Is UITT safe?

Pros

Cons

Is Uitt A Scam?

Introduction

In the ever-evolving world of forex trading, Uitt has emerged as a player, aiming to provide a platform for traders to engage in currency exchange. However, as with any financial service, it is crucial for traders to exercise caution and conduct thorough research before committing their funds. The forex market is rife with both reputable and dubious brokers, making it essential to differentiate between them. This article aims to investigate whether Uitt is a legitimate broker or if it raises any red flags that could suggest it is a scam. Our evaluation will be based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer security measures, user experiences, and potential risks.

Regulation and Legitimacy

The regulatory status of a broker is a cornerstone of its legitimacy. Uitt claims to operate under regulations, but its actual licensing status is questionable. A lack of proper regulation can expose traders to significant risks, including the potential for fraud. Below is a summary of Uitts regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Unknown | N/A | United Kingdom | Not Verified |

The absence of a reputable regulatory authority overseeing Uitt raises concerns. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) enforce strict guidelines to protect traders. Uitts lack of clear regulatory compliance could indicate potential risks for traders, making it imperative to question whether Uitt is safe for trading.

Company Background Investigation

Uitt Exchange Group Limited, the entity behind Uitt, has a somewhat obscure history. Details regarding its establishment, ownership structure, and management team are scarce. The lack of transparency surrounding the companys origins and its operational history is troubling. For a broker to gain the trust of traders, it should provide clear information about its management team, including their qualifications and experience in the financial sector.

Moreover, the absence of detailed disclosures about the company‘s operations and financial health can lead to skepticism among potential clients. A broker’s credibility is often built on its transparency, and Uitts failure to provide adequate information may lead traders to question the safety of their investments. In evaluating whether Uitt is safe, it is crucial to consider the importance of transparency as a foundational aspect of trust in the financial industry.

Trading Conditions Analysis

Uitt offers various trading conditions that may seem attractive at first glance. However, it is essential to delve deeper into the fee structure and overall trading costs associated with the platform. Heres a comparison of Uitt's core trading costs against industry averages:

| Fee Type | Uitt | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Unclear | Standard |

| Overnight Interest Range | High | Moderate |

The high spreads and unclear commission structure are concerning indicators. While many reputable brokers offer competitive spreads and transparent fee structures, Uitts terms may not align with industry standards. Traders should be wary of any broker that does not clearly articulate its fees, as this could be a tactic to obscure hidden costs. Therefore, it is crucial to assess whether Uitt is safe based on its trading conditions.

Client Funds Security

The security of client funds is paramount when choosing a forex broker. Uitt claims to implement various measures to protect client assets, including segregated accounts and investor protection policies. However, without verification from a reputable regulatory body, the effectiveness of these measures remains uncertain.

A thorough examination of Uitt's fund security protocols reveals a lack of clarity regarding their specifics. Traders should be cautious about investing with a broker that does not provide detailed information about how client funds are safeguarded. Moreover, past incidents involving mismanagement of client funds could serve as a warning sign. Hence, assessing whether Uitt is safe requires a critical look at its fund security measures.

Customer Experience and Complaints

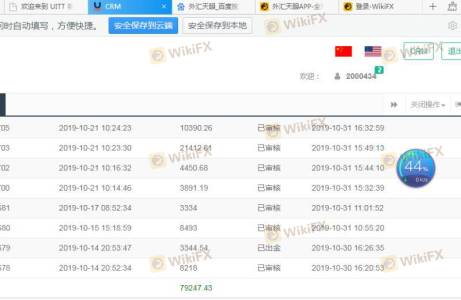

User feedback is a valuable resource for gauging a brokers reliability. A review of customer experiences with Uitt reveals a mix of satisfaction and dissatisfaction. Common complaints include difficulties in withdrawing funds, lack of customer support, and issues related to trade execution. Below is a summary of the major complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Unresponsive |

| Trade Execution | High | Inconsistent |

The severity of these complaints raises concerns about Uitts operational integrity. A broker that fails to address customer issues promptly can erode trust and lead to further dissatisfaction. Therefore, it is vital to consider these user experiences when evaluating whether Uitt is safe for trading.

Platform and Trade Execution

The trading platform offered by Uitt plays a critical role in the overall user experience. An analysis of its performance reveals that while it may have a user-friendly interface, there are significant concerns regarding order execution quality. Reports of slippage and high rejection rates for trades are prevalent among users. These issues can severely impact a trader‘s ability to execute strategies effectively and may indicate underlying problems with the platform’s reliability.

Moreover, any signs of potential platform manipulation should raise alarms. If a broker consistently executes trades in a manner that disadvantages clients, it could suggest unethical practices. Therefore, assessing whether Uitt is safe necessitates a thorough examination of the platforms execution capabilities.

Risk Assessment

Engaging with any forex broker carries inherent risks. A comprehensive risk assessment of Uitt highlights several areas of concern. Below is a risk scorecard summarizing key risk categories:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Lack of clear regulation |

| Fund Security | High | Uncertain protective measures |

| Customer Support | Medium | Slow response to issues |

| Trading Conditions | High | High spreads and unclear fees |

The high-risk levels across multiple categories indicate that traders should approach Uitt with caution. Effective risk mitigation strategies, such as diversifying investments and using risk management tools, are essential for those considering trading with Uitt. Evaluating whether Uitt is safe ultimately hinges on understanding these risks and taking appropriate steps to protect ones investments.

Conclusion and Recommendations

In summary, the investigation into Uitt raises several red flags that warrant caution. The lack of clear regulatory oversight, transparency issues, high trading costs, and numerous customer complaints suggest that traders should think twice before engaging with this broker. While Uitt may offer some attractive features, the potential risks associated with trading on its platform are significant.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are well-regulated, transparent in their operations, and demonstrate a commitment to customer service. Brokers with robust regulatory frameworks and positive user feedback can provide a safer trading environment. Thus, when questioning whether Uitt is safe, it is crucial to weigh all evidence carefully and make informed decisions based on thorough research.

Is UITT a scam, or is it legit?

The latest exposure and evaluation content of UITT brokers.

UITT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UITT latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.