Is Billion Forex safe?

Business

License

Is Billion Forex Safe or a Scam?

Introduction

Billion Forex, a relatively new player in the forex market, has garnered attention for its diverse trading offerings and aggressive marketing strategies. Established in 2020 and based in Estonia, this broker claims to provide a robust trading environment for both novice and experienced traders. However, as the forex market is rife with scams and unregulated entities, it is crucial for traders to exercise caution and thoroughly evaluate any broker before committing their funds. This article aims to investigate the legitimacy of Billion Forex by analyzing its regulatory status, company background, trading conditions, client fund security, customer feedback, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is paramount in determining its legitimacy and the safety of client funds. Billion Forex, however, operates without any significant regulatory oversight, which raises serious concerns about its trustworthiness.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Billion Forex is not subject to the stringent rules and oversight that licensed brokers must adhere to. This lack of regulatory framework exposes clients to higher risks, as there are no guarantees regarding the segregation of client funds or protection against insolvency. Furthermore, unregulated brokers often have the freedom to manipulate trading conditions and fees, making it difficult for traders to trust their operations.

Historical compliance records indicate that many unregulated brokers have faced legal actions and complaints from clients, leading to significant financial losses for traders. In the case of Billion Forex, the absence of a regulatory authority raises red flags about its operations and the safety of traders' investments. Thus, when evaluating if Billion Forex is safe, the lack of regulatory oversight is a critical factor to consider.

Company Background Investigation

Billion Forex is operated by Billion Traders Services OU, a company incorporated in Estonia. The broker's ownership structure lacks transparency, with limited information available about its management team and their professional backgrounds. Such opacity can be a warning sign, as reputable brokers typically provide detailed information about their leadership and operational practices.

The companys establishment in 2020 places it in the category of new brokers, which often raises concerns about their longevity and reliability. While some may argue that new brokers can offer innovative services, the lack of a proven track record can be detrimental when assessing their trustworthiness. Moreover, the absence of transparent operational details and the lack of a solid reputation in the industry further complicate the evaluation of whether Billion Forex is safe.

Trading Conditions Analysis

Billion Forex claims to offer competitive trading conditions, including high leverage and low spreads. However, the specifics of their fee structure and trading costs warrant careful scrutiny.

| Fee Type | Billion Forex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Model | Varies | Varies |

| Overnight Interest Range | Not disclosed | Varies |

While the advertised spreads may appear attractive, the lack of transparency regarding commissions and overnight interest raises concerns. Many brokers impose hidden fees that can significantly impact trading profitability. Additionally, the high leverage offered by Billion Forex (up to 1:888) can be enticing but also increases the risk of substantial losses, especially for inexperienced traders.

Such trading conditions, coupled with the absence of a clear commission structure, highlight the need for potential clients to approach Billion Forex with caution. Understanding the full cost of trading is essential for evaluating whether this broker is safe.

Client Fund Security

The security of client funds is a paramount concern for any trader. Billion Forex does not provide adequate information regarding its fund security measures. The absence of segregated accounts means that client funds may be at risk if the broker faces financial difficulties. Furthermore, the lack of investor protection schemes raises additional concerns about the safety of deposits.

Traders should be aware that, without regulatory oversight, there are no guarantees regarding the protection of their investments. Historical accounts of unregulated brokers often reveal instances of fund misappropriation and inability to withdraw funds. Thus, when considering if Billion Forex is safe, the glaring absence of protective measures for client funds is a significant red flag.

Customer Experience and Complaints

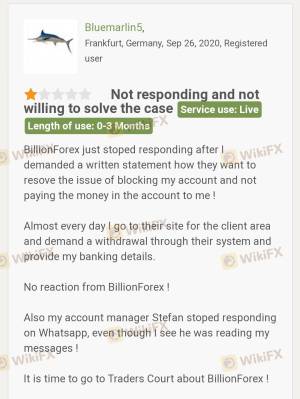

Customer feedback is a critical aspect of evaluating any broker's reliability. Reviews and testimonials regarding Billion Forex reveal a pattern of complaints, particularly concerning withdrawal issues and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Blocking | High | Poor |

| Unresponsive Support | Medium | Poor |

Several clients have reported difficulties in withdrawing their funds, with some alleging that their accounts were blocked without explanation. The lack of timely and effective responses from customer support exacerbates these issues, leading to frustration among traders.

For instance, one user detailed their experience of being unable to withdraw funds after multiple attempts, highlighting the broker's unresponsiveness and lack of accountability. Such complaints raise serious questions about the overall customer experience and whether Billion Forex is safe for traders.

Platform and Trade Execution

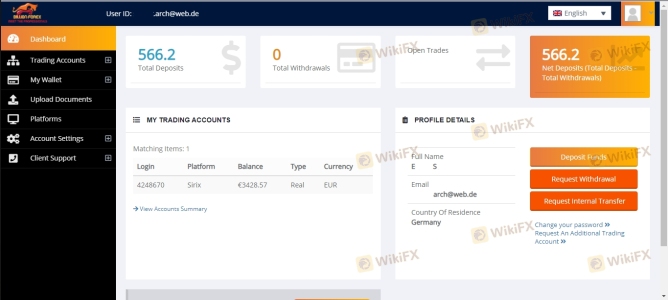

The trading platform offered by Billion Forex is the Sirix WebTrader, which is designed to be user-friendly and accessible across multiple devices. However, the platform's performance, stability, and execution quality are critical factors in assessing its effectiveness.

Traders have reported mixed experiences with order execution, including instances of slippage and rejected orders. These issues can significantly impact trading results, especially in volatile market conditions. Furthermore, any signs of potential manipulation or unfair practices on the platform can further undermine trust in the broker.

Overall, while the platform may offer a range of features, the reported execution issues and lack of transparency raise concerns about whether Billion Forex is safe for trading.

Risk Assessment

Engaging with Billion Forex comes with inherent risks, primarily due to its unregulated status and the lack of transparency surrounding its operations.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection. |

| Fund Security Risk | High | Client funds not segregated or protected. |

| Trading Condition Risk | Medium | Potential hidden fees and high leverage. |

| Customer Service Risk | Medium | Poor response to client inquiries and complaints. |

To mitigate these risks, traders should conduct thorough research and consider using regulated brokers with established reputations. Additionally, employing risk management strategies, such as limiting leverage and diversifying investments, can help protect against significant losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Billion Forex raises several red flags regarding its legitimacy and safety. The absence of regulatory oversight, coupled with numerous complaints from clients about withdrawal issues and poor customer service, indicates that this broker may not be a safe choice for traders.

For those considering engaging with Billion Forex, it is crucial to exercise extreme caution and thoroughly evaluate the potential risks involved. It may be advisable to explore alternative options with established, regulated brokers to ensure the safety of your investments.

For traders seeking reliable alternatives, consider brokers that are regulated by reputable authorities, such as those listed by the FCA or ASIC, which provide a higher level of security and investor protection.

Is Billion Forex a scam, or is it legit?

The latest exposure and evaluation content of Billion Forex brokers.

Billion Forex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Billion Forex latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.