Is Betensh safe?

Pros

Cons

Is Betensh Safe or Scam?

Introduction

Betensh is a relatively new player in the forex market, positioning itself as a broker that offers a range of trading instruments, including currencies, commodities, and contracts for difference (CFDs). With an increasing number of online trading platforms available, traders need to exercise caution in evaluating the credibility and safety of these brokers. The potential for scams is significant, and due diligence is essential to protect ones investments. In this article, we will explore the legitimacy of Betensh by examining its regulatory status, company background, trading conditions, customer experiences, and overall safety measures. Our investigation will rely on a thorough review of available data, customer feedback, and expert analyses.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its safety and reliability. Regulators impose strict guidelines to protect investors and ensure fair trading practices. Unfortunately, Betensh appears to operate without proper oversight from recognized regulatory bodies.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation is a major red flag. Betensh claims to be affiliated with the Financial Crimes Enforcement Network (FinCEN); however, it is crucial to note that FinCEN does not regulate forex brokers. This misleading information raises concerns about the broker's transparency and adherence to legal standards. Furthermore, the lack of a legitimate license suggests that traders may be exposed to significant risks, including the potential misuse of funds and lack of recourse in case of disputes.

Company Background Investigation

Founded in 2021, Betensh claims to be based in the United Kingdom, with its registered address in South Croydon. However, there is scant information regarding its ownership structure and the backgrounds of its management team. The lack of transparency about the individuals behind the company is concerning.

Betensh's website does not provide detailed information about its executives or their qualifications, which is a standard practice among reputable brokers. The absence of such information can lead to questions about the firm's legitimacy and operational integrity. A company that does not disclose its management team may be attempting to obscure its practices and avoid accountability.

Trading Conditions Analysis

Understanding the trading conditions is vital for assessing whether a broker is safe or potentially a scam. Betensh's overall fee structure appears to be vague and lacks clarity, which can be a tactic used by less scrupulous brokers to attract clients without revealing the true costs involved.

| Fee Type | Betensh | Industry Average |

|---|---|---|

| Spread for Major Pairs | N/A | Varies |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of specific fee information is concerning, as it can lead to unexpected costs for traders. Moreover, high leverage ratios of up to 1:400 are advertised by Betensh, which is significantly higher than what is permitted by many regulatory authorities. This can lure inexperienced traders into risky positions, leading to substantial losses.

Customer Fund Safety

The safety of customer funds is another critical aspect when evaluating a broker's reliability. Betensh does not appear to have robust measures in place to protect client funds. The absence of segregated accounts means that clients' funds may not be kept separate from the broker's operational funds, increasing the risk of loss in the event of financial difficulties.

Additionally, there is no information available regarding investor protection schemes or negative balance protection policies. This lack of safeguards can leave traders vulnerable to significant financial risks, especially in volatile market conditions. Historical data on any past security breaches or fund mismanagement issues related to Betensh is also absent, further complicating the assessment of its safety.

Customer Experience and Complaints

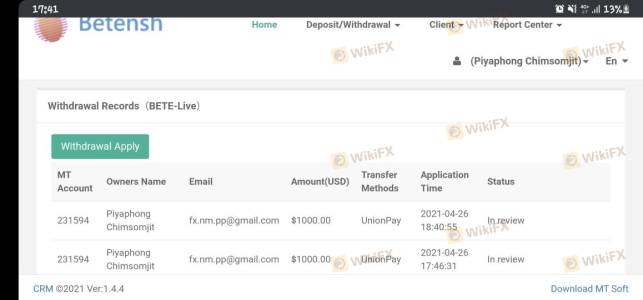

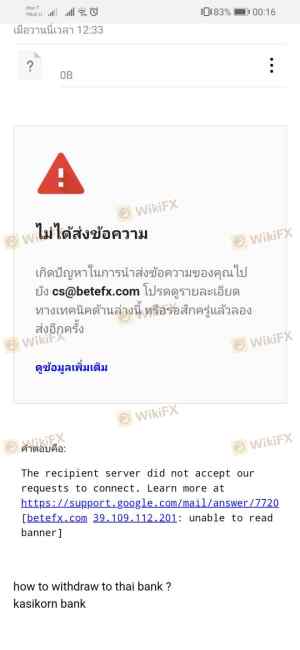

Customer feedback is a valuable resource for gauging a broker's reliability and service quality. Unfortunately, Betensh has received numerous negative reviews, with many users reporting issues such as difficulty withdrawing funds and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Misleading Information | High | Poor |

A common theme among complaints is the inability to access funds after depositing, which is a significant indicator of potential fraudulent activity. Additionally, the company's response to these complaints has been less than satisfactory, leading to further dissatisfaction among clients.

Platform and Trade Execution

The quality of the trading platform and execution is crucial for a positive trading experience. Betensh claims to offer access to popular trading platforms, but user experiences suggest otherwise. Many users have reported issues with platform stability, order execution delays, and high slippage rates.

These factors can severely impact trading outcomes, especially for those employing strategies that rely on precise execution. Furthermore, there are indications of potential platform manipulation, where the broker might interfere with trades to benefit itself at the expense of traders.

Risk Assessment

Engaging with Betensh presents several risks that potential traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No proper regulation, increasing risk of fraud. |

| Financial Risk | High | Lack of fund protection and high leverage. |

| Operational Risk | Medium | Platform instability and execution issues. |

To mitigate these risks, potential traders should conduct thorough research, consider using regulated brokers, and be cautious with their investments. Setting strict limits on trading amounts and employing risk management strategies can also help protect against potential losses.

Conclusion and Recommendations

In conclusion, based on the evidence gathered, it is clear that Betensh is not a safe choice for traders. The absence of regulatory oversight, poor customer feedback, and a lack of transparency are significant indicators of a potentially fraudulent operation. Traders should exercise extreme caution when considering this broker and be aware of the risks involved.

For those seeking a reliable trading experience, it is advisable to explore alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC offer a much safer environment for trading activities. Your financial future is too important to leave in the hands of an unregulated and potentially unscrupulous broker like Betensh.

Is Betensh a scam, or is it legit?

The latest exposure and evaluation content of Betensh brokers.

Betensh Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Betensh latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.