Is AGG safe?

Business

License

Is AGG Safe or Scam?

Introduction

AGG, or the iShares Core U.S. Aggregate Bond ETF, is a well-known exchange-traded fund that aims to provide investors with broad exposure to the U.S. investment-grade bond market. As one of the largest bond ETFs, AGG has gained popularity among both institutional and retail investors looking for a diversified fixed-income solution. However, the rise of online trading platforms and the increasing number of forex brokers have made it essential for traders to carefully evaluate the credibility of any trading platform they consider engaging with. This article aims to assess the safety and legitimacy of AGG by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile. The analysis is based on a review of various credible sources and data points related to AGG.

Regulation and Legitimacy

The regulatory environment in which a trading platform operates is crucial for ensuring investor protection and maintaining market integrity. AGG is managed by BlackRock, one of the largest asset management firms globally, and is regulated by the U.S. Securities and Exchange Commission (SEC). The SEC is known for its stringent regulations and oversight, which adds a layer of credibility to AGG as a financial product.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SEC | N/A | United States | Verified |

The importance of regulation cannot be overstated. It ensures that the trading platform adheres to specific guidelines and standards designed to protect investors. BlackRock's long-standing reputation and its compliance with SEC regulations suggest that AGG operates within a legitimate framework. However, it is essential to note that while AGG itself is regulated, the trading conditions and experiences may vary based on the platform through which it is accessed. Therefore, potential investors should ensure they are using a reputable broker when trading AGG.

Company Background Investigation

AGG has been in existence since its inception on September 22, 2003. Managed by BlackRock, the fund has grown significantly, boasting assets under management exceeding $119 billion. BlackRock is known for its robust governance structure and investment expertise, which enhances AGG's credibility. The management team includes seasoned professionals with extensive experience in fixed-income investments, providing confidence to investors regarding the fund's operational effectiveness.

BlackRocks transparency in operations and its commitment to regular reporting further bolster investor confidence. The company provides detailed information about AGG's holdings, performance, and any changes to the fund's strategy. This level of transparency is vital in fostering trust and ensuring that investors are well-informed about their investments.

Trading Conditions Analysis

The trading conditions associated with AGG, particularly its fee structure, are essential for assessing its overall value proposition. AGG has a low expense ratio of 0.03%, which is competitive compared to industry averages. However, it is important for traders to be aware of any additional fees that may be charged by the brokerage platform they choose to trade AGG.

| Fee Type | AGG | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Varies | Varies |

| Commission Structure | Varies | Varies |

| Overnight Interest Range | Varies | Varies |

While AGG itself has a low expense ratio, traders should be vigilant about other potential costs, such as commissions or spreads charged by their brokers. Understanding the complete cost structure is crucial for making informed trading decisions and maximizing returns.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. AGG, being a regulated ETF, benefits from robust investor protection measures. BlackRock employs strict protocols for fund management, including the segregation of client assets to ensure that investor funds are protected in the event of financial difficulties.

In addition to fund segregation, BlackRock is also subject to regulatory requirements that mandate the maintenance of adequate capital reserves. This regulatory framework is designed to protect investors in various scenarios, including market volatility and potential fund mismanagement. However, traders should still exercise caution and conduct thorough due diligence on the brokers they choose to trade AGG, as the level of protection may vary.

Customer Experience and Complaints

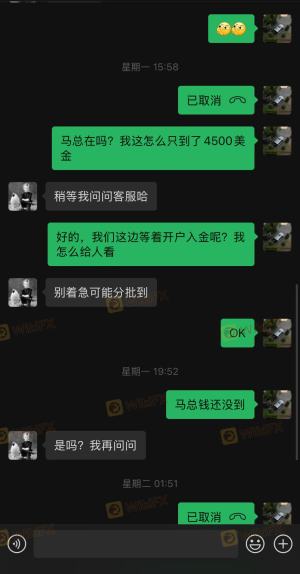

Customer feedback plays a significant role in assessing the reliability of any trading platform. Reviews of AGG generally highlight its stability and performance as a fixed-income investment. However, some users have expressed concerns regarding the responsiveness of customer service when issues arise.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Slow Customer Support | Moderate | Mixed |

| Withdrawal Delays | High | Varies |

Typical complaints include delays in withdrawals and slow responses from customer support teams. These issues can significantly impact the trading experience, leading to frustration among users. While AGG itself is a well-structured fund, the experience may vary based on the broker used for trading. Therefore, traders should choose brokers with a reputation for excellent customer service and support.

Platform and Trade Execution

The performance and reliability of the trading platform used to access AGG are critical for a smooth trading experience. Traders have reported that platforms offering AGG generally provide stable execution with minimal slippage. However, the quality of order execution can vary depending on the broker's infrastructure.

Traders should be vigilant for any signs of platform manipulation or execution issues, as these could significantly affect trading outcomes. A reliable platform should have a transparent order execution policy, ensuring that trades are executed fairly and efficiently.

Risk Assessment

Investing in AGG, like any financial product, carries inherent risks. The primary risks associated with AGG include interest rate risk, credit risk, and market risk. Understanding these risks is crucial for making informed investment decisions.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Interest Rate Risk | Medium | Changes in interest rates can impact bond prices. |

| Credit Risk | Low | AGG primarily holds investment-grade securities. |

| Market Risk | Medium | Economic fluctuations can affect overall bond market performance. |

To mitigate these risks, investors should consider diversifying their portfolios and not allocating excessive capital to any single investment. Additionally, staying informed about market trends and economic indicators can help investors make better decisions regarding their investments in AGG.

Conclusion and Recommendations

In summary, AGG is a well-established and regulated investment product managed by BlackRock, offering investors a reliable option for exposure to the U.S. investment-grade bond market. While there are no significant indications of fraud associated with AGG, traders must exercise caution when selecting a broker to trade this ETF.

Investors should prioritize brokers with strong regulatory oversight, transparent fee structures, and responsive customer service. For those looking for alternatives, other reputable bond ETFs, such as the Vanguard Total Bond Market ETF (BND), may also provide similar benefits with competitive fees.

Ultimately, while AGG is considered safe, traders should remain vigilant and conduct thorough research to ensure their trading experiences are positive and secure.

Is AGG a scam, or is it legit?

The latest exposure and evaluation content of AGG brokers.

AGG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AGG latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.