VoyaFX 2025 Review: Everything You Need to Know

Executive Summary

This voyafx review looks at VoyaFX, an online trading platform that has caught attention in the forex trading world. VoyaFX works as a Financial Conduct Authority regulated broker, offering forex and other financial trading services based on what we know and user feedback. The platform shows decent reliability. It has a trust score that suggests careful hope among traders.

VoyaFX markets itself as a trading solution for both new and experienced traders who want access to foreign exchange markets. The broker's FCA regulation gives a foundation of oversight. Still, traders should do careful research before putting money in. Key features include trading many assets and following regulations. This makes it good for traders who want regulatory protection when choosing a broker.

The platform seems to serve many different users, from beginners learning forex markets to experienced traders who need reliable execution and regulatory security. But like any financial service provider, potential users should carefully check all parts of the service against their own trading needs and how much risk they can handle.

Important Notice

This review uses publicly available information, user feedback, and regulatory data current as of 2025. Trading conditions, features, and regulatory status may change across different areas and can change over time. VoyaFX may work through different companies in various regions. Each might have different regulatory requirements and offer different service levels.

Our review method uses multiple data sources including regulatory databases, user testimonials, and market research. Readers should check current information directly with VoyaFX and do independent research before making trading decisions. Past performance and user experiences do not promise future results.

Rating Framework

Broker Overview

VoyaFX works as an online trading platform that focuses on foreign exchange and financial derivatives trading. Tradingfinder.com says the broker had review updates as recently as May 2025. This shows ongoing market presence and regulatory compliance monitoring. The company focuses on providing internet-based trading services. It positions itself within the competitive online forex brokerage sector.

The broker's business model centers on helping retail and institutional access to global currency markets through electronic trading platforms. VoyaFX aims to serve traders seeking regulated access to forex markets. However, specific details about company founding date and corporate history stay limited in available public documentation.

VoyaFX operates under Financial Conduct Authority regulation, giving traders regulatory protection under UK financial services framework. The broker offers trading in foreign exchange pairs and other financial instruments. Though complete asset class information requires direct checking with the company. This voyafx review notes that the regulatory framework provides important safeguards for client funds and trading operations. These are essential considerations for serious forex traders.

Regulatory Jurisdiction

VoyaFX operates under Financial Conduct Authority regulation, giving traders protection under UK financial services legislation. FCA oversight includes requirements for client fund separation, capital adequacy, and operational transparency.

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal options was not detailed in available sources. Traders should contact VoyaFX directly for current payment method availability and processing timeframes.

Minimum Deposit Requirements

Minimum deposit information was not specified in available documentation. Prospective clients should check current account opening requirements directly with the broker.

Details about bonus programs or promotional offers were not found in available sources. Trading incentives and promotional terms may be available through direct inquiry with VoyaFX.

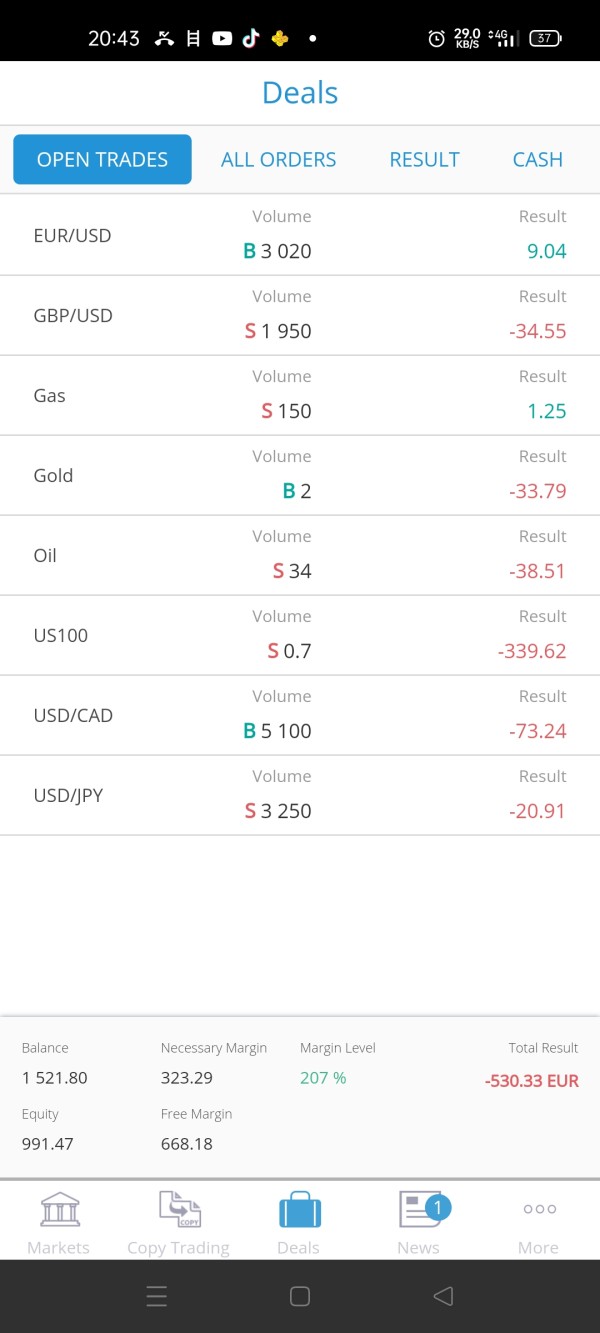

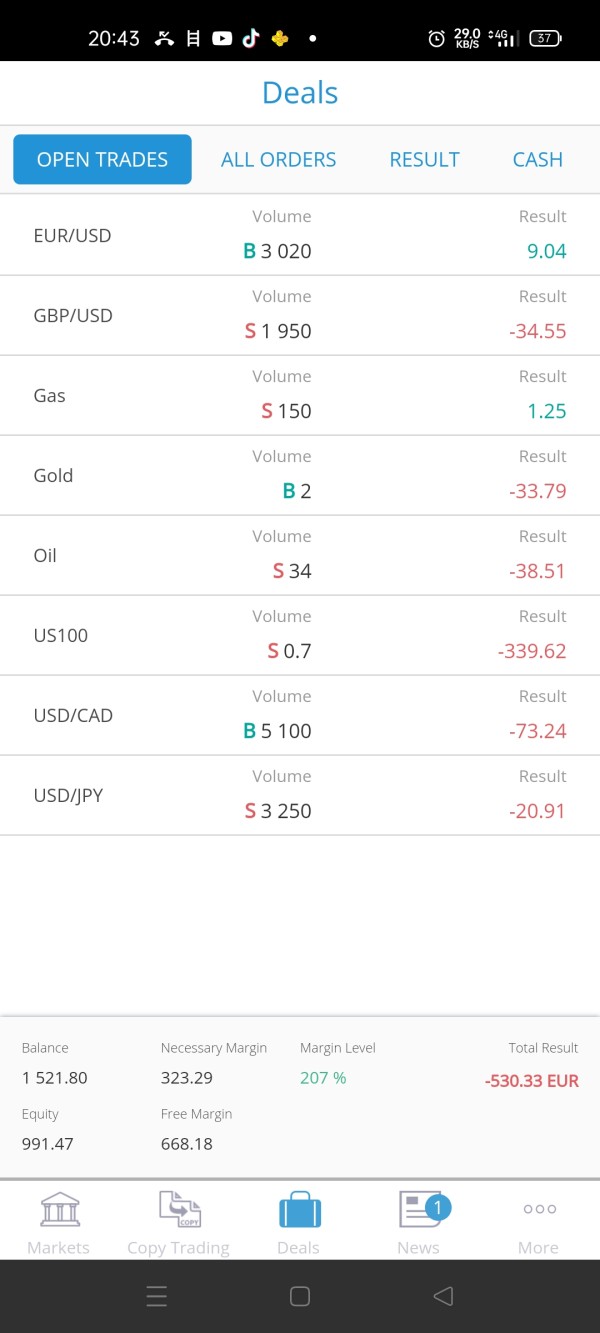

Available Trading Assets

VoyaFX provides access to forex trading and other financial instruments. The specific range of currency pairs, commodities, indices, and other tradeable assets requires checking through the broker's current offerings.

Cost Structure and Fees

Complete information about spreads, commissions, and other trading costs was not available in reviewed sources. This voyafx review recommends getting detailed fee schedules directly from VoyaFX before account opening.

Leverage Options

Leverage ratios and margin requirements were not specified in available documentation. EU and UK regulatory changes have affected leverage availability. This makes direct checking essential.

Specific trading platform information was not detailed in available sources. Platform features, mobile access, and technical capabilities require direct confirmation with the broker.

Geographic Restrictions

Information about regional service limitations was not available in reviewed materials. Traders should check service availability in their area before proceeding.

Customer Support Languages

Multilingual support capabilities were not specified in available documentation. Various language options may be available based on regional operations though.

Detailed Rating Analysis

Account Conditions Analysis

VoyaFX account conditions review faces limitations due to not enough publicly available information about account types, minimum deposit requirements, and specific terms and conditions. This voyafx review cannot provide complete analysis of account tiers, Islamic account availability, or special features without access to detailed account documentation.

The lack of clear account condition information creates challenges for potential traders seeking to compare VoyaFX offerings with competitors. Standard industry practice includes multiple account types serving different trader experience levels and capital requirements. But specific VoyaFX account structures require direct checking.

Account opening processes, verification requirements, and documentation needs were not detailed in available sources. Regulatory compliance under FCA oversight suggests standard KYC and AML procedures. But specific implementation details remain unclear.

The absence of detailed account condition information affects the overall review, resulting in a moderate rating that reflects information gaps rather than service quality assessment. Prospective traders should focus on getting complete account terms before making commitments.

Trading tools and research resources review encounters significant information limitations in available documentation. Modern forex trading requires sophisticated analytical tools, market research, and educational resources. But specific VoyaFX offerings in these areas lack detailed public information.

Contemporary forex brokers typically provide economic calendars, technical analysis tools, market commentary, and educational materials to support trader decision-making. The absence of detailed information about VoyaFX's tool suite prevents complete review of their competitive positioning in this crucial area.

Research capabilities, including market analysis, trading signals, and expert commentary, represent essential broker services for many traders. Without specific information about VoyaFX research offerings, traders cannot properly assess whether the broker meets their analytical requirements.

Educational resources, particularly important for new traders, typically include webinars, tutorials, and market education materials. The lack of available information about VoyaFX educational initiatives limits assessment of their commitment to trader development and support.

Customer Service and Support Analysis

Customer service review reveals mixed feedback from available user sources, showing moderate performance levels that suggest room for improvement. User comments referenced in available materials point to customer service as an area requiring attention. Though specific details about response times and service quality remain limited.

Support channel availability, including live chat, email, and telephone options, was not completely detailed in reviewed sources. Modern traders expect multiple contact methods with reasonable response times. This makes this information gap significant for service review.

Response time performance, crucial for active traders requiring prompt assistance, lacks specific data in available documentation. Trading support often requires immediate attention, particularly during market volatility or technical issues. This makes response speed a critical review factor.

Service quality assessment faces limitations due to insufficient user feedback detail in available sources. While some user commentary suggests moderate satisfaction levels, complete service quality review requires more extensive user experience data than currently available.

Multilingual support capabilities and operating hours were not specified in available materials. Though FCA-regulated brokers typically provide complete support services. Direct checking of support capabilities remains necessary for accurate assessment.

Trading Experience Analysis

Trading experience review encounters significant information limitations regarding platform performance, execution quality, and user interface design. This voyafx review cannot provide complete trading experience assessment without detailed user feedback and platform performance data.

Platform stability and execution speed represent crucial factors for forex trading success. But specific VoyaFX performance metrics were not available in reviewed sources. Traders require reliable platform performance during market volatility. This makes this information gap particularly significant.

Order execution quality, including slippage rates and fill prices, directly affects trading profitability but lacks specific documentation in available materials. Professional traders focus on execution transparency and performance consistency. They require detailed checking before platform commitment.

Mobile trading capabilities and cross-device synchronization represent essential features for modern forex trading. But specific VoyaFX mobile platform information was not detailed in available sources. Mobile trading functionality requires direct review by prospective users.

User interface design and usability feedback were not completely available, limiting assessment of platform accessibility for traders with varying experience levels. Platform ease-of-use significantly affects trading efficiency and user satisfaction.

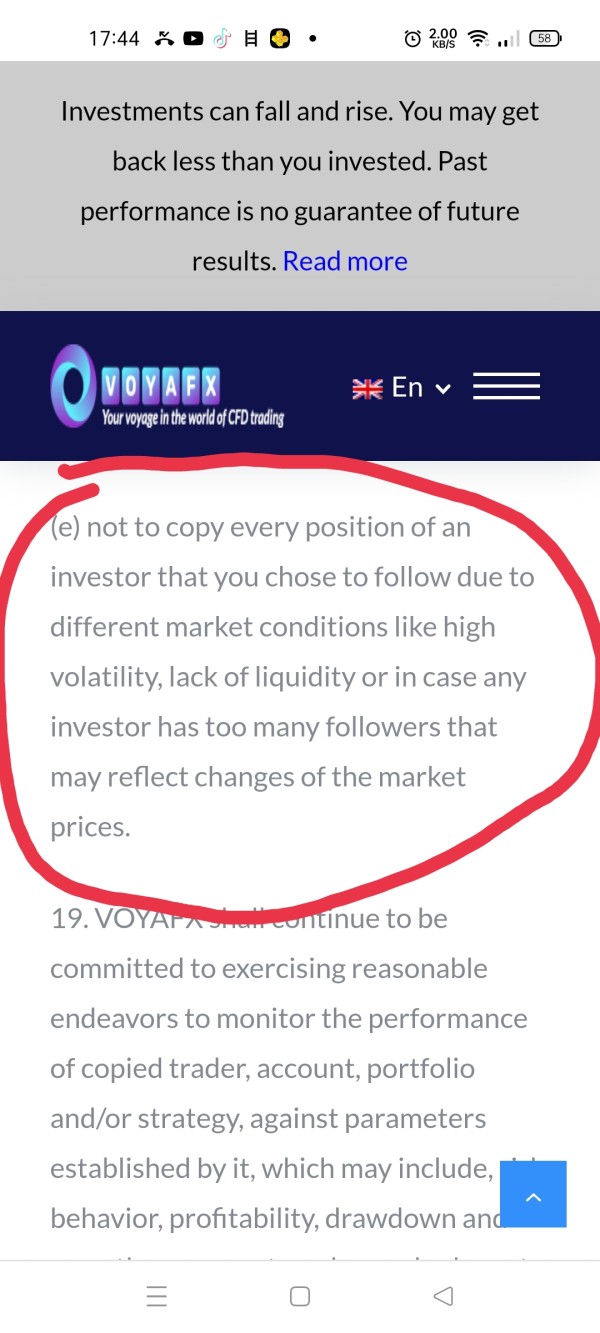

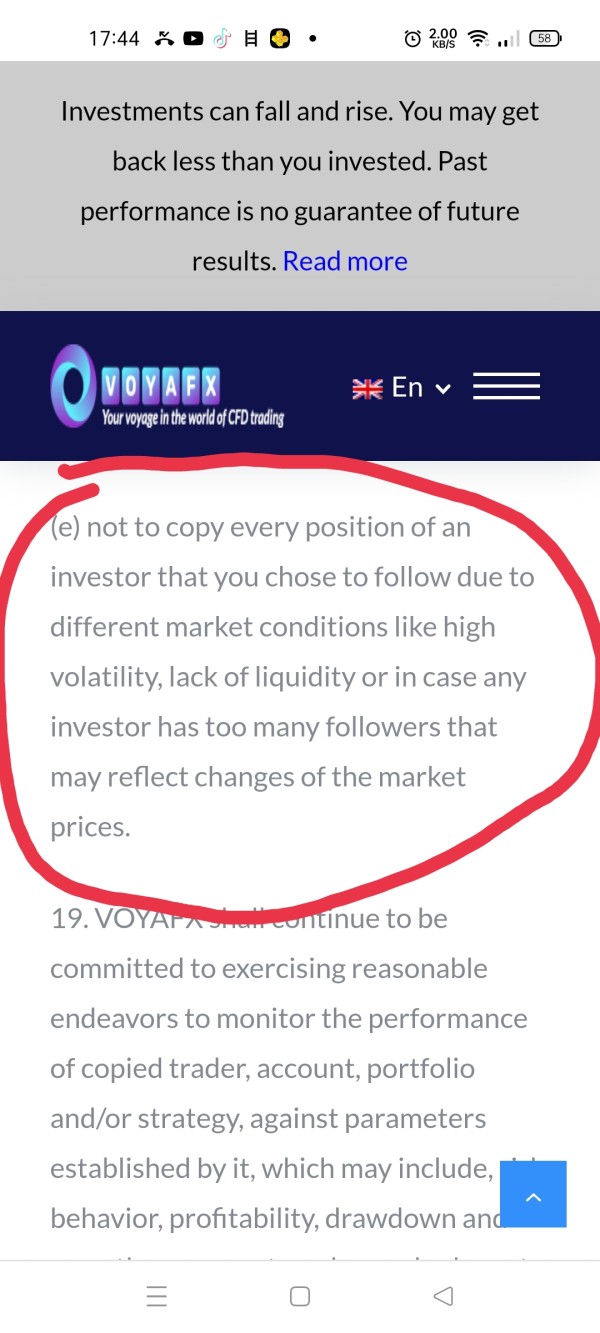

Trust and Safety Analysis

Trust review benefits from VoyaFX's Financial Conduct Authority regulation, providing important regulatory oversight and client protection measures. FCA regulation includes requirements for client fund separation. This ensures trader deposits remain separate from operational funds.

Regulatory compliance under FCA oversight provides baseline trust foundation. Though additional transparency measures could enhance overall confidence levels. Regulatory protection includes access to Financial Services Compensation Scheme coverage. This provides additional security for eligible clients.

Company transparency and operational disclosure face limitations in available public information, affecting complete trust assessment. Modern traders increasingly focus on broker transparency. This includes ownership structure, financial reporting, and operational practices.

Fund security measures beyond basic regulatory requirements were not detailed in available sources. Though FCA regulation mandates specific client fund protection protocols. Additional security features, including insurance coverage and segregated account details, require direct checking.

Industry reputation and third-party assessments provide limited data for complete trust review. User feedback suggests moderate confidence levels requiring further validation through direct research and regulatory checking.

User Experience Analysis

User experience assessment faces significant limitations due to insufficient detailed feedback from traders using VoyaFX services. Available user commentary suggests moderate satisfaction levels. Though complete experience review requires more extensive user data than currently available.

Interface design and platform usability review cannot be thoroughly conducted without detailed user feedback and platform demonstrations. User-friendly design significantly affects trading efficiency and satisfaction. This makes this information gap notable for prospective traders.

Registration and account verification processes were not detailed in available sources. Though FCA regulation requires standard compliance procedures. Streamlined onboarding processes enhance user experience. This requires direct review by prospective clients.

Fund management experience, including deposit and withdrawal processes, lacks specific user feedback in available documentation. Efficient fund operations represent crucial user experience factors. This is particularly true for active traders requiring frequent account access.

Common user concerns and complaint patterns were not completely detailed in available sources. This limits assessment of recurring issues or service gaps. User feedback analysis provides valuable insights into broker performance and areas requiring improvement.

Conclusion

This complete voyafx review reveals VoyaFX as an FCA-regulated forex broker with moderate market presence. Though significant information gaps limit thorough review. The broker's regulatory status provides important baseline protection for traders. While the lack of detailed operational information suggests the need for careful research.

VoyaFX appears suitable for traders who focus on regulatory protection and seek access to forex markets through a UK-regulated entity. However, the limited availability of detailed service information requires prospective clients to conduct direct research and checking before making trading commitments.

The broker's main advantages include FCA regulatory oversight and compliance with UK financial services standards. Primary limitations involve insufficient transparency in operational details, trading conditions, and service offerings. This requires enhanced disclosure for complete review. Traders should request detailed information directly from VoyaFX and compare offerings thoroughly with alternative brokers before making final decisions.