ROC Bank 2025 Review: Everything You Need to Know

Executive Summary

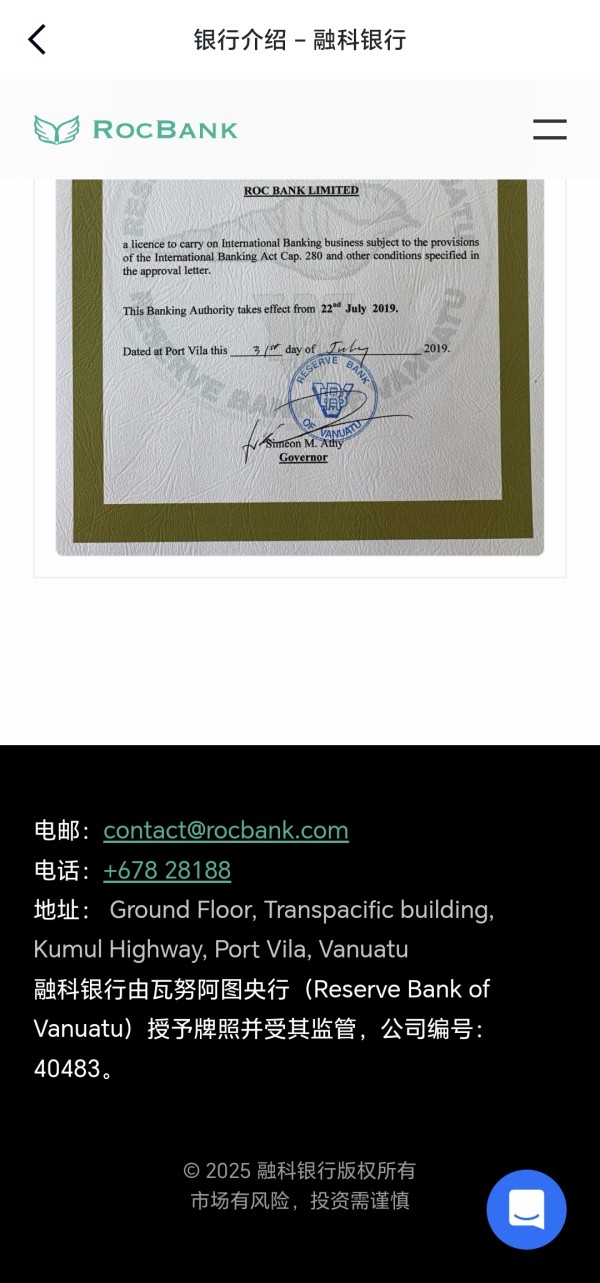

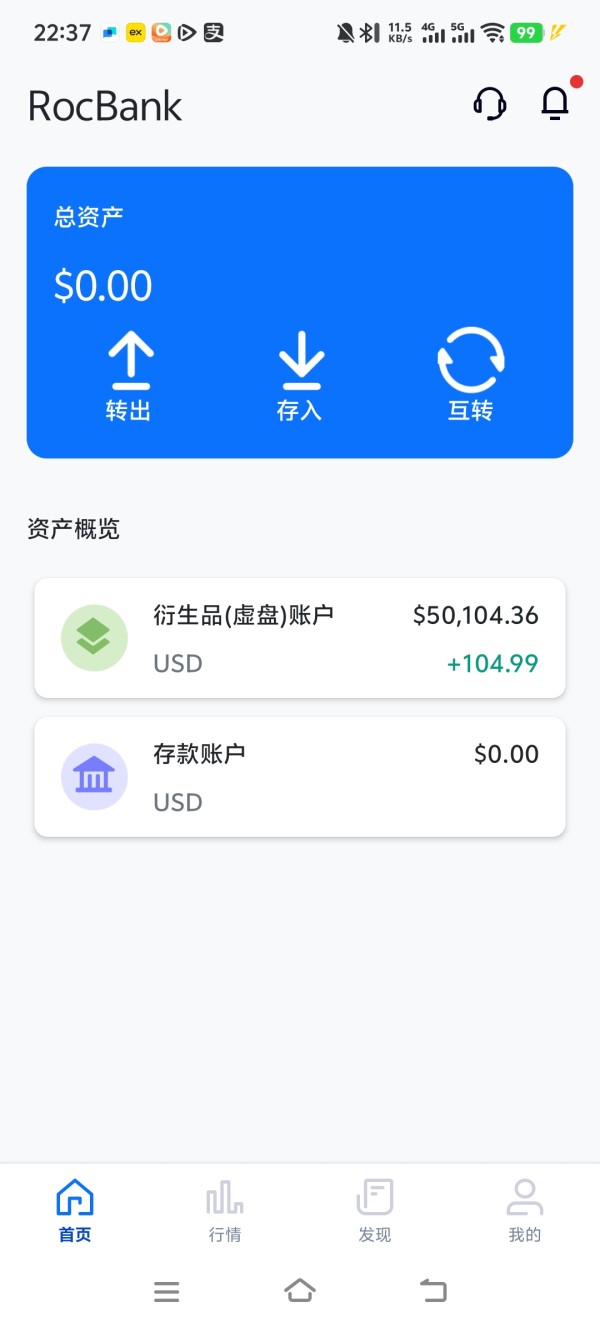

ROC Bank is a specialized financial institution registered in Vanuatu. It focuses primarily on small and medium enterprise solutions across the Asia-Pacific region. This roc bank review reveals a banking service provider that has gained recognition in the competitive financial services landscape, particularly for its targeted approach to SME banking needs.

The institution has achieved notable industry recognition. It was awarded "Best International SME Banking Solution in Asia-Pacific" by Wealth & Finance Magazine. This award suggests a level of professional competency and market acknowledgment within its specialized niche. ROC Bank positions itself as a comprehensive financial services provider, offering both personal and corporate banking solutions alongside investment services.

The primary user base consists of small and medium enterprises seeking international banking solutions. It also serves individual clients requiring modern digital banking services. The platform operates under the name "Roc Bank Trading" and provides mobile applications available on both Google Play and Apple App Store. This indicates a commitment to digital accessibility and modern banking convenience.

However, this review must note certain limitations in available information regarding regulatory oversight, detailed fee structures, and comprehensive service specifications. Potential clients should consider these factors when evaluating this banking option.

Important Notice

This roc bank review is based on publicly available information and should be considered alongside individual due diligence. ROC Bank operates as an international bank registered in Vanuatu. Potential clients should carefully consider the implications of cross-border banking relationships, including applicable tax obligations, regulatory protections, and legal frameworks that may differ from their home jurisdiction.

The evaluation methodology employed in this review relies on accessible documentation and public information sources. Some detailed operational aspects may not be fully represented due to information availability constraints. Prospective clients are encouraged to conduct direct inquiries with ROC Bank for comprehensive details regarding services, fees, and regulatory compliance specific to their individual circumstances.

Rating Framework

Broker Overview

ROC Bank operates as an international banking institution with registration in Vanuatu. It specializes in comprehensive financial services for both individual and corporate clients. While the exact establishment date is not specified in available documentation, the institution has developed a focused business model centered on small and medium enterprise solutions throughout the Asia-Pacific region. The bank's strategic positioning emphasizes modern digital banking capabilities combined with traditional financial services, creating a hybrid approach to contemporary banking needs.

The institution's business model revolves around providing specialized banking and investment services. It places particular emphasis on SME solutions that have earned industry recognition. ROC Bank's approach suggests an understanding of the unique challenges faced by smaller businesses in accessing international banking services. It positions itself as a bridge between traditional banking limitations and modern business requirements.

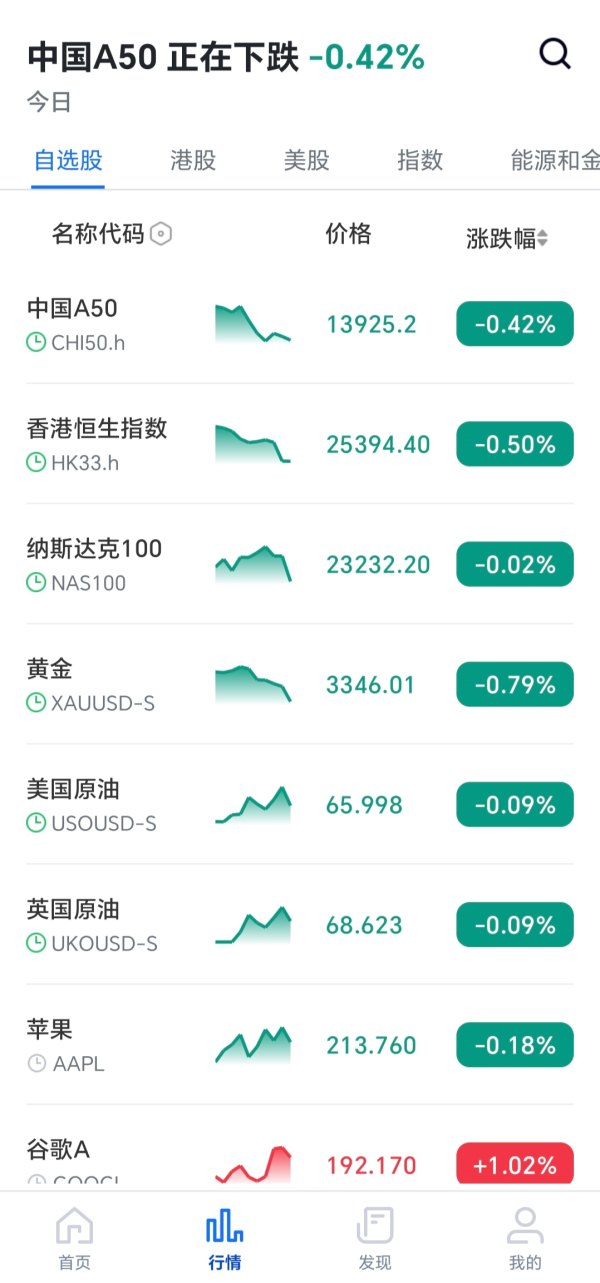

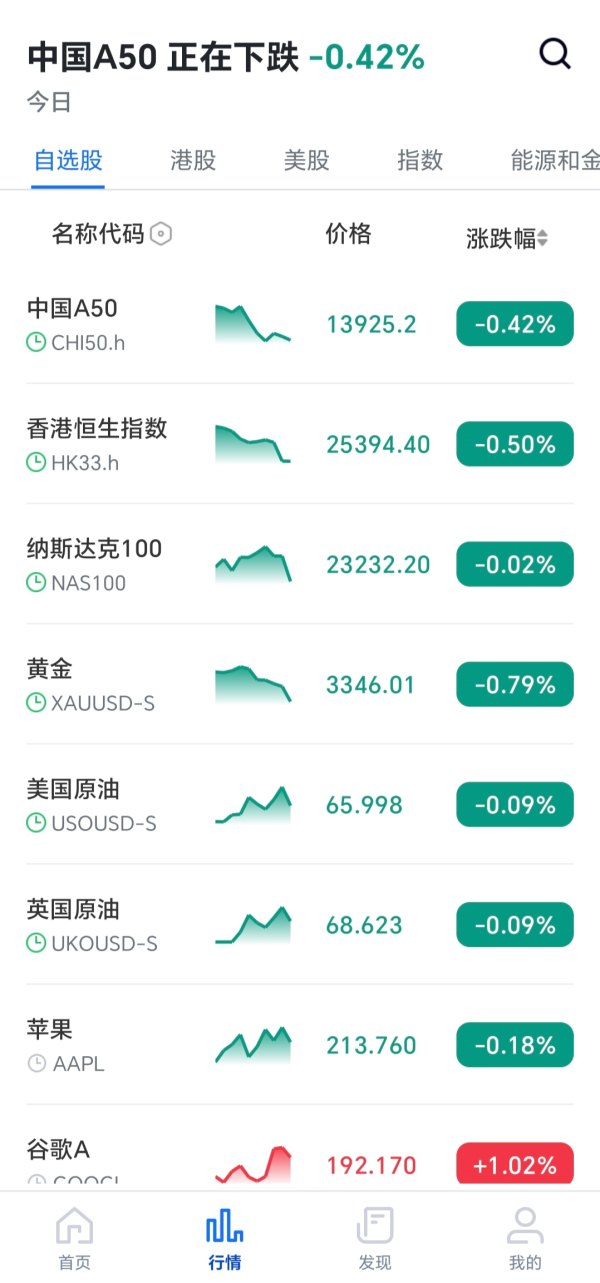

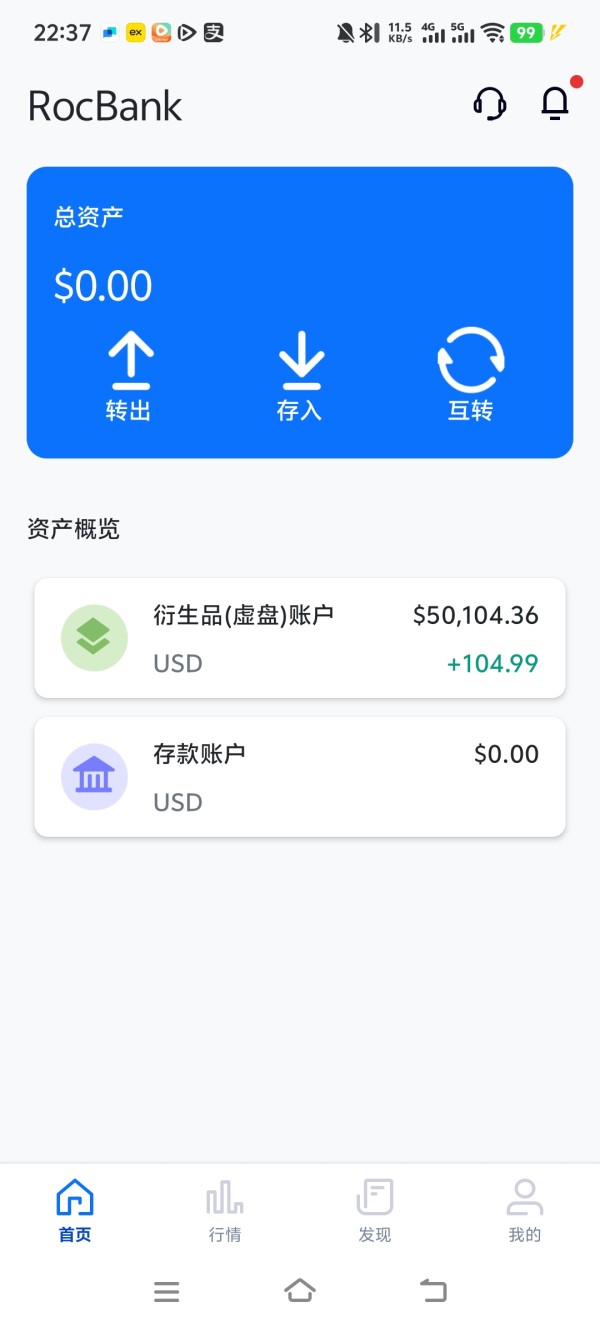

The trading platform operates under the "Roc Bank Trading" designation. It offers clients access to banking and investment services through digital channels. The availability of mobile applications on major platforms indicates a commitment to accessibility and modern user expectations. The asset coverage includes comprehensive financial services spanning both banking operations and investment opportunities, though specific details regarding tradeable instruments and investment products require direct inquiry for complete understanding. Regulatory oversight information is not detailed in current available sources. This represents an area where potential clients should seek clarification directly from the institution.

Regulatory Jurisdiction: Current available information does not specify detailed regulatory oversight mechanisms or specific licensing authorities governing ROC Bank's operations in Vanuatu or other jurisdictions.

Deposit and Withdrawal Methods: Specific information regarding supported payment methods, processing times, and associated fees for deposits and withdrawals is not detailed in accessible sources.

Minimum Deposit Requirements: Minimum account opening deposits and ongoing balance requirements are not specified in current documentation and would require direct inquiry.

Bonus and Promotional Offers: Information regarding welcome bonuses, promotional campaigns, or loyalty programs is not available in reviewed materials.

Tradeable Assets: While the platform offers banking and investment services, specific details regarding available investment instruments, currency pairs, or other tradeable assets are not comprehensively documented.

Fee Structure: Detailed information regarding trading fees, account maintenance charges, transaction costs, and other applicable fees is not available in current sources. This represents a significant information gap for potential clients.

Leverage Options: Leverage ratios and margin requirements are not specified in available documentation.

Platform Alternatives: Information regarding additional trading platforms or software options beyond the primary "Roc Bank Trading" platform is not detailed.

Geographic Restrictions: Specific information regarding service availability limitations by country or region is not documented in current sources.

Customer Support Languages: Available customer service languages and communication channels are not specified in reviewed materials.

This roc bank review identifies significant information gaps. Potential clients should address these through direct communication with the institution.

Detailed Rating Analysis

Account Conditions Analysis

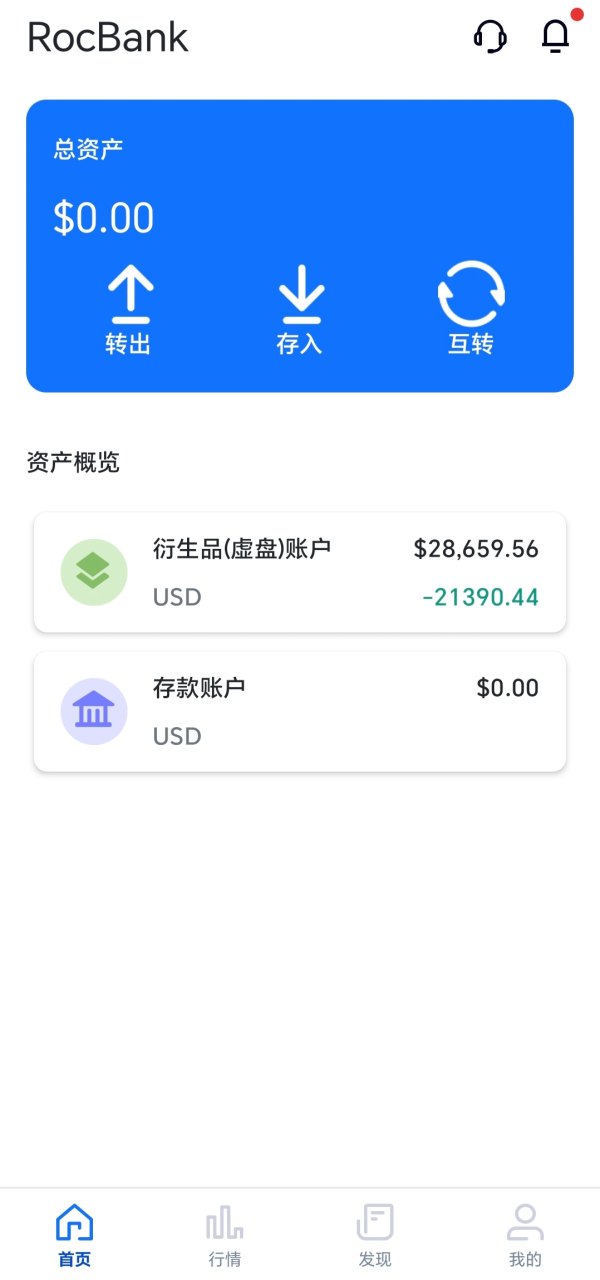

The evaluation of ROC Bank's account conditions faces significant limitations due to insufficient publicly available information regarding specific account types, requirements, and features. Traditional banking institutions typically offer various account categories including personal current accounts, savings accounts, business accounts, and specialized SME solutions. However, specific details regarding ROC Bank's account structure are not documented in accessible sources.

Minimum deposit requirements, which are crucial factors for potential clients, remain unspecified in current documentation. This information gap extends to account maintenance fees, transaction limits, and special features that might distinguish different account tiers. The absence of clear information regarding account opening procedures, required documentation, and verification processes presents challenges for prospective clients seeking to understand the practical aspects of establishing a banking relationship.

The institution's focus on SME solutions suggests the availability of specialized business account features. These potentially include multi-currency capabilities, enhanced transaction limits, and tailored business banking tools. However, without specific documentation, these assumptions cannot be confirmed. The lack of information regarding Islamic banking options or other specialized account types further limits the comprehensive evaluation of account conditions.

This roc bank review must note that the absence of detailed account condition information represents a significant limitation. Potential clients require clear understanding of terms, fees, and requirements before committing to a banking relationship.

The assessment of ROC Bank's tools and resources encounters substantial information limitations. Specific details regarding trading tools, analytical resources, and educational materials are not documented in available sources. Modern banking institutions typically provide clients with comprehensive digital tools including market analysis, portfolio management systems, research reports, and educational resources to support informed decision-making.

The existence of mobile applications on Google Play and Apple App Store suggests some level of digital tool availability. This indicates that ROC Bank recognizes the importance of mobile accessibility in contemporary banking. However, the specific functionality, features, and capabilities of these applications are not detailed in current documentation. This limits the ability to evaluate tool quality and comprehensiveness.

Research and analysis resources, which are essential components of investment-oriented banking services, are not specified in available information. This includes market research reports, economic analysis, technical analysis tools, and fundamental research capabilities that clients might expect from a full-service banking and investment platform.

Educational resources, including webinars, tutorials, market guides, and investment education materials, are not documented in accessible sources. The absence of information regarding automated trading support, API access, or advanced trading tools further limits the evaluation of the institution's technological capabilities and resource offerings.

Customer Service and Support Analysis

The evaluation of ROC Bank's customer service and support infrastructure faces significant challenges due to the absence of detailed information in available sources. Effective customer support is fundamental to banking relationships, particularly for international banking services where clients may require assistance across different time zones and in various languages.

Available communication channels, including phone support, email assistance, live chat capabilities, and in-person service options, are not specified in current documentation. The lack of information regarding customer service availability hours, response time commitments, and service level agreements presents difficulties in assessing the institution's commitment to client support.

Multi-language support capabilities, which are particularly important for an Asia-Pacific focused institution serving diverse markets, are not documented in accessible sources. The absence of information regarding specialized support for business clients, technical assistance for digital platforms, and escalation procedures for complex issues further limits the comprehensive evaluation of customer service quality.

Response time expectations for different inquiry types, problem resolution processes, and customer satisfaction metrics are not available in current sources. The lack of documented customer feedback regarding service quality, support effectiveness, and overall satisfaction levels restricts the ability to provide evidence-based assessment of customer service performance.

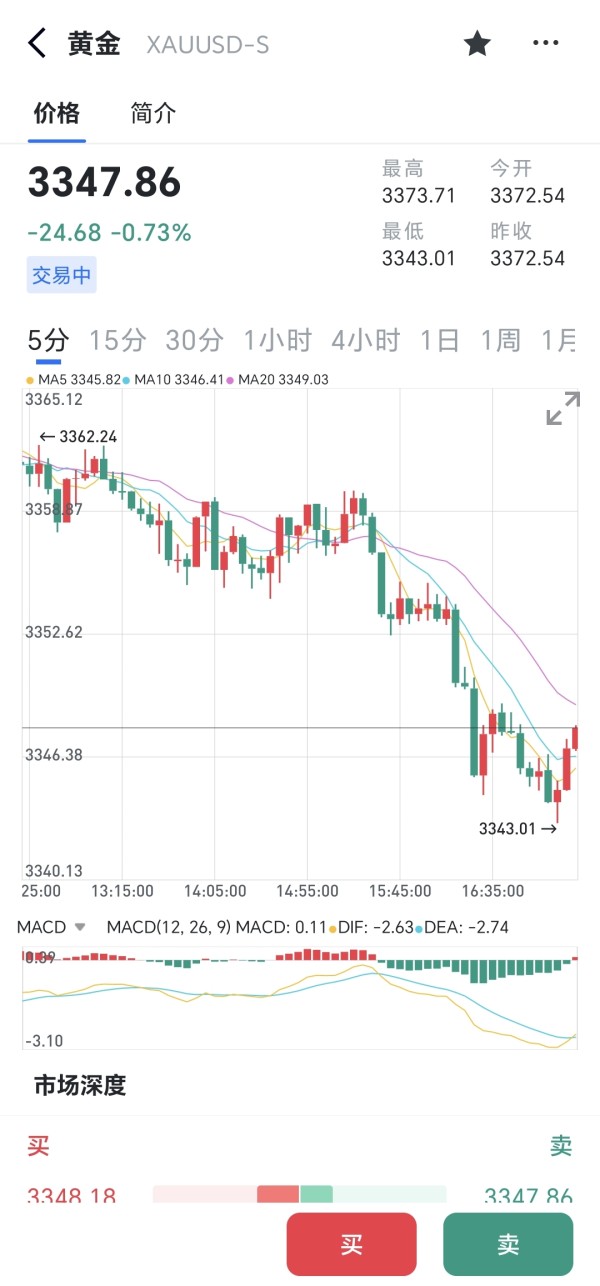

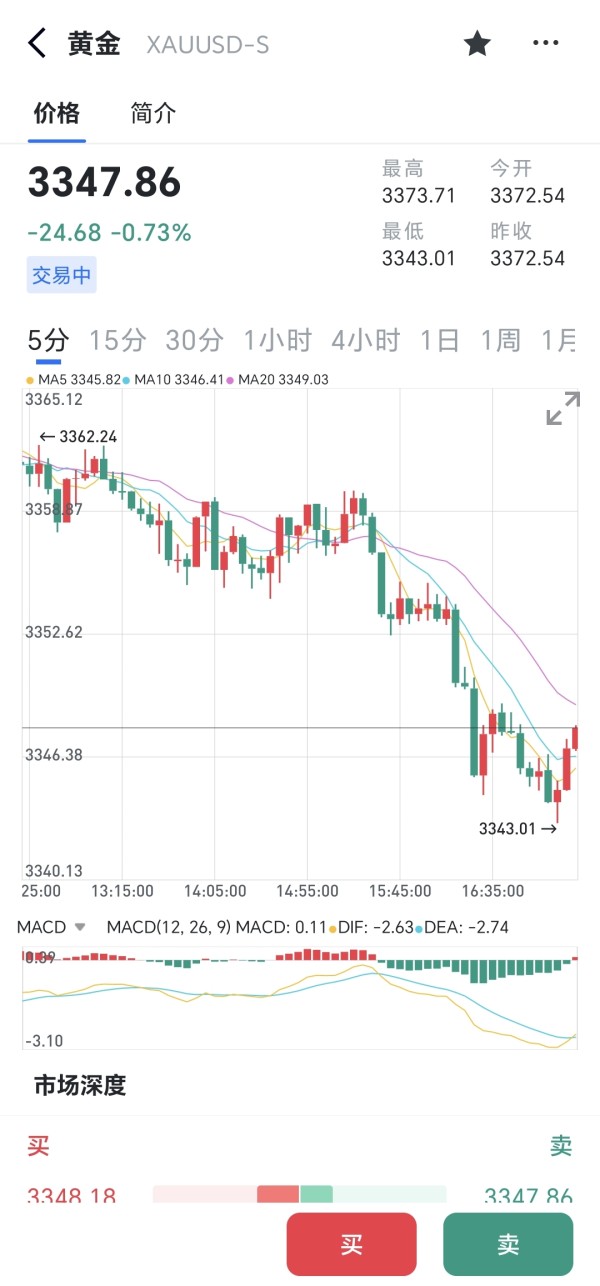

Trading Experience Analysis

The assessment of trading experience at ROC Bank encounters substantial information limitations. Specific details regarding platform performance, execution quality, and trading environment are not documented in available sources. The trading experience encompasses critical factors including platform stability, order execution speed, price accuracy, and overall system reliability that directly impact client satisfaction and trading outcomes.

Platform stability and uptime statistics, which are essential metrics for evaluating trading infrastructure quality, are not specified in current documentation. The absence of information regarding system maintenance schedules, technical downtime frequency, and platform performance during high-volume trading periods limits the ability to assess reliability expectations.

Order execution quality, including execution speed, price slippage, and fill rates, represents crucial aspects of trading experience that are not detailed in accessible sources. The lack of information regarding execution policies, order types supported, and market access capabilities further restricts comprehensive evaluation of trading functionality.

Mobile trading experience, despite the availability of mobile applications, lacks specific documentation regarding functionality, performance, and user interface quality. The absence of information regarding trading environment features, such as real-time data feeds, charting capabilities, and analytical tools integration, presents additional evaluation challenges.

This roc bank review must acknowledge that the limited availability of trading experience information represents a significant constraint. Potential clients need to understand platform capabilities and performance expectations.

Trust and Security Analysis

The evaluation of trust and security factors for ROC Bank faces considerable challenges due to limited information availability regarding regulatory oversight, security measures, and institutional safeguards. Trust and security represent fundamental considerations for banking relationships, particularly in international banking contexts where regulatory frameworks may differ from clients' home jurisdictions.

Regulatory licensing and oversight information, which forms the foundation of institutional trust, is not detailed in available sources. The absence of specific regulatory authority identification, compliance certifications, and supervisory framework details presents significant information gaps for security-conscious clients seeking regulatory protection assurance.

Fund security measures, including segregation policies, insurance coverage, and client asset protection mechanisms, are not documented in accessible sources. The lack of information regarding cybersecurity protocols, data protection measures, and financial crime prevention systems further limits the comprehensive assessment of security infrastructure.

Company transparency factors, including ownership structure, financial reporting, and corporate governance practices, are not specified in current documentation. However, the institution's recognition by Wealth & Finance Magazine for "Best International SME Banking Solution in Asia-Pacific" suggests some level of industry acknowledgment and professional standing within the financial services sector.

The absence of information regarding negative incident history, regulatory actions, or compliance issues limits the ability to assess risk factors and institutional stability comprehensively.

User Experience Analysis

The assessment of user experience at ROC Bank encounters significant information limitations. Comprehensive details regarding client satisfaction, interface design, and operational processes are not documented in available sources. User experience encompasses the entire client journey, from initial registration through ongoing banking relationship management, including digital interface quality and service accessibility.

Overall user satisfaction metrics, including client retention rates, satisfaction surveys, and testimonial feedback, are not available in current documentation. The absence of specific information regarding user interface design quality, navigation ease, and functional accessibility limits the evaluation of digital banking experience quality.

Registration and account verification processes, which represent critical initial user experience touchpoints, are not detailed in accessible sources. The lack of information regarding required documentation, processing timeframes, and verification complexity presents challenges for prospective clients seeking to understand onboarding expectations.

Financial transaction experience, including deposit and withdrawal processes, transaction processing times, and operational efficiency, is not specified in current sources. The absence of information regarding common user complaints, service improvement initiatives, and client feedback integration further restricts comprehensive user experience evaluation.

The availability of mobile applications suggests attention to modern user expectations. However, specific functionality, user ratings, and performance feedback are not documented in accessible sources. This limits the ability to assess actual user experience quality comprehensively.

Conclusion

This comprehensive roc bank review reveals an institution with notable industry recognition in the SME banking sector, particularly within the Asia-Pacific region. The bank's achievement of "Best International SME Banking Solution in Asia-Pacific" by Wealth & Finance Magazine demonstrates professional competency and market acknowledgment within its specialized niche.

ROC Bank appears most suitable for small and medium enterprises seeking international banking solutions. It also serves individual clients requiring modern digital banking services with investment capabilities. The institution's focus on SME solutions suggests understanding of unique business banking challenges and tailored service approaches.

However, significant information limitations regarding regulatory oversight, detailed fee structures, account conditions, and comprehensive service specifications present notable concerns for thorough evaluation. Prospective clients should conduct direct inquiries to address these information gaps before establishing banking relationships. This is particularly important regarding regulatory protections, cost structures, and service capabilities specific to their requirements.