Regarding the legitimacy of 6i forex brokers, it provides VFSC and WikiBit, .

Is 6i safe?

Rating Index

Software Index

License

Is 6i markets regulated?

The regulatory license is the strongest proof.

VFSC Retail Forex License

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Retail Forex License

Licensed Entity:

6I Group Limited

Effective Date:

2019-12-19Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is 6itrade Safe or Scam?

Introduction

6itrade is a forex broker that positions itself as a global trading platform, offering a variety of financial instruments including forex, commodities, and cryptocurrencies. Established in 2018 and registered in the Marshall Islands, 6itrade aims to attract traders with its promise of high leverage and a user-friendly trading platform. However, the forex market is notorious for its risks and the presence of unregulated brokers, making it essential for traders to carefully evaluate the credibility of brokers before investing their hard-earned money. This article investigates the safety and legitimacy of 6itrade by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in assessing its safety. Regulation provides a framework for accountability, ensuring that brokers adhere to specific standards and practices to protect traders. In the case of 6itrade, it claims to be regulated by the Vanuatu Financial Services Commission (VFSC) under license number 40374. However, multiple sources indicate that this license may not be valid, raising concerns about the broker's legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | 40374 | Vanuatu | Not Verified |

The lack of verification from the VFSC and the absence of any substantial regulatory oversight indicate that 6itrade may not be operating under a legitimate framework. This lack of regulation is particularly concerning as it means that clients' funds may not be protected by any legal framework, making it risky for traders to trust this broker with their investments.

Company Background Investigation

6itrade is operated by 6i Group Ltd, which is based in the Marshall Islands. The company is relatively new in the forex market, having been founded in 2018. The ownership structure and management team remain largely opaque, with limited information available about the individuals behind the company. This lack of transparency can be a red flag for potential investors. A reputable broker typically provides detailed information about its management and ownership to build trust with its clients.

The company's website offers minimal insights into its operational history or the qualifications of its management team. This raises questions about the broker's reliability and commitment to ethical practices. Given the competitive nature of the forex market, a well-established broker usually has a track record of compliance and transparency, which appears lacking in the case of 6itrade.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's profitability and overall experience. 6itrade claims to offer competitive spreads, high leverage, and a variety of account types. However, the actual costs and conditions may not be as favorable as advertised.

| Fee Type | 6itrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips | 1.0-1.5 pips |

| Commission Model | Variable | Fixed or Variable |

| Overnight Interest Range | Not Disclosed | 0.5-2.0% |

The spreads offered by 6itrade appear attractive at first glance, but the lack of transparency regarding commissions and overnight interest raises concerns. Many traders have reported unexpected fees and challenges in understanding the full cost of trading with this broker. Such practices can lead to a less favorable trading environment, making it essential for traders to scrutinize the fee structure carefully.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. 6itrade claims to implement various safety measures, but the lack of robust regulatory oversight raises questions about the actual effectiveness of these measures. There are no clear indications that client funds are held in segregated accounts, which is a standard practice among reputable brokers to ensure that client funds are protected in the event of insolvency.

Additionally, there is no mention of investor protection schemes or negative balance protection policies, which are crucial for safeguarding traders against significant losses. Historical complaints regarding withdrawal issues and fund accessibility further exacerbate concerns about the safety of funds with 6itrade.

Customer Experience and Complaints

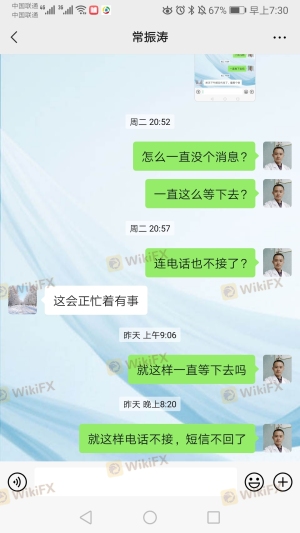

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of 6itrade reveal a troubling pattern of complaints, particularly regarding withdrawal delays and unresponsive customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow to Respond |

| Customer Support | Medium | Unresponsive |

| Account Blocking | High | No Resolution |

Many users have reported difficulties in withdrawing their funds, with some claiming that their accounts were blocked without clear explanations. Such issues can severely undermine a trader's trust in the broker. A few notable cases highlight the struggles traders have faced, including one user who reported waiting over three months for a withdrawal, only to receive no response from customer support.

Platform and Trade Execution

The trading platform provided by 6itrade is MetaTrader 4, a popular choice among traders for its advanced features and user-friendly interface. However, the execution quality and overall performance of the platform have come under scrutiny. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

The lack of detailed information on execution policies and potential manipulation raises further concerns. Traders must be cautious and consider whether they are receiving fair treatment in terms of order execution.

Risk Assessment

Engaging with any broker carries inherent risks, and 6itrade is no exception. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unverified regulatory claims. |

| Financial Risk | High | Potential for fund loss due to lack of protection. |

| Operational Risk | Medium | Reports of withdrawal and support issues. |

Given these risks, potential traders should exercise extreme caution when considering 6itrade as their broker. It's advisable to conduct thorough research and consider alternative options before committing any funds.

Conclusion and Recommendation

In conclusion, the investigation into 6itrade raises significant concerns about its legitimacy and safety. The lack of verified regulation, opaque company background, and troubling customer feedback suggest that this broker may not be a safe choice for traders.

While some traders may be drawn to the attractive spreads and high leverage, the potential risks and unresolved complaints indicate that caution is warranted. For those seeking a reliable trading experience, it may be advisable to consider alternative brokers with established regulatory oversight and positive customer reviews.

In summary, is 6itrade safe? The evidence points towards a broker that exhibits several red flags, making it prudent for traders to seek out more reputable options in the forex market.

6i Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

6i latest industry rating score is 2.19, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.19 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.