Billion Forex 2025 Review: Everything You Need to Know

Executive Summary

Billion Forex Asia presents itself as a multi-asset trading platform. Our comprehensive billion forex review reveals significant concerns that potential traders must carefully consider before investing their money. Operating from the British Virgin Islands without proper regulatory oversight, this broker poses considerable risks to trader funds and overall trading experience that cannot be ignored. While the platform offers access to multiple asset classes including forex, stocks, commodities, indices, and cryptocurrencies through the Sirix WebTrader platform, the lack of regulatory protection overshadows these offerings completely.

The broker requires a minimum deposit of $500 for their micro account. This amount is relatively high compared to industry standards for entry-level accounts that typically start at $100 or less. According to various sources including WikiFX reports, Billion Forex has received numerous negative reviews from users citing issues with customer service, withdrawal processes, and overall platform reliability that raise serious red flags. The company's operational structure in an offshore jurisdiction without meaningful regulatory compliance creates an environment where trader protection is minimal and risks are maximized. This makes Billion Forex primarily suitable only for traders who are willing to accept substantial risks in exchange for access to diverse trading instruments.

Important Notice

Regional Entity Differences: Billion Forex operates from the British Virgin Islands, a jurisdiction known for limited financial services regulation. Traders should be aware that this offshore location provides minimal investor protection compared to brokers regulated by major financial authorities such as the FCA, CySEC, or ASIC that offer comprehensive safeguards. The lack of regulatory oversight means that standard protections like deposit insurance, segregated client funds, and dispute resolution mechanisms may not be available to protect your investment.

Review Methodology: This evaluation is based on publicly available information, user feedback from various trading forums and review platforms, and regulatory databases. Our assessment has not involved direct testing of the platform's services, and traders should conduct their own due diligence before making any investment decisions that could impact their financial future.

Rating Framework

Broker Overview

Billion Forex Asia operates as an unregulated forex and CFD broker headquartered in the British Virgin Islands. While specific founding details are not clearly documented in available sources, the company positions itself as a provider of online trading services across multiple financial markets including currency pairs, stocks, and commodities. The broker's business model focuses on offering retail traders access to forex pairs, individual stocks, commodities, market indices, and cryptocurrency instruments through a web-based trading platform that promises multi-device compatibility.

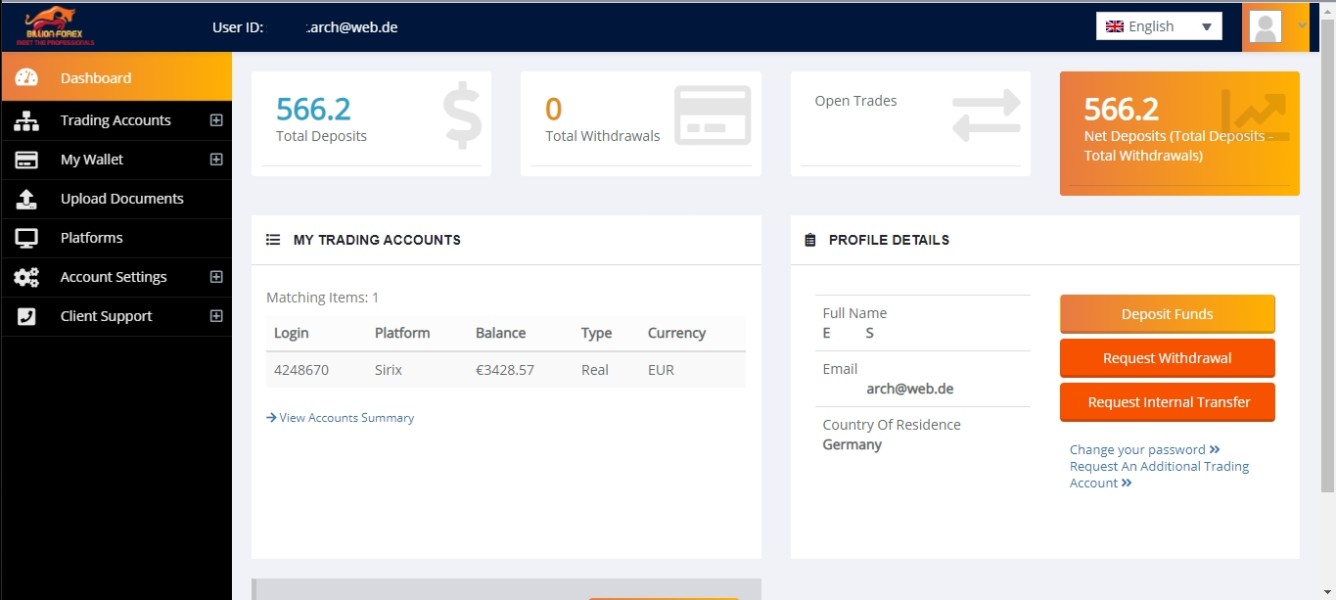

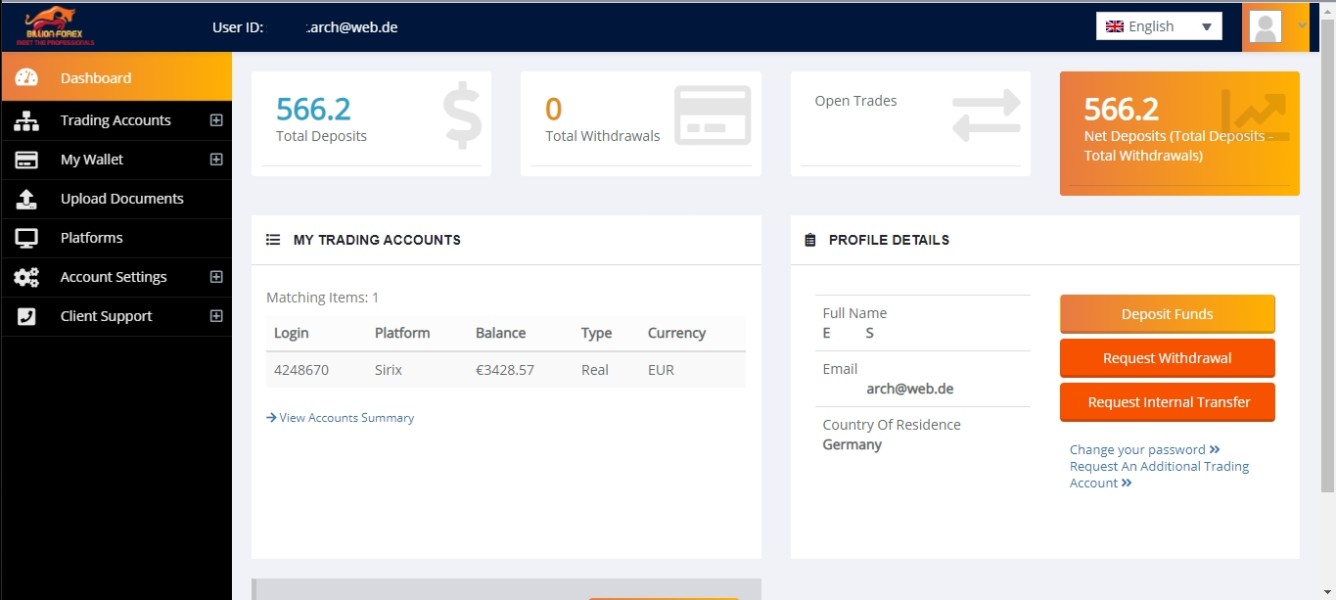

The company utilizes the Sirix WebTrader platform, which is accessible through web browsers on desktop computers, Mac systems, and mobile devices. This platform choice suggests an attempt to provide cross-device compatibility, though user feedback indicates mixed experiences with platform performance and reliability that may impact trading success. Billion Forex offers trading in major currency pairs alongside exotic pairs, various stock CFDs, precious metals, energy commodities, global stock indices, and popular cryptocurrencies that provide reasonable market diversity. However, the broker operates without oversight from recognized financial regulatory authorities, which significantly impacts the security and protection available to traders who choose this platform.

Regulatory Status: Billion Forex operates from the British Virgin Islands without regulation from any major financial authority. This offshore jurisdiction provides minimal oversight and trader protection compared to regulated environments that offer comprehensive safeguards.

Deposit and Withdrawal Methods: Specific information regarding payment methods and withdrawal procedures is not detailed in available sources. This raises concerns about transparency in financial operations that traders should consider carefully.

Minimum Deposit Requirements: The broker requires a minimum deposit of $500 for micro accounts, which is higher than many competitors who offer account opening with $100 or less. This higher barrier to entry may limit accessibility for new traders.

Bonus and Promotions: No specific information about promotional offers or trading bonuses is mentioned in available sources. This suggests limited marketing incentives compared to other brokers in the market.

Available Trading Assets: The platform provides access to forex currency pairs, stock CFDs, commodities including precious metals and energy, global indices, and cryptocurrency instruments. This offers reasonable asset diversity for traders seeking multiple market exposure.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not clearly specified in available documentation. This makes it difficult for traders to assess the true cost of trading with this broker.

Leverage Ratios: Specific leverage information is not mentioned in available sources, which is concerning given the importance of understanding leverage risks. Traders need this information to manage their risk exposure properly.

Platform Options: Billion Forex provides the Sirix WebTrader platform compatible with web browsers, desktop applications, Mac systems, and mobile devices. This multi-platform approach aims to serve traders across different devices and operating systems.

Geographic Restrictions: Information about specific country restrictions or regulatory limitations is not detailed in available sources. Traders should verify their eligibility before attempting to open accounts.

Customer Service Languages: Specific language support information is not provided in available documentation. This billion forex review highlights the significant information gaps that potential traders face when evaluating this broker, which itself raises red flags about transparency and professional operations.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

Billion Forex's account structure appears limited based on available information, with only micro accounts mentioned requiring a $500 minimum deposit. This entry requirement is notably higher than industry standards where many reputable brokers offer account opening with $100 or even lower amounts that make trading more accessible. The lack of detailed information about different account tiers, their specific features, or progression paths suggests a simplified but potentially restrictive account structure that may not meet diverse trader needs.

The absence of information regarding Islamic accounts, professional trader accounts, or other specialized account types indicates limited accommodation for diverse trader needs. User feedback suggests that account opening processes may lack the streamlined efficiency found with established, regulated brokers that prioritize customer onboarding. The higher minimum deposit requirement, combined with the broker's unregulated status, creates a risk-reward equation that heavily favors risk over potential benefits for most traders.

When compared to regulated competitors, Billion Forex's account conditions fall short of industry standards both in terms of accessibility and the protection framework surrounding client accounts. The lack of regulatory oversight means that standard account protections such as negative balance protection or segregated client funds may not be available, significantly impacting the overall value proposition for potential traders seeking this billion forex review.

Billion Forex utilizes the Sirix WebTrader platform, which provides basic trading functionality across web, desktop, and mobile environments. However, the depth and quality of trading tools appear limited compared to more established brokers who typically offer comprehensive charting packages, advanced order types, and sophisticated analytical tools that enhance trading effectiveness. The platform's multi-device compatibility is a positive aspect, but user feedback suggests performance issues that may impact trading effectiveness during critical market moments.

Research and analytical resources are not well-documented in available sources, which is concerning for traders who rely on market analysis and educational content to inform their trading decisions. The absence of detailed information about economic calendars, market news feeds, or fundamental analysis tools suggests that traders may need to rely on external sources for market intelligence that should be provided by their broker. Educational resources appear to be minimal or non-existent based on available information that raises questions about trader support.

Established brokers typically provide webinars, trading guides, video tutorials, and other educational materials to support trader development and success. The lack of such resources at Billion Forex may particularly disadvantage newer traders who benefit from structured learning materials and ongoing education support that helps them develop their skills.

Customer Service and Support Analysis (3/10)

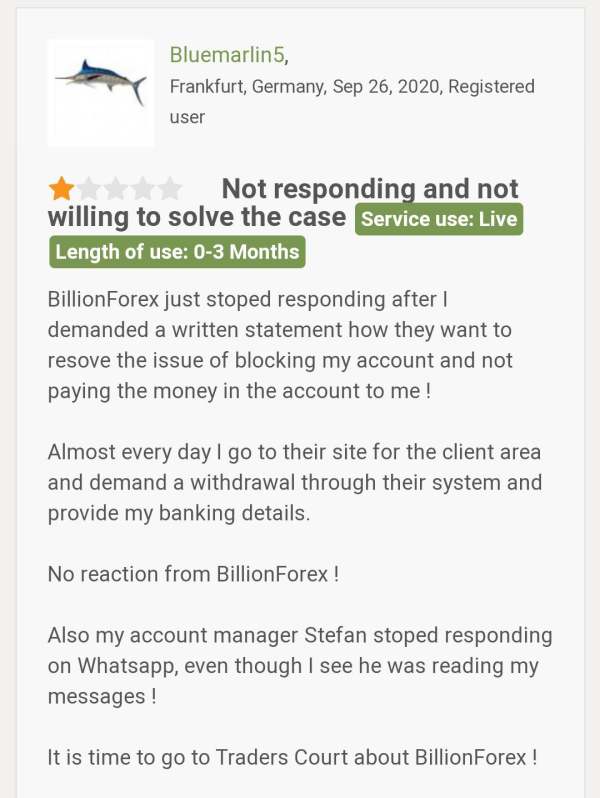

Customer service quality emerges as a significant weakness in user feedback about Billion Forex. Available reviews and user experiences suggest that support responsiveness and effectiveness fall well below industry standards that traders expect from professional financial service providers. The lack of clearly documented support channels, operating hours, or service level commitments raises concerns about the broker's commitment to customer care and satisfaction.

Response times appear to be problematic based on user complaints, with traders reporting delays in getting assistance with account issues, technical problems, or withdrawal requests. The quality of support interactions also receives criticism, with users indicating that support staff may lack the expertise or authority to resolve complex issues effectively when problems arise. Multiple language support information is not clearly available, which may limit accessibility for international traders who need assistance in their native language.

The absence of comprehensive support documentation, FAQ sections, or self-service options forces traders to rely primarily on direct contact methods that appear to be inadequate based on user experiences. This poor support infrastructure is particularly concerning given the broker's unregulated status, as traders have limited recourse when support fails to resolve issues satisfactorily or in a timely manner.

Trading Experience Analysis (4/10)

The trading experience with Billion Forex receives mixed to negative feedback from users, with particular concerns about platform stability and execution quality. While the Sirix WebTrader platform offers basic functionality, user reports suggest reliability issues that can impact trading effectiveness, especially during volatile market conditions when consistent platform performance is crucial for success. Order execution quality appears inconsistent based on available user feedback, though specific data about slippage rates, requote frequency, or execution speeds is not readily available to verify these claims.

This lack of transparency about execution statistics makes it difficult for traders to assess whether they can expect fair and efficient order processing, which is fundamental to successful trading outcomes. The absence of detailed information about spreads, commission structures, and overall trading costs creates uncertainty about the true cost of trading with Billion Forex that may impact profitability. User feedback suggests that the trading environment may not be as competitive as that offered by regulated brokers who are required to provide transparent pricing information to their clients.

Mobile trading functionality is available but appears to suffer from the same reliability issues reported with the web-based platform. This limits traders' ability to manage positions effectively when away from their primary trading setup, which is essential in today's fast-moving markets. This billion forex review indicates that the overall trading experience falls short of expectations, particularly when compared to regulated alternatives that offer greater transparency and reliability.

Trust and Security Analysis (2/10)

Trust and security represent the most significant concerns with Billion Forex, primarily due to the broker's unregulated status and operation from an offshore jurisdiction with minimal financial oversight. The absence of regulation by recognized authorities such as the FCA, CySEC, ASIC, or other major financial regulators means that traders have virtually no protection if issues arise with their funds or trading accounts that could result in financial loss. Fund security measures are not clearly documented, raising serious questions about client money protection that should be a top priority for any financial service provider.

Regulated brokers are typically required to segregate client funds from company operating funds and maintain these deposits with established financial institutions. Without regulatory oversight, there are no guarantees that such protections exist at Billion Forex, potentially putting trader deposits at risk of loss if the company faces financial difficulties. Company transparency is limited, with minimal information available about company leadership, financial statements, or operational procedures that would allow traders to assess the broker's stability and credibility.

This lack of transparency is particularly concerning in the financial services industry where trust is paramount for successful business relationships. User feedback includes concerning reports about withdrawal difficulties and communication issues, which further undermines confidence in the broker's operational integrity and commitment to client service. The overall industry reputation of Billion Forex appears poor based on available reviews and user experiences that consistently highlight problems with the broker's operations.

User Experience Analysis (4/10)

Overall user satisfaction with Billion Forex appears low based on available feedback and review sources. Users frequently report frustrations with various aspects of the service, from initial account setup through ongoing trading activities and support interactions that create a negative overall impression. The cumulative effect of these issues creates a user experience that fails to meet modern expectations for online trading platforms that should prioritize customer satisfaction.

Interface design and usability information is limited in available sources, but user feedback suggests that the platform may lack the intuitive design and smooth functionality that traders expect from contemporary trading applications. Navigation issues and platform complexity may create barriers to effective trading, particularly for less experienced users who benefit from straightforward, well-designed interfaces that facilitate easy platform use. Registration and account verification processes appear to lack the efficiency and clarity found with established brokers that have streamlined these procedures.

User complaints about lengthy verification times, unclear documentation requirements, and communication gaps during onboarding suggest that the initial user experience may be frustrating and time-consuming. The most common user complaints center around customer service responsiveness, platform reliability, and withdrawal processing issues that impact the fundamental aspects of the trading relationship. These fundamental operational problems significantly impact user satisfaction and create an environment where traders may feel uncertain about their ability to access their funds or receive adequate support when needed.

The pattern of negative feedback suggests systemic issues rather than isolated incidents, indicating that improvements would require fundamental changes to the broker's operational approach.

Conclusion

This comprehensive billion forex review reveals a broker that falls significantly short of industry standards across multiple critical dimensions. While Billion Forex offers access to diverse trading instruments through a multi-device platform, the fundamental issues of regulatory oversight, customer service quality, and operational transparency create an unacceptable risk profile for most traders who value security and reliability. The broker may only be suitable for highly experienced traders who fully understand and accept the substantial risks associated with unregulated brokers and who have sufficient risk capital that they can afford to lose entirely without impacting their financial stability.

For the vast majority of traders, particularly those seeking reliable service, regulatory protection, and professional support, numerous better alternatives exist in the regulated broker space. The primary advantages of multiple asset classes and platform accessibility are heavily outweighed by the significant disadvantages of no regulatory protection, poor customer service, questionable operational transparency, and negative user feedback patterns that create serious concerns about broker reliability. Potential traders should carefully consider these factors and explore regulated alternatives that offer similar trading opportunities with substantially better protection and service standards that prioritize client safety and satisfaction.