Is BFS safe?

Business

License

Is BFS Safe or a Scam?

Introduction

BFS Forex, operating under the name BFS Markets Ltd., has positioned itself within the Forex market since its inception in 2013. The broker primarily targets clients in the Asia-Pacific region, offering a range of trading services, including Forex and CFDs. However, as with any trading platform, it is vital for traders to conduct thorough due diligence before committing their funds. The Forex market is rife with potential risks, including scams and unregulated brokers that can jeopardize investors' capital. This article aims to provide a comprehensive assessment of BFS Forex, examining its regulatory standing, company background, trading conditions, and customer experiences, thereby helping readers answer the question: Is BFS safe?

To conduct this investigation, we utilized a combination of online reviews, regulatory information, and client testimonials. Our evaluation framework includes analyzing the broker's regulatory compliance, company history, trading conditions, client fund safety, and overall user experience.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in determining its legitimacy and the safety of client funds. BFS Forex has faced significant scrutiny regarding its regulatory status. Previously, it was licensed by the Vanuatu Financial Services Commission (VFSC), but this license has been revoked. Furthermore, the broker is not authorized by the National Futures Association (NFA) in the United States. The absence of valid regulation raises serious concerns about the oversight and accountability of BFS's operations, which is a major red flag for potential investors.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| VFSC | 300334 | Vanuatu | Revoked |

| NFA | 0520533 | USA | Unauthorized |

The lack of a legitimate regulatory framework means that BFS Forex does not adhere to the stringent compliance requirements typically imposed on regulated brokers. This absence of oversight can lead to significant risks for clients, as there is no guarantee that their funds are protected in case of insolvency or disputes. Furthermore, the company's history of regulatory issues further diminishes its credibility in the trading community.

Company Background Investigation

BFS Forex was established in 2013, focusing on providing trading services in the financial markets. The company is registered in Hong Kong, which allows it to cater to a diverse range of clients. However, its ownership structure has raised concerns due to past regulatory issues, specifically the revocation of licenses by various regulatory bodies. The management team behind BFS Forex has not been adequately disclosed, which is a common practice among unregulated brokers. This opacity can be a significant red flag for potential investors, as it leaves them with little recourse should issues arise.

The company claims to have served numerous clients; however, various reports indicate a high level of dissatisfaction, particularly concerning withdrawal issues and customer support. Consequently, the growth of its customer base has not been consistent or reliable.

Trading Conditions Analysis

BFS Forex offers a variety of trading instruments, including currency pairs, CFDs, and precious metals. However, the lack of clarity regarding fees and commissions raises concerns. The broker claims to offer competitive spreads, but many users have reported hidden fees and difficulties with withdrawals.

| Fee Type | BFS Forex | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2 pips | 1.5 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The absence of a clear and transparent fee structure can lead to unexpected costs for traders, undermining their trading experience. Moreover, the reports of scams and complaints regarding withdrawal issues highlight the potential risks associated with trading on this platform.

Client Fund Safety

The safety of client funds is paramount when evaluating any broker. BFS Forex has not provided clear information regarding its fund protection measures. Given its unregulated status, clients face substantial risks regarding the safety of their investments. There is no indication that client funds are kept in segregated accounts, which is a standard practice among regulated brokers to protect clients' capital from the company's operational funds.

Additionally, BFS Forex does not offer negative balance protection, which means clients could potentially lose more than their initial investment. Historical reports of clients facing difficulties in withdrawing funds further exacerbate concerns about the safety of their capital.

Customer Experience and Complaints

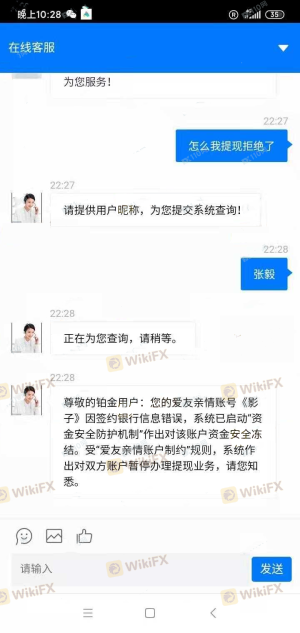

Customer feedback regarding BFS Forex is overwhelmingly negative, with many users reporting issues related to fund withdrawals and customer service responsiveness. Common complaints include difficulties in executing trades, high spreads, and unresponsive customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| High Spreads | Medium | Minimal |

One notable case involved a trader who reported significant delays in withdrawing funds, with the broker citing various administrative issues. This situation reflects a broader pattern of complaints related to the broker's operational inefficiencies and lack of accountability.

Platform and Trade Execution

BFS Forex provides access to the popular MetaTrader 4 (MT4) platform, which is generally favored for its user-friendly interface and robust trading capabilities. However, reviews indicate that the platform's performance can be inconsistent, with reports of slippage and order rejections during volatile market conditions. The execution quality has been questioned, with some users noting that their trades were not executed at the expected prices, leading to potential losses.

Risk Assessment

Using BFS Forex as a trading platform involves several risks that potential traders should be aware of:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns about fund safety. |

| Operational Risk | High | Inaccessible website and poor customer service. |

| Financial Risk | Medium | High leverage increases potential losses. |

To mitigate these risks, traders should consider using only regulated brokers that provide clear information about their trading conditions and safety measures. Additionally, employing risk management strategies, such as setting stop-loss orders and limiting leverage, can help protect capital.

Conclusion and Recommendations

In conclusion, the evidence suggests that BFS Forex operates as an unregulated broker with significant risks for potential investors. The lack of regulatory oversight, combined with poor customer feedback and unclear trading conditions, raises serious concerns about the broker's legitimacy.

Is BFS safe? The overwhelming consensus is that it is not a safe option for traders, particularly those who are inexperienced or risk-averse. We recommend that traders seek alternative options, such as brokers regulated by reputable authorities like the FCA or ASIC, to ensure their investments are protected.

For those considering engaging with BFS Forex, it would be prudent to proceed with extreme caution and thoroughly evaluate other, more reliable trading platforms that offer the necessary protections and transparency.

Is BFS a scam, or is it legit?

The latest exposure and evaluation content of BFS brokers.

BFS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BFS latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.