Regarding the legitimacy of F-wise Capital forex brokers, it provides FSCA and WikiBit, (also has a graphic survey regarding security).

Is F-wise Capital safe?

Business

License

Is F-wise Capital markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

F-WISE CAPITAL (PTY) LTD

Effective Date: Change Record

2017-10-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

292 SURREY AVENUE,CNR HARLEY STREETFERNDALERANDBURG2125Phone Number of Licensed Institution:

011 787 3666Licensed Institution Certified Documents:

Is F Wise Capital Safe or a Scam?

Introduction

F Wise Capital is a forex brokerage that claims to provide a range of trading services to clients globally. As with any financial service, it is crucial for traders to thoroughly evaluate the safety and reliability of a broker before committing their funds. The forex market is rife with opportunities, but it is also plagued by scams and unregulated entities that can jeopardize traders' investments. This article aims to provide a comprehensive analysis of F Wise Capital, assessing its regulatory status, company background, trading conditions, customer experiences, and overall safety. The evaluation will draw on various online resources, expert reviews, and user feedback to offer a balanced view of whether F Wise Capital is safe or if it poses significant risks to potential traders.

Regulation and Legitimacy

The regulatory status of a brokerage is a critical factor in determining its legitimacy and safety. F Wise Capital operates under the jurisdiction of South Africa, where it claims to be licensed as a financial service provider. However, scrutiny reveals that the broker's license has exceeded its validity, raising concerns about its operational legitimacy. Below is a summary of the regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 48564 | South Africa | Exceeded |

The Financial Sector Conduct Authority (FSCA) is responsible for regulating financial services in South Africa. While F Wise Capital initially had a license, the fact that it has exceeded its validity indicates a lapse in compliance with regulatory standards. This lack of current regulation is a significant red flag, as it suggests that the broker is not subject to the oversight that ensures the protection of client funds and adherence to fair trading practices. Therefore, the absence of a valid license raises serious questions about whether F Wise Capital is safe for traders.

Company Background Investigation

F Wise Capital was established as part of a broader financial services group, with its roots tracing back to the agricultural markets division of South Africa's JSE. The company has positioned itself as a forex solutions provider, leveraging its historical expertise in commodities trading. However, the lack of detailed information about its ownership structure and management team raises concerns about transparency.

The management team's professional backgrounds and experience in the financial sector are not prominently disclosed, which can hinder potential clients' ability to assess the broker's reliability. Transparency in company operations and ownership is essential for building trust with clients, and F Wise Capital falls short in this regard. Without clear information regarding who runs the company and their qualifications, it becomes challenging to determine whether F Wise Capital is safe or if it operates under questionable practices.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is vital. F Wise Capital presents a range of trading options, but the overall fee structure and potential hidden costs warrant careful examination. Traders should be aware of any unusual fees that could impact their profitability. Below is a comparison of core trading costs:

| Fee Type | F Wise Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The absence of transparent information regarding spreads, commissions, and overnight interest rates raises concerns about the broker's fee structure. Traders need to be cautious, as any hidden charges can significantly erode potential profits. Furthermore, the lack of clarity in fees can lead to misunderstandings and disputes, making it essential for traders to inquire directly with F Wise Capital before opening an account to ascertain whether F Wise Capital is safe for their trading activities.

Client Fund Security

The security of client funds is paramount when assessing a brokerage's safety. F Wise Capital claims to implement measures to protect client funds, but the effectiveness of these measures requires scrutiny. The broker's website does not provide comprehensive information regarding fund segregation, investor protection, or negative balance protection policies.

The absence of clear policies regarding these critical safety measures can leave clients vulnerable to potential losses, especially in the volatile forex market. A history of any past security issues or disputes related to fund management can also impact the broker's reputation. Therefore, it is crucial for potential clients to conduct thorough research and verify the safety of their funds. Without robust measures in place, one must question whether F Wise Capital is safe for trading.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability and service quality. Reviews for F Wise Capital reveal mixed experiences, with some clients praising the broker's customer service while others report significant issues. Common complaints include delays in withdrawals, lack of communication, and difficulties in resolving disputes. Below is a summary of the main complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Communication Issues | Medium | Fair |

| Dispute Resolution | High | Poor |

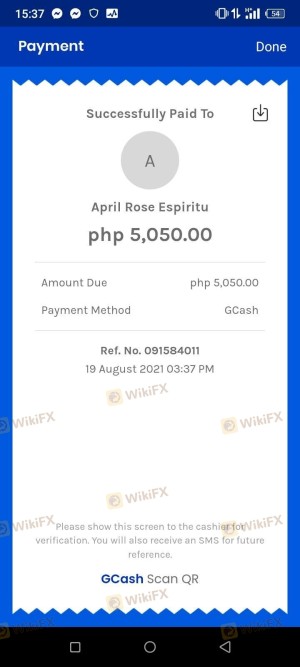

A few typical cases illustrate these complaints. For instance, some users reported waiting weeks for their withdrawal requests to be processed, while others experienced unresponsive customer service when trying to resolve issues. These patterns of complaints raise concerns about the overall client experience and whether the broker can adequately support its clients. Consequently, potential traders should carefully consider these factors when determining if F Wise Capital is safe for their trading needs.

Platform and Trade Execution

The performance of a trading platform significantly influences a trader's experience. F Wise Capital offers proprietary trading platforms, but user reviews indicate mixed feedback regarding their performance and stability. Traders have reported issues with order execution, including slippage and occasional rejections of orders during volatile market conditions.

The lack of robust performance metrics and user testimonials regarding the platform's reliability raises questions about its overall effectiveness. Traders need to be assured that their orders will be executed promptly without manipulation or undue delay. Therefore, potential clients should thoroughly test the platform through demo accounts before committing real funds to assess whether F Wise Capital is safe for their trading activities.

Risk Assessment

Engaging with any forex broker involves inherent risks, and F Wise Capital is no exception. A comprehensive risk assessment reveals several areas of concern that potential traders should consider:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Exceeded license validity |

| Customer Support | Medium | Mixed feedback on responsiveness |

| Fund Security | High | Lack of clear protection policies |

Given these risks, traders must approach F Wise Capital with caution. It is advisable to consider alternative brokers that offer more robust regulatory oversight and transparent trading conditions. For those who choose to engage with F Wise Capital, implementing risk management strategies, such as setting strict limits on investment amounts and maintaining a diversified trading portfolio, is crucial to mitigate potential losses.

Conclusion and Recommendations

In conclusion, the analysis of F Wise Capital reveals several red flags that suggest potential risks for traders. The broker's exceeded regulatory license, lack of transparency regarding its management, and mixed customer experiences raise significant concerns about whether F Wise Capital is safe for trading. While some traders may find value in the services offered, the overall safety profile indicates that caution is warranted.

For traders seeking reliable alternatives, it is recommended to consider brokers regulated by top-tier authorities, such as the FCA, ASIC, or SEC, which provide greater security and accountability. Ultimately, potential traders should conduct thorough due diligence and weigh the risks before deciding to engage with F Wise Capital or any similar brokerage.

Is F-wise Capital a scam, or is it legit?

The latest exposure and evaluation content of F-wise Capital brokers.

F-wise Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

F-wise Capital latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.