illuzion 2025 Review: Everything You Need to Know

Executive Summary

This illuzion review shows major concerns about this trading platform. Potential investors should think carefully before using it. The platform uses MetaTrader 4 and MetaTrader 5, which are popular trading tools in the forex industry. However, our research finds troubling gaps in regulatory transparency and safety records.

The platform targets traders who know MT4/MT5 environments and want diverse trading options. Using established trading platforms shows some technical skill, but the lack of clear regulatory information creates red flags. Field survey reports found no physical office at regulatory addresses, especially in Australia.

This illuzion review shows the broker might work for experienced traders who understand platform risks. The lack of regulatory oversight makes it wrong for careful investors or beginners who want secure trading environments. The mix of familiar trading technology with questionable regulatory status creates a complex risk profile.

Important Notice

Traders should know that illuzion may operate under different regulatory rules across various locations. This potentially exposes users to varying levels of legal protection and compliance standards. The regulatory landscape for this broker appears unclear with reports showing differences between claimed addresses and actual operational presence.

This evaluation uses available information sources and field survey reports. Given the limited transparency about regulatory status and the existence of safety concerns in public discussions, potential clients should do additional research before using this platform.

Rating Framework

Broker Overview

illuzion operates as a trading platform in the competitive forex and CFD market. Specific details about its establishment date and founding background remain unclear in available documentation. The company's business model and operational structure are not thoroughly detailed in accessible public information.

This creates uncertainty about its corporate foundation and strategic direction. The broker's primary technological infrastructure centers around the MetaTrader 4 and MetaTrader 5 platforms, which are industry-standard solutions widely recognized for their reliability and comprehensive trading features. However, critical information about asset classes, specific trading instruments, and regulatory oversight remains notably absent from public sources.

This illuzion review highlights a concerning pattern where essential broker information is missing or inadequately disclosed. Such information gaps significantly impact the ability to assess the broker's legitimacy and safety standards comprehensively.

Regulatory Status: Available sources do not specify particular regulatory authorities overseeing illuzion's operations. This raises significant compliance concerns for potential traders.

Deposit and Withdrawal Methods: Specific information about payment processing options, supported currencies, and transaction procedures is not detailed in available documentation.

Minimum Deposit Requirements: The entry-level investment amounts and account funding thresholds are not specified in accessible source materials.

Promotional Offers: Details about bonus structures, promotional campaigns, or incentive programs are not mentioned in available information.

Tradeable Assets: While the platform supports multiple trading instruments, specific asset categories and available markets are not comprehensively detailed.

Cost Structure: Information about spreads, commissions, overnight fees, and other trading costs remains unspecified in source materials.

Leverage Options: Maximum leverage ratios and margin requirements are not detailed in available documentation.

Platform Options: illuzion provides access to MetaTrader 4 and MetaTrader 5. This offers traders familiar and robust trading environments.

Geographic Restrictions: Specific country limitations or regional access restrictions are not clearly outlined in available sources.

Customer Support Languages: Multi-language support capabilities and communication options are not specified in accessible documentation.

This illuzion review emphasizes the significant information gaps that potential traders should consider when evaluating this platform.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of illuzion's account conditions faces substantial limitations due to insufficient information in available source materials. Traditional account assessment criteria including account type varieties, tier structures, and specialized features cannot be thoroughly analyzed without comprehensive documentation.

Minimum deposit requirements remain unspecified across available sources. This absence of fundamental account information creates significant uncertainty for potential clients attempting to understand entry-level investment commitments and account funding obligations. Account opening procedures, verification requirements, and documentation standards are not detailed in accessible materials.

This makes it impossible to assess the onboarding experience comprehensively. Additionally, specialized account features such as Islamic accounts, demo account availability, and professional trader accommodations are not mentioned in source documentation.

The lack of transparent account condition information represents a significant concern in this illuzion review. These details are fundamental for informed trading decisions and regulatory compliance verification.

illuzion demonstrates technical competency through its implementation of MetaTrader 4 and MetaTrader 5 platforms. These are industry-leading trading solutions recognized globally for their comprehensive functionality and reliability. The platforms provide traders with advanced charting capabilities, technical analysis tools, and automated trading support through Expert Advisors.

The MT4/MT5 infrastructure suggests that illuzion offers access to professional-grade trading technology. This includes real-time market data, multiple order types, and sophisticated risk management features. However, specific details about additional proprietary tools, research resources, or value-added services are not detailed in available documentation.

Educational resources, market analysis provision, and trader development programs are not mentioned in accessible source materials. This limits the assessment of the broker's commitment to client education and support. Similarly, information about economic calendars, market commentary, and analytical research availability remains unspecified.

While the platform foundation appears technically sound, the absence of detailed information about supplementary tools and resources represents a limitation. This affects evaluating the broker's comprehensive service offering.

Customer Service and Support Analysis

Customer service evaluation for illuzion faces significant challenges due to the absence of detailed support information in available source materials. Traditional service assessment criteria including support channel availability, response time standards, and service quality metrics cannot be comprehensively analyzed without adequate documentation.

Multi-language support capabilities are not specified in accessible sources. This creates uncertainty about communication accessibility for diverse client bases. Similarly, customer service operating hours, timezone coverage, and emergency support availability remain undocumented.

Support channel diversity, including live chat, email, telephone, and social media support options, is not detailed in available materials. This information gap prevents thorough assessment of client accessibility and communication convenience factors that significantly impact trading experiences.

Problem resolution procedures, escalation protocols, and client complaint handling mechanisms are not mentioned in source documentation. This makes it impossible to evaluate the broker's commitment to client satisfaction and issue resolution effectiveness.

Trading Experience Analysis

The assessment of illuzion's trading experience encounters substantial limitations due to insufficient performance data and user feedback in available source materials. Platform stability metrics, execution speed benchmarks, and system reliability indicators are not provided in accessible documentation.

Order execution quality remains unspecified across available sources. These performance indicators are crucial for evaluating the practical trading environment and determining platform suitability for various trading strategies. Mobile trading capabilities, cross-device synchronization, and platform accessibility features are not detailed in source materials.

This limits the assessment of modern trading convenience and flexibility requirements. Similarly, advanced trading features, customization options, and professional trader accommodations are not comprehensively documented.

Technical performance data, server uptime statistics, and connectivity reliability measures are absent from available information. This prevents thorough evaluation of the platform's operational excellence. This illuzion review emphasizes that trading experience assessment requires more comprehensive data than currently available.

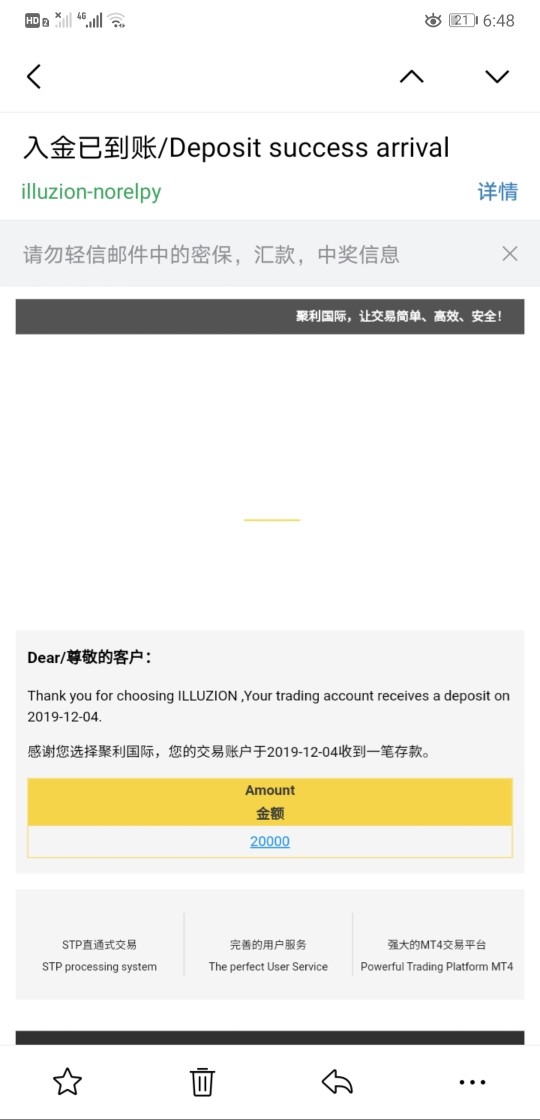

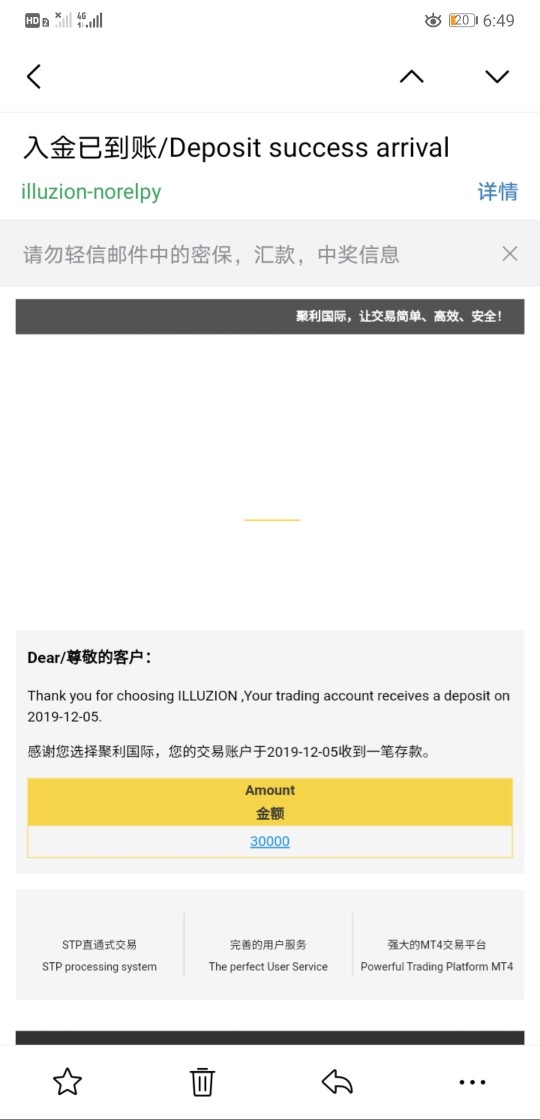

Trust Factor Analysis

The trust factor evaluation reveals significant concerns regarding illuzion's regulatory transparency and operational legitimacy. Available sources indicate an absence of clear regulatory authority oversight, which represents a fundamental safety concern for potential traders seeking secure trading environments.

Field survey reports specifically mention instances where no office was found at claimed regulatory addresses, particularly in Australia. This raises serious questions about operational transparency and physical presence verification. Such findings significantly impact confidence in the broker's legitimacy and compliance standards.

Company transparency measures are not evident in available source materials. This lack of transparency contrasts sharply with industry standards where reputable brokers maintain comprehensive public disclosure practices. The existence of safety and legality discussions in public forums indicates ongoing concerns within the trading community about illuzion's operational status.

These negative discussions, combined with regulatory information gaps, contribute to a concerning trust profile. Potential traders should carefully consider this information.

User Experience Analysis

User experience evaluation for illuzion faces substantial constraints due to limited feedback and testimonial information in available source materials. Traditional user satisfaction indicators, including platform usability ratings, client retention data, and satisfaction surveys, are not accessible for comprehensive analysis.

Interface design quality, navigation efficiency, and user-friendly features cannot be thoroughly assessed without detailed user feedback and platform demonstrations. Similarly, registration process efficiency, account verification experiences, and onboarding satisfaction levels remain undocumented in available sources.

Funding and withdrawal experience quality is not detailed in accessible materials. These operational aspects significantly impact overall user satisfaction and platform usability. Common user complaints, recurring issues, and client feedback patterns are not documented in available sources.

This prevents identification of potential problem areas or service improvement opportunities. This information gap limits the ability to provide comprehensive user experience guidance for potential traders.

Conclusion

This comprehensive illuzion review reveals a concerning pattern of limited transparency and regulatory uncertainty that significantly impacts the platform's overall assessment. While illuzion demonstrates technical competency through its use of established MetaTrader 4 and MetaTrader 5 platforms, the absence of clear regulatory oversight and operational transparency creates substantial risk factors.

The platform may appeal to experienced traders familiar with MT4/MT5 environments. However, it is not recommended for risk-averse investors or beginners seeking secure, well-regulated trading environments. The combination of technical capability with regulatory uncertainty creates a complex risk profile requiring careful consideration.

Key advantages include access to professional-grade trading platforms, while significant disadvantages encompass regulatory transparency gaps and concerning field survey findings. Potential traders should conduct extensive due diligence and consider alternative, well-regulated brokers before engaging with this platform.