Is FB SECURITIES safe?

Business

License

Is FB Securities Safe or Scam?

Introduction

FB Securities is an online forex broker that positions itself as a player in the global financial markets, offering various trading services and products. As the forex market continues to grow, it attracts a plethora of brokers, making it crucial for traders to carefully evaluate their options. The legitimacy and safety of a broker can significantly impact a trader's experience and investment outcomes. Therefore, this article aims to investigate whether FB Securities is a safe platform or a potential scam by examining its regulatory status, company background, trading conditions, customer experiences, and risk factors.

To conduct this investigation, we utilized various online resources, including user reviews, regulatory databases, and expert analyses. Our evaluation framework focuses on key areas such as regulation, company history, trading conditions, customer safety, and overall reputation in the forex trading community.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. A regulated broker must adhere to specific standards set by financial authorities, which helps protect traders from fraud and malpractice. Unfortunately, FB Securities operates without regulation, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that clients of FB Securities lack legal protection in the event of disputes or financial issues. This unregulated status is particularly alarming given that the broker is based in Belize—a jurisdiction often associated with lax regulatory oversight. Without the safety net of a regulatory body, traders are at risk of losing their investments without any recourse.

Moreover, the lack of historical compliance records and regulatory oversight raises red flags. Traders should exercise extreme caution when dealing with unregulated brokers like FB Securities, as they may not be held accountable for their actions.

Company Background Investigation

FB Securities is owned by FB Corporation, which is registered in Belize. However, specific details regarding the company's history, ownership structure, and management team are scarce. This lack of transparency is concerning, as it makes it difficult for potential clients to assess the broker's credibility.

The management team behind FB Securities has not been disclosed, which further complicates the evaluation of the brokers reliability. A robust management team with relevant experience is essential for a broker to provide trustworthy services. The absence of this information raises questions about the company's operational integrity and commitment to client welfare.

Furthermore, the company does not provide clear information on its website regarding its financial practices, such as how it handles client funds or its approach to risk management. This opacity can be a significant warning sign for prospective traders, as transparency is a hallmark of trustworthy brokers.

Trading Conditions Analysis

When evaluating whether FB Securities is safe, it is essential to consider its trading conditions, including fees and spreads. The broker advertises competitive trading conditions; however, the lack of clarity regarding its fee structure can be concerning.

| Fee Type | FB Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific numbers in the table indicates a lack of transparency in FB Securities' fee structure. Traders often face unexpected costs when brokers do not clearly outline their fees, which can lead to dissatisfaction and financial loss. Furthermore, any unusual or hidden fees can significantly affect a trader's profitability, making it vital to have a clear understanding of the costs involved.

In summary, the trading conditions at FB Securities do not inspire confidence, particularly due to the lack of detailed information on their fees and spreads. This lack of clarity is a potential indicator that traders should be wary of when considering whether FB Securities is a safe broker.

Customer Funds Safety

The safety of customer funds is paramount when assessing the reliability of a forex broker. In the case of FB Securities, the absence of regulatory oversight raises serious concerns about how client funds are managed.

Traders typically expect their funds to be held in segregated accounts, providing additional protection against broker insolvency. However, FB Securities has not provided any information regarding its policies on fund segregation or investor protection measures. This lack of information leaves traders vulnerable, as they may not have any recourse if the broker mismanages their funds.

Additionally, there is no mention of negative balance protection, which is crucial for traders using leverage. This protection ensures that clients cannot lose more money than they have deposited, thus preventing significant financial distress. The absence of such safety measures further questions the broker's commitment to safeguarding client interests.

Historically, unregulated brokers have been involved in various financial disputes and scandals, leading to significant losses for traders. FB Securities' lack of transparency regarding its funds management practices only adds to the apprehension surrounding its safety.

Customer Experience and Complaints

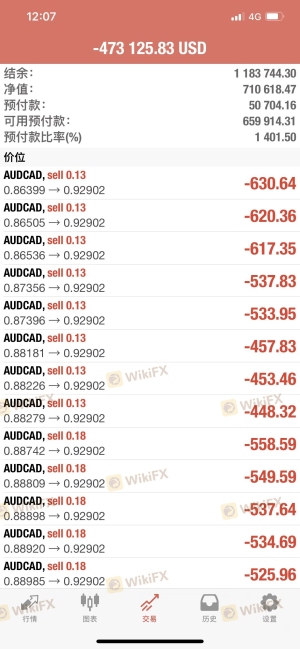

Customer feedback is invaluable in assessing the overall reliability of a broker. In the case of FB Securities, numerous complaints have surfaced regarding difficulties in withdrawing funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Unresponsive |

Many users have reported being unable to access their funds, which is a serious concern for any trader. Such issues not only impact the financial well-being of clients but also reflect poorly on the broker's operational integrity. The company's slow or inadequate response to these complaints further exacerbates the situation, leaving traders feeling abandoned and frustrated.

In some cases, clients have reported that their withdrawal requests were either delayed or completely ignored. These patterns of complaints suggest a troubling trend that potential clients should consider before deciding to invest with FB Securities.

Platform and Trade Execution

The trading platform's performance is another critical aspect of evaluating whether FB Securities is safe. A reliable broker should offer a stable and user-friendly platform that allows for smooth trade execution. However, there is limited information available regarding the performance and reliability of FB Securities' trading platform.

Users have reported mixed experiences with order execution, including instances of slippage and rejected orders. Such issues can significantly affect trading outcomes, particularly for those employing high-frequency or scalping strategies.

Moreover, the lack of transparency regarding the technology behind the trading platform raises concerns about potential manipulation or unfair practices. Traders should be cautious when engaging with platforms that do not provide clear insights into their execution methods.

Risk Assessment

Using FB Securities involves various risks that potential clients should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns about safety. |

| Financial Risk | High | Lack of transparency in fees can lead to unexpected costs. |

| Operational Risk | Medium | Mixed reviews on platform performance and customer service. |

The high regulatory risk associated with FB Securities is a significant concern, as it leaves traders without legal protections. Additionally, the financial risks stemming from unclear fees and potential withdrawal issues further complicate the decision-making process for traders.

To mitigate these risks, traders should consider using regulated brokers with transparent practices and a proven track record of client satisfaction.

Conclusion and Recommendations

In conclusion, the investigation into FB Securities raises significant concerns regarding its safety and legitimacy. The broker's unregulated status, lack of transparency, and numerous complaints from users suggest that it may not be a reliable option for traders. Therefore, it is crucial for potential clients to exercise caution and consider alternative options.

For traders seeking a safe and trustworthy environment, it is advisable to choose regulated brokers with strong reputations and proven track records. Some recommended alternatives include brokers that are regulated by top-tier authorities, which can provide the necessary protections and assurances that FB Securities lacks.

Ultimately, is FB Securities safe? The evidence suggests that it is not, and traders should be vigilant when considering their investment options.

Is FB SECURITIES a scam, or is it legit?

The latest exposure and evaluation content of FB SECURITIES brokers.

FB SECURITIES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FB SECURITIES latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.