Is Primetrendmarket safe?

Business

License

Is PrimeTrendMarket A Scam?

Introduction

In the ever-evolving landscape of the foreign exchange market, PrimeTrendMarket has emerged as a player that promises traders a range of investment opportunities. However, with the allure of high returns comes the necessity for thorough scrutiny. Traders must be vigilant when selecting brokers, as the market is fraught with potential scams that can lead to significant financial losses. This article aims to evaluate whether PrimeTrendMarket is a safe trading platform or a scam, utilizing a structured approach that includes an analysis of its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a trading platform is a crucial factor in determining its legitimacy and safety. PrimeTrendMarket operates without any recognized regulatory oversight, which raises significant red flags. Below is a summary of the regulatory information available:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulation means that PrimeTrendMarket is not held accountable to any governing body, which is essential for ensuring the safety of client funds and fair trading practices. Regulated brokers are required to adhere to strict standards that protect investors, such as maintaining segregated accounts for client funds and providing transparency in their operations. The lack of such oversight for PrimeTrendMarket indicates that traders are exposed to higher risks, including potential fraud and mismanagement of funds.

Company Background Investigation

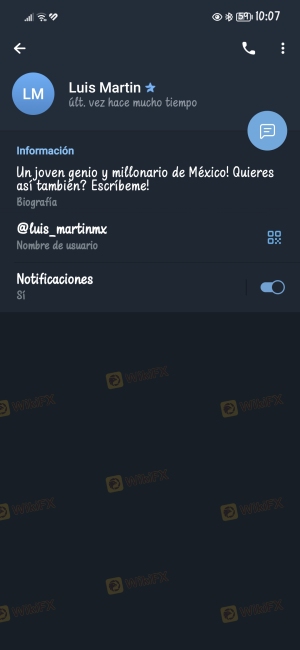

PrimeTrendMarket presents itself as a modern trading platform, but its company history and ownership structure are shrouded in ambiguity. Limited information is available regarding its establishment, ownership, or the qualifications of its management team. This lack of transparency is concerning, as reputable brokers typically provide detailed information about their history, leadership, and operational practices.

The absence of a verifiable track record raises questions about the company's credibility. Furthermore, the management team's background is essential in assessing the broker's reliability. A team with extensive experience in financial markets and regulatory compliance can significantly enhance the trustworthiness of a broker. However, without this information, potential clients are left in the dark regarding who is managing their investments.

Trading Conditions Analysis

Understanding the trading conditions offered by PrimeTrendMarket is key to evaluating its attractiveness as a broker. The platform claims to provide competitive spreads and a variety of account types, but the lack of transparency regarding fees and commissions is alarming. Below is a comparison of core trading costs:

| Fee Type | PrimeTrendMarket | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1-2 pips |

| Commission Model | N/A | $5 per lot |

| Overnight Interest Range | N/A | 2-5% |

The absence of clear information about spreads and commissions makes it difficult for traders to assess the overall cost of trading with PrimeTrendMarket. Additionally, any unusual fees or hidden charges can significantly impact a trader's profitability. The industry's average costs provide a benchmark, and without competitive pricing, PrimeTrendMarket may not be a viable option for cost-conscious traders.

Client Funds Safety

The safety of client funds is paramount in the trading industry. PrimeTrendMarket does not provide any information regarding its security measures, such as fund segregation, investor protection schemes, or negative balance protection. Without these safeguards, clients' funds are at risk.

Historically, unregulated brokers have been known to engage in dubious practices, including misappropriation of client funds. This lack of security measures raises substantial concerns about the safety of investments made with PrimeTrendMarket. Traders must be aware that if the broker encounters financial difficulties or engages in fraudulent activities, recovering lost funds may be nearly impossible.

Client Experience and Complaints

Analyzing client feedback is essential in understanding the real-world performance of PrimeTrendMarket. User reviews and complaints reveal a pattern of dissatisfaction, particularly regarding withdrawal issues. Below is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Poor |

| Lack of Support | Medium | Average |

| Misleading Promotions | High | Poor |

Many clients have reported being unable to withdraw their funds, which is a significant warning sign. The company's response to these complaints has been largely inadequate, with many users feeling ignored or dismissed. Such patterns of behavior are indicative of a potentially fraudulent operation, reinforcing the notion that PrimeTrendMarket may not be a safe trading platform.

Platform and Execution

The performance of a trading platform is crucial for a trader's success. PrimeTrendMarket claims to offer a user-friendly interface and reliable execution, but independent reviews suggest otherwise. Issues such as slippage and high rejection rates have been reported, which can severely impact trading outcomes.

Traders should be cautious of platforms that do not provide clear evidence of execution quality. Any signs of manipulation, such as frequent rejections of trades or unexplained slippage, can indicate a lack of integrity in the platform's operations.

Risk Assessment

Using PrimeTrendMarket presents several risks that potential clients should consider. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight available |

| Financial Risk | High | Potential for fund mismanagement |

| Operational Risk | Medium | Issues with withdrawal and support |

| Market Risk | Medium | Volatility in trading conditions |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative, regulated brokers that offer greater security and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that PrimeTrendMarket exhibits several characteristics typical of a scam. The lack of regulation, combined with poor client experiences and ambiguous trading conditions, raises significant concerns about its trustworthiness. Traders should exercise extreme caution and consider seeking alternative brokers that prioritize safety and regulatory compliance.

For those seeking reliable trading options, brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC are recommended. These entities provide a safer trading environment, ensuring better protection for client funds and transparent operational practices. In light of the findings, it is clear that PrimeTrendMarket is not a safe option for traders looking to invest their hard-earned money.

Is Primetrendmarket a scam, or is it legit?

The latest exposure and evaluation content of Primetrendmarket brokers.

Primetrendmarket Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Primetrendmarket latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.