Is Silvercrest safe?

Business

License

Is Silvercrest Safe or a Scam?

Introduction

Silvercrest is an online forex broker that claims to offer a wide range of trading opportunities across various financial markets. Established as a player in the forex trading environment, it positions itself as a gateway for both novice and experienced traders seeking to capitalize on market fluctuations. However, the world of forex trading is fraught with risks, and traders must exercise caution when evaluating brokers. The potential for scams and fraudulent activities is high, especially with unregulated entities. Thus, it is crucial for traders to conduct thorough due diligence before investing their hard-earned money.

This article aims to provide a comprehensive analysis of Silvercrest by examining its regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and associated risks. The evaluation will draw on various online sources, user reviews, and regulatory databases to ascertain whether Silvercrest is a safe trading option or a potential scam.

Regulation and Legitimacy

One of the most critical aspects of assessing any forex broker is its regulatory status. Regulation serves as a protective measure for traders, ensuring that brokers adhere to specific standards of conduct, maintain transparency, and safeguard client funds. Unfortunately, Silvercrest operates without any recognized regulatory oversight, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Silvercrest is not subject to any oversight from reputable financial authorities. This lack of regulation can lead to a higher risk of fraud, as unregulated brokers often operate with little accountability. Moreover, Silvercrest has made dubious claims about being regulated by various authorities, including the U.S. Financial Services Authority, which does not exist. Such misleading information is a red flag for potential investors.

The quality of regulation is paramount, as it impacts the safety of client funds and the integrity of trading conditions. Historical compliance records indicate that many unregulated brokers engage in unethical practices, such as manipulating trading conditions or refusing withdrawals. Therefore, it is imperative to approach Silvercrest with caution, as its unregulated status suggests it may not be a trustworthy option for traders.

Company Background Investigation

Silvercrest's company history and ownership structure are essential components to consider when evaluating its credibility. However, information about Silvercrest is scarce and often inconsistent. The lack of transparency regarding its ownership and operational history raises questions about its legitimacy.

The management teams background is another critical factor. A robust and experienced management team can enhance a broker's credibility, but Silvercrest does not provide sufficient information about its leadership. This lack of information can lead to concerns about the broker's operational integrity and commitment to client welfare.

Furthermore, the level of information disclosure is a significant concern. A legitimate broker typically provides comprehensive details about its operations, including its physical address, contact information, and details about its regulatory compliance. However, Silvercrest's website lacks these essential details, which is often characteristic of fraudulent brokers.

In conclusion, the limited information available about Silvercrest's company background, coupled with its lack of transparency, raises serious concerns about its safety. Therefore, traders should be wary of engaging with this broker, as the absence of credible information may indicate a lack of legitimacy.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions it offers is crucial. Silvercrest presents itself as a competitive platform, but the details surrounding its fee structure and trading conditions are questionable.

Silvercrest has set a minimum deposit requirement of $1,000, which is significantly higher than the industry average. Most reputable brokers allow new traders to open accounts with deposits as low as $10 to $250. This high entry barrier raises suspicion, as it may deter novice traders while simultaneously appealing to those who may not be fully aware of the risks involved.

| Fee Type | Silvercrest | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.9 pips | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies (typically $5-10 per lot) |

| Overnight Interest Range | N/A | Varies (typically 3% - 5%) |

The spread offered by Silvercrest is also notably higher than the industry average. A spread of 1.9 pips for major currency pairs is not competitive and could significantly impact trading profitability. Additionally, the absence of a clear commission structure raises concerns about hidden fees and costs that may be applied during trading.

Moreover, the lack of leverage options is another point of concern. Many reputable brokers offer leverage to enhance trading potential, while Silvercrest appears to limit this feature, which may not align with the expectations of experienced traders. Overall, the trading conditions at Silvercrest do not inspire confidence, and potential clients should carefully consider these factors before proceeding.

Customer Funds Safety

The safety of customer funds is paramount when selecting a forex broker. Silvercrest's approach to fund security is concerning, given its unregulated status. The broker does not provide clear information regarding client fund segregation, investor protection measures, or negative balance protection policies.

In regulated environments, brokers are typically required to keep client funds in segregated accounts, separate from their operational funds. This practice ensures that client money remains safe even in the event of broker insolvency. However, Silvercrest's lack of regulatory oversight means it is not bound by such requirements, leaving client funds vulnerable.

Furthermore, the absence of investor protection schemes is another significant risk. In many jurisdictions, regulated brokers participate in compensation schemes that protect clients in case of broker failure. Silvercrest's unregulated status means that no such protection exists for its clients, which is a considerable risk factor.

In summary, the lack of transparency surrounding Silvercrest's fund safety measures raises red flags. Potential traders should be acutely aware of these risks, as investing with an unregulated broker can lead to substantial financial losses without any recourse for recovery.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding a broker's reliability. Reviews and testimonials can provide insight into the experiences of other traders with Silvercrest. Unfortunately, the feedback surrounding Silvercrest is predominantly negative, with numerous complaints regarding withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Misleading Information | High | Ignored |

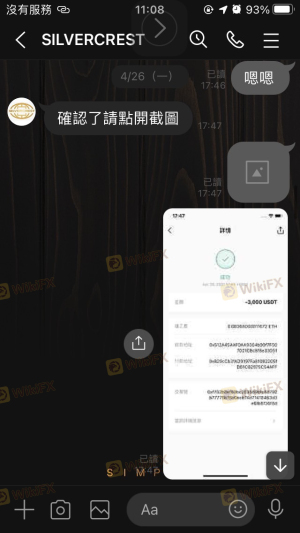

Common complaints include difficulties in withdrawing funds, with many users reporting that their requests were either denied or delayed without clear explanations. Additionally, the quality of customer support has been criticized, as many clients have experienced slow response times and unhelpful assistance when seeking resolutions to their issues.

Several users have reported feeling misled by the broker's promotional materials, which often promise high returns and exceptional trading conditions that do not materialize. These recurring issues suggest a pattern of behavior that is typical of scam brokers, where the focus is on acquiring deposits rather than providing quality service.

In conclusion, the negative customer experiences associated with Silvercrest further reinforce the notion that it may not be a safe trading option. Traders should consider the potential risks involved and seek alternative brokers with a proven track record of positive customer feedback.

Platform and Trade Execution

The trading platform provided by a broker plays a crucial role in the overall trading experience. Silvercrest claims to offer a web-based trading platform, but user reviews indicate that it falls short of industry standards.

Many traders have reported issues with platform stability, including frequent downtime and slow execution speeds. These factors can severely impact trading performance, especially in a fast-paced market like forex. Additionally, the platform reportedly lacks essential features such as advanced charting tools and automated trading options, which are standard in many reputable trading platforms.

Concerns about order execution quality have also been raised. Users have reported instances of slippage and order rejections, which can lead to unexpected losses. Such issues are often indicative of a broker manipulating trades to their advantage, further emphasizing the need for caution when considering Silvercrest as a trading partner.

Overall, the platform's performance and execution quality appear to be inadequate, raising further doubts about the broker's reliability. Traders should be wary of engaging with Silvercrest, as the platform's shortcomings could lead to significant challenges in executing trades effectively.

Risk Assessment

Engaging with any forex broker carries inherent risks, and Silvercrest is no exception. The combination of its unregulated status, poor customer feedback, and questionable trading conditions presents a high-risk environment for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing fraud risk. |

| Withdrawal Risk | High | Numerous complaints about withdrawal difficulties. |

| Platform Risk | Medium | Inadequate platform features and execution issues. |

| Transparency Risk | High | Lack of clear information about company operations. |

To mitigate these risks, potential traders should consider several strategies. First, it is advisable to conduct thorough research on any broker before investing. Look for regulatory licenses, read customer reviews, and assess the broker's overall reputation in the trading community. Additionally, starting with a small investment can help limit exposure to potential losses while testing the broker's services.

In summary, the risks associated with trading through Silvercrest are significant, and potential clients should approach this broker with extreme caution.

Conclusion and Recommendations

In conclusion, the evidence gathered throughout this analysis indicates that Silvercrest is not a safe trading option. The broker's unregulated status, lack of transparency, poor customer feedback, and inadequate trading conditions all point to a high likelihood of fraudulent activity. Traders should be particularly wary of the high minimum deposit requirement, the numerous complaints regarding withdrawal issues, and the inadequate platform performance.

For those seeking reliable forex trading options, it is recommended to consider established and regulated brokers with a solid track record of customer satisfaction. Some reputable alternatives include brokers regulated by well-known authorities such as the FCA, ASIC, or CySEC, which offer better protection for traders' funds and more favorable trading conditions.

Ultimately, the key takeaway is that due diligence is essential in the forex trading landscape. The risks associated with unregulated brokers like Silvercrest far outweigh any potential benefits, making it imperative for traders to seek safer avenues for their trading endeavors.

Is Silvercrest a scam, or is it legit?

The latest exposure and evaluation content of Silvercrest brokers.

Silvercrest Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Silvercrest latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.