Capital Trade 2025 Review: Everything You Need to Know

Executive Summary

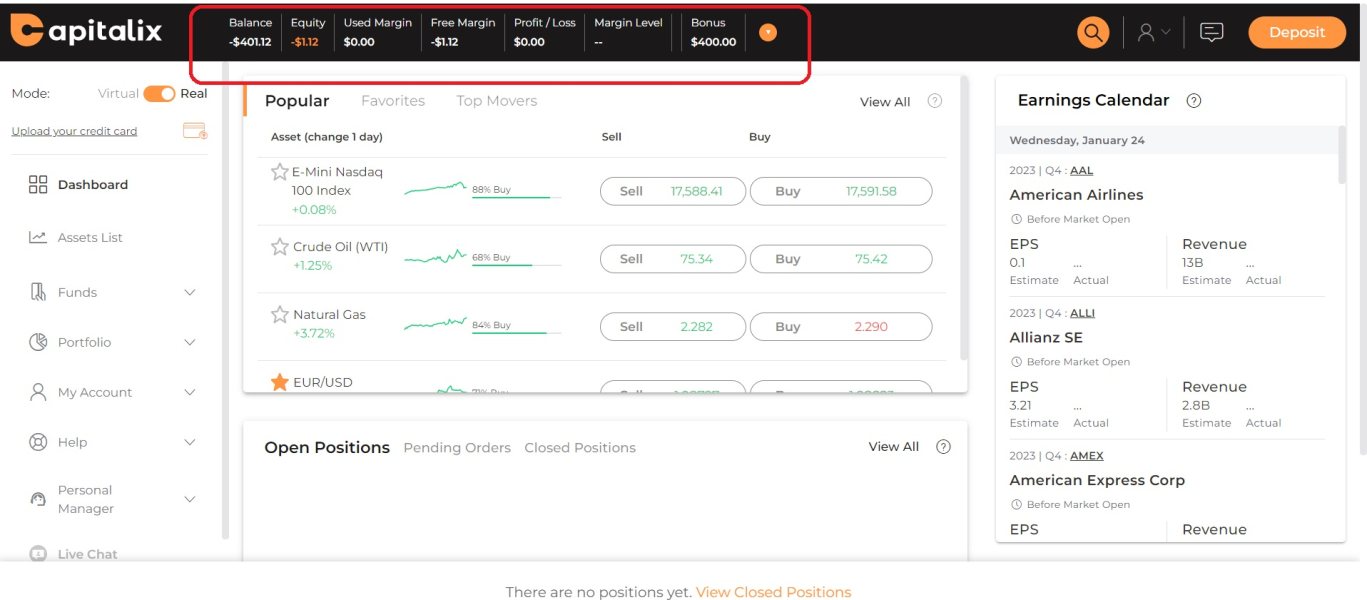

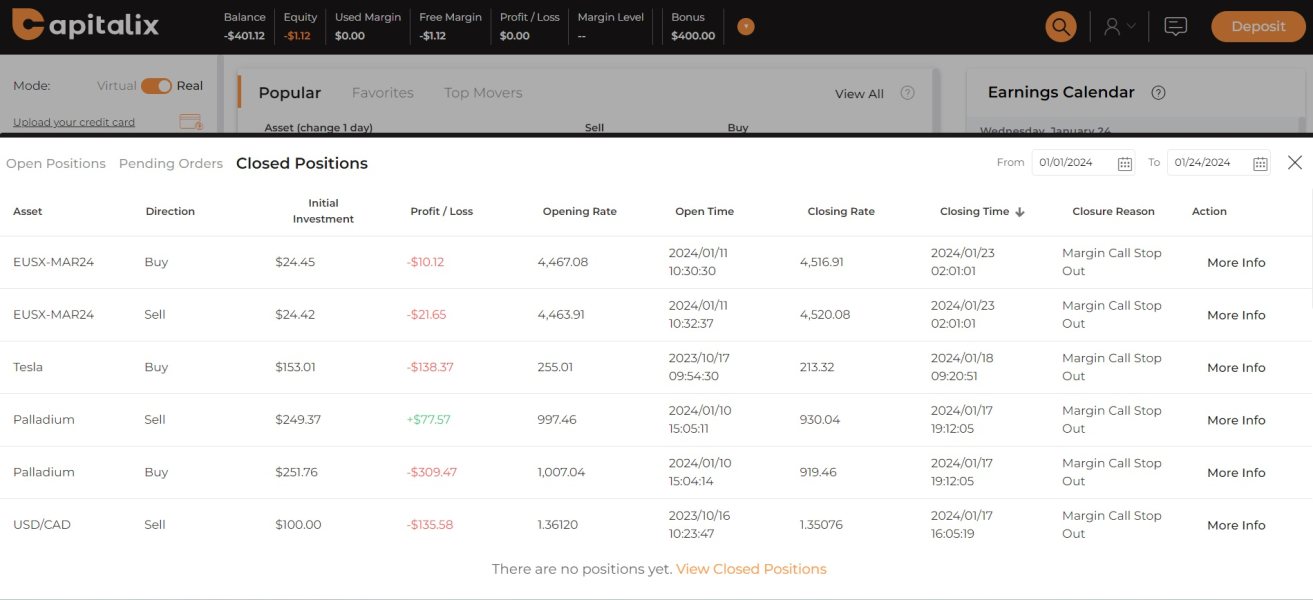

This comprehensive capital trade review reveals significant concerns about the broker's legitimacy and operational transparency. Capital Trade operates as an unregulated forex and CFD broker, claiming management by UIT Solution LTD without providing proper licensing information. The platform lacks essential regulatory oversight. This makes it unsuitable for serious traders seeking secure trading environments. Our investigation found minimal transparency regarding trading conditions, account types, and customer support structures. The absence of regulatory compliance and verifiable licensing raises substantial red flags for potential investors. This review aims to provide traders with critical information needed to make informed decisions about their trading platform selection. We particularly highlight the risks associated with unregulated brokers in today's competitive forex market.

Important Notice

Traders should exercise extreme caution when considering unregulated brokers. Different jurisdictions maintain varying regulatory standards that directly impact investor protection. The absence of proper regulatory oversight significantly increases the risk of fund loss and limits recourse options for dispute resolution. This evaluation is based on available market information, user feedback, and regulatory database searches, with particular emphasis on transparency and trustworthiness factors. Our assessment methodology prioritizes regulatory compliance, customer protection measures, and operational transparency as fundamental criteria for broker evaluation. Given the limited verifiable information about Capital Trade's operations, potential clients should conduct additional due diligence before making any investment decisions.

Rating Framework

Broker Overview

Capital Trade presents itself as a forex and CFD trading platform. Specific establishment details remain unclear from available documentation. The broker claims association with UIT Solution LTD, yet fails to provide comprehensive background information about its corporate structure, founding history, or operational timeline. This lack of fundamental transparency immediately raises concerns about the company's legitimacy and commitment to industry standards. The absence of clear founding dates, executive team information, or corporate milestones suggests either a recently established entity or deliberate opacity regarding company origins.

The platform's business model appears focused on forex and CFD trading services. Specific details about trading instruments, account structures, and service offerings remain largely undisclosed. Unlike established brokers that typically provide detailed information about their trading platforms, available asset classes, and regulatory frameworks, Capital Trade's operational structure lacks clarity. The broker operates without apparent regulatory oversight from recognized financial authorities. This represents a significant departure from industry best practices. This regulatory absence eliminates crucial investor protections typically associated with licensed financial service providers, making it an unsuitable choice for risk-conscious traders.

Regulatory Status: Capital Trade operates without regulatory oversight from recognized financial authorities. This presents substantial risks for potential clients. The absence of licensing from established regulators like the FCA, CySEC, or ASIC eliminates fundamental investor protections.

Deposit and Withdrawal Methods: Available documentation fails to specify supported payment methods, processing times, or associated fees for fund transfers. This creates uncertainty about financial transaction procedures.

Minimum Deposit Requirements: Specific minimum deposit amounts remain undisclosed. This prevents potential clients from understanding entry-level investment requirements or account accessibility.

Promotional Offers: No information exists regarding welcome bonuses, trading incentives, or promotional campaigns. This suggests either absence of such programs or poor marketing transparency.

Trading Assets: The broker claims to offer forex and CFD trading but fails to specify available currency pairs, commodity options, index selections, or cryptocurrency offerings. This limits informed decision-making.

Cost Structure: Critical pricing information including spreads, commission rates, overnight fees, and withdrawal charges remains undisclosed. This prevents accurate cost-benefit analysis for potential clients.

Leverage Options: Maximum leverage ratios and margin requirements are not specified. This creates uncertainty about risk management parameters and capital efficiency options.

Platform Selection: No information confirms whether the broker offers popular platforms like MetaTrader 4, MetaTrader 5, or proprietary trading solutions. This limits technical analysis capabilities.

Geographic Restrictions: Service availability across different jurisdictions remains unclear. This potentially affects international client accessibility.

Customer Support Languages: Available support languages are not specified. This potentially limits communication effectiveness for non-English speaking clients.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

Capital Trade's account structure represents a significant weakness in this capital trade review. This is primarily due to the complete absence of transparent information about available account types, their respective features, and qualification requirements. Traditional brokers typically offer multiple account tiers designed for different trader profiles, ranging from basic accounts for beginners to premium accounts for high-volume traders. However, Capital Trade fails to provide any details about account categorization. This makes it impossible for potential clients to understand which services align with their trading needs and experience levels.

The lack of minimum deposit information creates additional uncertainty for prospective traders attempting to assess accessibility and affordability. Most reputable brokers clearly communicate entry-level investment requirements, allowing traders to budget appropriately and understand commitment levels. Without this fundamental information, potential clients cannot determine whether the platform suits their financial capacity or investment strategy. Furthermore, the absence of information about account opening procedures, verification requirements, and approval timelines suggests either inadequate operational structure or deliberate opacity that contradicts industry transparency standards.

The trading tools and educational resources offered by Capital Trade remain largely undisclosed. This represents a critical deficiency for traders seeking comprehensive market analysis capabilities. Professional trading platforms typically provide extensive technical analysis tools, including advanced charting packages, indicator libraries, and automated trading support systems. However, available documentation fails to specify whether Capital Trade offers these essential features. This leaves potential clients uncertain about analytical capabilities and trading efficiency tools.

Educational resources constitute another significant gap in Capital Trade's service offering, as no information exists regarding market analysis, trading guides, webinars, or educational content designed to support trader development. Established brokers typically invest heavily in client education, providing market commentary, economic calendars, and learning materials that enhance trading knowledge and decision-making capabilities. The absence of such resources suggests either minimal commitment to client success or inadequate platform development that fails to meet modern trading requirements.

Customer Service and Support Analysis (Score: 1/10)

Capital Trade's customer service infrastructure remains completely undisclosed. This creates substantial concerns about client support availability and effectiveness. Professional brokers typically provide multiple communication channels including live chat, email support, telephone assistance, and comprehensive FAQ sections designed to address client inquiries promptly and effectively. The absence of clear support channel information suggests either inadequate customer service infrastructure or deliberate concealment of contact methods that could indicate operational deficiencies.

Response time commitments, service quality standards, and support availability hours are not specified. This prevents potential clients from understanding service level expectations. Modern traders expect rapid response times, knowledgeable support staff, and multilingual assistance capabilities, particularly when dealing with time-sensitive trading issues or technical difficulties. Without clear support structures and communication channels, clients risk experiencing significant delays in problem resolution. This potentially impacts trading performance and fund security.

Trading Experience Analysis (Score: 1/10)

The overall trading experience offered by Capital Trade cannot be adequately assessed due to insufficient information about platform stability, execution quality, and technological infrastructure. This capital trade review reveals concerning gaps in fundamental trading environment details that professional traders require for informed platform selection. Modern trading platforms must provide reliable order execution, minimal slippage, and robust technological infrastructure capable of handling high-frequency trading activities without performance degradation.

Platform functionality, user interface design, and mobile trading capabilities remain undisclosed. This prevents assessment of user experience quality and trading efficiency. Professional traders require sophisticated charting tools, real-time market data, and seamless order management systems that enable effective strategy implementation. The absence of specific platform information suggests either inadequate technological development or deliberate concealment of platform limitations that could negatively impact trading performance and user satisfaction.

Trust and Reliability Analysis (Score: 1/10)

Capital Trade's trustworthiness represents the most significant concern highlighted in this evaluation. This is primarily due to the complete absence of regulatory oversight and licensing from recognized financial authorities. Regulatory compliance serves as the foundation of broker trustworthiness, providing essential investor protections including segregated client funds, dispute resolution mechanisms, and operational transparency requirements. The lack of regulatory status eliminates these crucial safeguards. This substantially increases risks for potential clients.

Corporate transparency deficiencies further compound trust concerns, as the broker fails to provide comprehensive information about company ownership, operational history, or financial stability. Reputable brokers typically publish detailed corporate information, regulatory compliance documentation, and financial statements that demonstrate operational legitimacy and fiscal responsibility. The absence of such transparency suggests either inadequate corporate governance or deliberate concealment of operational details that could reveal significant business risks or operational deficiencies.

User Experience Analysis (Score: 1/10)

User experience assessment for Capital Trade proves challenging due to the absence of verifiable client feedback, user testimonials, or independent review data from established rating platforms. Professional broker evaluation typically relies on comprehensive user feedback covering platform usability, customer service quality, trading execution efficiency, and overall satisfaction levels. The lack of accessible user reviews suggests either limited client base, recent market entry, or potential issues with client retention that prevent positive feedback accumulation.

Interface design, navigation efficiency, and overall platform usability cannot be evaluated without access to the trading platform or detailed user experience documentation. Modern traders expect intuitive platform design, streamlined account management processes, and efficient fund transfer procedures that minimize administrative burden while maximizing trading focus. Without clear user experience information or accessible platform demonstrations, potential clients cannot assess whether Capital Trade meets contemporary usability standards or provides competitive user experience quality.

Conclusion

This comprehensive capital trade review concludes that Capital Trade presents substantial risks and limitations that make it unsuitable for serious forex and CFD traders. The broker's unregulated status, combined with significant transparency deficiencies and absent customer protection measures, creates an environment unsuitable for secure trading activities. The lack of essential information about trading conditions, platform capabilities, and corporate structure suggests either inadequate business development or deliberate opacity that contradicts professional trading standards. Based on this evaluation, we cannot recommend Capital Trade to any category of trader, whether beginner or experienced, due to the substantial risks associated with unregulated broker operations and the absence of fundamental investor protections.