TRADESMART Review 1

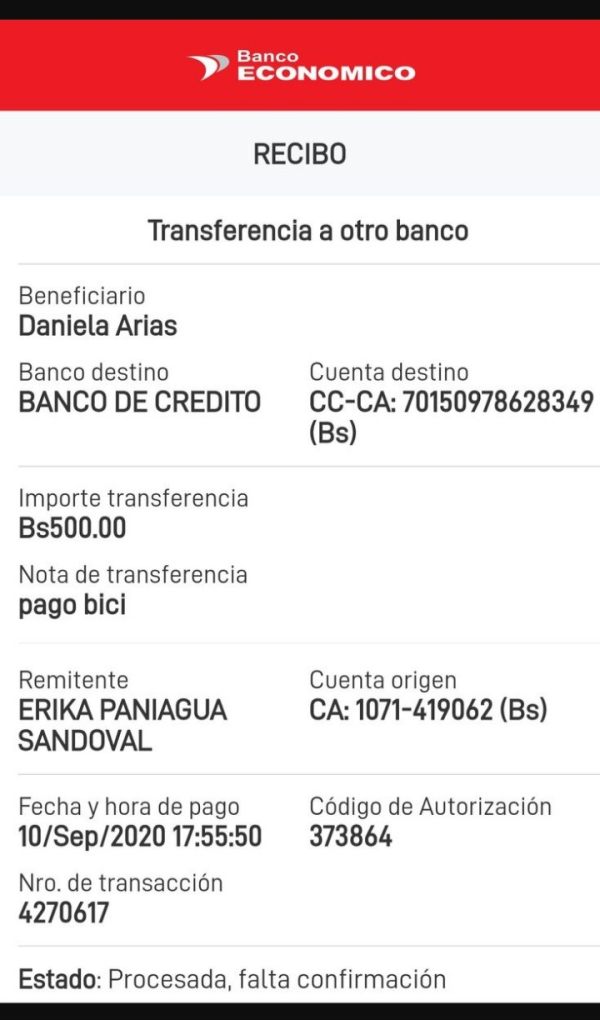

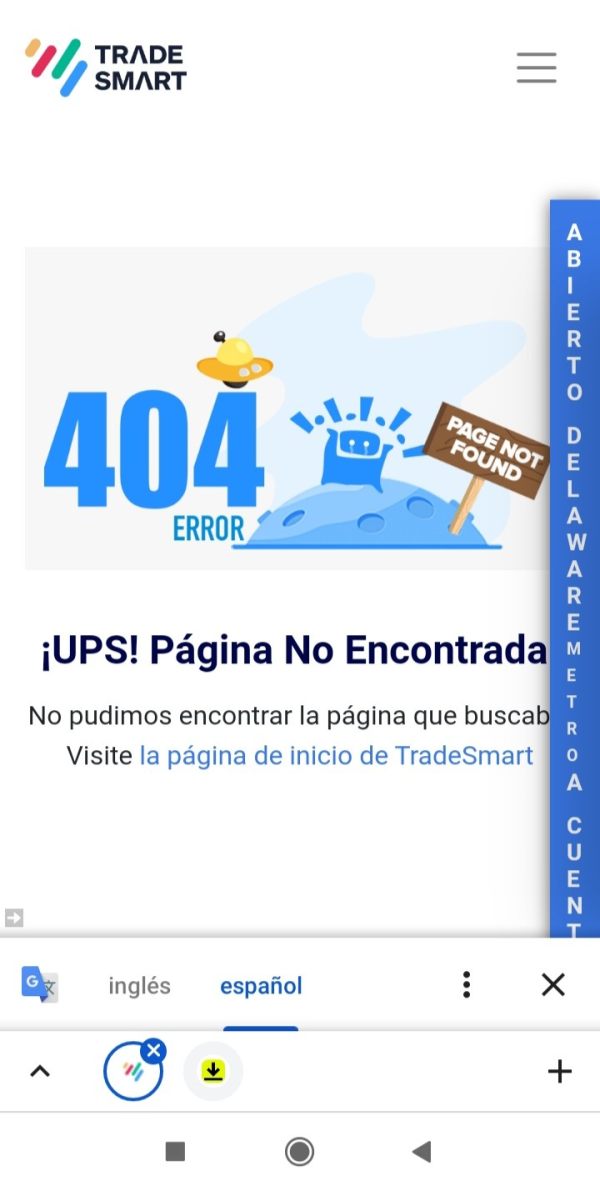

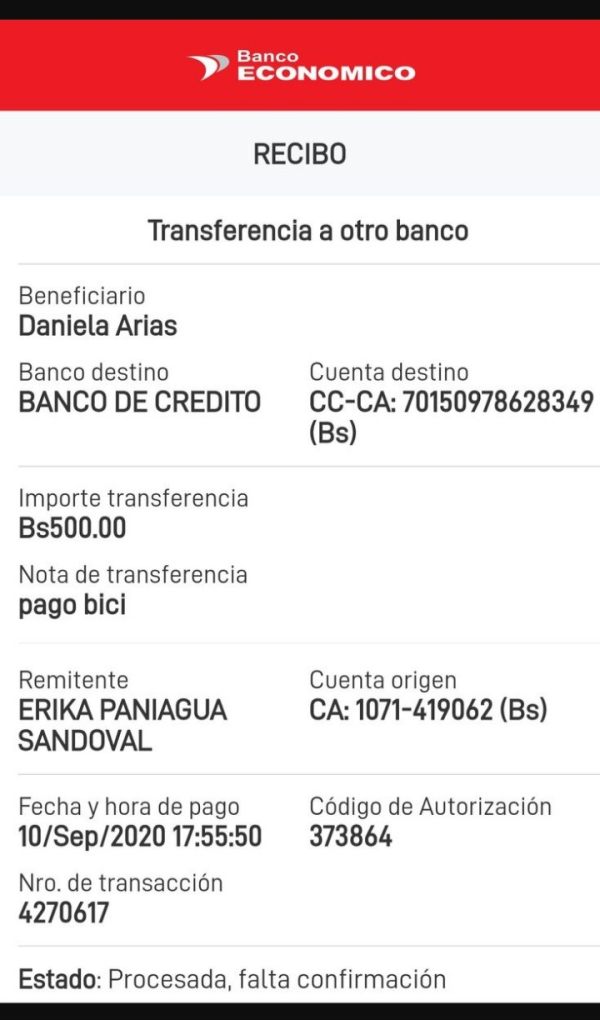

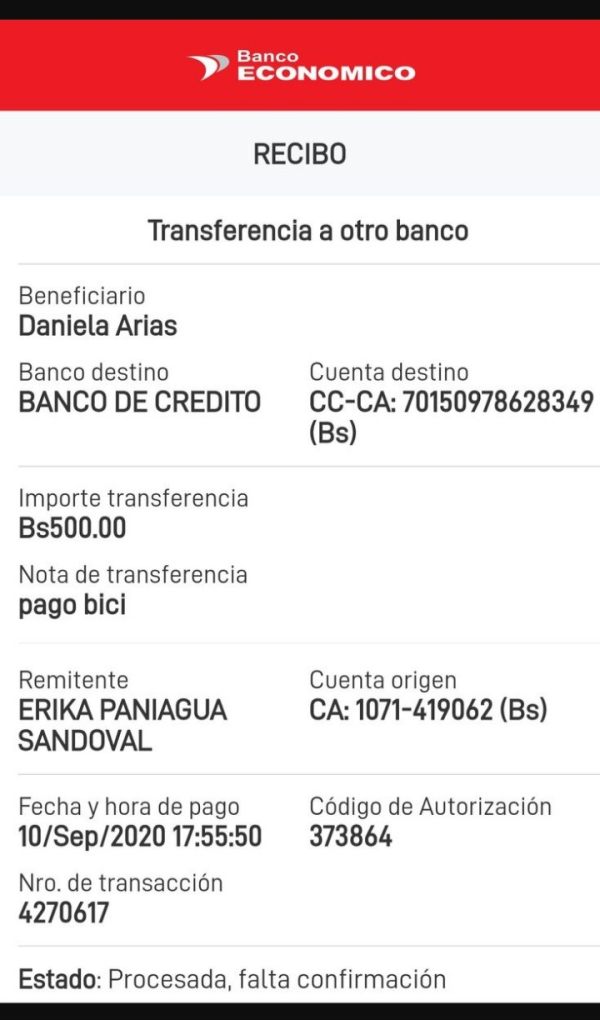

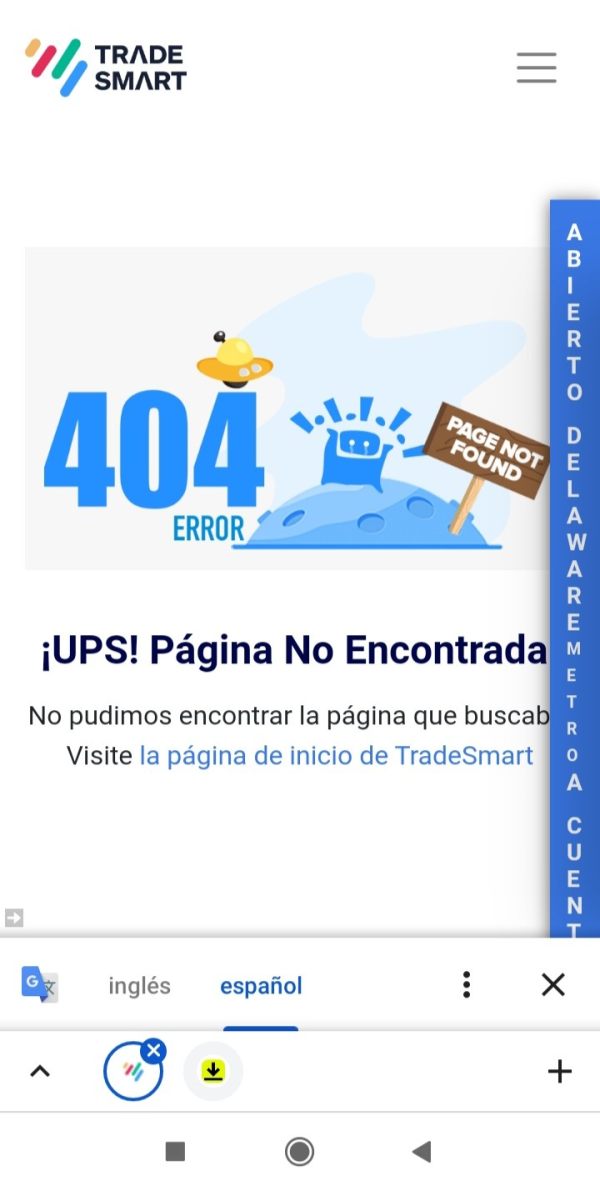

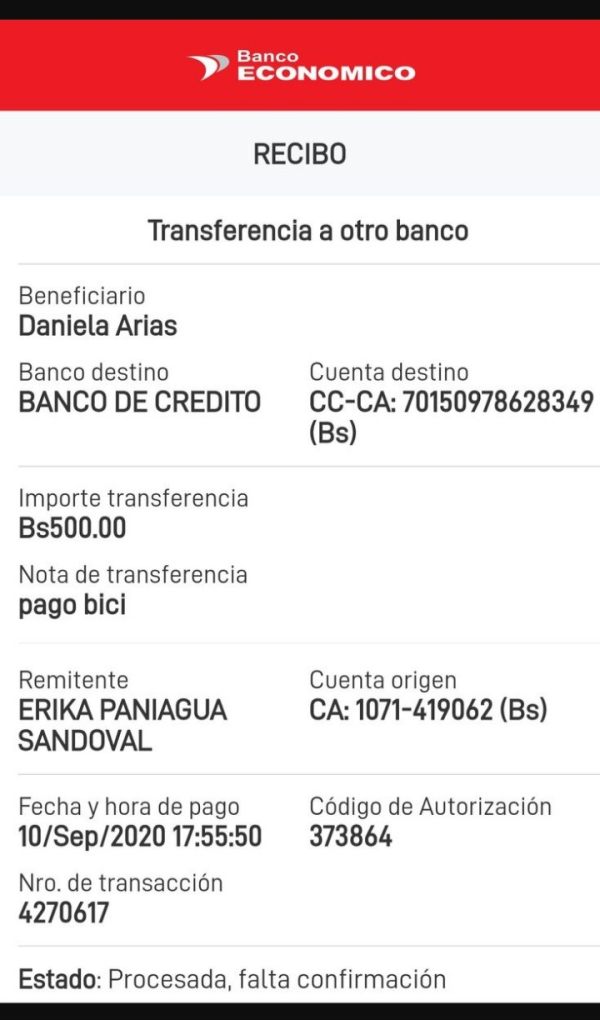

The website was of no response because my withdrawal made it out of control. I thought they should give me a solution including the tnitial deposit of 500.

TRADESMART Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

The website was of no response because my withdrawal made it out of control. I thought they should give me a solution including the tnitial deposit of 500.

This Tradesmart review looks at an unregulated forex broker that serves traders who want diverse trading instruments and flexible platform options. Tradesmart gives access to over 100 tradeable instruments across multiple asset classes, including currencies, cryptocurrencies, indices, precious metals, energies, and stocks. The broker supports both Web-based trading and the popular MetaTrader 5 platform. This provides traders with familiar and robust trading environments.

Tradesmart is based in London, United Kingdom. The company positions itself as a broker suitable for intermediate to advanced traders, particularly those interested in forex and cryptocurrency markets. However, the lack of regulatory oversight presents significant considerations for potential clients regarding fund safety and legal protections. The broker offers educational resources for forex trading and maintains a diverse instrument selection. Traders must carefully weigh the benefits against the inherent risks associated with unregulated brokers.

Traders should exercise extreme caution when considering this broker due to Tradesmart's unregulated status. The absence of regulatory oversight means that standard investor protections, compensation schemes, and regulatory compliance measures may not be available. This review is based on publicly available information. It does not constitute investment advice or a recommendation to trade with this broker.

Our analysis methodology relies on available data sources and does not include direct trading experience or verification of all claimed features. Potential clients should conduct thorough due diligence and consider regulated alternatives before making any trading decisions.

| Evaluation Criteria | Score | Rating Justification |

|---|---|---|

| Account Conditions | N/A | Specific account condition information not detailed in available sources |

| Tools and Resources | 8/10 | Strong offering with 100+ tradeable instruments across six asset classes |

| Customer Service | N/A | Customer service details not specified in available materials |

| Trading Experience | N/A | Specific trading experience metrics not available for assessment |

| Trust and Safety | 3/10 | Significant concerns due to unregulated status affecting fund security |

| User Experience | N/A | Detailed user experience information not available in source materials |

Tradesmart operates as a forex and multi-asset broker headquartered in London, United Kingdom. The company's business model focuses on providing access to global financial markets through online trading platforms, though specific details about its founding date and corporate history are not detailed in available sources. The broker's strategic positioning targets traders seeking exposure to diverse asset classes. These include traditional forex pairs, emerging cryptocurrency markets, and various derivative instruments.

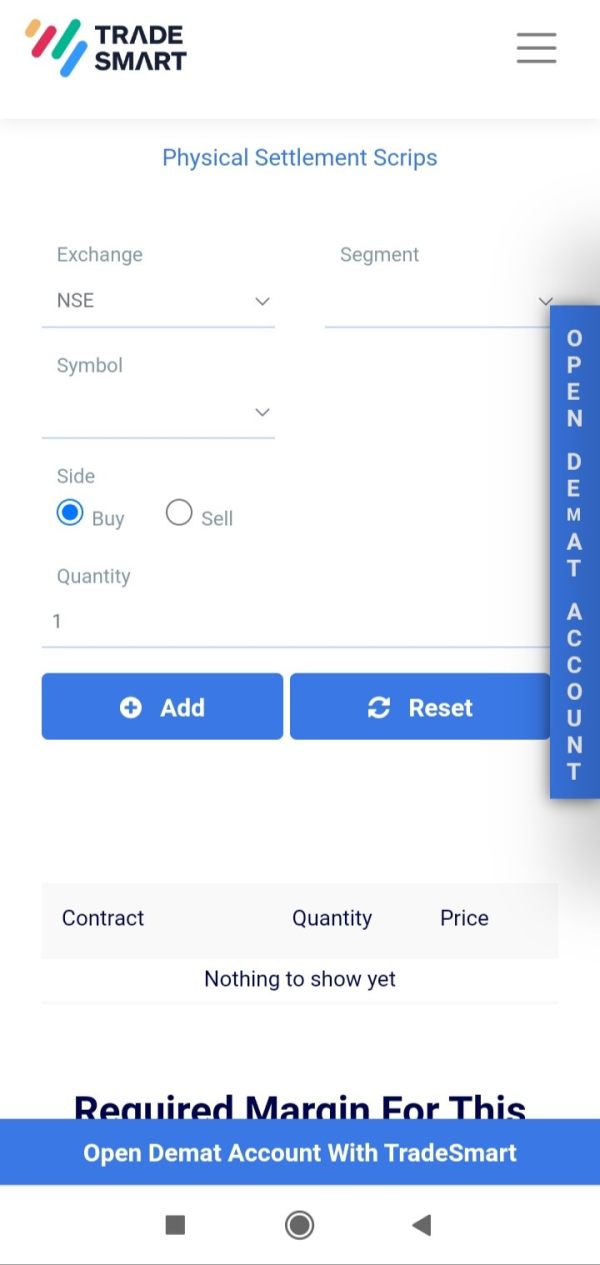

The broker's operational framework centers around offering Web-based trading solutions alongside the industry-standard MetaTrader 5 platform. This dual-platform approach allows Tradesmart to serve different trader preferences, from those favoring browser-based convenience to users requiring advanced charting and automated trading capabilities. The company's asset portfolio encompasses six major categories. These are currencies, cryptocurrencies, indices, precious metals, energy commodities, and individual stocks, providing comprehensive market exposure for diversified trading strategies.

However, this Tradesmart review must emphasize that the broker operates without regulatory supervision from recognized financial authorities. This significantly impacts its credibility and the safety measures available to clients.

Regulatory Status: Tradesmart operates as an unregulated broker. This means it does not fall under the supervision of major financial regulatory bodies such as the FCA, CySEC, or ASIC. This status raises important concerns about client fund protection and dispute resolution mechanisms.

Deposit and Withdrawal Methods: Specific information regarding funding methods, processing times, and minimum withdrawal amounts is not detailed in available sources. This requires direct contact with the broker for clarification.

Minimum Deposit Requirements: The minimum deposit threshold for opening trading accounts with Tradesmart is not specified in accessible materials. This indicates potential clients need to inquire directly with the broker.

Promotional Offers: Details about welcome bonuses, deposit bonuses, or other promotional incentives are not mentioned in available sources. This suggests either no current offers or limited marketing of such programs.

Trading Instruments: Tradesmart provides access to over 100 trading instruments across six asset categories. These are foreign exchange currencies, cryptocurrencies, stock indices, precious metals, energy commodities, and individual equity shares. This diverse selection enables traders to implement various strategies across different market sectors.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not detailed in available materials. This makes cost comparison challenging without direct broker contact.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in accessible sources. This requires clarification from the broker regarding available leverage for different instrument types.

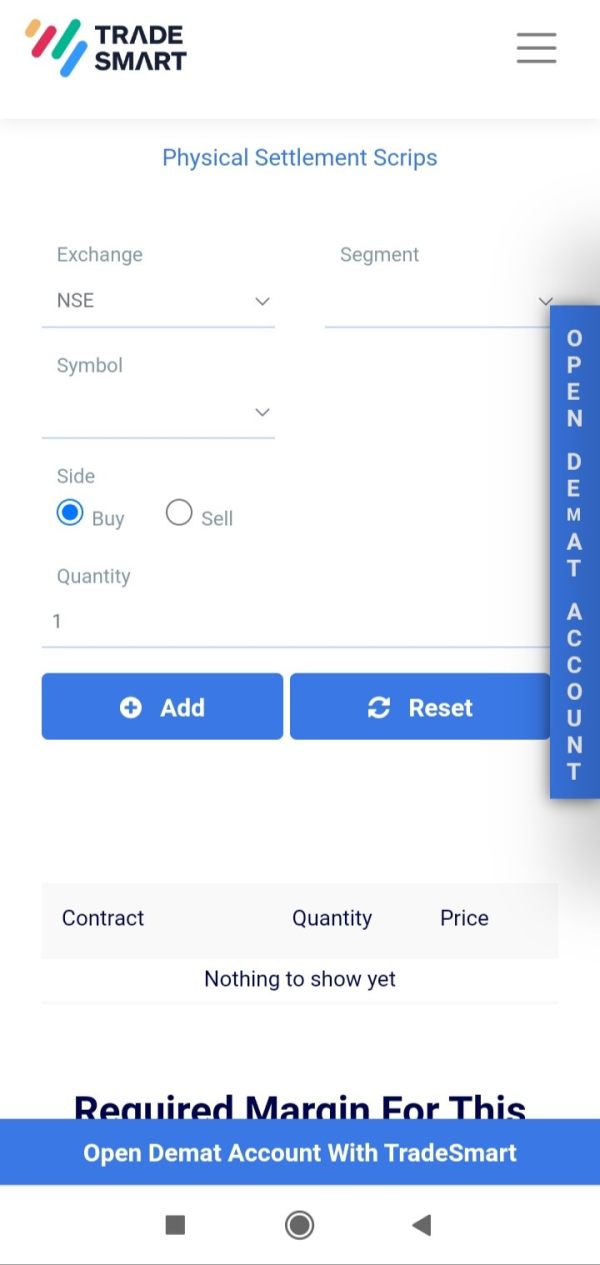

Platform Options: The broker supports Web-based trading platforms and MetaTrader 5. This provides both convenience and advanced functionality for different trader needs.

Geographic Restrictions: Information about restricted countries or regional limitations is not specified in available materials.

Customer Support Languages: Available customer service languages are not detailed in accessible sources.

This Tradesmart review highlights significant information gaps that potential clients should address through direct broker communication.

The evaluation of Tradesmart's account conditions faces substantial limitations due to insufficient information in available sources. Standard account features such as account types, minimum deposit requirements, and special account options remain unspecified. This creates uncertainty for potential clients attempting to assess suitability.

Traders cannot adequately compare Tradesmart's offerings against regulated competitors without detailed account specifications. The absence of clear account tier structures, associated benefits, or qualification criteria represents a significant transparency gap. Professional traders typically require detailed information about account conditions to make informed decisions. Yet this Tradesmart review reveals limited publicly available data.

The lack of information regarding Islamic accounts, VIP services, or institutional account options further complicates assessment for specific trader segments. Additionally, account opening procedures, verification requirements, and documentation processes are not detailed in accessible materials.

Potential clients face elevated uncertainty regarding their trading relationship terms and conditions given the broker's unregulated status combined with limited account condition transparency.

Tradesmart demonstrates strength in its trading instrument diversity. The broker offers access to over 100 tradeable assets across six major categories. This comprehensive selection enables traders to diversify portfolios and implement cross-market strategies effectively. The inclusion of traditional forex pairs alongside emerging cryptocurrency options positions the broker to serve both conservative and speculative trading approaches.

The broker's platform selection features both Web-based solutions and MetaTrader 5. This provides technological flexibility. MetaTrader 5 offers advanced charting capabilities, automated trading support, and comprehensive technical analysis tools, meeting professional trader requirements. The Web platform option ensures accessibility for traders preferring browser-based convenience.

Educational resources for forex trading are mentioned in available sources. However, specific content, format, and comprehensiveness details are not provided. The quality and depth of educational materials significantly impact trader development, yet this aspect requires further investigation.

Critical gaps exist regarding research and analysis resources, market commentary, economic calendars, and trading signals. These analytical tools often differentiate professional brokers from basic service providers. Yet their availability through Tradesmart remains unclear.

Customer service evaluation for Tradesmart encounters significant limitations due to insufficient information in available sources. Essential service metrics including contact channels, response times, service quality assessments, and support availability hours are not detailed in accessible materials.

The broker's London location suggests potential Greenwich Mean Time zone operations. However, specific customer service hours and international support coverage remain unspecified. Multi-language support capabilities, crucial for international broker operations, are not documented in available sources.

Professional traders typically require responsive, knowledgeable support for technical issues, account problems, and trading queries. Potential clients cannot assess Tradesmart's support reliability without established service level agreements or documented response time commitments.

The absence of detailed customer service information, combined with the broker's unregulated status, raises concerns about dispute resolution mechanisms and client protection procedures. Regulated brokers typically provide formal complaint procedures and escalation pathways. Yet such protections may be unavailable through unregulated entities.

Assessment of Tradesmart's trading experience relies heavily on platform capabilities rather than verified performance metrics. The broker's support for MetaTrader 5 provides access to a robust, industry-standard platform known for reliable order execution, advanced charting, and comprehensive trading tools.

MetaTrader 5 offers features including multiple order types, algorithmic trading support, and extensive technical analysis capabilities. These platform strengths potentially contribute to positive trading experiences for users familiar with the MetaTrader ecosystem.

Critical trading experience factors including execution speed, slippage rates, requote frequency, and server stability are not documented in available sources. These performance metrics significantly impact actual trading results. Yet verification requires direct trading experience or third-party testing data.

The Web platform option provides accessibility and convenience. However, specific functionality, reliability, and user interface quality assessments are not available. Mobile trading capabilities, increasingly important for modern traders, are not detailed in accessible materials.

This Tradesmart review emphasizes that trading experience evaluation requires comprehensive performance data currently unavailable for independent verification.

Tradesmart's unregulated status represents the most significant concern in this trust and safety evaluation. Operating without oversight from recognized financial regulatory authorities eliminates standard investor protections. These include segregated client funds, compensation schemes, and formal dispute resolution procedures.

Regulated brokers must comply with strict capital adequacy requirements, client fund segregation rules, and regular financial reporting obligations. These protections are typically unavailable with unregulated entities. This exposes clients to elevated counterparty risks.

The absence of regulatory supervision also means standard compliance measures regarding fair trading practices, conflict of interest management, and client treatment standards may not apply. This regulatory gap creates uncertainty about operational standards and client protection measures.

Fund safety measures, including client money segregation, bank account protections, and insurance coverage, are not detailed in available sources. Client deposits may face elevated risks compared to regulated broker alternatives without these protections.

The broker's London location does not automatically confer regulatory protection. Operating location and regulatory status are distinct considerations. Many unregulated brokers maintain prestigious addresses while lacking actual regulatory oversight.

User experience evaluation for Tradesmart faces limitations due to insufficient feedback data and detailed interface assessments in available sources. The broker's platform selection offers both Web-based and MetaTrader 5 options. This suggests recognition of diverse user preferences and technical requirements.

MetaTrader 5 provides a familiar interface for experienced traders. This potentially reduces learning curves and improves adoption rates. The platform's established user base and comprehensive documentation support positive user experiences for those comfortable with its functionality.

Specific user satisfaction metrics, interface design assessments, and usability evaluations are not available in accessible sources. Registration processes, account verification procedures, and onboarding experiences remain undocumented. This creates uncertainty about initial user interactions.

The target demographic of intermediate to advanced traders suggests Tradesmart focuses on users with existing market knowledge and platform familiarity. This positioning may benefit experienced traders while potentially limiting accessibility for beginners requiring extensive guidance and simplified interfaces.

This evaluation cannot provide definitive conclusions about actual user satisfaction levels or common user concerns without comprehensive user feedback data or detailed experience assessments.

This Tradesmart review reveals a broker offering diverse trading instruments and established platform options while operating without regulatory oversight. The broker's strength lies in its comprehensive asset selection exceeding 100 instruments across six categories. It combines this with MetaTrader 5 and Web platform support.

Significant concerns arise from Tradesmart's unregulated status, which eliminates standard investor protections and creates elevated risks for client funds. The substantial information gaps regarding account conditions, costs, customer service, and operational details further complicate assessment for potential clients.

Tradesmart may suit experienced traders specifically seeking diverse instrument access and comfortable with elevated risks associated with unregulated brokers. Most traders would benefit from considering regulated alternatives offering comparable services with enhanced safety measures and transparent operational standards.

The combination of limited transparency and regulatory absence suggests extreme caution for anyone considering this broker. Regulated competitors likely provide superior protection and accountability for trading activities.

FX Broker Capital Trading Markets Review