Trademax Global Limited Review 1

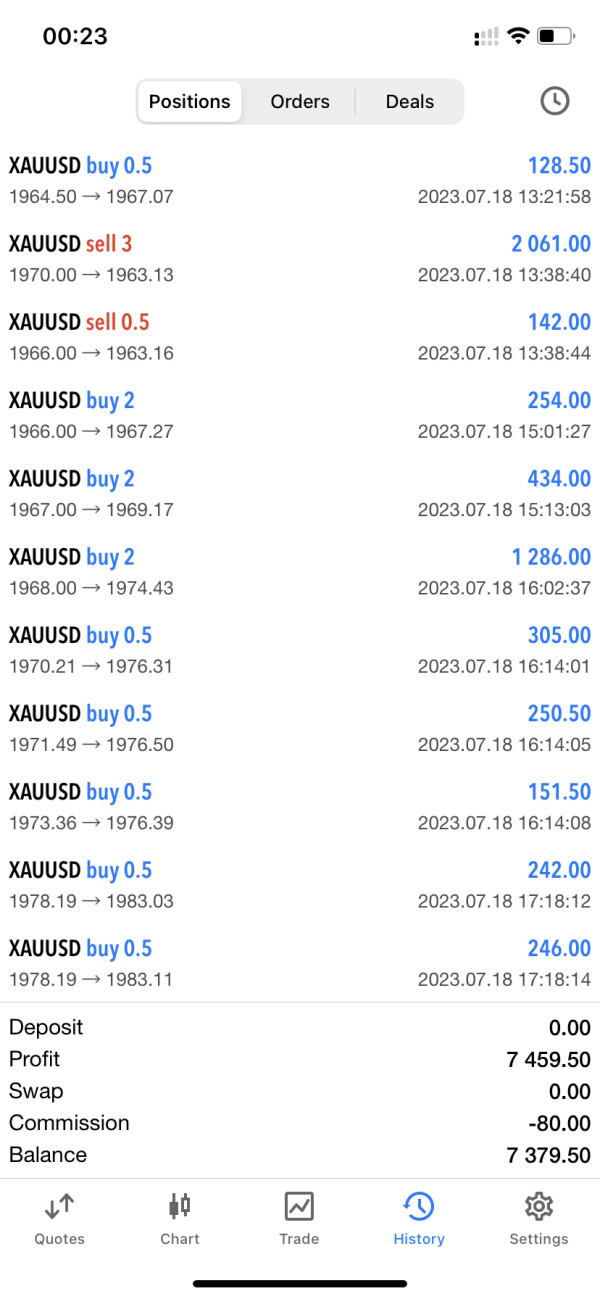

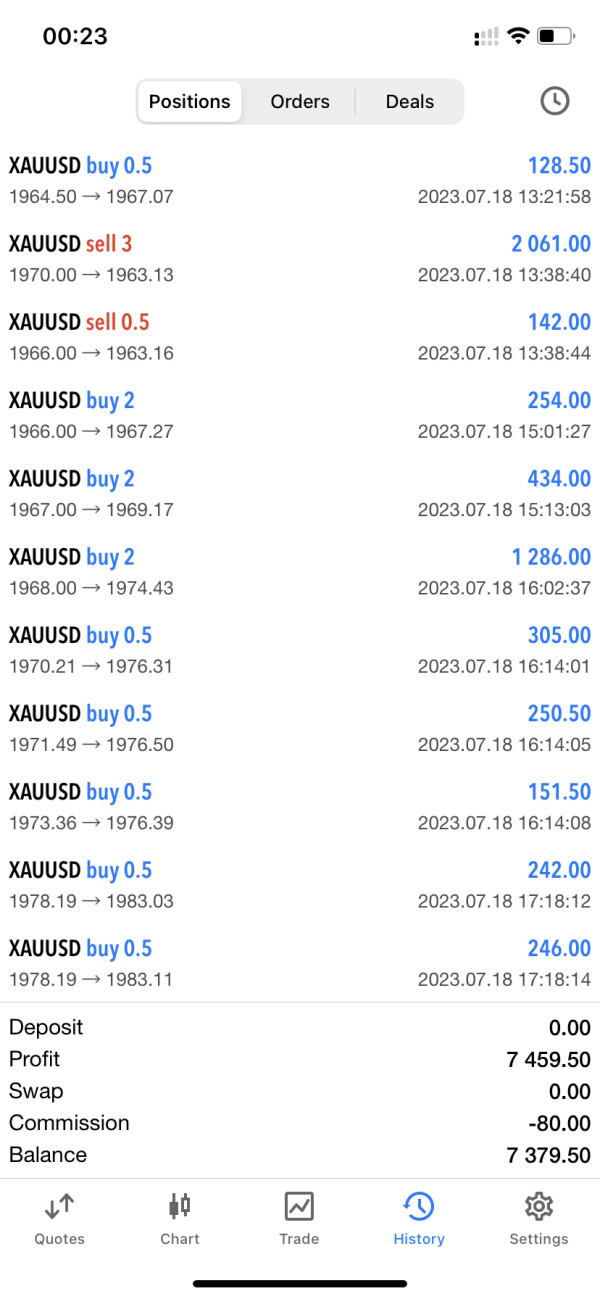

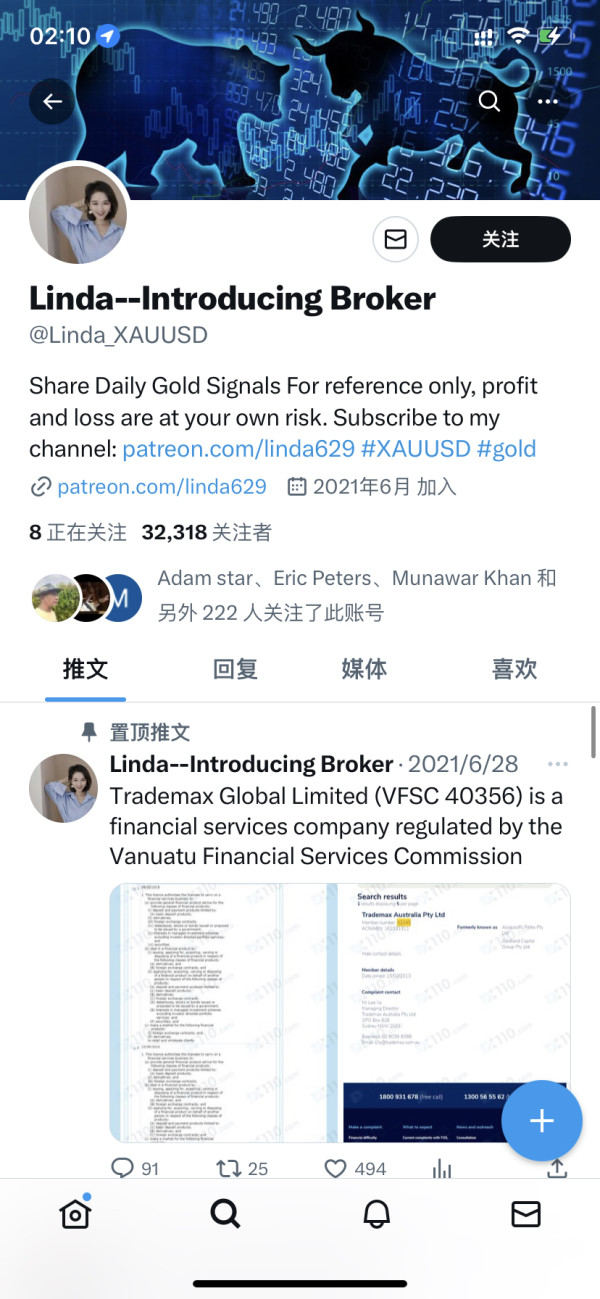

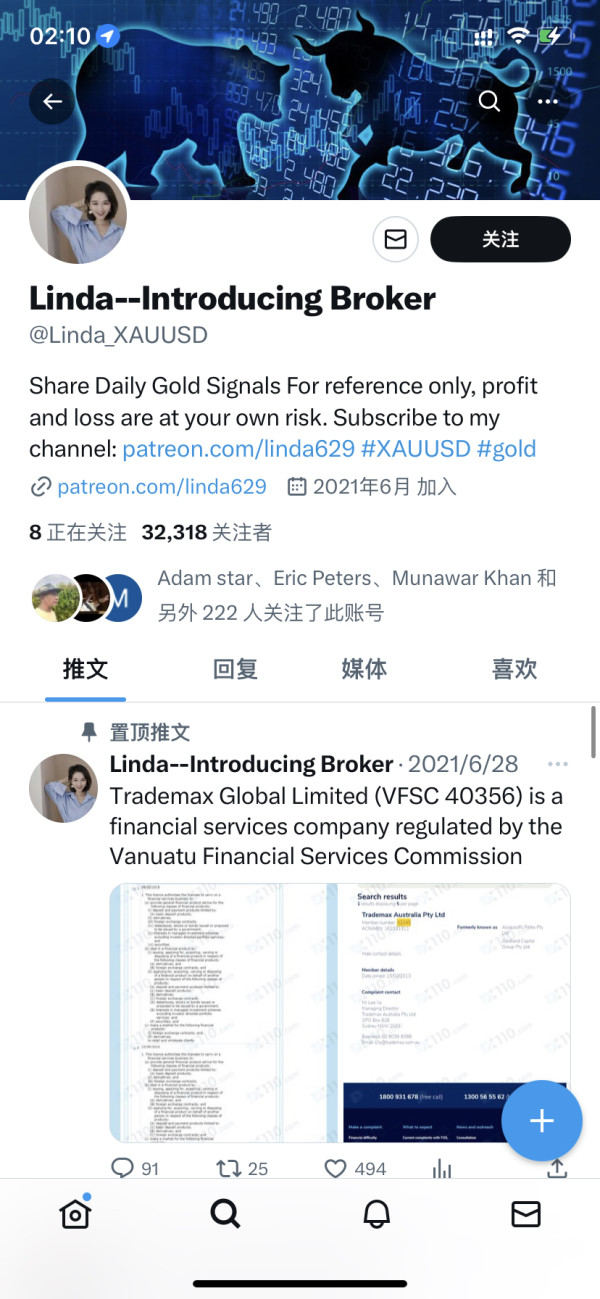

Fake platform, unable to withdraw money, there is a woman named Linda on Twitter who is a liar.

Trademax Global Limited Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

Fake platform, unable to withdraw money, there is a woman named Linda on Twitter who is a liar.

This trademax global limited review looks at a forex and CFD broker from Vanuatu. TradeMax Global Limited works under VFSC rules with license number 40356, and it gives traders high leverage up to 1:1000 plus negative balance protection for better safety.

The broker stands out because it has offices in different countries. The Vanuatu office offers great trading conditions for clients around the world, with compensation plans that include up to 10 million AUD under Professional Indemnity insurance and extra coverage up to EUR 20,000 under The Financial Commission. It supports the IRESS trading platform along with its own software.

TradeMax Global Limited focuses on traders who want high leverage and many different trading tools. The broker offers forex pairs, stock CFDs, and other instruments, making it good for both new and experienced traders who want flexible trading conditions.

TradeMax Global Limited works under Vanuatu Financial Services Commission rules. This is an offshore regulatory setup that may offer different protections than top-tier places like the UK, Australia, or European Union.

The broker has multiple offices in different areas, each following different rules and protection standards. This review uses public information and user feedback from 2025, but individual experiences may be different. Traders should do their own research before opening accounts, and they should check current information directly with the broker since rules and conditions can change.

| Evaluation Criteria | Score | Justification |

|---|---|---|

| Account Conditions | 8/10 | Strong leverage offerings up to 1:1000, negative balance protection, and comprehensive compensation schemes |

| Tools and Resources | 7/10 | IRESS platform integration with proprietary software, multiple asset classes available |

| Customer Service and Support | 6/10 | Mixed user feedback regarding response times and service quality consistency |

| Trading Experience | 8/10 | Stable platform performance with competitive trading conditions |

| Trust and Reliability | 7/10 | VFSC regulation with compensation schemes, though offshore jurisdiction limits maximum trust score |

| User Experience | 8/10 | Generally positive user feedback with intuitive platform design |

TradeMax Global Limited is part of the TMGM trading group. The company has its headquarters in Port Vila, Vanuatu, at Kumul Highway 1276, and it focuses on technology-driven trading solutions.

The broker calls its platform "created by traders for traders." This shows in how they provide easy-to-use but advanced trading tools for clients worldwide, with their business model centered on forex and CFD trading through high-tech systems.

TradeMax Global Limited uses its offshore status to offer higher leverage and flexible conditions that stricter regulators might not allow. The company has multiple offices to serve different markets while following local rules, and it uses the IRESS platform plus its own software to give traders professional tools and real-time market access.

The broker lets people trade forex pairs and stock CFDs. This serves traders with different risk levels and investment plans, and the company's VFSC license number 40356 ensures basic compliance while offering offshore financial services flexibility.

Regulatory Jurisdiction: TradeMax Global Limited operates under Vanuatu Financial Services Commission authorization with registration number 40356. This offshore framework gives operational flexibility while keeping basic compliance standards for international trading.

Deposit and Withdrawal Methods: The available materials did not detail specific deposit and withdrawal methods. The broker likely supports standard payment options common to international forex brokers.

Minimum Deposit Requirements: Available documentation did not specify minimum deposit requirements. This suggests potential variation based on account types and client location.

Bonus and Promotional Offers: Current promotional offerings and bonus structures were not detailed in available materials. This indicates either no such programs or variable promotional terms.

Tradeable Assets: The broker provides access to foreign exchange pairs and stock CFDs. Traders get exposure to major currency pairs and equity markets through derivative instruments.

Cost Structure: Trading costs are commission-based and vary by trading volume. Clients should review spread structures and additional fees carefully, as available materials did not outline specific cost details comprehensively.

Leverage Ratios: TradeMax Global Limited offers maximum leverage up to 1:1000. This is much higher than what tier-1 regulated jurisdictions typically allow, making it attractive for traders seeking better capital efficiency.

Platform Selection: The broker provides access to the IRESS trading platform with proprietary software solutions. This supports various trading strategies and offers professional analytical tools for market analysis and order execution.

This detailed trademax global limited review shows a broker positioned to serve international traders seeking flexible conditions under offshore regulation.

TradeMax Global Limited shows strong performance in account conditions. The broker's main strength is competitive leverage offerings and client protection measures, with leverage up to 1:1000 that is much higher than tier-1 regulated brokers offer.

This high leverage ratio attracts experienced traders seeking maximum capital efficiency. The negative balance protection adds significant value by ensuring traders cannot lose more than their deposited funds even in volatile markets, which is especially important given the high leverage ratios offered.

The broker's compensation scheme represents another strong aspect. With coverage up to 10 million AUD under Professional Indemnity insurance plus additional protection up to EUR 20,000 under The Financial Commission, TradeMax Global Limited provides more comprehensive client protection than many offshore competitors.

However, the lack of detailed information about account types, minimum deposits, and specific features prevents a perfect score. The offshore regulatory status enables favorable trading conditions but also means reduced oversight compared to tier-1 jurisdictions.

This trademax global limited review shows that account conditions represent a significant competitive advantage for traders prioritizing high leverage and client protection.

TradeMax Global Limited offers solid trading tools through IRESS platform integration and proprietary software. The IRESS platform is widely recognized for professional-grade capabilities, providing advanced charting tools, real-time market data, and sophisticated order management systems.

The broker's proprietary software complements the IRESS platform. This potentially offers customized features tailored to TradeMax client needs, and the dual-platform approach lets traders choose the environment that best suits their trading style and technical requirements.

Multiple asset classes including forex pairs and stock CFDs provide diversification opportunities within a single account. This multi-asset approach is valuable for traders seeking cross-market strategies or position hedging across different instrument types.

However, the evaluation is limited by lack of detailed information about educational resources, research materials, and analytical tools. Many modern brokers provide comprehensive market analysis, economic calendars, and educational content to support trader development.

The absence of specific information about these resources suggests either limited offerings or insufficient documentation. Additionally, information about automated trading support, API access, and third-party integration capabilities was not available, which are increasingly important features for sophisticated strategies.

Customer service represents a challenging area for TradeMax Global Limited. Mixed feedback exists regarding service quality and responsiveness, and while the broker provides multiple contact methods, support consistency and quality appear to vary based on available user feedback.

The offshore operational base in Vanuatu may present challenges for customer service delivery. This particularly affects time zone coverage and language support for international clients, and many traders prefer brokers with 24/7 support availability.

Response times appear to be a concern based on available feedback. Some users report delays in receiving assistance for account-related inquiries or technical issues, which is problematic for active traders who require prompt support during trading hours.

The lack of detailed information about available support channels, languages supported, and service level commitments makes comprehensive assessment difficult. Modern traders expect multi-channel support including live chat, email, phone, and potentially social media integration.

However, the broker's compensation schemes and regulatory compliance suggest commitment to client welfare. This may translate to improved service quality over time, though the challenge lies in scaling support operations to match the international client base while maintaining consistent quality standards.

The trading experience with TradeMax Global Limited appears generally positive. The IRESS platform provides a stable and professional trading environment, and the platform's reputation for reliability and advanced features contributes significantly to overall trading experience quality.

Order execution quality appears to meet industry standards. The high leverage ratios enable traders to implement strategies that might not be possible with more restrictive brokers, and negative balance protection adds confidence by allowing calculated risks without fear of catastrophic losses.

Platform stability is crucial for active traders. The IRESS infrastructure generally provides robust performance with minimal downtime, and the integration of proprietary software alongside the main platform offers additional flexibility for traders with specific technical requirements.

Multi-asset trading capability enhances the experience by allowing portfolio diversification within a single account. This is particularly valuable for traders implementing complex strategies across different markets or those seeking to hedge positions using various instrument types.

However, the evaluation is limited by lack of specific information about mobile trading capabilities. These are increasingly important for modern traders who need to monitor and manage positions while away from their primary trading setup.

This trademax global limited review indicates that while the core trading experience is solid, enhanced mobile functionality and additional platform features could improve the overall trader experience.

TradeMax Global Limited's trust and reliability profile is anchored by VFSC regulation under license number 40356. This provides a foundation of regulatory compliance and operational oversight, and while VFSC represents an offshore regulatory environment with less stringent requirements than tier-1 jurisdictions, it still provides basic protections and operational standards.

The broker's comprehensive compensation scheme significantly enhances its reliability profile. The combination of Professional Indemnity insurance coverage up to 10 million AUD plus additional protection under The Financial Commission up to EUR 20,000 demonstrates commitment to client fund protection that exceeds many offshore competitors.

Negative balance protection implementation shows responsible risk management practices. This protects clients from losing more than their deposited funds even in extreme market conditions, which is particularly important given the high leverage ratios offered and demonstrates the broker's commitment to sustainable client relationships.

Client fund segregation, as indicated in the broker's operational structure, provides additional security. This ensures client deposits are kept separate from company operational funds, which is standard practice among reputable brokers and essential for client fund protection.

However, the offshore regulatory status inherently limits the maximum trust score achievable. Traders accustomed to tier-1 regulatory protection may find the VFSC framework less reassuring than FCA, ASIC, or CySEC regulation, and the lack of detailed transparency information regarding company ownership, financial reporting, and operational metrics also constrains the trust assessment.

The overall user experience with TradeMax Global Limited appears positive based on available feedback and platform capabilities. The IRESS platform integration provides a professional and intuitive interface that caters to both novice and experienced traders with comprehensive charting tools and analytical capabilities.

Account registration and verification processes appear streamlined. Specific details about documentation requirements and processing times were not available in the reviewed materials, but the broker's multi-entity structure may provide flexibility in account opening procedures depending on client jurisdiction.

Platform navigation and functionality receive positive feedback. The IRESS interface offers customizable layouts and advanced order management features, and the availability of proprietary software alongside the main platform provides additional options for traders with specific technical preferences.

High leverage ratios and negative balance protection combine to create a user-friendly environment. This serves traders seeking enhanced capital efficiency with appropriate risk management, and this balance between opportunity and protection is particularly appreciated by active traders.

However, some users have reported concerns about customer service responsiveness. This can impact the overall user experience during critical moments, and the lack of detailed information about mobile trading capabilities may limit the experience for traders who require on-the-go account access.

The compensation schemes and fund protection measures contribute positively to user confidence. Traders know their investments have multiple layers of protection beyond standard segregated account requirements.

This comprehensive trademax global limited review reveals a broker that offers competitive trading conditions within the offshore regulatory framework. TradeMax Global Limited successfully combines high leverage ratios up to 1:1000 with robust client protection measures including negative balance protection and comprehensive compensation schemes totaling up to 10 million AUD plus EUR 20,000 coverage.

The broker is most suitable for experienced traders seeking enhanced capital efficiency through high leverage while maintaining appropriate risk management protections. The IRESS platform integration provides professional-grade trading tools, making it appropriate for both individual traders and those implementing sophisticated trading strategies across multiple asset classes.

Key strengths include competitive leverage offerings, comprehensive client protection measures, and stable trading platform infrastructure. Areas for improvement include customer service consistency and enhanced transparency regarding operational procedures and additional platform features, and while the offshore regulatory status enables favorable trading conditions, traders should carefully consider their regulatory preferences and risk tolerance before engaging with the platform.

FX Broker Capital Trading Markets Review