VIPTRADE 2025 Review: Everything You Need to Know

Executive Summary

VIPTRADE presents itself as an international forex broker. The company has gotten mixed reactions from the trading community. This viptrade review looks at a platform that says it offers user-friendly trading solutions with competitive fee structures. According to various sources, VIPTRADE markets itself as "an international broker worth trying out," emphasizing accessibility for traders seeking cost-effective trading environments.

The broker targets traders who want low-cost trading and simple platform design. However, the trading community stays divided on VIPTRADE's legitimacy, with some sources asking whether the platform works as a real brokerage or presents potential risks to traders. This uncertainty has created a careful atmosphere around the broker. It makes thorough research essential for future clients.

Despite these concerns, VIPTRADE continues to operate in the international forex market. The company offers trading services across multiple asset classes. The platform's focus on user experience and competitive pricing has attracted attention from cost-conscious traders. However, the lack of complete regulatory transparency remains a significant consideration for potential users.

Important Notice

This review uses publicly available information and user feedback collected from various sources as of 2025. Regulatory status and service offerings may vary significantly across different jurisdictions. Traders should verify current regulatory compliance in their specific region before engaging with any broker.

The evaluation method used in this review relies on available user testimonials, platform features analysis, and publicly disclosed information. Due to limited comprehensive data availability, some assessments are based on general market observations and comparative analysis with industry standards.

Rating Framework

Broker Overview

VIPTRADE operates as an international forex broker. Specific details about its founding date and corporate structure remain unclear from available sources. The company positions itself within the competitive forex brokerage landscape by emphasizing accessibility and cost-effectiveness as primary value propositions.

The broker's business model focuses on providing trading access to international markets while maintaining competitive fee structures. According to sources describing the platform, VIPTRADE aims to serve traders who want straightforward trading environments without complex fee arrangements that might deter cost-conscious participants.

VIPTRADE's trading infrastructure centers around what sources describe as a user-friendly platform designed to accommodate traders across various experience levels. The broker reportedly offers access to multiple trading markets, though specific asset class details and platform specifications are not fully documented in available materials. The absence of clear regulatory disclosure in public information raises questions about the broker's oversight and compliance framework. Potential clients should carefully consider this when evaluating their options.

This viptrade review notes that while the broker markets itself as an international service provider, the lack of transparent regulatory information represents a significant gap in the publicly available information that traders typically rely upon when selecting a brokerage partner.

Regulatory Status: Available information does not clearly specify VIPTRADE's regulatory jurisdiction or oversight bodies. This lack of transparency regarding regulatory compliance represents a significant concern for traders seeking regulated brokerage services.

Deposit and Withdrawal Methods: Specific information about supported payment methods and processing procedures is not detailed in available sources. This requires direct inquiry with the broker for clarification.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in publicly available information. However, the broker's positioning suggests competitive entry requirements.

Promotions and Bonuses: Current promotional offerings and bonus structures are not detailed in available sources. This indicates potential clients should contact the broker directly for current incentive programs.

Tradeable Assets: Sources indicate VIPTRADE provides access to multiple trading markets. However, specific asset classes, instruments, and market coverage details are not fully documented.

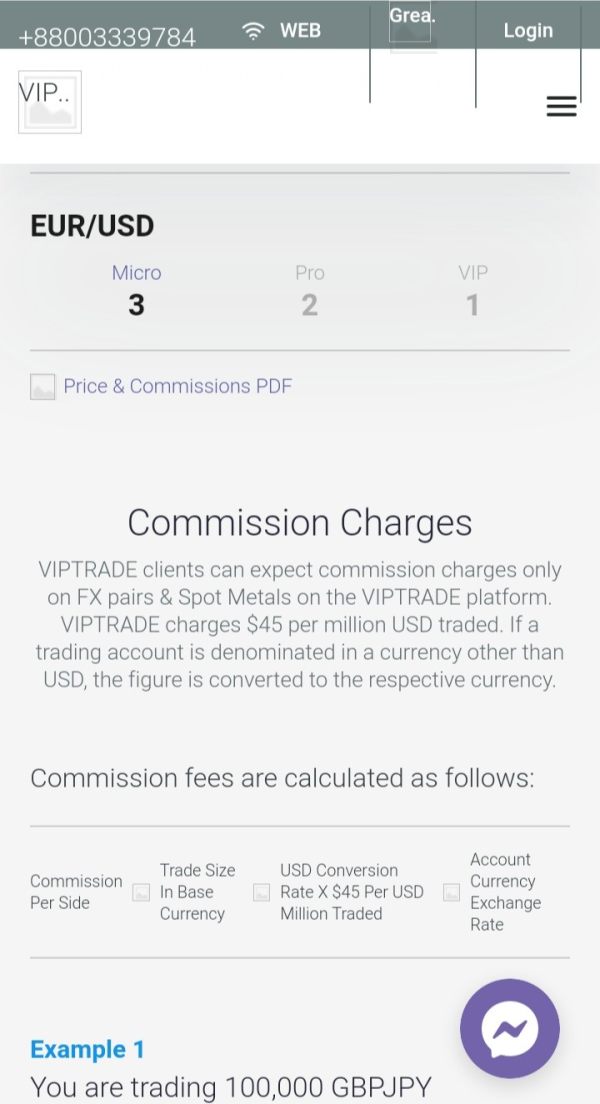

Cost Structure: VIPTRADE reportedly offers competitive fees and low-cost trading. However, specific spread ranges, commission structures, and additional charges are not detailed in available public information.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in accessible sources. This requires direct verification with the broker.

Platform Options: Sources describe VIPTRADE as offering a user-friendly trading platform. However, technical specifications, platform types, and feature sets are not fully detailed.

Geographic Restrictions: Information regarding service availability and regional restrictions is not clearly outlined in available materials.

Customer Support Languages: Supported languages and communication options for customer service are not specified in accessible sources.

This viptrade review emphasizes that the limited availability of detailed operational information represents a significant consideration for traders evaluating the broker's suitability for their trading requirements.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of VIPTRADE's account conditions faces significant limitations due to insufficient publicly available information. Standard industry practices would typically include multiple account tiers designed to accommodate different trader profiles. These range from beginner-friendly options to advanced trading environments for experienced participants.

Without specific details about account types, minimum deposit requirements, or special features such as Islamic accounts, potential clients cannot adequately assess whether VIPTRADE's offerings align with their trading needs and financial capabilities. The absence of transparent account structure information raises concerns about the broker's commitment to clear communication with prospective clients.

Industry standards typically require brokers to clearly outline account opening procedures, verification requirements, and ongoing account maintenance conditions. The lack of readily available information about these fundamental aspects suggests that interested traders would need to engage directly with VIPTRADE to obtain essential account details.

This viptrade review notes that the limited transparency regarding account conditions represents a significant barrier to informed decision-making for potential clients who require comprehensive information before committing to a brokerage relationship.

VIPTRADE's trading tools and resources evaluation is constrained by limited available information about specific platform capabilities and analytical offerings. Sources suggest the broker provides a user-friendly trading environment. This typically implies basic charting capabilities and essential trading functionalities.

However, comprehensive details about advanced trading tools, research resources, market analysis provisions, or educational materials are not readily available in public sources. Modern traders often require sophisticated analytical tools, real-time market data, and comprehensive research support to make informed trading decisions.

The absence of detailed information about automated trading support, API access, or third-party platform integration limits the ability to assess VIPTRADE's suitability for traders who rely on advanced trading technologies or algorithmic strategies.

Educational resources and trader development programs are increasingly important differentiators in the competitive brokerage landscape. Yet available sources do not provide insight into VIPTRADE's commitment to client education and skill development.

Customer Service and Support Analysis

Evaluating VIPTRADE's customer service capabilities is challenging due to the absence of detailed information about support channels, availability, and service quality metrics. Effective customer support represents a critical component of successful brokerage relationships. This is particularly true for traders who require timely assistance with technical issues or account-related inquiries.

Standard industry expectations include multiple communication channels such as live chat, email support, and telephone assistance, with reasonable response times and knowledgeable support staff. The lack of publicly available information about VIPTRADE's customer service infrastructure raises questions about the broker's commitment to client support.

Multilingual support capabilities are essential for international brokers serving diverse client bases. Yet available sources do not specify the languages supported or the geographic coverage of customer service operations. Additionally, support availability hours and emergency contact procedures are not documented in accessible materials.

The absence of user testimonials or feedback specifically addressing customer service experiences limits the ability to assess actual service quality and problem resolution effectiveness.

Trading Experience Analysis

VIPTRADE's trading experience evaluation benefits from sources describing the platform as user-friendly with competitive fee structures. This suggests a potentially positive trading environment. User-friendly platform design typically indicates intuitive navigation, efficient order execution interfaces, and accessible market information presentation.

The emphasis on low fees represents a significant advantage for cost-conscious traders, particularly those engaged in frequent trading activities where transaction costs can significantly impact overall profitability. However, specific details about execution speed, slippage rates, and order types are not available in public sources.

Platform stability and reliability are crucial factors affecting trading experience. Yet available information does not provide insight into system uptime, technical performance metrics, or contingency procedures during high-volatility market conditions.

Mobile trading capabilities and cross-device synchronization are increasingly important for modern traders. However, specific information about VIPTRADE's mobile offerings and multi-platform support is not detailed in available sources.

This viptrade review acknowledges that while initial indicators suggest a positive trading environment, the lack of comprehensive technical specifications limits the ability to fully assess the trading experience quality.

Trust and Safety Analysis

VIPTRADE's trust and safety evaluation reveals significant concerns due to ongoing questions about the broker's legitimacy and regulatory status. Sources specifically mention questioning "whether VIPTRADE is a scam or a legitimate forex broker." This indicates substantial uncertainty within the trading community about the platform's credibility.

The absence of clear regulatory disclosure represents a major red flag for traders seeking secure and compliant brokerage services. Legitimate brokers typically maintain transparent regulatory relationships and provide clear information about oversight bodies, license numbers, and compliance frameworks.

Fund safety measures, including segregated client accounts, deposit insurance, and audit procedures, are not detailed in available sources. These protections are essential for trader confidence and represent standard industry practices among reputable brokers.

Corporate transparency, including company registration details, management information, and financial disclosures, appears limited based on available public information. This lack of transparency contributes to the uncertainty surrounding VIPTRADE's legitimacy and operational integrity.

The presence of scam allegations and legitimacy questions within the trading community represents a significant trust barrier that potential clients must carefully consider when evaluating VIPTRADE as a brokerage option.

User Experience Analysis

VIPTRADE's user experience assessment reveals a mixed picture with positive elements balanced against significant concerns. Sources indicate positive feedback regarding platform usability and user-friendly design. This suggests that the broker has invested in creating an accessible trading environment.

The emphasis on intuitive platform design typically translates to reduced learning curves for new users and efficient workflow management for experienced traders. However, the overall user experience extends beyond platform design to encompass account management, customer service, and operational transparency.

The presence of legitimacy questions and scam allegations significantly impacts user confidence and overall experience satisfaction. Trust represents a fundamental component of positive user experience, and uncertainty about broker credibility creates anxiety that can overshadow technical platform advantages.

Registration and verification procedures, fund management processes, and withdrawal experiences are not detailed in available sources. This limits the ability to assess these critical user touchpoints. Additionally, user feedback compilation and systematic review analysis are constrained by limited publicly available testimonials and experience reports.

The mixed nature of available feedback suggests that while VIPTRADE may offer satisfactory technical functionality, broader concerns about legitimacy and transparency significantly impact overall user experience quality.

Conclusion

VIPTRADE presents a complex evaluation profile characterized by potentially positive platform features balanced against significant transparency and trust concerns. While sources suggest the broker offers user-friendly trading environments with competitive fee structures, ongoing questions about legitimacy and regulatory compliance create substantial uncertainty for potential clients.

The broker appears most suitable for traders who prioritize low-cost trading and platform simplicity, provided they are comfortable with limited regulatory transparency and the associated risks. However, the absence of comprehensive operational information and persistent legitimacy questions make VIPTRADE a challenging recommendation for risk-averse traders or those requiring fully regulated brokerage services.

Primary advantages include reported user-friendly platform design and competitive fee structures. Significant disadvantages encompass regulatory transparency deficits, limited operational information disclosure, and ongoing community concerns about legitimacy. Prospective clients should conduct thorough due diligence and consider these factors carefully before engaging with VIPTRADE's services.