Is BIT BUD safe?

Business

License

Is Bit Bud A Scam?

Introduction

Bit Bud is an online forex broker that has been attracting attention in the financial trading community. Positioned as a platform for trading various asset classes, including forex, commodities, and indices, it claims to offer competitive trading conditions and a user-friendly interface. However, in the volatile world of forex trading, it is crucial for traders to conduct thorough due diligence before engaging with any broker. The importance of assessing a broker's legitimacy cannot be overstated, especially given the prevalence of scams and unregulated entities in the market. In this article, we will investigate the safety and reliability of Bit Bud by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

Regulation and Legitimacy

Regulatory oversight is vital in the forex industry, serving as a safeguard for traders' investments and ensuring fair practices. For Bit Bud, however, the lack of clear regulatory information raises significant concerns.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

Bit Bud operates without any valid regulatory licenses, which is alarming for potential traders. The absence of oversight means that there are no legal protections in place for clients, increasing the risk of fraud or mismanagement of funds. Furthermore, the platform's claims of offering high potential returns should be approached with skepticism, as these are often red flags for potential scams. Historical compliance issues and the absence of a regulatory framework suggest that traders should exercise extreme caution when considering this broker.

Company Background Investigation

Bit Bud's history and ownership structure provide further insight into its credibility. Unfortunately, details about the company's formation, management team, and operational transparency are scarce. The lack of publicly available information about who runs Bit Bud and their qualifications raises questions about the broker's legitimacy.

While many reputable brokers have a clear history and robust management teams with experience in finance and trading, Bit Bud does not seem to follow this trend. Transparency is a critical factor in establishing trust, and the absence of information about the company's operations could indicate potential issues. Without a solid foundation and a trustworthy management team, the risk of encountering problems with Bit Bud increases significantly.

Trading Conditions Analysis

When evaluating whether Bit Bud is safe, the broker's trading conditions play a crucial role. A transparent fee structure is essential for traders to understand their potential costs and make informed decisions. However, Bit Bud's fee structure is not well-documented, leading to confusion and potential hidden costs.

| Fee Type | Bit Bud | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.5 - 2.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The lack of clarity regarding spread, commission, and overnight interest rates raises concerns about the broker's transparency. Traders should be wary of brokers that do not provide clear information about their fees, as this can lead to unexpected costs and reduced profitability. In addition, any unusual fees or conditions should be scrutinized, as they may indicate a lack of integrity in the broker's operations.

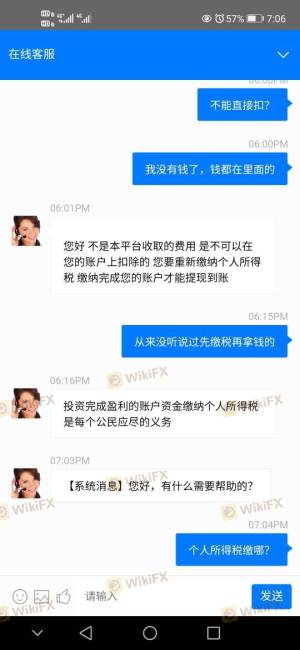

Customer Funds Security

The security of customer funds is a top priority for any forex broker. Bit Bud's measures to protect client funds are essential to evaluate its safety. Unfortunately, the absence of information regarding fund segregation, investor protection schemes, and negative balance protection policies is concerning.

Without proper fund segregation, clients' investments could be at risk in the event of the broker's insolvency. Furthermore, if there are no investor protection mechanisms in place, traders may find it challenging to recover their funds in case of disputes or fraud. Historical issues related to fund safety must also be considered, as any past incidents could indicate ongoing risks.

Customer Experience and Complaints

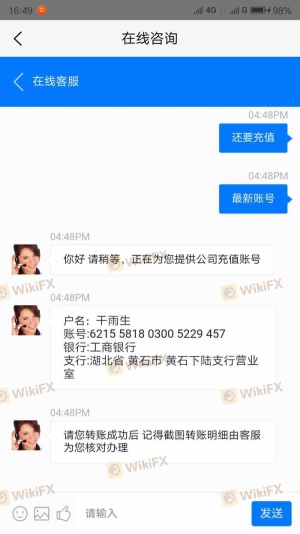

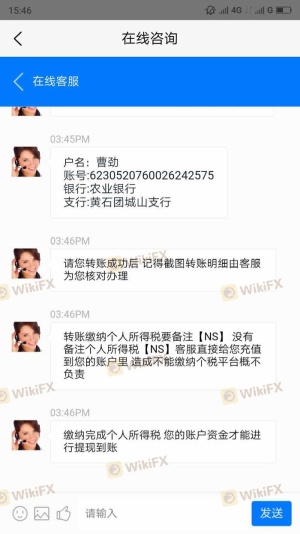

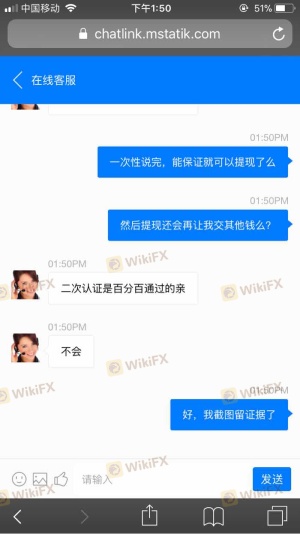

Customer feedback is invaluable in assessing the reliability of a broker. Unfortunately, there are numerous complaints surrounding Bit Bud, primarily focusing on withdrawal issues and customer service responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Inconsistent |

Many users have reported difficulties in withdrawing their funds, often citing vague excuses from customer support. This pattern of complaints raises serious red flags regarding the broker's operational integrity. A reliable broker should have a responsive customer support team that addresses issues promptly and effectively. The inability of Bit Bud to resolve these complaints satisfactorily is a significant concern for potential traders.

Platform and Trade Execution

The performance of the trading platform is crucial for a positive trading experience. Bit Bud claims to offer a user-friendly interface, but the lack of detailed information about its execution quality, slippage rates, and order rejection instances makes it difficult to assess its reliability.

Traders need to know that their orders will be executed swiftly and accurately. Any signs of platform manipulation or execution issues could severely impact trading outcomes. Therefore, potential users should be cautious and consider the risks associated with using Bit Bud's trading platform.

Risk Assessment

Using Bit Bud presents various risks that traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Transparency Risk | High | Lack of information |

| Customer Service Risk | Medium | Poor complaint handling |

| Fund Security Risk | High | No clear protection policies |

Given the high-risk levels associated with Bit Bud, traders should approach this broker with caution. It is advisable to consider alternative platforms that offer better regulatory oversight, transparency, and customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that Bit Bud raises significant concerns regarding its safety. The lack of regulation, transparency issues, and numerous customer complaints indicate that traders should be wary of engaging with this broker. While it may offer attractive trading conditions, the risks associated with using Bit Bud outweigh the potential benefits.

For traders seeking reliable alternatives, it is recommended to consider brokers that are well-regulated, transparent in their operations, and have a proven track record of customer satisfaction. Platforms with robust regulatory frameworks and strong customer support are essential for ensuring a safe trading environment. Always prioritize brokers that can demonstrate their commitment to client safety and regulatory compliance.

Is BIT BUD a scam, or is it legit?

The latest exposure and evaluation content of BIT BUD brokers.

BIT BUD Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BIT BUD latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.