Silvercrest 2025 Review: Everything You Need to Know

Executive Summary

This silvercrest review examines Silvercrest Asset Management Group. The company is an independent registered investment advisor that provides asset management and family office services to families and select institutional investors. Based in New York with 51-200 employees and 8,034 followers, the firm positions itself as a wealth management specialist rather than a traditional retail forex broker.

The company combines client-focused service reminiscent of traditional private banks with modern portfolio construction theories, risk management, and diversification strategies. Our evaluation reveals a neutral assessment of Silvercrest's overall offering. The firm's Managing Directors average more than 25 years of wealth management experience and have guided clients through various market cycles.

However, specific trading conditions, platform details, and retail forex trading capabilities remain unclear from available information. The company appears best suited for high-net-worth individuals seeking comprehensive wealth management and family office services rather than active retail traders looking for competitive spreads and advanced trading platforms.

Important Notice

This review focuses on Silvercrest Asset Management Group as an investment advisory firm. Readers should note that our evaluation methodology relies on available public information, company disclosures, and third-party assessments.

The firm's regulatory status and specific service offerings may vary by jurisdiction and client type. Given the limited availability of detailed retail trading information, this assessment provides a general overview of the company's wealth management services. Potential clients should conduct their own due diligence and verify all information directly with the firm before making any investment decisions.

Rating Framework

Broker Overview

Silvercrest Asset Management Group operates as an independent registered investment advisor. The firm distinguishes itself from traditional retail forex brokers through its focus on comprehensive wealth management services. The firm was established to serve families and select institutional investors, combining the personalized service approach of traditional private banks with contemporary investment strategies and risk management techniques.

The company's business model centers on providing asset management and family office services. This suggests a high-touch, relationship-driven approach to client service. With a team of Managing Directors who collectively possess more than 25 years of wealth management experience, Silvercrest positions itself as a sophisticated investment advisor capable of navigating both bull and bear market conditions.

The firm's 51-200 employee base indicates a substantial operation with the capacity to serve a significant client roster. This silvercrest review must acknowledge that the firm's structure and service offerings differ significantly from typical retail forex brokers. Rather than focusing on high-frequency trading, tight spreads, or leverage products, Silvercrest appears to prioritize long-term wealth preservation and growth strategies for affluent clients.

This positioning suggests that the firm may not be suitable for retail traders seeking active trading opportunities or competitive transaction costs.

Regulatory Status: Silvercrest Asset Management Group operates as an independent registered investment advisor. Specific regulatory registration numbers and jurisdictional details are not provided in available materials.

Deposit and Withdrawal Methods: Information regarding specific funding methods and procedures is not detailed in available documentation. Specific minimum investment thresholds are not disclosed in publicly available information.

Minimum Deposit Requirements: Specific minimum investment thresholds are not disclosed in publicly available information. No information about promotional offerings or bonus structures is available in current materials.

Promotions and Bonuses: No information about promotional offerings or bonus structures is available in current materials. The firm appears to focus on traditional investment vehicles and portfolio management rather than specific trading instruments, though detailed asset lists are not provided.

Tradeable Assets: The firm appears to focus on traditional investment vehicles and portfolio management rather than specific trading instruments. Detailed asset lists are not provided.

Cost Structure: Specific fee schedules, management costs, and transaction charges are not detailed in available public information. No information about leverage products or margin trading capabilities is available.

Leverage Options: No information about leverage products or margin trading capabilities is available. Details about trading platforms or investment management interfaces are not specified in current materials.

Platform Options: Details about trading platforms or investment management interfaces are not specified in current materials. Service availability and geographic limitations are not clearly defined in available information.

Geographic Restrictions: Service availability and geographic limitations are not clearly defined in available information. Specific language support options are not detailed in current documentation.

Customer Support Languages: Specific language support options are not detailed in current documentation. This silvercrest review highlights the limited availability of detailed operational information typically expected for retail trading services.

Account Conditions Analysis

The account conditions offered by Silvercrest Asset Management Group remain largely unclear due to limited publicly available information. As an independent registered investment advisor focusing on wealth management and family office services, the firm likely operates under different account structures compared to traditional retail forex brokers.

The absence of detailed information about account types, minimum balances, or specific terms and conditions makes it challenging to evaluate the accessibility and suitability of their services for different investor categories. Given the firm's positioning as a wealth management provider for families and select institutional investors, it's reasonable to assume that account requirements may be substantially higher than typical retail trading accounts. The company's focus on high-net-worth clients suggests that minimum investment thresholds could be significant, though specific amounts are not disclosed.

The lack of transparent pricing and account condition information may reflect the firm's preference for personalized consultation and tailored service agreements. The absence of readily available account opening procedures or online application processes further indicates that Silvercrest likely operates through a relationship-based model requiring direct consultation. This silvercrest review notes that potential clients seeking straightforward account opening processes and clearly defined terms may find the lack of transparency challenging when evaluating the firm's services.

Information about specific trading tools and resources offered by Silvercrest Asset Management Group is notably absent from available materials. Unlike traditional retail forex brokers that typically provide detailed descriptions of their trading platforms, analytical tools, and educational resources, Silvercrest's public information focuses primarily on their wealth management philosophy and team experience rather than specific technological offerings.

The firm's emphasis on "state of the art theories of portfolio construction, risk management and diversification" suggests that they employ sophisticated investment analysis and portfolio management tools. However, without detailed information about specific platforms, research capabilities, or client-facing technology, it's difficult to assess the quality and comprehensiveness of their technological infrastructure. The absence of information about educational resources, market analysis tools, or trading platforms indicates that Silvercrest may operate primarily through direct advisor-client relationships rather than self-directed trading interfaces.

This approach aligns with their family office service model but may not satisfy clients seeking independent access to trading tools and market research capabilities. The lack of transparency regarding technological resources represents a significant information gap for potential clients evaluating the firm's capabilities.

Customer Service and Support Analysis

Silvercrest Asset Management Group's approach to customer service appears to center on personalized wealth management relationships rather than traditional broker-client support structures. The firm's emphasis on combining "client-focused service which was the hallmark of private banks and investment counsel firms" suggests a high-touch, relationship-driven service model that prioritizes direct advisor-client interactions over standardized support channels.

The company's team structure, featuring Managing Directors with extensive wealth management experience, indicates that client service likely involves direct access to senior professionals rather than tiered support systems common in retail brokerage firms. This approach may provide more personalized attention but could also result in limited availability and higher service costs compared to traditional retail brokers. However, specific information about customer service channels, response times, availability hours, and support languages is not available in current materials.

The absence of details about online support systems, chat services, or telephone support makes it difficult to evaluate the accessibility and efficiency of their client service operations. This lack of transparency regarding support infrastructure may concern potential clients who value clear communication channels and responsive service capabilities.

Trading Experience Analysis

The trading experience offered by Silvercrest Asset Management Group appears to differ fundamentally from traditional retail forex trading environments. Rather than providing direct access to currency markets through proprietary or third-party trading platforms, the firm seems to focus on managed investment strategies and portfolio construction services that may include currency exposure as part of broader diversification strategies.

The absence of information about trading platforms, execution speeds, order types, or market access suggests that Silvercrest operates primarily as an investment advisor rather than a trading facilitator. This approach may appeal to clients seeking professional portfolio management but would likely disappoint active traders looking for direct market access and competitive execution capabilities. Without detailed information about platform stability, mobile trading options, or real-time market data access, it's challenging to evaluate the firm's technological capabilities for clients who prefer to monitor their investments actively.

The lack of transparency regarding trading infrastructure and execution capabilities represents a significant limitation for this silvercrest review, particularly for readers comparing the firm to traditional retail forex brokers that emphasize trading technology and market access.

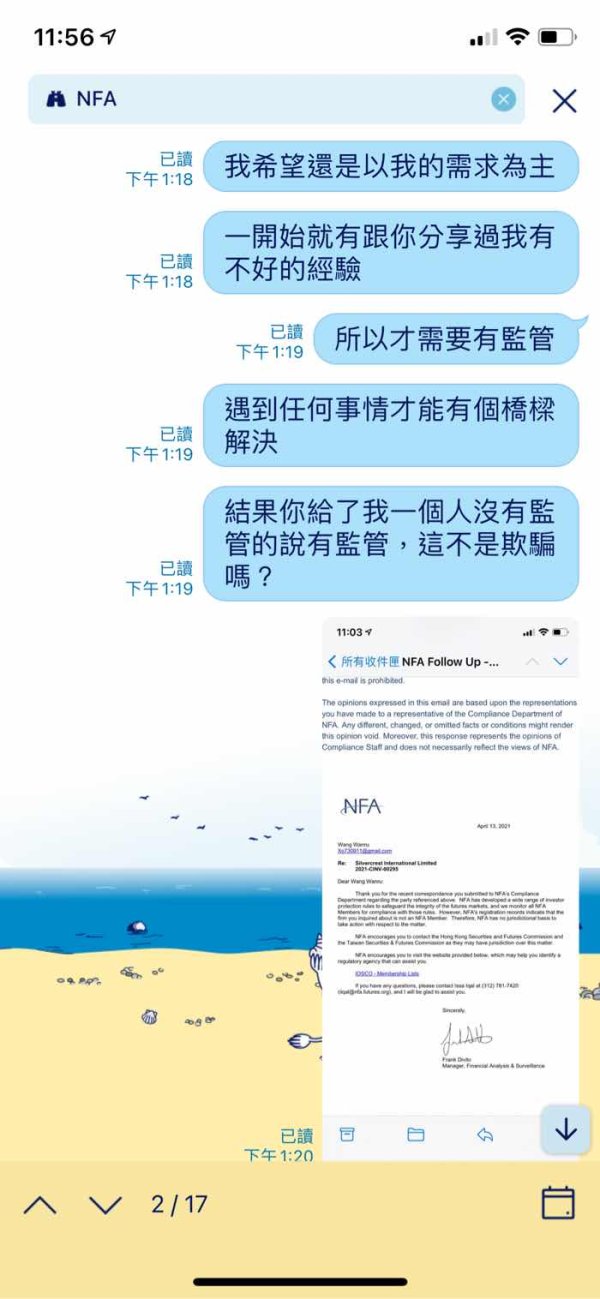

Trust and Reliability Analysis

Silvercrest Asset Management Group's trust profile benefits from its status as an independent registered investment advisor and its team's extensive experience in wealth management. The firm's Managing Directors' average of more than 25 years in the industry provides credibility and suggests a track record of navigating various market conditions.

The company's focus on serving families and institutional investors also indicates a business model built on long-term relationships and trust. However, the evaluation of trust and reliability is limited by the absence of specific regulatory information, such as registration numbers, regulatory history, or compliance records. While the firm identifies itself as a registered investment advisor, the lack of detailed regulatory disclosures makes it difficult to verify their current standing with relevant authorities or assess any historical regulatory issues.

The absence of client testimonials, performance records, or third-party ratings further limits the ability to assess the firm's reliability from a client satisfaction perspective. Additionally, information about asset protection measures, insurance coverage, or segregation of client funds is not available in current materials. These transparency gaps may concern potential clients seeking comprehensive due diligence information before engaging with the firm.

User Experience Analysis

The user experience with Silvercrest Asset Management Group appears to be designed around personalized wealth management relationships rather than self-service digital platforms common among retail brokers. The firm's emphasis on family office services and institutional client relationships suggests an experience focused on direct advisor interaction and customized service delivery rather than standardized online interfaces.

Without information about digital platforms, mobile applications, or online account management systems, it's unclear how clients access their account information, monitor portfolio performance, or communicate with their advisors. This lack of digital transparency may indicate either a preference for traditional communication methods or limited investment in client-facing technology infrastructure. The absence of user feedback, client testimonials, or satisfaction surveys makes it challenging to evaluate the actual client experience with Silvercrest's services.

The firm's relationship-based approach may provide superior personalized service for clients who value direct advisor access, but it may not satisfy clients who prefer digital tools and self-service capabilities. The limited information about user experience represents a significant evaluation challenge for potential clients considering the firm's services.

Conclusion

This silvercrest review reveals a wealth management firm that operates quite differently from traditional retail forex brokers. Silvercrest Asset Management Group's focus on family office services and institutional clients, combined with their team's extensive experience, suggests a reputable firm within the wealth management sector.

However, the significant lack of detailed information about trading conditions, platforms, costs, and client services makes it difficult to provide a comprehensive evaluation for retail trading purposes. The firm appears most suitable for high-net-worth individuals seeking comprehensive wealth management services rather than active traders looking for competitive spreads and advanced trading platforms. Potential clients should expect a relationship-driven approach with personalized service but should also be prepared for potentially higher minimum investments and fees compared to retail brokers.