STC Trade, registered in Canada, has been operational since 2019. This platform offers a variety of financial instruments to its clients, primarily focusing on the Asian market. However, concerns have swirled around its legitimacy due to its unverified regulatory standing and reports identifying it as a potential Ponzi scheme. While the platform promotes itself as a legitimate trading broker, its operational transparency remains questionable, warranting scrutiny from all potential investors.

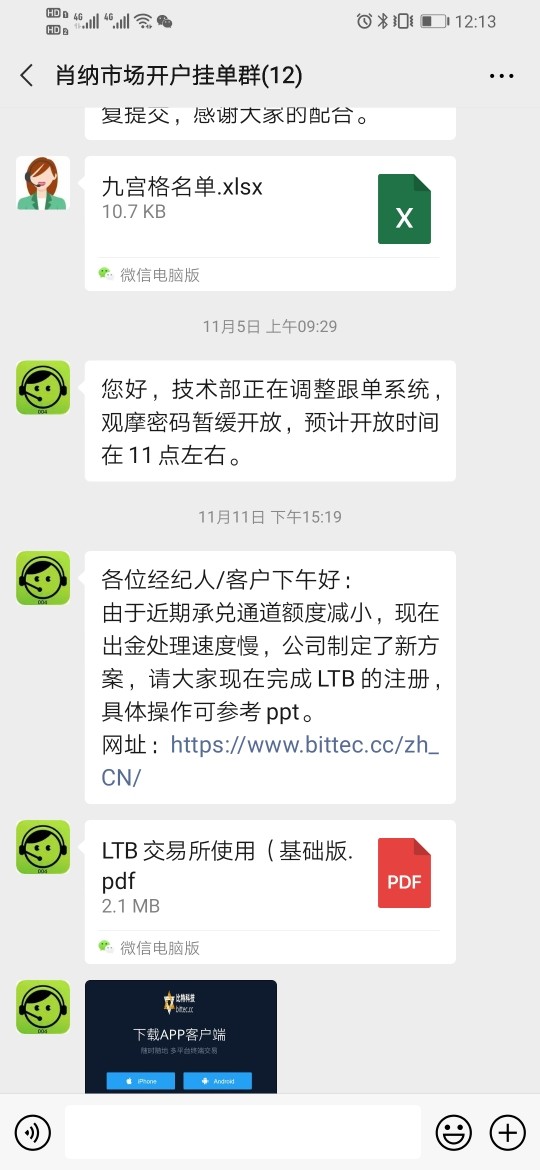

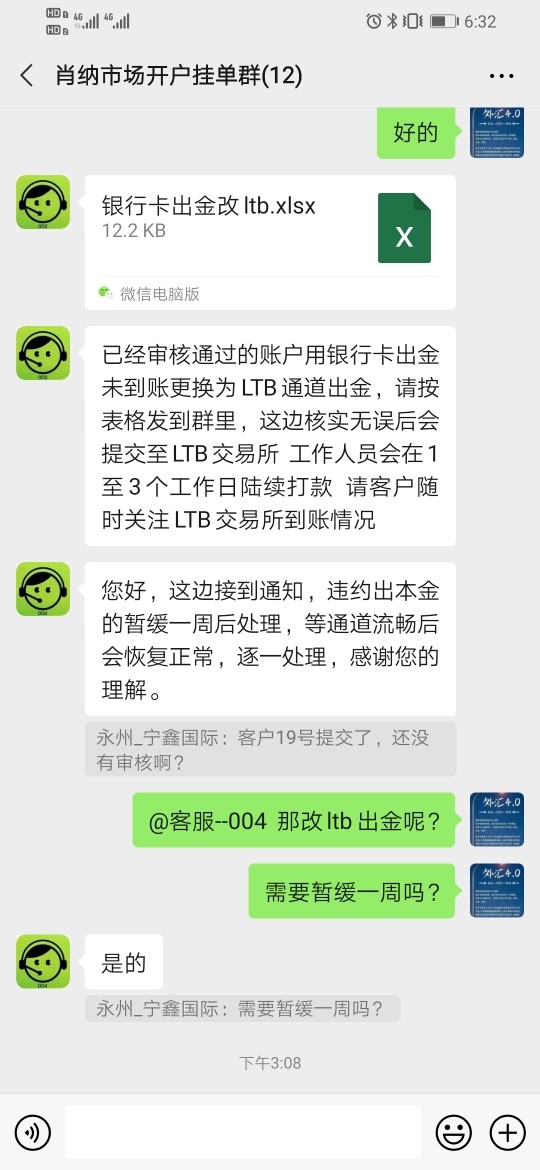

STC Trade claims to provide diversified trading services, including futures and options across various asset classes, but lacks the expected regulatory oversight. According to the available information, the broker lists itself under the jurisdiction of unverified bodies, a primary indicator of potential fraud. Moreover, the brokers British website has been reported as inactive since February 2021, creating further concerns regarding accountability and operational status.

The claims regarding STC Trade's legitimacy are muddied by contradictions in its regulatory information. Reports indicate it has been flagged by multiple entities, including WikiFX, which lists it as a scam broker with all licenses expired. This lack of verified oversight raises concerns for potential investors about the safety of their funds and the risk of engaging with a potentially fraudulent platform.

- Visit the Canadian Securities Administrators website to check for firm registration.

- Search for STC Trade on the NFA's BASIC database to verify regulatory standing.

- Investigate any registered offices or addresses to ensure they match provided information.

- Look at online reviews from reliable sources like WikiFX.

This platform is a Ponzi scheme. Please stay away!" — Anonymous user feedback

This feedback highlights the necessity for self-verification given the grave risks outlined.

Industry Reputation and Summary

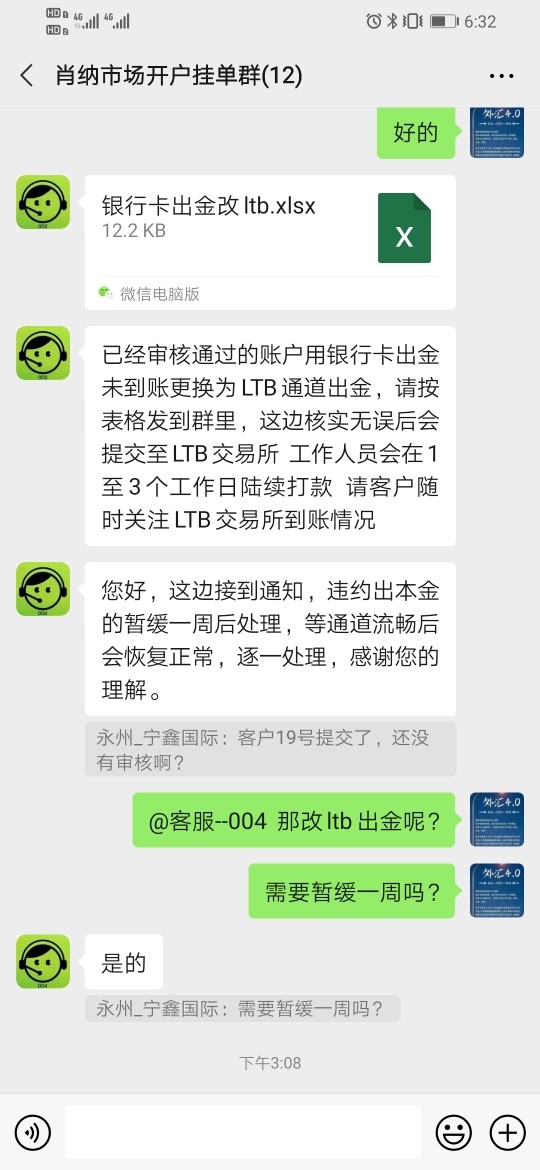

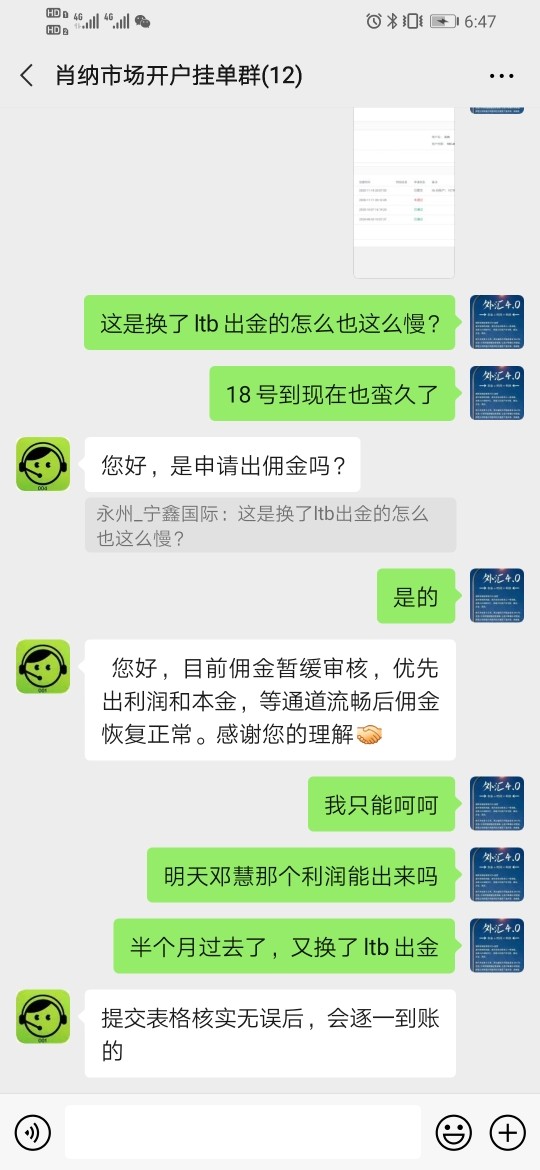

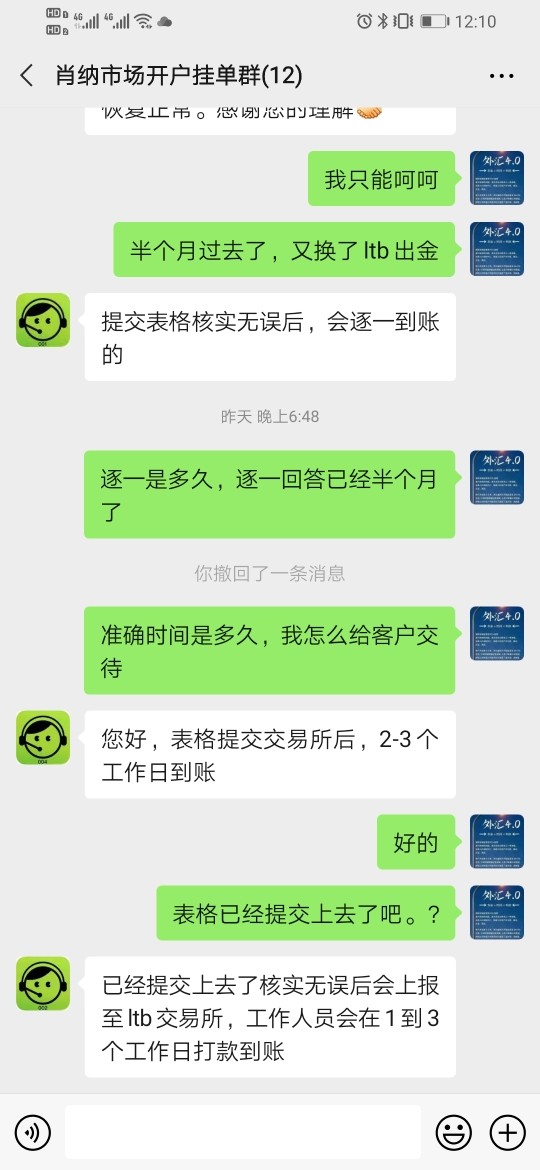

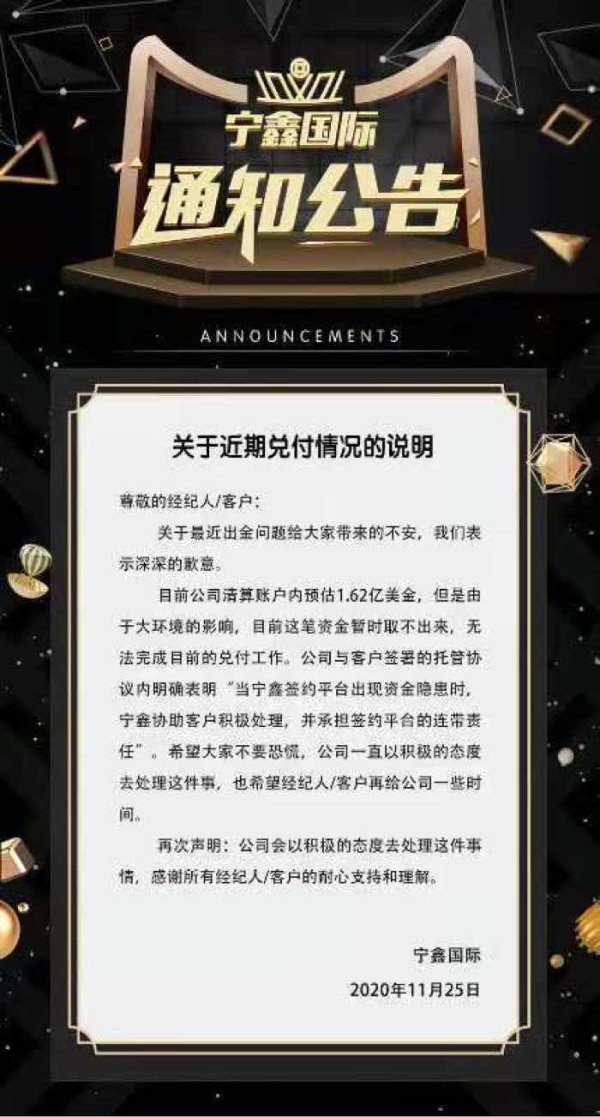

User feedback regarding fund safety is overwhelmingly negative. Individuals have reported issues with fund withdrawals and lack of recourse leading to substantial losses. Such sentiments reinforce the importance of rigorous due diligence for prospective investors.

Trading Costs Analysis

Advantages in Commissions

STC Trade advertises a low-cost commission structure, presumably designed to attract new traders into their platform. Attractive commission rates can be appealing, especially for those new to forex trading.

The "Traps" of Non-Trading Fees

Despite its low commissions, STC Trade levies substantial withdrawal fees that have led to user dissatisfaction. Complaints indicate that these fees can reach as high as $30, discouraging traders from accessing their funds.

“As soon as I tried to withdraw my funds, I faced substantial fees that I was unaware of!” — User complaint

This cost structure is a classic example of hidden charges that can erode profitability for traders, highlighting the need for caution.

Cost Structure Summary

While STC Trades low commission rates may attract cost-sensitive traders, the accompanying risks of non-trading fees and the potential for exploitative practices render it a precarious choice.

STC Trade claims to offer various trading platforms, but the actual availability of user-friendly tools remains limited. Traders have reported a lack of accessibility and options that are typically expected from established brokers.

Many users have noted that the analytical tools offered do not meet industry standards, with limited educational resources available. This can pose a barrier for beginners or traders seeking to refine their strategies.

Users describe their experiences with the platform as frustrating, especially regarding navigation and functionality. Many complaints highlight the challenges in accessing tools that should ideally support trading decisions.

“The platform is not intuitive, and it lacks key features that other brokers provide.” — Trader feedback

User Experience Analysis

Overview of User Experiences

The user experience with STC Trade has frequently been characterized by numerous frustrations, particularly relating to fund withdrawal processes. Customer reviews reflect an overarching sense of dissatisfaction, adding to the broker's negative reputation.

Customer Support Analysis

Evaluating Support Resources

Customer support has been reported as slow and often unhelpful. There are considerable delays in response times, and users frequently express frustration over the lack of meaningful assistance during critical issues.

Overall Assessment

Due to negative patterns in customer service, prospective clients may find STC Trade less appealing, underlining the importance of immediate access to effective support systems when trading.

Account Conditions Analysis

Examination of Conditions

STC Trade's account conditions list high minimum deposits alongside unclear terms. These factors can complicate the decision-making process for traders evaluating where they want to allocate their investment.

Conditions Summary

The complexity surrounding account conditions only serves to amplify the concerns about the brokers overall reliability.

Conclusion

In reviewing STC Trade, it becomes clear that potential investors face a multitude of risks. With its questionable regulatory status, allegations of operating as a Ponzi scheme, and substantial user complaints about withdrawal difficulties and customer support, the platform remains a hazardous territory for traders. Investors are advised to approach STC Trade with extreme caution and conduct rigorous due diligence prior to making any financial commitments.