Is BPROFX safe?

Business

License

Is BProFx Safe or Scam?

Introduction

BProFx is an online forex broker that has attracted attention in the trading community for its aggressive marketing strategies and promises of high returns. Operating primarily as an offshore broker based in Dominica, BProFx has become a subject of scrutiny among traders and regulatory bodies alike. As the forex market continues to grow, it is essential for traders to carefully evaluate brokers to ensure their safety and legitimacy. This article aims to provide an objective analysis of BProFx, focusing on its regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and overall risk assessment. The information presented here is derived from multiple credible sources, including user reviews, regulatory databases, and financial news articles.

Regulation and Legitimacy

One of the most critical factors in determining whether BProFx is safe or a scam is its regulatory status. A regulated broker is typically subject to strict oversight, which helps protect traders' funds and ensures fair trading practices. Unfortunately, BProFx operates without any recognized regulatory authority, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation is a major red flag for potential investors. Many reports indicate that unregulated brokers like BProFx often engage in practices that can lead to the loss of clients' funds. The lack of transparency regarding the company's operations and ownership adds to the concerns about its safety. Furthermore, the fact that BProFx is based in Dominica, a jurisdiction known for its lax regulatory framework, further complicates the situation. Without a regulatory body to hold them accountable, traders have little recourse if they encounter issues with withdrawals or account management.

Company Background Investigation

BProFx is owned by Dynamics Solutions Ltd., a company registered in Dominica. However, limited information is available regarding its history, ownership structure, or management team. The absence of publicly accessible data about the company's executives and their professional backgrounds raises questions about transparency and accountability.

The company's lack of a clear operational history and identifiable leadership makes it difficult for traders to assess its reliability. In the forex industry, a transparent and well-documented company is often a sign of legitimacy. Unfortunately, BProFx does not meet these standards, which can be a cause for concern for potential investors.

Trading Conditions Analysis

When evaluating whether BProFx is safe, it is essential to consider its trading conditions, including fees and spreads. The broker claims to offer competitive spreads and a range of trading instruments, but without proper regulation, these claims should be scrutinized.

| Fee Type | BProFx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While BProFx may advertise attractive trading conditions, traders should be wary of hidden fees or unfavorable terms that could erode their profits. The lack of transparency in fee structures is a common tactic among unregulated brokers, and traders must exercise caution when considering this broker.

Customer Fund Security

The security of client funds is a paramount concern for any trader. BProFx's lack of regulation raises significant questions about its fund management practices. Without a regulatory body overseeing its operations, there is no assurance that client funds are kept in segregated accounts or that the broker adheres to best practices for fund security.

Additionally, there is no information available regarding any investor protection schemes, such as negative balance protection, which could safeguard clients against significant losses. Historical complaints and issues related to fund security further highlight the risks associated with trading with BProFx.

Customer Experience and Complaints

Analyzing customer feedback is crucial in determining whether BProFx is safe. Numerous reviews and reports indicate a pattern of complaints regarding withdrawal issues and poor customer service. Many users have reported difficulties in accessing their funds, with some claiming that their withdrawal requests were delayed for months.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

Several case studies illustrate the challenges faced by clients. One user reported that after depositing funds, they were pressured to invest more, only to find that their withdrawal requests were repeatedly ignored. Such experiences suggest a systemic issue within BProFx's operations, reinforcing the notion that it may not be a safe trading environment.

Platform and Execution

The trading platform offered by BProFx is another critical aspect to consider. User reviews indicate mixed experiences regarding platform stability and execution quality. Traders have reported instances of slippage and order rejections, which can significantly affect trading outcomes.

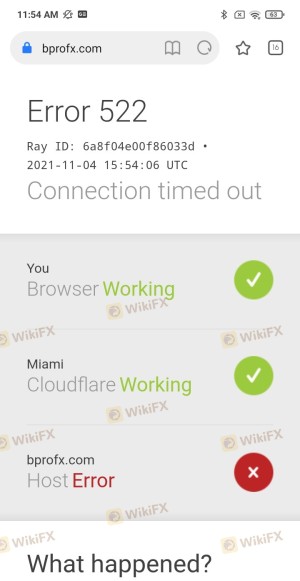

In a market where timely execution is essential, any signs of manipulation or technical issues can be detrimental to a trader's success. The lack of transparency regarding the platform's performance and the absence of a reputable regulatory body to oversee its operations further contribute to the concerns surrounding BProFx.

Risk Assessment

Overall, the risks associated with trading through BProFx are considerable. The absence of regulation, coupled with a lack of transparency and a history of customer complaints, paints a concerning picture for potential investors.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | No segregation of client funds |

| Customer Service Risk | Medium | Poor response to complaints |

To mitigate these risks, potential traders should consider using regulated brokers with established track records. Conducting thorough research and reading user reviews can also help identify safer trading environments.

Conclusion and Recommendations

In conclusion, the evidence suggests that BProFx is not a safe trading option for forex traders. The lack of regulation, transparency issues, and numerous customer complaints indicate that it may operate more like a scam than a legitimate broker. Traders should exercise extreme caution and avoid investing their hard-earned money in unregulated entities like BProFx.

For those seeking reliable alternatives, consider brokers that are regulated by recognized authorities, such as the FCA or ASIC. These brokers typically offer better security for client funds, transparent fee structures, and responsive customer service. Ultimately, ensuring your trading environment is safe is paramount to achieving success in the forex market.

Is BPROFX a scam, or is it legit?

The latest exposure and evaluation content of BPROFX brokers.

BPROFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BPROFX latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.