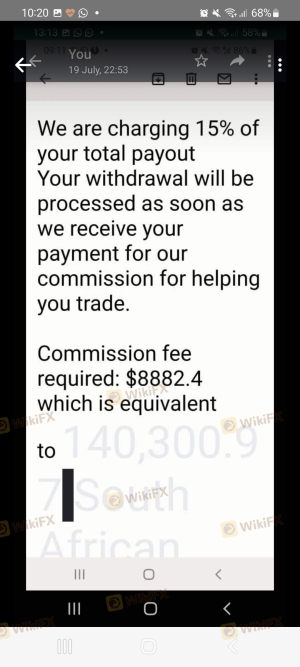

Analyzing customer feedback is crucial to understanding whether FendaTrade is a scam. Numerous reviews and testimonials from users indicate a pattern of complaints regarding withdrawal issues, unresponsive customer support, and difficulties in accessing funds after making deposits.

Heres a summary of the main complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Support | High | Poor |

| Misleading Information | Medium | Poor |

For instance, several users have reported that after depositing funds, they were unable to withdraw their money, with the broker often citing various fees or conditions that were not disclosed upfront. This pattern of complaints raises serious concerns about the integrity of FendaTrade and whether it can be trusted with clients' funds.

Platform and Trade Execution

The performance of a trading platform is another critical factor in assessing whether FendaTrade is safe. Users have reported that the platform is unstable, with frequent technical issues that hinder trading activities. Furthermore, the quality of order execution is a significant concern, as traders have experienced slippage and rejected orders, which can lead to financial losses.

The lack of transparency regarding the platform‘s technology raises questions about potential manipulation. Legitimate brokers typically provide robust trading platforms that offer reliable execution and comprehensive trading tools. In contrast, FendaTrade’s platform appears to lack these essential features, further indicating that it may not be a trustworthy option for traders.

Risk Assessment

Using FendaTrade poses several risks that potential clients should consider before investing. The absence of regulation, unclear trading conditions, and poor customer feedback contribute to an overall high-risk profile for this broker.

Heres a risk summary:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated and potentially fraudulent |

| Financial Risk | High | Lack of transparency in fees |

| Operational Risk | High | Platform instability and execution issues |

To mitigate these risks, traders should conduct thorough research and consider alternative, regulated brokers that offer transparent conditions and reliable customer support.

Conclusion and Recommendations

In conclusion, the investigation into FendaTrade raises serious concerns about its legitimacy and safety. The lack of regulation, transparency in trading conditions, and numerous customer complaints strongly suggest that FendaTrade may not be a safe option for traders.

For those seeking to engage in forex trading, it is advisable to consider regulated brokers with proven track records and transparent practices. Some reputable alternatives include brokers that are registered with established regulatory authorities, offer comprehensive customer support, and provide clear information about their trading conditions.

In summary, FendaTrade exhibits several characteristics commonly associated with scam brokers, making it essential for traders to exercise caution and seek safer trading environments.

Is Fendatrade a scam, or is it legit?

The latest exposure and evaluation content of Fendatrade brokers.

Fendatrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fendatrade latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.