Is Datongjt safe?

Business

License

Is Datongjt Safe or Scam?

Introduction

Datongjt is an emerging player in the forex trading market, positioning itself as a broker that offers various trading services to retail and institutional clients. As the forex market continues to grow, so does the number of brokers vying for traders' attention. However, with this proliferation comes the necessity for traders to exercise caution and conduct thorough due diligence before committing their funds. This article aims to evaluate the safety and legitimacy of Datongjt by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile. The investigation is based on a comprehensive analysis of online reviews, regulatory data, and user experiences.

Regulatory and Legitimacy

The regulatory status of a forex broker is paramount in determining its safety and credibility. A regulated broker is typically subject to stringent oversight, which helps protect traders' interests. In the case of Datongjt, the broker claims to operate under certain regulatory frameworks, but a closer look reveals some inconsistencies.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CFFEX | N/A | China | Unverified |

While Datongjt claims to be regulated, it lacks verification from a top-tier regulatory body, which raises concerns about its legitimacy. Top-tier regulators such as the FCA (UK) and ASIC (Australia) enforce strict compliance standards, ensuring that brokers adhere to high operational norms. The absence of such oversight could expose traders to risks, including potential fraud or mismanagement of funds. Therefore, it is crucial to question is Datongjt safe if it operates without robust regulatory backing.

Company Background Investigation

Datongjt's history and ownership structure are essential factors in assessing its credibility. Established in recent years, Datongjt has sought to carve out a niche in the competitive forex landscape. However, the lack of a well-documented history raises red flags. The management team appears to have a mix of experience, but detailed profiles of key personnel are scarce, making it difficult to gauge their expertise and reliability.

Transparency is another area of concern. The company has not provided sufficient information regarding its operational practices and financial health, which is vital for potential clients. A broker's willingness to disclose information about its operations often reflects its confidence in its legitimacy. Given the limited information available, traders should be cautious and consider whether is Datongjt safe for their investments.

Trading Conditions Analysis

Understanding the trading conditions offered by Datongjt is critical for evaluating its attractiveness as a broker. The broker claims to provide competitive spreads and various trading instruments, but the overall fee structure warrants scrutiny.

| Fee Type | Datongjt | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | N/A | $5 per lot |

| Overnight Interest Range | 2% | 1.5% |

The spreads offered by Datongjt are slightly higher than the industry average, which could impact profitability for traders, especially those engaging in high-frequency trading. Furthermore, the absence of a clear commission structure raises questions about hidden fees that could erode traders' capital. As such, potential clients should carefully evaluate whether is Datongjt safe in terms of its trading costs.

Client Funds Security

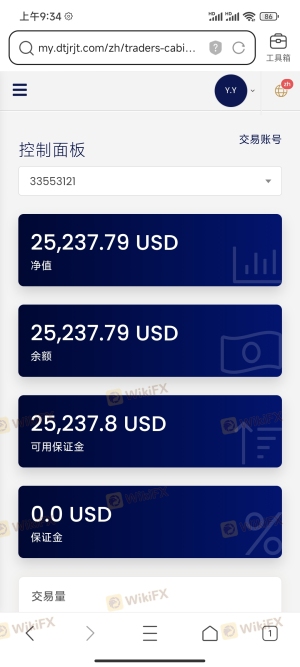

The safety of client funds is a paramount concern for any forex trader. Datongjt claims to implement various measures to protect client funds, such as segregating accounts and offering negative balance protection. However, the effectiveness of these measures remains uncertain.

The lack of a clear investor compensation scheme is another significant issue. In the event of insolvency, traders may find themselves with limited recourse to recover their funds. Historical incidents involving other brokers highlight the importance of robust fund protection mechanisms. Given these concerns, traders must assess whether is Datongjt safe considering its approach to client funds security.

Customer Experience and Complaints

Analyzing customer feedback can provide valuable insights into a broker's reliability. Reviews of Datongjt reveal a mixed bag of experiences. While some users report satisfactory trading experiences, others cite issues related to withdrawals and customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Poor Customer Support | Medium | Inconsistent |

| Misleading Information | High | Unresolved |

Common complaints include delays in processing withdrawals and inadequate customer support, which can severely impact a trader's experience. For instance, one user reported waiting weeks for their withdrawal request to be fulfilled, raising concerns about the broker's operational efficiency. These issues prompt further inquiry into whether is Datongjt safe based on user experiences.

Platform and Execution

The performance of a trading platform is crucial for ensuring a seamless trading experience. Datongjt offers a proprietary trading platform, but user reviews indicate mixed performance regarding stability and execution quality.

Traders have reported instances of slippage and rejected orders, which can be detrimental during volatile market conditions. The platform's user interface has also received criticism for being less intuitive compared to industry-standard platforms like MetaTrader 4. Given these factors, potential clients should consider whether is Datongjt safe in terms of its trading platform reliability.

Risk Assessment

Engaging with any forex broker involves inherent risks. For Datongjt, several risk factors emerge from the analysis.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight from top-tier regulators |

| Operational Risk | Medium | Reports of withdrawal delays and poor support |

| Financial Risk | Medium | Unclear fee structure and fund protection |

The high regulatory risk associated with Datongjt is particularly concerning, as it may expose traders to potential fraud or mismanagement. To mitigate these risks, it is advisable for traders to maintain a diversified portfolio and limit the amount of capital allocated to Datongjt. Therefore, it is essential to ask oneself, is Datongjt safe for trading?

Conclusion and Recommendations

In conclusion, the investigation into Datongjt raises several concerns regarding its legitimacy and safety as a forex broker. The lack of robust regulatory oversight, coupled with customer complaints and unclear trading conditions, suggests that traders should approach Datongjt with caution. While some users have reported positive experiences, the risks associated with this broker cannot be overlooked.

For traders seeking a more secure trading environment, it may be advisable to consider alternatives that offer better regulatory protections and transparent operations. Brokers regulated by top-tier authorities such as the FCA or ASIC should be prioritized, as they provide stronger investor safeguards. Ultimately, the question of whether is Datongjt safe remains unanswered, and potential clients should carefully weigh their options before proceeding.

Is Datongjt a scam, or is it legit?

The latest exposure and evaluation content of Datongjt brokers.

Datongjt Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Datongjt latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.