Is 886-fareast safe?

Business

License

Is 886 Fareast Safe or Scam?

Introduction

886 Fareast is a forex brokerage that has recently emerged in the competitive landscape of foreign exchange trading. Positioned as a platform for traders seeking to engage in forex transactions, 886 Fareast aims to attract both novice and experienced traders. However, the rapid growth of online trading has also led to an increase in fraudulent activities, making it crucial for traders to carefully assess the legitimacy and safety of their chosen brokers. This article investigates the safety of 886 Fareast by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. The evaluation is based on a thorough analysis of available online resources and user feedback.

Regulation and Legitimacy

Understanding the regulatory framework surrounding a forex broker is essential for assessing its legitimacy. Regulation ensures that brokers adhere to specific standards and practices, providing a layer of protection for traders. Unfortunately, 886 Fareast lacks valid regulatory information, raising significant concerns about its safety.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of regulation from recognized authorities such as the FCA or ASIC indicates that 886 Fareast operates in a high-risk environment. Regulatory bodies enforce strict compliance measures and provide oversight to protect investors. Without such oversight, traders may find themselves vulnerable to potential fraud or malpractice. Moreover, the lack of historical compliance data further complicates the assessment of 886 Fareast's trustworthiness.

Company Background Investigation

886 Fareast, also known as 英巴斯特金融, is registered in China and has been operational for less than two years, which raises questions about its stability and reliability. The relatively short history of the company suggests that it may not have established a solid reputation in the trading community.

The management team behind 886 Fareast remains largely unverified, with minimal information available regarding their professional backgrounds and experience in the financial sector. This lack of transparency can be a red flag for potential investors, as a well-established management team is often indicative of a broker's credibility. Furthermore, the company's website has faced accessibility issues, which could hinder potential clients from obtaining necessary information about its operations and services.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including fees and spreads, is paramount. 886 Fareast offers various trading options, but potential clients should be wary of any unusual fee structures that may not align with industry standards.

| Fee Type | 886 Fareast | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 2% - 5% |

The absence of clear information regarding spreads and commissions raises concerns about the overall cost of trading with 886 Fareast. Traders must be cautious of hidden fees that could significantly impact their trading profitability. The lack of transparency in this area could suggest that the broker may not prioritize fair trading practices.

Client Fund Safety

The safety of client funds is a critical aspect of any forex broker's evaluation. 886 Fareast's website does not provide comprehensive information about its fund security measures, such as fund segregation, investor protection schemes, or negative balance protection policies.

Without proper fund segregation, traders' deposits may be at risk if the broker encounters financial difficulties. Additionally, the absence of investor protection mechanisms means that clients may have limited recourse in the event of a dispute or fraud. Historical complaints regarding fund withdrawal issues further exacerbate concerns about 886 Fareasts safety.

Customer Experience and Complaints

Customer feedback is a valuable source of information when assessing a broker's reliability. A review of user experiences with 886 Fareast reveals a pattern of negative reviews, particularly concerning withdrawal issues and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Unavailability | Medium | Poor |

| Transparency Concerns | High | Poor |

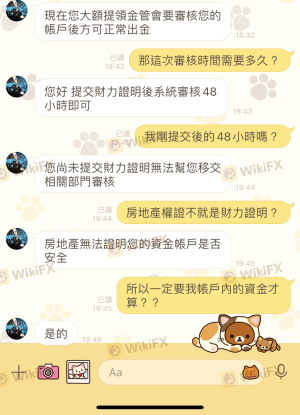

Many users have reported difficulties in withdrawing their funds, with some alleging that the broker imposes unreasonable conditions for processing withdrawals. Additionally, the quality of customer support has been criticized, with many traders finding it challenging to receive timely assistance. These complaints indicate a troubling trend that suggests 886 Fareast may not prioritize client satisfaction or transparency.

Platform and Execution

The trading platform provided by 886 Fareast is a crucial element in the trading experience. A reliable platform should offer stability, fast execution, and a user-friendly interface. However, there are concerns regarding the performance of 886 Fareast's trading platform.

Users have reported instances of slippage and order rejections, which can significantly impact trading outcomes. Additionally, any indications of potential platform manipulation should be thoroughly investigated, as they can compromise the integrity of the trading environment. Without a solid reputation for platform reliability, traders may face unnecessary risks when using 886 Fareast.

Risk Assessment

Engaging with 886 Fareast carries inherent risks that traders should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation. |

| Fund Safety Risk | High | Lack of fund protection measures. |

| Customer Service Risk | Medium | Poor response to complaints. |

| Trading Execution Risk | High | Reports of slippage and rejections. |

Given these risks, potential traders should exercise caution when considering 886 Fareast as their forex broker. It is advisable to conduct thorough research and consider alternative options with better regulatory oversight and customer feedback.

Conclusion and Recommendations

In conclusion, the investigation into 886 Fareast raises significant concerns about its safety and legitimacy. The lack of regulation, negative customer feedback, and issues with fund security indicate that traders should approach this broker with caution. There are clear signs of potential fraud, particularly regarding withdrawal difficulties and inadequate customer support.

For traders seeking reliable forex brokers, it is recommended to consider well-regulated alternatives with positive reputations, such as those overseen by top-tier regulatory authorities. This can provide a safer trading environment and greater peace of mind. Ultimately, the decision to engage with 886 Fareast should be made with careful consideration of the associated risks.

Is 886-fareast a scam, or is it legit?

The latest exposure and evaluation content of 886-fareast brokers.

886-fareast Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

886-fareast latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.