Alpha Tradex 2025 Review: Everything You Need to Know

Executive Summary

This alpha tradex review gives you a complete look at an offshore forex broker that has faced big challenges in staying legal and keeping users happy. Alpha Tradex started in 2018 and has its main office in Saint Vincent and the Grenadines, working as a broker without regulation that targets small traders and beginners. The platform offers nice features like leverage up to 1:500 and a low minimum deposit of just $50, but these good points are hurt by serious legal problems and mostly bad user reviews.

The broker gives you several account types including standard, ECN, and swap-free accounts, mainly through the MT4 trading platform. But our study shows big problems with legal oversight, customer support, and whether you can trust them. The data shows that Alpha Tradex has received 1 positive review, 1 neutral review, and 80 exposure reviews from users, which means people have serious concerns about how the broker works. The lack of current legal permission and the loss of its ASIC registration make these problems even worse, making it suitable mainly for new traders who are willing to take higher risks.

Important Notice

Alpha Tradex works as an offshore broker without current legal oversight, which creates risks that potential clients should think about carefully. The company used to have ASIC registration, but they lost it, leaving traders without the legal protection that comes with licensed brokers. This alpha tradex review uses available user feedback, company information, and standard industry evaluation methods to judge the broker. Readers should know that legal status and working conditions may be different in different places, and not having proper legal oversight greatly affects how much protection investors get.

Rating Framework

Broker Overview

Alpha Tradex started working in the forex trading market in 2018. The company set itself up as an offshore broker based in Saint Vincent and the Grenadines, focusing on serving small traders and people new to the forex market by offering easy entry through low minimum deposits. Since it started, the broker has tried to build a client base by giving high leverage ratios and multiple account options designed to fit different trading preferences and risk levels.

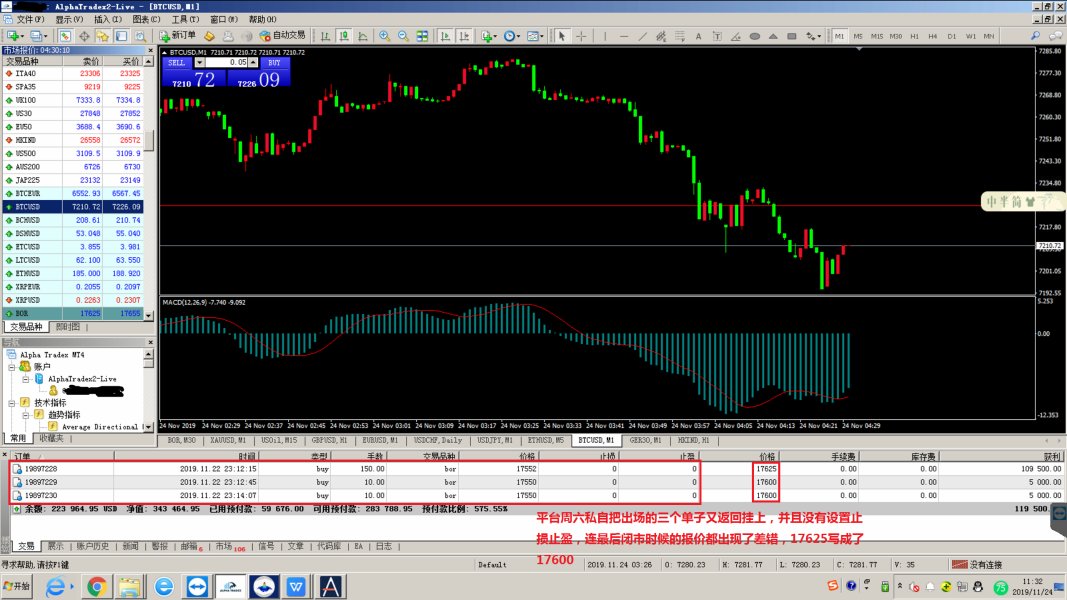

The broker's business structure focuses on providing forex trading services mainly through the MetaTrader 4 platform. Alpha Tradex offers three main account types: standard accounts for general trading, ECN accounts for direct market access, and swap-free accounts for Islamic trading principles. But the company's legal journey has been full of problems, with its Australian Securities and Investments Commission registration being taken away, leaving current operations without major legal oversight. This alpha tradex review shows that while the broker keeps basic trading infrastructure, serious concerns exist about legal compliance and long-term stability.

Regulatory Status: Alpha Tradex currently works without effective legal oversight from major financial authorities. The broker used to have ASIC registration, which has been taken away, leaving clients without the protection that usually comes with regulated brokers. This legal gap represents a big concern for trader fund safety and dispute resolution.

Minimum Deposit Requirements: The broker keeps a relatively easy entry point with a minimum deposit requirement of $50, making it potentially attractive to beginning traders or those with limited starting capital. This low barrier to entry fits with the company's clear strategy of targeting new market participants.

Available Trading Assets: Alpha Tradex mainly focuses on forex trading, though specific details about the range of currency pairs, commodities, or other financial instruments available for trading are not fully detailed in available sources.

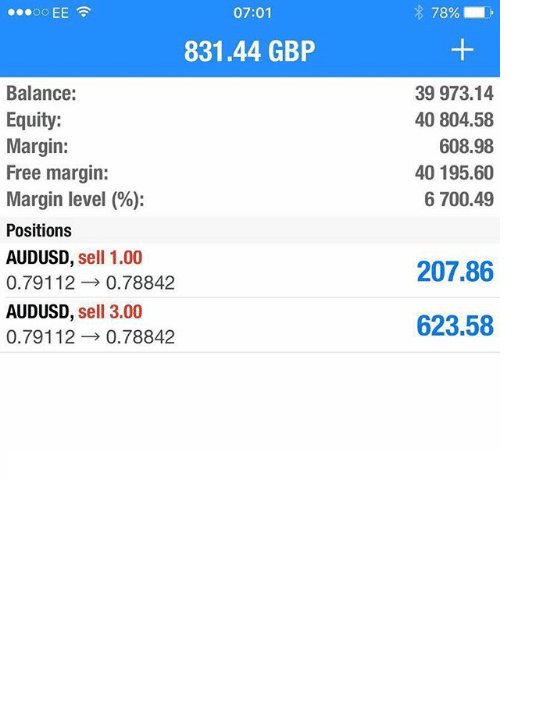

Leverage Ratios: The broker offers maximum leverage of 1:500, which represents a high-risk, high-reward option typical of offshore brokers. While this leverage level can increase potential profits, it also greatly increases the risk of big losses, especially for inexperienced traders.

Trading Platform Options: The primary trading platform offered is MetaTrader 4, which provides standard charting tools, technical indicators, and order execution capabilities. However, the broker appears to lack support for mobile applications across iOS, Android, MacOS, and web-based platforms, potentially limiting trading access.

Cost Structure and Fees: Specific information about spreads, commissions, and other trading costs is not clearly detailed in available sources, requiring potential clients to contact the broker directly for complete pricing information.

This alpha tradex review reveals several areas where information transparency could be improved, especially regarding detailed fee structures and complete asset offerings.

Account Conditions Analysis

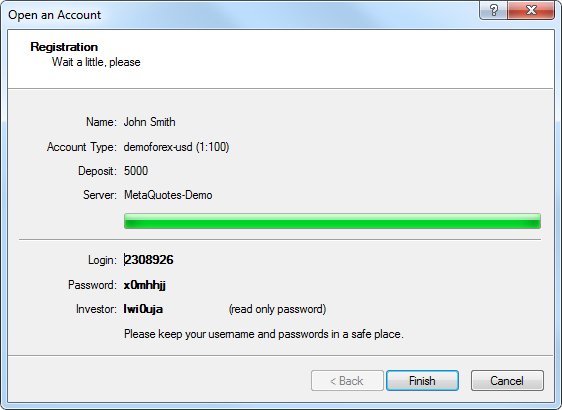

Alpha Tradex provides three different account types designed to fit different trading approaches and client needs. The standard account serves as the main offering for most retail traders, featuring the $50 minimum deposit requirement and standard market execution. The ECN account targets more experienced traders seeking direct market access with potentially tighter spreads, though specific pricing details for this account level remain unclear. The swap-free account addresses the needs of Islamic traders by removing overnight interest charges, following Sharia-compliant trading principles.

The account opening process appears to be fully digital, allowing clients to register and begin trading without extensive paperwork or long verification procedures. However, user feedback about the actual registration experience is limited, making it hard to judge the efficiency and user-friendliness of the onboarding process. The relatively low minimum deposit requirement of $50 positions Alpha Tradex competitively among brokers targeting entry-level traders, though this advantage must be weighed against the legal and safety concerns identified in this alpha tradex review.

Account management features and additional services such as account protection mechanisms, negative balance protection, or client fund separation practices are not clearly documented in available materials. This lack of transparency about client protection measures represents a big concern for potential account holders, especially given the broker's unregulated status.

The trading infrastructure at Alpha Tradex centers mainly around the MetaTrader 4 platform, which provides basic charting capabilities, technical analysis tools, and standard order execution features. While MT4 is widely recognized as a reliable trading platform, the broker's offering appears limited compared to competitors who provide additional proprietary tools, advanced analytics, or complete market research resources.

Educational resources, market analysis, and trader development programs are not prominently featured in available information about Alpha Tradex's services. This absence of educational support may especially hurt the new traders who appear to be the broker's target demographic. Advanced trading tools such as automated trading systems, custom indicators, or sophisticated risk management features beyond standard MT4 capabilities are not mentioned in available documentation.

The lack of mobile application support across major platforms represents a big limitation in today's mobile-first trading environment. This restriction may severely limit the broker's appeal to active traders who require constant market access and position monitoring capabilities while away from desktop computers.

Customer Service and Support Analysis

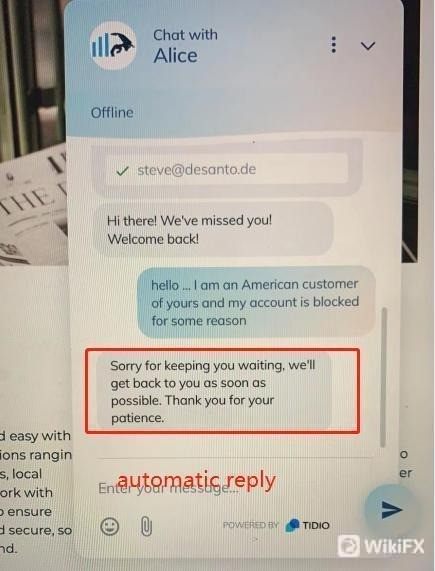

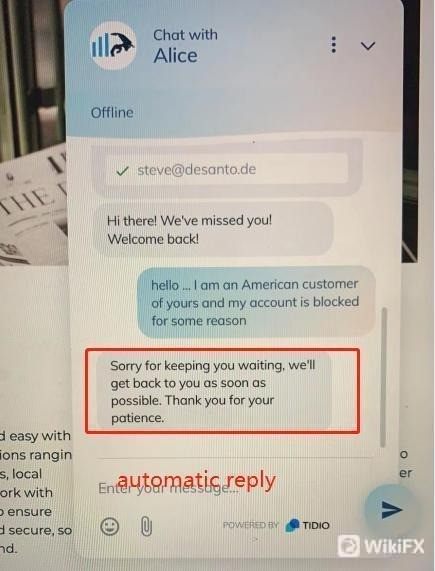

Customer service information for Alpha Tradex remains notably limited in available sources, raising concerns about the broker's commitment to client support and communication. Specific details about support channels, availability hours, response times, and multilingual capabilities are not clearly documented, making it difficult for potential clients to assess the quality of assistance they might expect.

The limited user feedback available suggests that customer service experiences may vary greatly, though the dominance of exposure reviews over positive testimonials indicates potential systemic issues with client satisfaction and support quality. Without clear information about dedicated account managers, technical support specialists, or complaint resolution procedures, clients may face challenges when seeking assistance with trading issues or account problems.

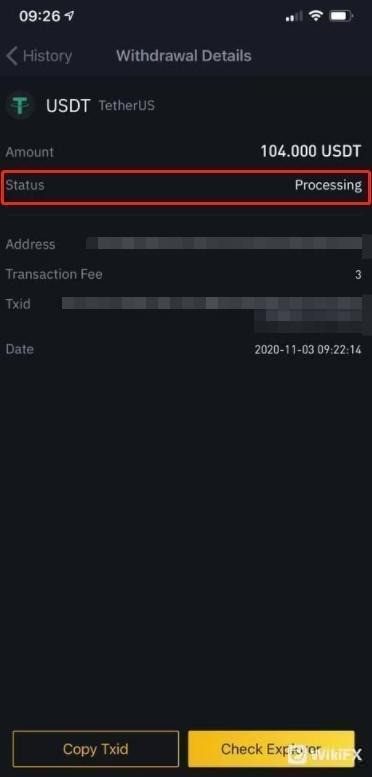

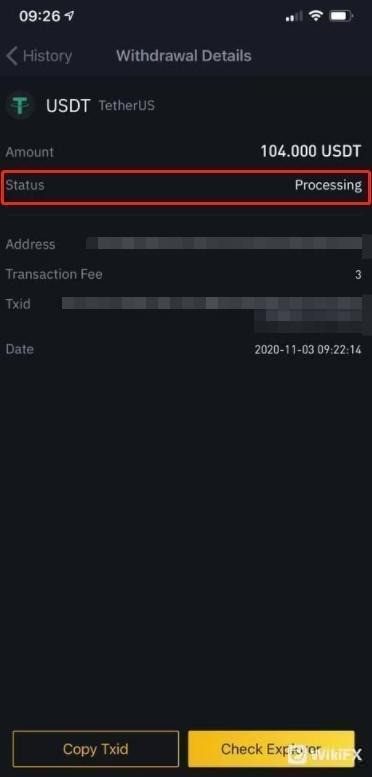

The absence of complete customer service information is especially concerning given Alpha Tradex's unregulated status, as clients cannot rely on regulatory bodies for dispute resolution or complaint handling. This gap in support infrastructure may leave traders without adequate recourse when facing account issues, technical problems, or withdrawal difficulties.

Trading Experience Analysis

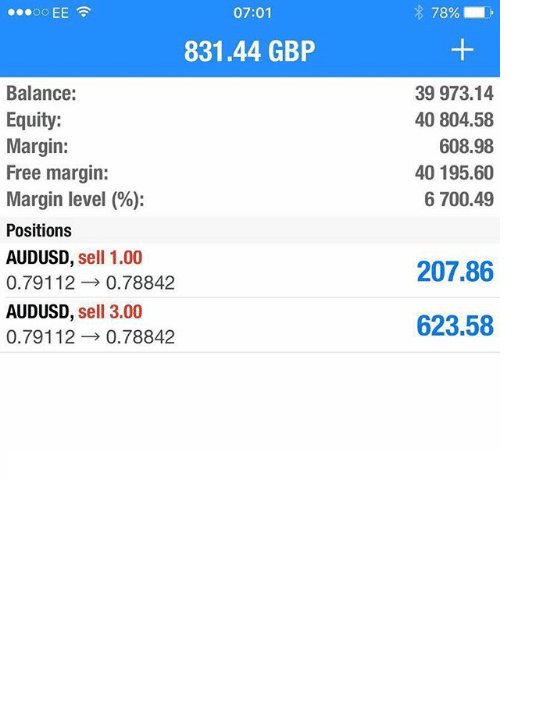

The trading experience at Alpha Tradex is mainly delivered through the MetaTrader 4 platform, which offers standard functionality including real-time price feeds, technical analysis tools, and various order types. While MT4 is generally considered reliable and user-friendly, the overall trading experience depends heavily on factors such as execution speed, spread competitiveness, and platform stability, which are not thoroughly documented in available user feedback.

Order execution quality, including potential issues with slippage, requotes, or execution delays, cannot be properly assessed based on limited user testimonials. The high leverage ratio of 1:500 may appeal to traders seeking significant market exposure with limited capital, but this feature also greatly increases risk exposure, especially for inexperienced traders who may not fully understand leverage implications.

The absence of mobile trading applications represents a big limitation in the modern trading environment, where traders increasingly expect seamless access across multiple devices. This restriction may force clients to rely solely on desktop-based trading, potentially limiting their ability to respond quickly to market movements or manage positions while away from their primary trading setup. The alpha tradex review data suggests that platform limitations may contribute to overall user dissatisfaction with the trading experience.

Trust and Safety Analysis

Trust and safety represent the most critical concerns in this alpha tradex review, mainly due to Alpha Tradex's lack of current legal oversight and the loss of its previous ASIC registration. The absence of regulatory supervision means that client funds lack the protection typically provided by major financial authorities, including separated account requirements, compensation schemes, and regulatory audit oversight.

The loss of ASIC registration raises serious questions about the broker's compliance with regulatory standards and operational practices. While the specific reasons for this regulatory action are not detailed in available sources, such losses typically result from significant compliance failures or operational problems that pose risks to client interests.

Fund safety measures, such as client money separation, negative balance protection, or deposit insurance coverage, are not clearly documented or guaranteed by Alpha Tradex. This absence of transparent safety protocols, combined with the unregulated operating environment, creates substantial risk for client deposits and trading capital. The dominance of exposure reviews over positive testimonials further suggests that trust issues may be widespread among the broker's user base.

User Experience Analysis

User experience analysis reveals big concerns about Alpha Tradex's service quality and client satisfaction levels. With only 1 positive review compared to 80 exposure reviews, the broker faces substantial challenges in meeting client expectations and maintaining user satisfaction. This heavily skewed feedback pattern suggests systemic issues that may affect multiple aspects of the client experience.

The fully digital registration process may offer convenience for account opening, but the lack of detailed user feedback makes it difficult to assess the actual efficiency and user-friendliness of the onboarding experience. Similarly, while the low minimum deposit requirement may attract beginners, the overall user experience appears to be compromised by other operational factors.

The target demographic of small-scale traders and beginners may find the basic MT4 platform accessible, but the lack of educational resources, mobile applications, and complete customer support may leave these users poorly prepared for successful trading. The absence of detailed user testimonials about specific aspects of the trading experience makes it challenging to identify particular strengths or weaknesses in the user journey.

Conclusion

This complete alpha tradex review reveals a broker that faces big challenges in multiple critical areas, especially regulatory compliance and user satisfaction. While Alpha Tradex offers some attractive features such as low minimum deposits and high leverage, these advantages are greatly outweighed by serious concerns about regulatory oversight, customer support, and overall operational transparency.

The broker may be suitable for new traders or small-scale investors who prioritize accessibility and are willing to accept higher risks associated with unregulated trading environments. However, the lack of regulatory protection, limited customer feedback, and absence of complete safety measures make Alpha Tradex a high-risk choice for most traders. Potential clients should carefully consider these significant limitations and explore regulated alternatives that offer better investor protection and more complete service offerings.