Regarding the legitimacy of Brickhill Capital forex brokers, it provides FSPR and WikiBit, (also has a graphic survey regarding security).

Is Brickhill Capital safe?

Business

License

Is Brickhill Capital markets regulated?

The regulatory license is the strongest proof.

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

RevokedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

BRICKHILL CAPITAL (NZ) LIMITED

Effective Date:

2014-04-19Email Address of Licensed Institution:

info@brickhillcap.comSharing Status:

No SharingWebsite of Licensed Institution:

www.brickhillcap.co.nzExpiration Time:

2018-04-17Address of Licensed Institution:

Suite C3 Level 2 99 Queen Street, Auckland Central, Auckland, 0000, New ZealandPhone Number of Licensed Institution:

+64 9 8694764Licensed Institution Certified Documents:

Is Brickhill Capital Safe or Scam?

Introduction

Brickhill Capital is a forex broker that positions itself in the competitive landscape of online trading, aiming to provide retail and institutional traders with access to global foreign exchange markets. However, the rise of online trading has brought with it a proliferation of brokers, some of which may not operate with the best interests of their clients in mind. This makes it crucial for traders to carefully evaluate the legitimacy and reliability of any forex broker before investing their hard-earned money. In this article, we will investigate the safety and legitimacy of Brickhill Capital by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our assessment is based on a comprehensive review of multiple sources, including regulatory announcements, user reviews, and expert analyses.

Regulatory and Legality

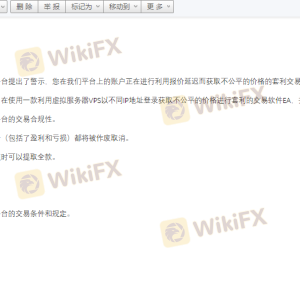

One of the most critical factors in determining whether Brickhill Capital is safe lies in its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards of conduct and financial practices. Brickhill Capital is registered in Belize and operates under the oversight of the International Financial Services Commission (IFSC). However, it has a controversial history regarding its compliance with regulations, which raises questions about its reliability.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC | IFSC/60/490/BCA/16 | Belize | Active |

While having a license from the IFSC is better than operating without any regulation, it is important to note that the IFSC is often viewed as a less stringent regulatory body compared to more reputable authorities such as the UK‘s Financial Conduct Authority (FCA) or the US’s Commodity Futures Trading Commission (CFTC). Furthermore, Brickhill Capital has faced scrutiny for its business practices, including allegations of unfair profit deductions and poor customer service, which could indicate potential regulatory issues. Therefore, it is essential for potential clients to consider these factors when evaluating whether Brickhill Capital is safe for trading.

Company Background Investigation

Brickhill Capital's history and ownership structure also provide insights into its credibility. The company was initially registered in New Zealand but has since shifted its operations to Belize, a common practice among brokers seeking a more lenient regulatory environment. This transition raises concerns about the broker's commitment to regulatory compliance and ethical business practices. The management team behind Brickhill Capital has a mixed background, with some members having experience in financial markets, while others lack a clear history in reputable trading firms.

Transparency is another area where Brickhill Capital falls short. The company has been criticized for not providing adequate information about its operations, including details about its ownership and management team. This lack of transparency can be a red flag for potential investors, as it may indicate that the broker is not fully committed to ethical practices. Therefore, when assessing whether Brickhill Capital is safe, it is crucial to consider these factors related to its company background and management.

Trading Conditions Analysis

The trading conditions offered by Brickhill Capital are another vital aspect to evaluate. The broker claims to provide competitive spreads and various account types, with a minimum deposit requirement of $200. However, many reviews indicate discrepancies between the advertised trading conditions and the actual experience of users. For instance, while the broker claims an average spread of 1.8 pips for major currency pairs, users have reported experiencing spreads as high as 2.4 to 2.6 pips during peak trading hours.

| Fee Type | Brickhill Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips (advertised) | 1.2 - 1.5 pips |

| Commission Model | None specified | Varies widely |

| Overnight Interest Range | Varies | Varies widely |

Additionally, the absence of a clear commission structure and the lack of variable spread specifications across account types can lead to confusion for traders. While lower entry barriers can be appealing, they should not overshadow the importance of transparent and fair trading conditions. Consequently, traders should carefully consider whether Brickhill Capital is safe based on its trading conditions and fee structures.

Client Fund Security

Client fund security is paramount when evaluating the safety of any forex broker. Brickhill Capital claims to implement various security measures to protect client funds, including segregated accounts and adherence to data protection protocols. However, the lack of clear information about these measures raises concerns.

Many reputable brokers provide detailed information about how they segregate client funds and ensure investor protection, but Brickhill Capital has not been forthcoming with such details. Furthermore, there have been reports of funds being withheld from clients under questionable circumstances, which is a significant red flag.

Given these considerations, it is essential for potential clients to thoroughly investigate the safety of their funds when trading with Brickhill Capital. While the broker may have some security measures in place, the overall lack of transparency and the history of client complaints suggest that Brickhill Capital may not be the safest option for traders.

Customer Experience and Complaints

Customer experiences with Brickhill Capital have been mixed, with numerous complaints surfacing regarding its customer service and trading practices. Many users have reported issues such as unresponsive customer support, delayed withdrawals, and sudden changes in trading conditions that were not communicated beforehand.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

| Sudden Spread Changes | High | Poor |

One notable case involved a trader who reported losing a significant amount of money due to what they described as "unreasonable profit deductions" by the broker. This incident highlights the potential risks and frustrations that clients may face when dealing with Brickhill Capital. As such, it is crucial for traders to weigh these experiences when determining whether Brickhill Capital is safe for their trading needs.

Platform and Trade Execution

The trading platform provided by Brickhill Capital is primarily MetaTrader 4 (MT4), a widely used platform known for its reliability and comprehensive features. However, users have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading performance.

Many traders have expressed concerns about the execution quality, particularly during volatile market conditions. Instances of severe slippage have been reported, raising suspicions about potential platform manipulation. This aspect of the trading experience is critical to consider, as it can directly affect a trader's profitability and overall satisfaction with the broker.

Given these concerns, it is essential to evaluate whether Brickhill Capital is safe based on the performance and reliability of its trading platform.

Risk Assessment

The overall risk profile of trading with Brickhill Capital is a combination of regulatory concerns, customer complaints, and platform reliability. Traders must be aware of the potential pitfalls associated with this broker, including the possibility of fund mismanagement, lack of transparency, and poor customer service.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Operates in a less regulated environment |

| Fund Security | Medium | Lack of transparency in fund protection |

| Customer Support | High | Numerous complaints about responsiveness |

To mitigate these risks, traders should conduct thorough due diligence before opening an account with Brickhill Capital. Seeking out alternative brokers with stronger regulatory oversight, better customer service, and transparent trading conditions is advisable.

Conclusion and Recommendations

In conclusion, while Brickhill Capital presents itself as a viable option for forex trading, several red flags indicate that traders should exercise caution. The broker's regulatory status, mixed customer feedback, and questionable trading conditions raise significant concerns about its safety and reliability.

Therefore, it is essential for traders to critically assess whether Brickhill Capital is safe for their trading activities. For those seeking more reliable alternatives, brokers with robust regulatory frameworks, transparent trading conditions, and positive customer reviews should be prioritized. Ultimately, the decision to trade with Brickhill Capital should be made with careful consideration of the risks involved and a thorough understanding of the broker's practices.

Is Brickhill Capital a scam, or is it legit?

The latest exposure and evaluation content of Brickhill Capital brokers.

Brickhill Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Brickhill Capital latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.