Is ALPHA TRADEX safe?

Business

License

Is Alpha Tradex A Scam?

Introduction

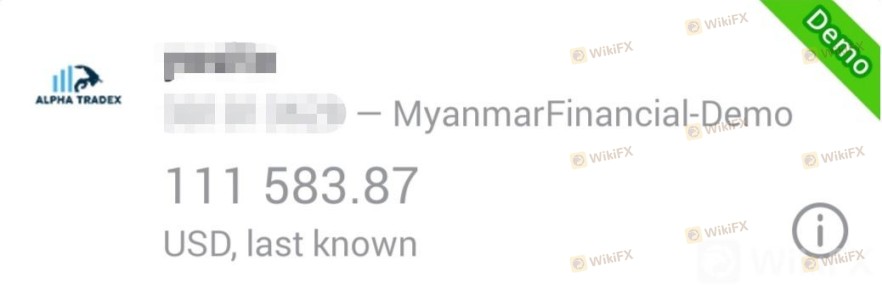

Alpha Tradex is an offshore forex broker that has been attracting attention in the trading community due to its enticing offers and high leverage ratios. Operating under the umbrella of Alpha Tradex Limited, the broker claims to provide a wide array of trading instruments and competitive trading conditions. However, the lack of regulation and transparency surrounding Alpha Tradex raises significant concerns among potential investors. In the highly volatile forex market, it is crucial for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to investigate the legitimacy of Alpha Tradex by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors influencing its credibility. Alpha Tradex operates without a license from any recognized regulatory authority. The broker was previously associated with the Australian Securities and Investments Commission (ASIC), but this registration has since been revoked. The absence of regulatory oversight means that traders have no recourse if issues arise, such as withdrawal problems or disputes over trades.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| ASIC | Revoked | Australia | Not Verified |

The lack of a legitimate regulatory framework significantly undermines the broker's reputation. Unregulated brokers like Alpha Tradex can operate with minimal accountability, leading to potential risks for traders. Regulatory bodies like the FCA in the UK or ASIC in Australia provide a layer of protection for clients, ensuring that brokers adhere to strict guidelines regarding fund management and operational transparency. Without such oversight, traders are left vulnerable to potential fraud or mismanagement of their funds.

Company Background Investigation

Alpha Tradex Limited was established in 2018 and is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment. The company's ownership structure is not transparently disclosed, which raises further concerns about accountability. A lack of information about the management team, including their professional backgrounds and experience in the financial sector, adds to the uncertainty surrounding the broker's operations.

The opaque nature of Alpha Tradex's corporate structure is a red flag for potential investors. Transparency in a broker's operations is vital for building trust, and the absence of such transparency can lead to skepticism among traders. In a market where trust is paramount, the inability to access critical information about the company's leadership and operational practices makes it challenging for traders to assess whether Alpha Tradex is safe for their investments.

Trading Conditions Analysis

Alpha Tradex offers various trading accounts with appealing conditions, such as a low minimum deposit requirement of $50 and leverage ratios of up to 1:500. However, it is essential to scrutinize the overall cost structure and any hidden fees that may affect trading profitability.

| Fee Type | Alpha Tradex | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.5 pips | 1.0 pips |

| Commission Structure | Variable | Typically zero or low |

| Overnight Interest Rates | Variable | Typically lower |

While the spread on major currency pairs seems competitive, the lack of clarity regarding commission structures and overnight interest rates raises concerns. Traders may find themselves facing unexpected costs that could erode their profits. Moreover, the broker's marketing of "no hidden fees" should be approached with caution, as many unregulated brokers often have undisclosed fees that can catch clients off guard.

Client Fund Security

The safety of client funds is paramount in the trading environment, and Alpha Tradex's lack of regulatory oversight raises significant concerns in this regard. The broker does not offer segregated accounts, meaning that client funds may not be kept separate from the company's operational funds. This practice can put investors at risk, especially in the event of financial difficulties faced by the broker.

Additionally, there is no evidence of investor protection schemes that would compensate clients in case of insolvency. The absence of negative balance protection further exacerbates the risk, as traders could potentially lose more than their initial investment. Historical complaints and reports from users indicate that Alpha Tradex has faced issues related to fund withdrawals, highlighting the potential dangers associated with trading with an unregulated broker.

Customer Experience and Complaints

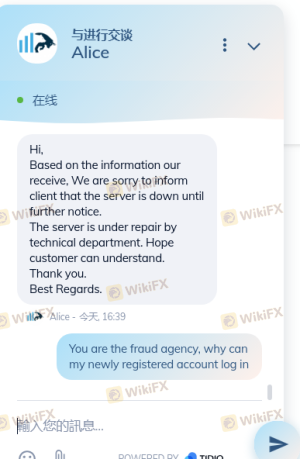

Customer feedback plays a crucial role in assessing the reliability of a broker. Reviews and complaints regarding Alpha Tradex reveal a troubling pattern of issues, particularly concerning withdrawal processes and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | High | Poor |

| Misleading Promotions | Medium | Poor |

Many users have reported difficulties in withdrawing their funds, with some claiming that their accounts were disabled after they requested withdrawals. This pattern of behavior is often indicative of a scam, where brokers create barriers to prevent clients from accessing their money. Furthermore, the company's customer support has been criticized for being unresponsive or evasive, which can significantly impact the overall trading experience.

Platform and Trade Execution

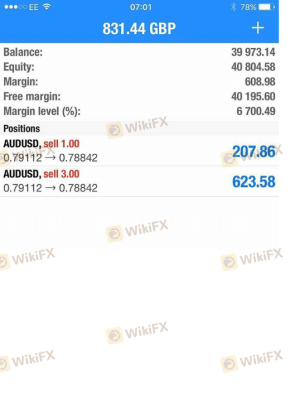

The trading platform offered by Alpha Tradex is MetaTrader 4 (MT4), a widely recognized platform among traders. However, the performance and reliability of the platform are crucial for successful trading. Reports indicate that users have experienced issues with order execution, including slippage and rejected orders, which can hinder trading performance.

A broker's ability to execute trades promptly and accurately is vital for traders, particularly in a fast-paced market like forex. Any signs of manipulation or technical issues can lead to significant financial losses. Therefore, it is essential for traders to ensure that the broker they choose provides a stable and efficient trading environment.

Risk Assessment

Using Alpha Tradex comes with inherent risks due to its unregulated status and the associated lack of consumer protections.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | No segregation of funds |

| Withdrawal Risk | High | History of withdrawal issues |

Given these risks, potential traders should exercise extreme caution. It is advisable to consider alternative brokers that are regulated and offer robust protections for client funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that Alpha Tradex is not a safe broker for trading. The lack of regulation, transparency, and the history of client complaints raise significant red flags. Traders are strongly advised to approach this broker with caution, as the potential for fraud and mismanagement of funds is high.

For those seeking to engage in forex trading, it is recommended to choose regulated brokers with a proven track record of reliability and customer satisfaction. Brokers such as eToro, IG, and AvaTrade offer solid alternatives with regulatory oversight and better protections for client funds. Always prioritize safety and due diligence when selecting a broker to ensure a secure trading experience.

Is ALPHA TRADEX a scam, or is it legit?

The latest exposure and evaluation content of ALPHA TRADEX brokers.

ALPHA TRADEX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ALPHA TRADEX latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.