Is 500investments safe?

Business

License

Is 500Investments A Scam?

Introduction

In the ever-evolving world of forex trading, brokers play a pivotal role in providing traders with access to financial markets. 500Investments has emerged as a notable player, offering a range of trading options, including forex, stocks, commodities, indices, and cryptocurrencies. However, as the number of online brokers increases, so does the necessity for traders to conduct thorough due diligence before entrusting their funds. This article aims to assess whether 500Investments is a safe and legitimate broker or if it raises red flags that suggest otherwise. We will explore its regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and overall risk assessment to provide a well-rounded evaluation.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors influencing its legitimacy. 500Investments is operated by Cabsy Holdings Ltd., and its headquarters is located in Saint Vincent and the Grenadines, a jurisdiction known for its lack of stringent regulatory oversight. The absence of regulation raises significant concerns regarding the safety of client funds and the broker's operational integrity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unregulated |

The importance of regulation cannot be overstated; it ensures that brokers adhere to specific standards, including the segregation of client funds, regular audits, and compliance with anti-fraud practices. 500Investments has been flagged by several regulatory bodies, including the Financial Conduct Authority (FCA) in the UK and the Financial Markets Authority (FMA) in New Zealand, which have issued warnings about its operations. Such warnings are indicative of potential fraudulent activities, making it imperative for traders to approach 500Investments with caution.

Company Background Investigation

500Investments is owned and operated by Cabsy Holdings Ltd., which operates from an offshore jurisdiction. The company has not established a solid reputation within the trading community, and its history is relatively obscure. The lack of transparency surrounding its ownership structure and operational history raises questions about its reliability.

Moreover, the management team behind 500Investments has not been adequately disclosed, which adds to the uncertainty regarding their expertise and experience in the financial markets. A reputable broker typically provides detailed information about its management team, including their backgrounds and qualifications. The absence of such information may lead potential clients to question the broker's commitment to transparency and ethical practices.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for evaluating its overall value. 500Investments claims to offer competitive spreads and a variety of account types, but the specifics can be concerning. The broker's fee structure includes several unusual charges that could significantly impact trading profitability.

| Fee Type | 500Investments | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable | Low |

| Commission Model | N/A | Low |

| Overnight Interest Range | High | Moderate |

The spread on major currency pairs is variable, which can lead to higher trading costs compared to more established brokers. Furthermore, the absence of a clear commission structure raises concerns about hidden fees that could be detrimental to traders. Additionally, 500Investments imposes inactivity fees and withdrawal fees, which are not commonly found in reputable brokerage firms. Such policies may be seen as red flags, warranting further scrutiny of their trading conditions.

Client Funds Safety

When it comes to trading, the safety of client funds is paramount. 500Investments operates without a regulatory framework that mandates the segregation of client funds, which means that traders' money may be at risk. The broker does not provide clear information regarding investor protection measures or negative balance protection, which are essential for safeguarding traders against significant losses.

The lack of regulatory oversight and the absence of investor protection mechanisms could expose clients to various risks, including the potential for fund misappropriation or withdrawal issues. Historical complaints and warnings from regulatory authorities about 500Investments further underscore the concerns regarding its commitment to client safety.

Customer Experience and Complaints

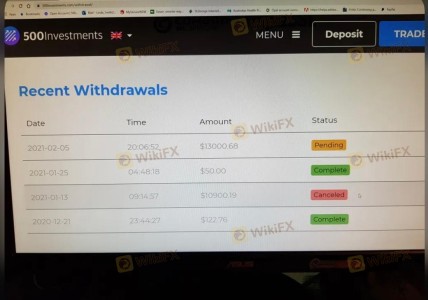

Analyzing customer feedback provides valuable insights into a broker's reliability. Reviews for 500Investments reveal a pattern of negative experiences, particularly concerning withdrawal issues and aggressive sales tactics.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Pushy Account Managers | Medium | Poor |

| Lack of Transparency | High | Poor |

Many clients have reported difficulties in withdrawing their funds, with some claiming that their accounts were blocked upon requesting withdrawals. Such complaints highlight significant operational issues within 500Investments. Additionally, the aggressive marketing tactics employed by account managers have raised concerns about the broker's ethical practices.

Platform and Trade Execution

The trading platform provided by 500Investments is web-based and proprietary, which can be a double-edged sword. While proprietary platforms can offer unique features, they may also lack the reliability and functionality of industry-standard platforms like MetaTrader 4 or 5.

Traders have reported mixed experiences regarding platform performance, with some citing issues related to order execution, slippage, and high rejection rates. The absence of transparent information about order execution quality raises further doubts about the broker's operational integrity.

Risk Assessment

Using 500Investments presents several risks that traders should be aware of.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker operating in a high-risk jurisdiction. |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues and account blocking. |

| Transparency Risk | Medium | Lack of clear information regarding management and operational practices. |

Traders should be cautious when considering 500Investments due to the high regulatory risk and the potential for withdrawal issues. It is advisable to implement risk mitigation strategies, such as starting with a minimal deposit and conducting thorough research before committing significant funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that 500Investments raises several red flags that warrant serious consideration. The lack of regulation, negative customer feedback, and questionable trading conditions indicate that this broker may not be a safe choice for traders.

For those considering trading with 500Investments, it is crucial to exercise caution and consider alternative options. Reputable brokers with strong regulatory oversight, transparent fee structures, and positive customer experiences should be prioritized. Some recommended alternatives include brokers regulated by the FCA, ASIC, or CySEC, which offer a safer trading environment and better protection for client funds.

In light of the findings, it is clear that 500Investments is not a broker that can be recommended without reservations.

Is 500investments a scam, or is it legit?

The latest exposure and evaluation content of 500investments brokers.

500investments Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

500investments latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.