Is Antrush Group safe?

Business

License

Is Antrush Group Safe or a Scam?

Introduction

Antrush Group is a relatively new player in the forex trading market, claiming to offer a range of trading services including forex, CFDs, and cryptocurrencies. With a website that presents itself as a legitimate brokerage, Antrush Group has attracted the attention of many traders looking for new opportunities. However, the forex market is fraught with risks, and traders must exercise caution when evaluating brokers. The need for due diligence is paramount, as many fraudulent entities operate under the guise of legitimate businesses. This article aims to assess the safety and legitimacy of Antrush Group by examining its regulatory status, company background, trading conditions, customer security measures, user experiences, and overall risk assessment.

To conduct this investigation, we relied on a comprehensive review of multiple sources, including user testimonials, expert analyses, and regulatory databases. Our evaluation framework focuses on key aspects that determine the trustworthiness of a forex broker, ultimately answering the question: Is Antrush Group safe for traders?

Regulation and Legitimacy

When it comes to forex trading, regulation plays a critical role in ensuring that brokers operate within legal frameworks designed to protect investors. Antrush Group claims to be regulated by several authorities, including ASIC (Australian Securities and Investments Commission) and FinCEN (Financial Crimes Enforcement Network). However, a closer inspection reveals serious discrepancies regarding its regulatory status.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Not Registered |

| FinCEN | N/A | United States | Not Regulated |

The lack of a valid license from recognized regulatory bodies raises significant concerns about the legitimacy of Antrush Group. It is crucial to note that ASIC and other reputable regulators impose strict requirements on brokers, including capital adequacy and transparency in operations. Antrush Group's claims of regulation appear misleading, as there is no evidence to support its assertions. Furthermore, operating without a license means that traders have little recourse in the event of disputes or fund mismanagement.

The absence of regulatory oversight means that Antrush Group may not adhere to industry standards, making it a risky choice for traders. Thus, the question remains: Is Antrush Group safe? The evidence suggests otherwise, as the broker operates in an unregulated environment, exposing traders to potential fraud and malpractice.

Company Background Investigation

Antrush Group's history and ownership structure are critical to understanding its credibility. The company claims to have been established in 2000, yet its website was only registered in 2022. This inconsistency raises red flags about the authenticity of its claims. Additionally, there is little information available regarding its ownership and management team, which further obscures its legitimacy.

A thorough background check reveals that Antrush Group lacks transparency in its operations. The absence of publicly available information about its founders, management team, and operational history makes it difficult for potential clients to assess its reliability. Furthermore, the lack of a physical address and contact details beyond an email address creates an environment of distrust.

In summary, the opaque nature of Antrush Group's background raises significant concerns about its safety for traders. Without clear information on its history and management, it becomes increasingly difficult to determine whether Antrush Group is safe or merely a facade for a potentially fraudulent operation.

Trading Conditions Analysis

The trading conditions offered by Antrush Group are another critical factor in assessing its legitimacy. The broker advertises a minimum deposit requirement of $500, which is significantly higher than many legitimate brokers. Additionally, the leverage offered by Antrush Group is as high as 1:500, a practice that is often associated with high-risk trading environments.

| Cost Type | Antrush Group | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding spreads, commissions, and other fees is concerning. Legitimate brokers typically provide detailed information about their fee structures, allowing traders to make informed decisions. In contrast, Antrush Group's vague policies may indicate hidden fees or unfavorable trading conditions.

Moreover, the high leverage offered can be enticing for traders looking to maximize their profits. However, it also significantly increases the risk of substantial losses, especially for inexperienced traders. The combination of high leverage and unclear fees raises the question of whether Antrush Group is safe for traders seeking a reliable trading environment.

Customer Fund Security

The safety of customer funds is paramount when evaluating a forex broker. Antrush Group's website provides little information on its fund security measures. Traders need to know whether their funds are held in segregated accounts, protected by investor compensation schemes, or subject to negative balance protection policies.

Unfortunately, Antrush Group does not appear to offer any of these essential protections. The absence of segregated accounts means that customer funds may be at risk if the broker encounters financial difficulties. Furthermore, without any investor compensation schemes in place, traders could potentially lose their entire investment without recourse.

The lack of historical data on fund security incidents involving Antrush Group also raises concerns. Traders should be wary of brokers that do not disclose their track record regarding customer fund security. Given these factors, it is evident that Antrush Group is not safe when it comes to protecting customer funds.

Customer Experience and Complaints

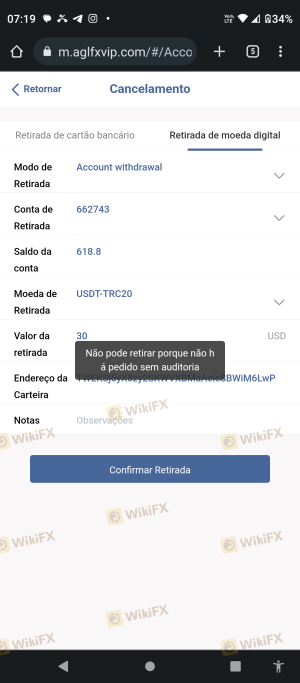

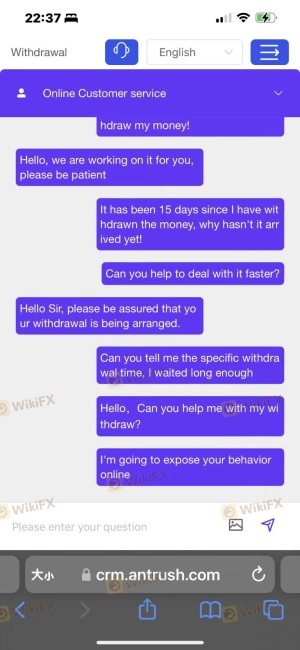

Customer feedback is an invaluable resource for assessing a broker's reliability. A review of user experiences with Antrush Group reveals a pattern of complaints, particularly concerning withdrawal issues and unresponsive customer service. Many users report difficulties in accessing their funds, with some claiming that their accounts were frozen without explanation.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Freezing | High | Poor |

| Customer Service | Medium | Slow |

Typical complaints include users being unable to withdraw their funds, lack of communication from customer service, and unfulfilled promises regarding trading conditions. The severity of these complaints indicates that Antrush Group may not prioritize customer satisfaction, raising further questions about its trustworthiness.

In summary, the customer experience with Antrush Group paints a troubling picture. The consistent reports of withdrawal issues and inadequate customer support suggest that Antrush Group is not safe for traders who value reliable service and access to their funds.

Platform and Trade Execution

The trading platform provided by Antrush Group is another area of concern. While the broker claims to offer the widely used MetaTrader 5 (MT5) platform, the quality of execution, stability, and user experience remains uncertain. Reports of slippage, order rejections, and execution delays have surfaced, which can significantly impact trading performance.

Moreover, the potential for platform manipulation raises alarms. Traders should be wary of brokers that do not provide clear information about their trading infrastructure and execution policies. The risk of encountering issues such as price manipulation or unfair trading practices is heightened in an unregulated environment.

In conclusion, the performance and execution quality of Antrush Group's trading platform remain questionable. Given the potential risks associated with trading on an unregulated platform, it is prudent to consider whether Antrush Group is safe for conducting trading activities.

Risk Assessment

The overall risk of using Antrush Group as a forex broker is substantial. The lack of regulation, transparency in operations, and numerous complaints from users indicate a high-risk environment for traders. Below is a risk scorecard summarizing the key risk areas associated with Antrush Group:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unregulated broker with false claims |

| Fund Security | High | No investor protection or segregation |

| Customer Support | Medium | Poor responsiveness to complaints |

| Trading Conditions | High | High leverage and unclear fees |

To mitigate these risks, traders should conduct thorough research, avoid investing large sums of money, and consider using regulated brokers with a proven track record.

Conclusion and Recommendations

In conclusion, the investigation into Antrush Group reveals significant concerns regarding its legitimacy and safety for traders. The lack of regulatory oversight, transparency issues, and numerous customer complaints suggest that Antrush Group is not safe for trading. Traders should be cautious and consider alternative options that offer better protection and reliability.

For traders seeking safer alternatives, consider well-regulated brokers such as IG, OANDA, or Forex.com, which have established reputations and adhere to strict regulatory standards. These brokers provide a more secure trading environment, ensuring that your investments are protected and that you have access to reliable customer support.

Ultimately, the evidence points to the conclusion that Antrush Group may not be a trustworthy broker, and traders should exercise extreme caution when considering their services.

Is Antrush Group a scam, or is it legit?

The latest exposure and evaluation content of Antrush Group brokers.

Antrush Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Antrush Group latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.