Is TAYA safe?

Pros

Cons

Is Taya Safe or Scam?

Introduction

Taya is a forex broker that has garnered attention in the trading community since its establishment in 2006. Operating under Taya Financial Ltd., the broker claims to offer a range of trading services including forex, CFDs, stocks, commodities, and cryptocurrencies. However, the forex market is rife with unregulated brokers, making it essential for traders to exercise caution when selecting a trading partner. In this article, we will thoroughly investigate the legitimacy and safety of Taya, focusing on its regulatory status, company background, trading conditions, and customer experiences. Our assessment will be based on a comprehensive review of available data and user feedback to determine whether Taya is safe or if it poses risks to traders.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial for ensuring the safety of traders' funds and the integrity of trading practices. Taya claims to be regulated by the Central Bank of Canada and the Financial Conduct Authority (FCA) in the UK. However, there are significant concerns regarding the authenticity of these claims.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Central Bank of Canada | M 21965479 | Canada | Unverified |

| FCA | 31000185561216 | UK | Unverified |

The lack of verifiable information raises red flags about Taya's operational legitimacy. Offshore brokers often exploit regulatory loopholes, presenting misleading information about their licenses. Given that Taya operates as an offshore broker, the absence of solid regulatory backing suggests that Taya may not be safe for traders looking to protect their investments.

Company Background Investigation

Taya Financial Ltd. claims to have a multinational presence, with offices in the United States, the United Kingdom, and Singapore. However, the companys transparency regarding its ownership structure and management team is lacking. The absence of publicly accessible information about the CEO and key executives is concerning, as it leaves potential clients in the dark about who is managing their funds.

Moreover, the company's history is relatively short, and its offshore status raises questions about its long-term viability. A broker with a solid reputation typically has a well-documented history and clear ownership details. In the case of Taya, the lack of information significantly undermines its credibility, leading to the conclusion that Taya is not safe for traders seeking a trustworthy partner.

Trading Conditions Analysis

Taya advertises attractive trading conditions, including a low minimum deposit requirement of just $1 and a variety of trading instruments. However, it is essential to scrutinize the overall fee structure and any hidden costs that may affect profitability.

| Fee Type | Taya | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1-2 pips |

| Commission Structure | Not specified | $5 per lot |

| Overnight Interest Range | Not disclosed | Varies |

The lack of transparency regarding spreads and commissions is alarming. Traders typically expect to find clear information about trading costs upfront. The absence of this data may indicate that Taya employs unfavorable trading conditions that could erode profits. Therefore, potential clients should be wary, as Taya may not be safe due to hidden fees that could significantly impact trading outcomes.

Client Fund Safety

Ensuring the security of client funds is paramount for any forex broker. Taya claims to implement various safety measures, but the specifics are vague. The broker's website does not provide detailed information about fund segregation or investor protection policies.

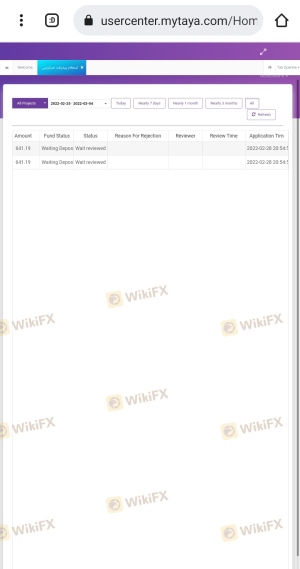

In the event of insolvency, traders need assurance that their funds are protected. Additionally, the absence of a clear negative balance protection policy raises concerns about the potential for clients to lose more than their initial investment. Historical complaints about withdrawal issues further exacerbate worries regarding the safety of funds with Taya. As such, it is reasonable to conclude that Taya is not safe for traders who prioritize the security of their investments.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews for Taya indicate a mixed experience, with several users reporting difficulties in withdrawing funds and a lack of responsive customer support. The common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Service | Medium | Unresolved queries |

| Lack of Transparency | High | Ignored feedback |

For instance, one user reported that their withdrawal request was delayed for several weeks, leading to frustration and distrust. Such complaints are significant red flags, suggesting that Taya is not safe for traders who may require timely access to their funds.

Platform and Trade Execution

The trading platform offered by Taya is based on MetaTrader 4 (MT4), a popular choice among traders for its user-friendly interface and robust features. However, the platform's performance and execution quality are critical factors that determine the overall trading experience.

Users have reported issues related to order execution, including slippage and high rejection rates. These problems can lead to significant losses, especially in volatile market conditions. If traders cannot rely on the platform for accurate execution, their overall trading strategy may be compromised. Thus, the evidence suggests that Taya may not be safe for traders who depend on efficient trade execution.

Risk Assessment

When considering the overall risk of trading with Taya, several factors must be taken into account. The combination of regulatory concerns, lack of transparency, customer complaints, and execution issues contributes to a higher risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unverified claims of regulation |

| Financial Risk | Medium | Potential for fund mismanagement |

| Operational Risk | High | Poor customer service and execution issues |

To mitigate these risks, traders should conduct thorough research, avoid investing large sums initially, and consider using a demo account before committing real funds. Given the current evidence, it is prudent to approach Taya with caution, as Taya is not safe for most traders.

Conclusion and Recommendations

In conclusion, the investigation into Taya reveals several concerning issues that suggest it may not be a safe option for traders. The lack of verifiable regulatory oversight, transparency in operations, and numerous customer complaints raise significant doubts about the broker's legitimacy.

For traders looking for a reliable forex broker, it is advisable to consider alternatives with established regulatory frameworks and positive customer feedback. Brokers such as OANDA, IG, and Forex.com are examples of reputable firms that provide a safer trading environment. Therefore, potential clients should exercise caution and conduct thorough due diligence before proceeding with Taya, as the evidence indicates that Taya is not safe for trading.

Is TAYA a scam, or is it legit?

The latest exposure and evaluation content of TAYA brokers.

TAYA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TAYA latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.