Is Evergreen Forex safe?

Business

License

Is Evergreen Forex Safe or a Scam?

Introduction

Evergreen Forex is an online forex broker that positions itself in the highly competitive foreign exchange market. As an entity that claims to offer trading services across various financial instruments, including forex pairs, commodities, and cryptocurrencies, it attracts both novice and experienced traders. However, the importance of thoroughly evaluating forex brokers cannot be overstated, especially in a market rife with scams and fraudulent activities. Traders need to ensure that their chosen broker is trustworthy, regulated, and transparent to safeguard their investments. This article employs a comprehensive investigative approach, analyzing Evergreen Forex's regulatory status, company background, trading conditions, customer experiences, and overall risk profile to determine whether Evergreen Forex is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in assessing its legitimacy and reliability. Evergreen Forex claims to operate under the auspices of several regulatory bodies; however, upon closer inspection, it becomes evident that the broker lacks valid regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0545141 | United States | Non-member, no oversight |

The above table highlights that although Evergreen Forex asserts a connection to the National Futures Association (NFA), it is a non-member and does not fall under the NFA's regulatory purview. This lack of regulation raises significant concerns about the broker's operational practices and accountability. Without a reputable regulatory framework, traders have limited recourse in the event of disputes or fraudulent activities. Furthermore, the absence of oversight means that there are no mandated standards for client fund segregation, transparency, or ethical conduct. Thus, the question arises: Is Evergreen Forex safe? The answer leans heavily towards caution, as the broker's unregulated status poses inherent risks for traders.

Company Background Investigation

A thorough investigation into the companys history reveals that Evergreen Forex Global Limited was registered in the United Kingdom but lacks a substantial operational history. Founded in 2021, the company claims to provide a range of trading services; however, details regarding its ownership structure and management team remain obscure.

The lack of transparency regarding the company's leadership raises further red flags. A competent management team with a proven track record is essential for establishing trust in a brokerage. Unfortunately, Evergreen Forex does not provide adequate information about its executives or their professional backgrounds. This opacity can be indicative of poor business practices and a lack of accountability. In a market where trust is paramount, the absence of clear information about the companys leadership and operational history contributes to the skepticism surrounding whether Evergreen Forex is safe.

Trading Conditions Analysis

When evaluating whether Evergreen Forex is safe, it is essential to analyze the trading conditions it offers. The broker claims to provide competitive spreads and leverage options; however, the lack of clarity regarding fees and trading costs is concerning.

| Fee Type | Evergreen Forex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Structure | None specified | $5 - $10 per lot |

| Overnight Interest Range | Not disclosed | 0.5% - 2.0% |

The table above illustrates that Evergreen Forex does not disclose essential information about its fee structure, which can lead to unexpected trading costs. Furthermore, the broker's promise of low commissions and spreads may not hold up under scrutiny, particularly given the unregulated nature of the company. Traders should be wary of any broker that does not provide clear and comprehensive information regarding its fees. This ambiguity raises questions about the overall transparency of the broker and whether it can be trusted.

Customer Funds Security

The security of customer funds is a critical aspect of any forex broker's operations. In the case of Evergreen Forex, the absence of regulation is alarming as it implies that there are no enforced measures for fund protection.

Traders should expect brokers to implement robust security protocols, including segregated accounts, investor protection schemes, and negative balance protection. However, Evergreen Forex does not provide any information regarding such policies. Without these essential safeguards, traders are left vulnerable to potential fraud or mismanagement of funds. Historical complaints from users about difficulties in withdrawing funds further exacerbate concerns about the security of investments with this broker. Given these factors, it is reasonable to conclude that Evergreen Forex is not safe for traders looking to protect their capital.

Customer Experience and Complaints

Customer feedback is often a telling indicator of a broker's reliability. In the case of Evergreen Forex, the majority of user reviews are overwhelmingly negative. Many traders have reported issues with fund withdrawals, hidden fees, and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Ignored |

| Hidden Fees | Medium | Inadequate |

| Poor Customer Service | High | Unresponsive |

The above table summarizes the common complaints associated with Evergreen Forex. Users have expressed frustration over their inability to access funds and the lack of support from the broker when issues arise. For instance, one user reported being unable to withdraw their funds after being asked for a significant deposit as a security measure. Such experiences raise serious concerns about the broker's operational integrity and whether Evergreen Forex is safe for investment.

Platform and Trade Execution

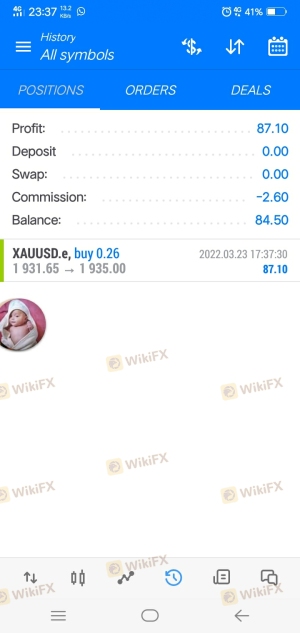

The trading platform provided by a broker significantly impacts the trading experience. Evergreen Forex claims to offer a robust trading platform; however, user experiences suggest otherwise. Many customers have reported issues related to platform stability, execution quality, and instances of slippage.

Moreover, there are no indications of market manipulation; however, the lack of transparency and user complaints about execution issues contribute to the overall skepticism regarding the broker's practices. A reliable trading platform should provide stable performance and efficient order execution, and the reported issues at Evergreen Forex suggest that it may not meet these standards.

Risk Assessment

Using Evergreen Forex presents various risks that potential traders should consider carefully.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Financial Risk | High | Potential for loss without protection. |

| Operational Risk | Medium | Issues with platform stability and support. |

The table above summarizes the key risk areas associated with trading with Evergreen Forex. The absence of regulation significantly heightens the risk profile, as traders lack the protections typically afforded by regulated entities. Additionally, operational risks related to platform performance and customer service further compound the potential for negative trading experiences. Therefore, it is crucial for traders to be aware of these risks and consider whether they can tolerate them.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Evergreen Forex is not safe for traders. The broker's lack of regulatory oversight, transparency issues, and numerous customer complaints raise significant concerns about its legitimacy. Traders should exercise extreme caution when considering this broker for their trading activities.

For those seeking more reliable trading options, it is advisable to choose brokers that are regulated by reputable authorities such as the FCA, ASIC, or NFA. These brokers typically offer better protections for client funds, transparent trading conditions, and responsive customer service. In light of the findings regarding Evergreen Forex, it is prudent for traders to explore alternative options that prioritize safety and transparency in their operations.

Is Evergreen Forex a scam, or is it legit?

The latest exposure and evaluation content of Evergreen Forex brokers.

Evergreen Forex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Evergreen Forex latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.