Is PROFIT TRADE safe?

Pros

Cons

Is Profit Trade Safe or a Scam?

Introduction

Profit Trade is an online forex and CFD broker that has garnered attention in the trading community. Positioned as a platform offering various trading instruments, including forex, cryptocurrencies, and commodities, it claims to provide users with opportunities for significant returns. However, the rise of online trading has been accompanied by an increase in fraudulent schemes, making it imperative for traders to exercise caution when selecting a broker. Evaluating the safety and legitimacy of brokers like Profit Trade is crucial to protect one‘s investments and avoid potential scams. This article employs a comprehensive investigative approach, utilizing a blend of qualitative assessments and quantitative data to evaluate the broker’s credibility.

Regulation and Legitimacy

The regulatory status of a broker is a cornerstone of its legitimacy and safety. In the case of Profit Trade, multiple sources indicate that it operates without any significant regulatory oversight. This lack of regulation raises red flags for potential investors. Below is a summary of the regulatory information related to Profit Trade:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Profit Trade is reportedly registered in the Marshall Islands, a jurisdiction known for its lax regulatory framework, which has made it a haven for many unregulated brokers. The absence of oversight from reputable financial authorities, such as the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission) in Australia, significantly diminishes the safety of trading with Profit Trade. Furthermore, the broker has faced warnings from various regulatory bodies, including the Austrian Financial Market Authority, which has explicitly stated that Profit Trade is not authorized to operate within its jurisdiction. This lack of regulatory compliance poses a significant risk to investors, making it essential to question: Is Profit Trade safe?

Company Background Investigation

Profit Trade is owned by Global Top Marketing Ltd., which is registered in the Marshall Islands. The company claims to have operations in Bulgaria; however, the legitimacy of these claims is questionable. The absence of verifiable information regarding the company's ownership and management team raises concerns about transparency. Furthermore, the lack of a clear corporate structure and the use of offshore registration can often be indicative of a broker attempting to evade regulatory scrutiny.

The management team behind Profit Trade has not been prominently featured in their marketing materials, which is unusual for a legitimate trading firm. A transparent broker typically provides information about its leadership, including their professional backgrounds and expertise. The lack of such information further contributes to doubts about the broker's credibility. Overall, the opacity surrounding Profit Trade's corporate structure and management raises significant concerns about its reliability and safety. Therefore, traders must carefully consider whether Profit Trade is safe for their investments.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is pivotal. Profit Trade offers various account types with differing minimum deposit requirements, starting at $250. However, the overall fee structure and trading conditions have been scrutinized by industry experts. Heres a brief overview of the trading costs associated with Profit Trade:

| Fee Type | Profit Trade | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable (often high) | Low (1-2 pips) |

| Commission Structure | None | Varies |

| Overnight Interest Range | High | Low |

Many reviews indicate that the spreads offered by Profit Trade can be significantly higher than industry standards, which can eat into potential profits for traders. Additionally, the lack of a clear commission structure raises questions about hidden fees, which are common in unregulated brokerages. Traders need to be cautious about the potential for unexpected costs when trading with Profit Trade, as high fees can lead to substantial losses. Thus, a critical evaluation of whether Profit Trade is safe for trading becomes paramount.

Client Fund Safety

The safety of client funds is a major concern for any trader. Profit Trade has been criticized for its lack of transparency regarding fund protection measures. There is little to no information available about the brokers policies on fund segregation, investor protection, or negative balance protection. The absence of these safeguards can expose traders to significant risks, especially in volatile market conditions.

Moreover, historical reports suggest that Profit Trade has faced issues related to fund withdrawals, with numerous complaints from users who have struggled to access their funds. Such incidents raise serious questions about the broker's operational integrity and its commitment to client fund safety. In light of these factors, traders must seriously consider whether Profit Trade is safe for their financial investments.

Customer Experience and Complaints

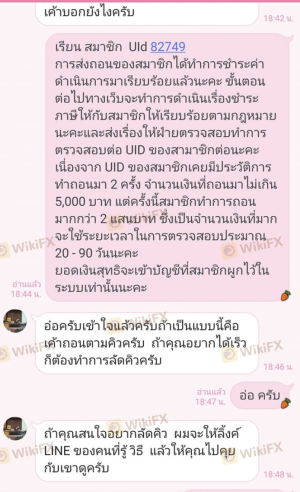

Analyzing customer feedback is essential in assessing a broker's reliability. Many users have reported negative experiences with Profit Trade, particularly concerning withdrawal issues and the quality of customer support. Common complaints include difficulties in processing withdrawals, unresponsive customer service, and aggressive marketing tactics aimed at securing additional deposits.

Heres a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Quality | Medium | Poor |

| Misleading Promotions | High | Inconsistent |

One notable case involved a trader who deposited funds only to find that withdrawal requests were met with delays and evasive responses from customer support. This pattern of behavior is concerning and suggests that Profit Trade may not prioritize customer satisfaction or ethical practices. Therefore, it is crucial for potential clients to contemplate whether Profit Trade is safe based on the collective experiences of existing users.

Platform and Trade Execution

The trading platform offered by Profit Trade is proprietary and lacks the advanced features commonly found in industry-standard platforms like MetaTrader 4 or 5. Users have reported issues with platform stability and execution quality, including high slippage and rejected orders during critical trading moments. Such performance issues can significantly impact trading outcomes and raise concerns about the broker's operational reliability.

Moreover, the absence of a demo account feature limits traders' ability to test the platform before committing funds. This lack of transparency and functionality can lead to a frustrating trading experience, further questioning whether Profit Trade is safe for prospective traders.

Risk Assessment

Engaging with Profit Trade carries inherent risks, primarily due to its unregulated status and the numerous complaints surrounding its operations. Below is a risk scorecard summarizing the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation, potential for fraud. |

| Fund Safety | High | Lack of investor protection measures. |

| Customer Support Reliability | Medium | Numerous complaints about responsiveness. |

| Platform Performance | High | Issues with stability and execution. |

To mitigate these risks, traders are advised to conduct extensive research, maintain realistic expectations, and consider using regulated brokers with transparent practices. Thus, the question of whether Profit Trade is safe becomes increasingly relevant.

Conclusion and Recommendations

In conclusion, the evidence suggests that Profit Trade exhibits several characteristics typical of unregulated and potentially fraudulent brokers. The absence of regulatory oversight, coupled with numerous complaints regarding fund safety and customer service, raises significant concerns about the brokers integrity. Therefore, it is prudent for traders to approach Profit Trade with caution and consider alternative options.

For those seeking reliable trading platforms, it is advisable to explore brokers regulated by reputable authorities such as the FCA or ASIC, which offer better protections for client funds and transparent trading conditions. Ultimately, the question remains: Is Profit Trade safe? Based on the findings presented, it is advisable for traders to exercise caution and seek safer alternatives in the forex market.

Is PROFIT TRADE a scam, or is it legit?

The latest exposure and evaluation content of PROFIT TRADE brokers.

PROFIT TRADE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PROFIT TRADE latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.