Is ASCENT BRIGHT safe?

Business

License

Is Ascent Bright A Scam?

Introduction

Ascent Bright is a forex broker that positions itself primarily in the Chinese market, offering trading services through platforms like MetaTrader 4 and 5. As with any broker, particularly those operating in the forex market, traders must exercise caution and conduct thorough evaluations before committing their funds. The forex market can be rife with scams, and the potential for financial loss is significant if traders choose an unreliable broker. In this article, we will investigate whether Ascent Bright is a safe trading option or a potential scam. Our analysis is based on extensive research, including regulatory information, company background, trading conditions, customer feedback, and risk assessments.

Regulation and Legitimacy

One of the foremost considerations when evaluating a forex broker is its regulatory status. Regulation ensures that brokers adhere to certain standards, providing a layer of protection for traders. Ascent Bright appears to be lacking in valid regulatory oversight, which raises red flags regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Ascent Bright does not operate under the scrutiny of a recognized financial authority. This lack of oversight can expose traders to higher risks, including potential fraud or mismanagement of funds. Moreover, the company's history shows no evidence of compliance with regulatory standards, leading to concerns about its operational integrity. In the absence of a regulatory body to oversee its activities, traders must be particularly vigilant when engaging with this broker.

Company Background Investigation

Ascent Bright Tech Limited was founded relatively recently, with its operations primarily targeting the Chinese market. However, the company's history and ownership structure remain unclear, which can be a significant concern for potential investors. The management team behind Ascent Bright lacks publicly available credentials, making it difficult to ascertain their experience or expertise in the forex trading industry.

Transparency is crucial in building trust with clients, and Ascent Bright's limited disclosure of information raises questions about its commitment to operational integrity. The absence of detailed information regarding the management team and ownership can be a warning sign for potential traders. A broker that is open about its leadership and operational practices is generally more trustworthy than one that is not.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is essential. Ascent Bright's fee structure appears to be opaque, with limited information available regarding spreads, commissions, and overnight interest rates. This lack of clarity can lead to unexpected costs for traders, which is a common tactic among less reputable brokers.

| Fee Type | Ascent Bright | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5%-2% |

The absence of specific figures for trading fees and costs can be a significant drawback for traders seeking to understand their potential expenses. A transparent broker typically provides detailed information about their fee structure, allowing traders to make informed decisions. The lack of such information from Ascent Bright raises concerns about hidden fees and potential exploitation of clients.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. Ascent Bright does not provide clear information regarding its safety measures for client funds. Key aspects such as fund segregation, investor protection, and negative balance protection are critical in assessing a broker's reliability.

The absence of regulatory oversight further complicates the situation, as there are no guarantees that client funds are held securely. Traders should be cautious when dealing with brokers that do not clearly outline their safety measures, as this could lead to significant financial risks.

Customer Experience and Complaints

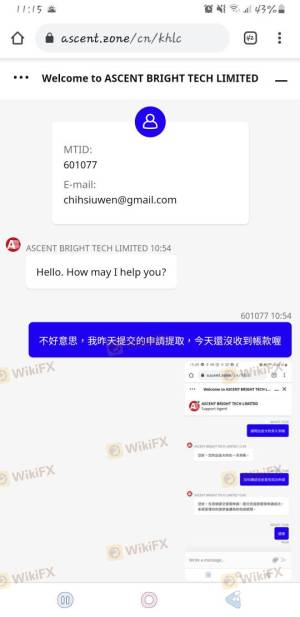

Customer feedback is a vital aspect of evaluating a broker's reliability. Many reviews regarding Ascent Bright highlight issues related to withdrawal difficulties and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Fair |

The prevalence of complaints regarding withdrawal issues suggests that traders may encounter significant challenges when trying to access their funds. This is a common warning sign of a potentially fraudulent broker. Moreover, the company's poor response to customer complaints indicates a lack of commitment to customer service, which can further exacerbate frustrations for traders.

Platform and Trade Execution

The trading platform's performance and execution quality are critical for a successful trading experience. Ascent Bright offers trading through MetaTrader 4 and 5, which are widely recognized platforms in the forex industry. However, there are concerns regarding the stability and reliability of these platforms when used with Ascent Bright.

Issues such as slippage and order rejections can significantly impact trading outcomes. Traders have reported instances of delayed executions and unfulfilled orders, which can be detrimental in a fast-paced trading environment. The lack of transparency regarding the platform's operational integrity raises questions about potential manipulation or unfair practices.

Risk Assessment

Engaging with Ascent Bright carries several risks that potential traders must consider. The lack of regulatory oversight, unclear trading conditions, and poor customer feedback contribute to an overall high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Unclear fee structure |

| Operational Risk | Medium | Platform performance issues |

To mitigate these risks, traders should approach Ascent Bright with caution. It is advisable to start with a small investment or consider alternative brokers with better regulatory standing and customer reviews.

Conclusion and Recommendations

In conclusion, the evidence suggests that Ascent Bright may not be a safe trading option for forex traders. The lack of regulatory oversight, unclear trading conditions, and numerous customer complaints raise significant concerns about the broker's reliability and integrity.

Traders should be particularly cautious when considering this broker and may want to explore alternative options that offer better regulatory protection and clearer trading conditions. Recommended alternatives include brokers that are regulated by reputable authorities and have a track record of positive customer feedback.

Ultimately, it is crucial for traders to prioritize safety and transparency when selecting a forex broker, and the current findings regarding Ascent Bright indicate that it may be prudent to look elsewhere.

Is ASCENT BRIGHT a scam, or is it legit?

The latest exposure and evaluation content of ASCENT BRIGHT brokers.

ASCENT BRIGHT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ASCENT BRIGHT latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.