Taya 2025 Review: Everything You Need to Know

Executive Summary

This taya review examines a broker that presents significant challenges for comprehensive evaluation due to limited available information. Based on current research, Taya appears to involve multiple entities across different sectors, including Taya Brokerage Inc, which operates in the real estate sector rather than forex trading. The company shows an authorized operational status and was established in 2007, headquartered in North Bay, Canada, operating as an unfunded entity.

The primary concern for potential forex traders is the lack of transparent trading-specific information typically expected from established forex brokers. While some entities bearing the Taya name exist in various sectors including restaurants and beauty products, concrete details about forex trading services, regulatory compliance, and trading conditions remain unclear. This situation requires careful consideration from traders seeking reliable forex brokerage services.

Our analysis targets traders who prioritize thorough due diligence and prefer brokers with clear operational transparency. Given the information gaps identified, this review serves as a cautionary examination rather than a standard broker evaluation.

Important Notice

Regional Entity Differences: The available information suggests multiple entities operating under the Taya name across different industries and regions. Potential users should verify they are engaging with the correct entity for forex trading services, as confusion may arise from similarly named businesses in unrelated sectors.

Review Methodology: This evaluation is based on limited available information and publicly accessible data. The absence of comprehensive trading-specific details significantly impacts the depth of analysis possible. Readers should seek additional verification before making any trading decisions.

Rating Framework

Broker Overview

Taya Brokerage Inc was established in 2007 and operates from North Bay, Canada. The company maintains authorized status as an unfunded company. However, the primary focus appears to be real estate brokerage rather than forex trading services. The company's background suggests experience in property transactions and real estate market operations, which differs significantly from the specialized requirements of forex brokerage services.

The absence of clear forex trading information raises questions about the entity's actual involvement in currency trading. While the company maintains operational authorization, this appears to relate to real estate activities rather than financial services regulation typically required for forex operations. This distinction is crucial for potential traders seeking legitimate forex brokerage services.

According to available company snapshots, Taya Brokerage Inc operates independently without external funding. This suggests a self-sustained business model. However, the lack of specific trading platform information, asset offerings, or regulatory compliance details typically associated with forex brokers presents significant concerns for potential trading clients.

Regulatory Status: Specific information about forex-related regulatory oversight remains unavailable in current documentation. The authorized status appears to relate to real estate operations rather than financial services regulation.

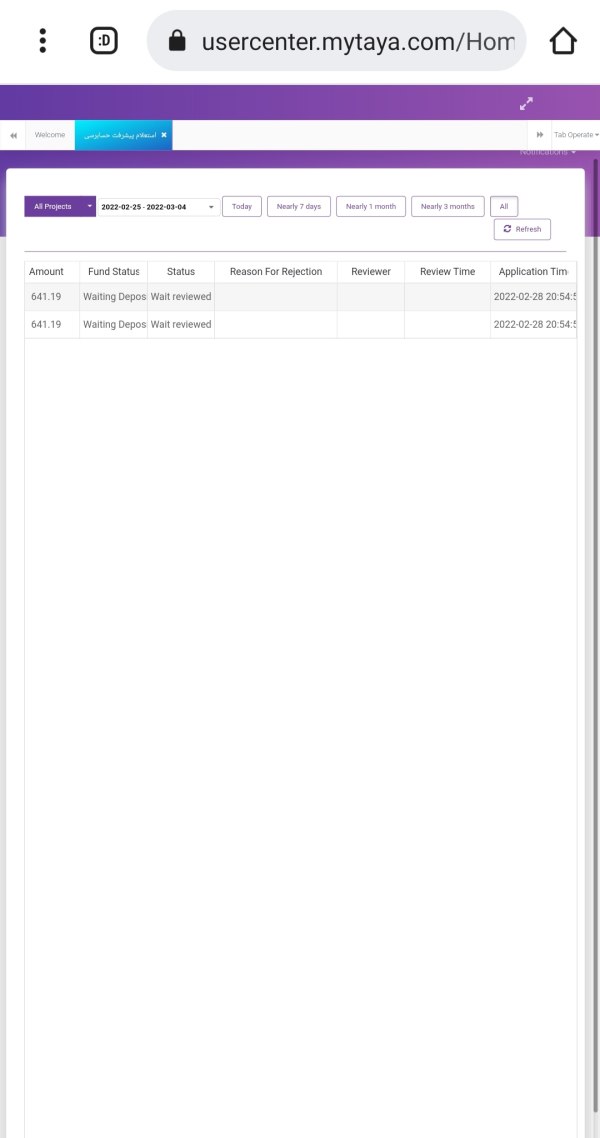

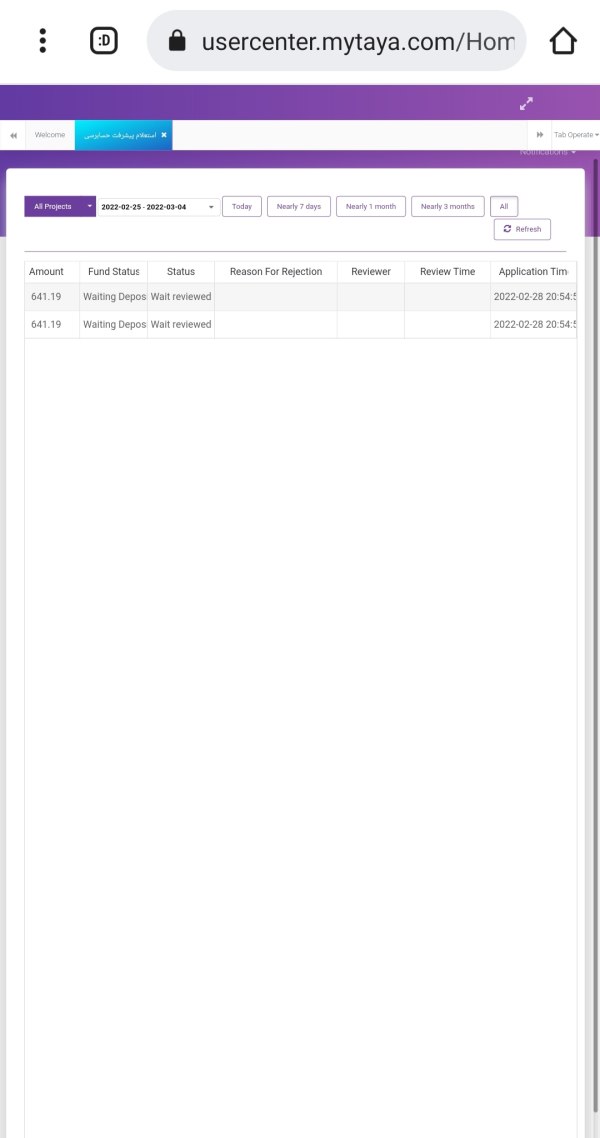

Deposit and Withdrawal Methods: No information regarding payment processing, deposit methods, or withdrawal procedures has been disclosed for trading services.

Minimum Deposit Requirements: Specific minimum deposit amounts for trading accounts are not mentioned in available materials.

Promotional Offers: Details about trading bonuses, promotional campaigns, or special offers are not provided in accessible documentation.

Tradeable Assets: Information about available currency pairs, commodities, indices, or other trading instruments remains undisclosed.

Cost Structure: Specific details regarding spreads, commissions, overnight fees, or other trading costs are not available for evaluation.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in current information sources.

Platform Selection: Trading platform options, software compatibility, and technical specifications are not detailed in available materials.

Geographic Restrictions: Information about regional availability or trading restrictions is not provided in accessible documentation.

Customer Support Languages: Specific language support options for customer service are not mentioned in current materials.

This taya review highlights the significant information gaps that prevent comprehensive evaluation of trading services and conditions.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of account conditions proves challenging due to the absence of specific information about trading account types, features, or requirements. Standard forex broker evaluations typically examine multiple account tiers, each designed for different trader experience levels and capital requirements. However, no such information is available for Taya.

Account opening procedures, verification requirements, and documentation standards remain undisclosed. The lack of information about account minimums, maintenance fees, or special account features significantly hampers potential traders' ability to assess suitability for their needs. Professional traders typically require detailed information about account specifications, including execution types, order management capabilities, and account protection measures.

Without clear account condition details, traders cannot adequately compare offerings against industry standards. The absence of information about Islamic accounts, managed accounts, or institutional services further limits evaluation capabilities. This taya review cannot provide meaningful assessment of account conditions due to insufficient data availability.

Trading tools and educational resources represent critical components of modern forex brokerage services. Professional traders rely on comprehensive analytical tools, market research, and educational materials to enhance trading performance. However, specific information about available tools and resources remains unavailable for evaluation.

Standard industry offerings typically include economic calendars, market analysis, trading signals, and educational webinars. Advanced platforms often provide custom indicators, algorithmic trading support, and institutional-grade research. The absence of such information prevents assessment of the broker's commitment to trader development and success.

Educational resources particularly matter for developing traders who require structured learning materials, market insights, and risk management guidance. Without details about available resources, potential users cannot evaluate the broker's educational support capabilities or commitment to client development.

Customer Service and Support Analysis

Customer service quality significantly impacts trader satisfaction and problem resolution efficiency. Professional forex brokers typically offer multiple communication channels, extended support hours, and multilingual assistance to serve diverse client bases. However, specific information about Taya's customer service infrastructure remains unavailable.

Response times, service quality metrics, and support channel availability are not disclosed in accessible materials. The absence of information about live chat, phone support, email assistance, or help desk capabilities prevents meaningful evaluation of customer service standards. Professional traders require reliable support, particularly during market volatility or technical difficulties.

Support quality often distinguishes professional brokers from less established entities. Without user feedback or service level information, this evaluation cannot assess the broker's commitment to customer satisfaction or problem resolution capabilities.

Trading Experience Analysis

Trading experience encompasses platform stability, execution speed, order management, and overall system reliability. Professional traders require robust platforms capable of handling high-frequency trading, complex order types, and real-time market data processing. However, specific information about trading platform performance remains unavailable.

Platform stability during market volatility, order execution quality, and system uptime statistics are not provided in accessible documentation. Mobile trading capabilities, platform customization options, and advanced trading features cannot be evaluated due to information limitations. Professional traders particularly value low-latency execution and reliable platform performance.

The absence of platform specifications, technical requirements, or performance metrics prevents comprehensive assessment of trading experience quality. This taya review cannot provide meaningful evaluation of trading conditions due to insufficient technical information.

Trust and Reliability Analysis

Trust and regulatory compliance form the foundation of legitimate forex brokerage operations. Professional traders require transparent regulatory oversight, client fund protection, and operational accountability from their chosen brokers. However, specific regulatory information for forex operations remains unclear in available documentation.

While Taya Brokerage Inc maintains authorized status, this appears related to real estate operations rather than financial services regulation. The absence of clear regulatory oversight for forex activities raises significant concerns about operational legitimacy and client protection measures. Professional traders typically verify regulatory compliance before engaging with any broker.

Fund safety measures, segregated account policies, and insurance coverage details are not disclosed in accessible materials. Without transparent regulatory information and client protection details, potential traders cannot adequately assess operational reliability or fund security measures.

User Experience Analysis

User experience evaluation relies heavily on client feedback, platform usability, and overall service satisfaction metrics. Professional brokers typically maintain transparent review systems and actively address client concerns to maintain service quality. However, specific user feedback about trading services remains limited in available sources.

Registration processes, account verification procedures, and onboarding experiences are not detailed in accessible documentation. The absence of user testimonials, satisfaction surveys, or independent reviews prevents comprehensive assessment of client experience quality. Professional traders value peer feedback when selecting brokerage services.

Interface design, navigation efficiency, and user-friendly features cannot be evaluated without platform access or detailed specifications. The lack of user experience information significantly limits this evaluation's ability to assess service quality from the client perspective.

Conclusion

This taya review reveals significant information gaps that prevent comprehensive evaluation of forex trading services. While Taya Brokerage Inc maintains operational authorization and established business history, the focus appears to be real estate rather than forex trading. The absence of trading-specific information, regulatory transparency, and user feedback creates substantial concerns for potential forex traders.

The evaluation suggests that traders seeking reliable forex brokerage services should prioritize brokers with transparent operational details, clear regulatory compliance, and comprehensive service information. The information limitations identified in this review indicate the need for additional research and verification before considering any trading engagement.

Potential users are advised to seek brokers with established forex trading credentials, transparent regulatory oversight, and comprehensive service documentation to ensure adequate client protection and service quality.