Is Capital Trade safe?

Business

License

Is Capital Trade A Scam?

Introduction

Capital Trade is a forex broker that positions itself within the highly competitive landscape of online trading. It offers a variety of financial instruments, including forex, indices, commodities, cryptocurrencies, and stocks. However, the legitimacy of Capital Trade has come under scrutiny, raising concerns among potential traders. This article aims to provide an objective assessment of whether Capital Trade is a safe and reliable broker or if it exhibits characteristics commonly associated with scams.

In the realm of forex trading, it is crucial for traders to conduct thorough evaluations of brokers before committing their funds. The potential for fraud is significant, with many unregulated brokers employing dubious practices to exploit unsuspecting investors. This investigation employs a comprehensive framework that includes regulatory compliance, company background, trading conditions, customer safety, and user experiences to determine the trustworthiness of Capital Trade.

Regulatory and Legality

The regulatory status of any broker is a vital indicator of its legitimacy. A well-regulated broker is typically subject to stringent oversight, which helps protect investors' funds and ensures fair trading practices. Unfortunately, Capital Trade is not regulated by any recognized financial authority, which raises serious red flags about its operations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Capital Trade does not adhere to the rigorous standards set by reputable regulatory bodies. Regulatory agencies, such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the USA, enforce rules that ensure brokers maintain adequate capital reserves, segregate client funds, and provide transparent pricing. Without such oversight, traders are at a higher risk of losing their investments and having no recourse for recovery.

Historically, the lack of regulation has been linked to numerous complaints and fraudulent activities associated with unregulated brokers. Capital Trade's failure to secure a license from a reputable authority indicates that it may not be a safe option for traders, making it essential to consider alternative brokers with established regulatory frameworks.

Company Background Investigation

Understanding the history and ownership structure of a broker is crucial in assessing its reliability. However, information regarding Capital Trade's history, ownership, and management team is sparse and often unreliable. The lack of transparency regarding who operates the company raises further concerns about its legitimacy.

Capital Trade claims to offer a range of trading accounts and services, yet it does not provide clear information about its management team or their qualifications. A reputable broker typically showcases its leadership team, providing details about their experience and expertise in the financial markets. In this case, the absence of such information is alarming, as it suggests that the company may not prioritize transparency or accountability.

Furthermore, the unavailability of the official website raises questions about the broker's operational integrity. A legitimate trading platform should have a functional website that provides comprehensive information about its services, account types, fees, and contact details. The lack of a reliable online presence is a significant indicator that Capital Trade may not be a trustworthy broker.

Trading Conditions Analysis

When evaluating a broker, it is essential to analyze its trading conditions, including fees, spreads, and commission structures. Capital Trade claims to offer competitive trading conditions; however, the lack of transparency regarding its fee structure is concerning.

| Fee Type | Capital Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While the advertised spreads appear attractive, the absence of detailed information about commission structures and overnight interest rates raises questions about the overall cost of trading with Capital Trade. Traders should be wary of hidden fees that can significantly impact their profitability.

Moreover, the lack of clarity surrounding the fee structure could indicate that Capital Trade may impose unexpected charges, making it difficult for traders to assess the true cost of their trading activities. This opacity in pricing is a common tactic used by unscrupulous brokers to exploit traders.

Client Funds Safety

The safety of client funds is a paramount concern when selecting a broker. Capital Trade's lack of regulatory oversight raises significant concerns regarding its client fund protection measures. A reputable broker should have robust systems in place to ensure the security of client funds, including segregated accounts and investor protection mechanisms.

Unfortunately, there is little information available about Capital Trade's policies regarding fund segregation and negative balance protection. In the event of financial difficulties or insolvency, traders may find themselves at risk of losing their deposits without any recourse for recovery. Additionally, the absence of a compensation scheme, such as those offered by regulatory bodies, further exacerbates the risk associated with trading with Capital Trade.

Historically, unregulated brokers have faced numerous allegations of misappropriating client funds, leading to significant financial losses for traders. Without a clear commitment to fund safety, Capital Trade's operations seem to align more closely with the characteristics of a scam than those of a legitimate broker.

Customer Experience and Complaints

Customer feedback is a critical component in assessing a broker's reputation. Unfortunately, the reviews and testimonials regarding Capital Trade are predominantly negative. Many users have reported difficulties in withdrawing their funds and have expressed frustration with the company's customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Minimal |

| Customer Service Complaints | High | Poor |

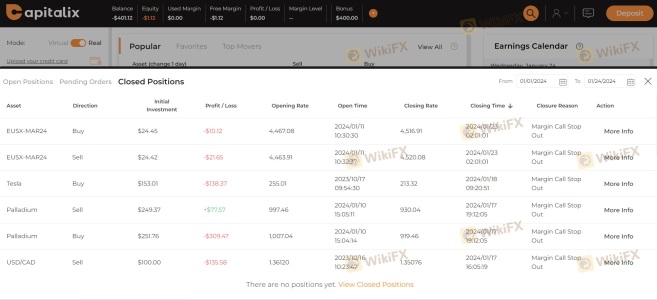

Common complaints include unresponsive customer support and challenges in accessing funds, which are significant indicators of a broker's reliability. In one instance, a trader reported being unable to withdraw their funds despite multiple requests, highlighting the potential risks associated with trading with Capital Trade. Such experiences are alarming and suggest that the broker may not prioritize client satisfaction or transparency.

Platform and Execution

The trading platform's performance and execution quality are vital factors in a trader's success. Capital Trade claims to offer a user-friendly trading environment; however, the lack of transparency regarding the platform's stability and execution quality is concerning.

Traders have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading outcomes. A reliable broker should provide a seamless trading experience, ensuring that orders are executed promptly and accurately. The absence of clear information regarding these aspects raises doubts about Capital Trade's operational integrity.

Risk Assessment

Using Capital Trade entails various risks, primarily due to its unregulated status and lack of transparency. Traders should be aware of the following risk categories:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of fund segregation and protection |

| Execution Risk | Medium | Potential for slippage and rejected orders |

To mitigate these risks, traders should consider conducting thorough research before committing funds and explore alternative brokers with established regulatory frameworks. Additionally, it is advisable to start with a small investment and test the broker's platform and services before scaling up.

Conclusion and Recommendations

Based on the comprehensive analysis, it is evident that Capital Trade raises significant concerns regarding its legitimacy and safety. The lack of regulation, transparency, and customer complaints suggest that it may not be a safe option for traders.

Potential investors should exercise caution and consider alternative brokers that are regulated by reputable authorities. Brokers such as IG, OANDA, or Forex.com offer robust regulatory oversight and transparent trading conditions, making them safer options for forex trading.

In summary, if you are considering trading with Capital Trade, it is crucial to weigh the risks carefully. The evidence strongly indicates that Capital Trade is not a safe broker, and traders should be wary of potential scams associated with its operations.

Is Capital Trade a scam, or is it legit?

The latest exposure and evaluation content of Capital Trade brokers.

Capital Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Capital Trade latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.