OBEX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive obex review reveals a financial services provider that operates with a distinct focus on high-net-worth individuals and institutional clients. OBEX Securities & Investments positions itself as a specialized firm offering unique financial instruments and creative hedging strategies, backed by over 30 years of industry experience. Led by Randy and his global team of experienced investment professionals, the company emphasizes world-class service delivery across multiple asset classes.

However, our evaluation reveals significant information gaps regarding regulatory oversight, specific trading conditions, and platform details. While the company's specialization in serving affluent clients and established businesses suggests a boutique approach to financial services, the lack of transparent regulatory information and detailed trading specifications raises important considerations for potential clients. The target demographic appears to be sophisticated investors, emerging hedge funds, and well-established businesses requiring customized financial solutions rather than retail traders seeking standard forex services.

Important Notice

Regional Entity Differences: Available information does not specify distinct regulatory requirements across different jurisdictions where OBEX may operate. Potential clients should verify local regulatory compliance independently, as requirements may vary significantly between regions.

Review Methodology: This evaluation is based on publicly available information and company materials. Due to limited user feedback and market data available in public sources, certain aspects of the trading experience and service quality cannot be comprehensively assessed through independent verification.

Rating Framework

Note: Scoring has been suspended due to insufficient publicly available information across all evaluated dimensions.

Broker Overview

OBEX Securities & Investments operates as a specialized financial services provider with an established presence spanning over three decades in the securities industry. According to company materials, the firm has built its reputation around delivering customized financial solutions to a select clientele of high-net-worth individuals, emerging hedge funds, and established business entities. The company's approach emphasizes personalized service delivery and sophisticated financial structuring rather than mass-market retail trading services.

The firm's business model centers on providing unique financial instruments and creative hedging strategies tailored to specific client requirements. This positioning suggests a boutique-style operation that prioritizes relationship management and customized solutions over standardized product offerings. Randy, identified as a key figure in the organization, leads what the company describes as a global team of highly experienced investment professionals committed to delivering world-class service across various asset classes.

However, specific details regarding the company's founding year, headquarters location, primary trading platforms, and exact range of tradeable assets remain undisclosed in available materials. The absence of clear regulatory information and standard trading specifications indicates that this obex review must rely on limited public disclosures, which may not provide the comprehensive picture typically expected for thorough broker evaluations.

Regulatory Jurisdictions: Specific regulatory oversight information is not detailed in available company materials, representing a significant information gap for potential clients seeking regulatory assurance.

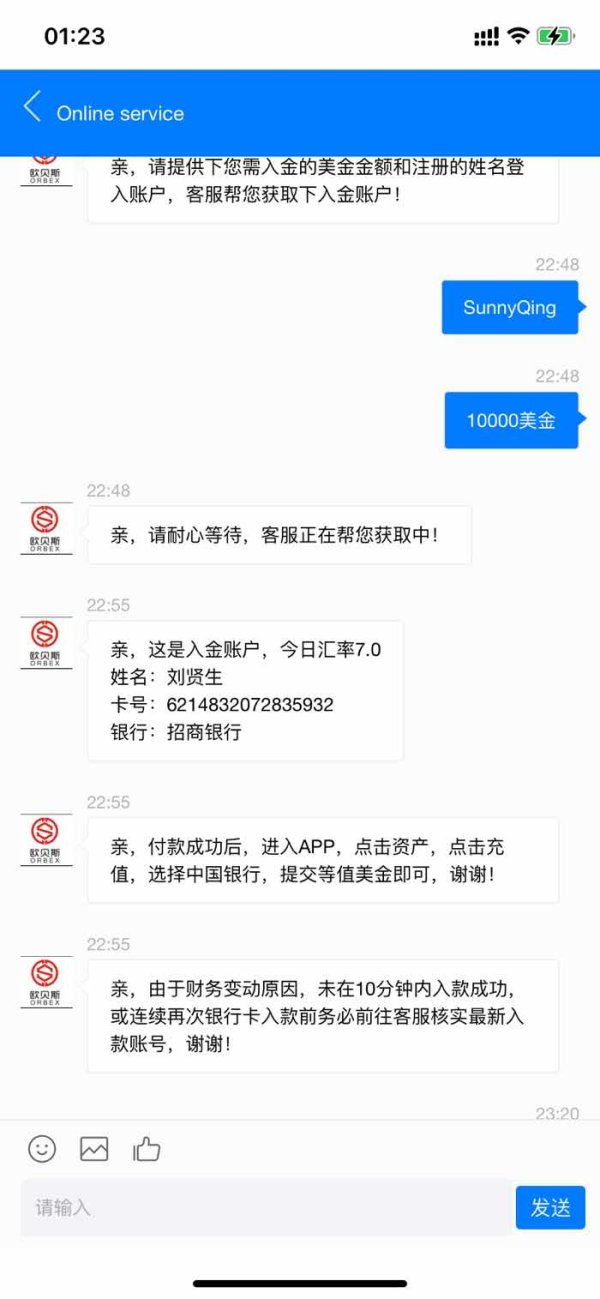

Deposit and Withdrawal Methods: Available documentation does not specify accepted payment methods, processing timeframes, or associated fees for funding account operations.

Minimum Deposit Requirements: Specific minimum deposit thresholds are not disclosed in publicly available information, though the focus on high-net-worth clients suggests potentially elevated entry requirements.

Bonus and Promotional Offers: Current promotional structures, welcome bonuses, or ongoing incentive programs are not detailed in accessible company materials.

Tradeable Assets: While the company references service delivery "across a wide range of asset classes," specific instruments, markets, and product categories are not enumerated in available documentation.

Cost Structure: Detailed information regarding spreads, commissions, overnight fees, and other trading costs is not provided in accessible materials, limiting cost comparison capabilities.

Leverage Ratios: Maximum available leverage ratios and margin requirements are not specified in current company disclosures.

Platform Options: Specific trading platform software, mobile applications, or web-based trading interfaces are not identified in available information.

Geographic Restrictions: Jurisdictional limitations or restricted territories are not clearly outlined in accessible documentation.

Customer Support Languages: Available language support for client services is not specified in current materials.

This obex review highlights the substantial information gaps that potential clients would need to address through direct inquiry with the firm.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of account conditions for OBEX Securities & Investments faces significant limitations due to insufficient publicly available information. Standard account types, their respective features, and qualification requirements are not detailed in accessible company materials. Without specific information regarding minimum deposit thresholds, account tier structures, or special account categories such as Islamic-compliant options, a comprehensive assessment cannot be completed.

The company's stated focus on high-net-worth individuals and institutional clients suggests that account structures may differ substantially from typical retail forex offerings. However, without explicit details about account opening procedures, documentation requirements, or verification processes, potential clients cannot adequately evaluate the accessibility and suitability of available account options.

The absence of clear fee structures, maintenance requirements, or account-specific benefits further complicates the assessment process. This obex review must acknowledge that account condition evaluation requires direct consultation with the firm to obtain necessary details for informed decision-making.

Assessment of trading tools and analytical resources offered by OBEX Securities & Investments cannot be completed based on available information. The company materials do not specify particular trading platforms, analytical software, or research tools provided to clients. While the firm emphasizes delivering "world-class service" and "value-added financial services," the specific technological infrastructure and analytical capabilities remain undisclosed.

Educational resources, market research publications, automated trading support, and third-party integrations are not detailed in accessible documentation. The absence of information regarding charting capabilities, technical indicators, economic calendars, or market analysis tools prevents meaningful evaluation of the firm's technological offerings.

For sophisticated investors and institutional clients that the company targets, comprehensive analytical tools and research resources typically represent critical service components. However, without specific details about available platforms and analytical capabilities, potential clients cannot assess whether the firm's technological infrastructure meets their operational requirements.

Customer Service and Support Analysis

Customer service evaluation for OBEX Securities & Investments faces substantial limitations due to insufficient information about support structures and service delivery methods. Available materials do not specify customer service channels, operating hours, response time commitments, or service quality standards that clients can expect.

The company emphasizes "exceptional personal service" as a core offering, particularly for high-net-worth individuals and institutional clients. However, specific details about account management approaches, dedicated relationship managers, or personalized service protocols are not provided in accessible documentation.

Multi-language support capabilities, regional service availability, and technical support structures remain unspecified. Without information about customer service accessibility, problem resolution procedures, or service escalation processes, potential clients cannot evaluate the adequacy of support infrastructure for their operational needs. The absence of user testimonials or service quality feedback further limits the assessment capabilities for this aspect of the firm's operations.

Trading Experience Analysis

Evaluation of the trading experience provided by OBEX Securities & Investments cannot be completed due to insufficient information about platform performance, execution quality, and operational infrastructure. Available materials do not detail specific trading platforms, execution methods, or technological capabilities that would directly impact client trading experiences.

Platform stability, order execution speed, slippage rates, and system reliability metrics are not disclosed in accessible documentation. Without information about trading interface design, mobile platform availability, or advanced order types, potential clients cannot assess the practical aspects of trade execution and platform functionality.

The firm's focus on sophisticated financial instruments and hedging strategies suggests that trading infrastructure may be designed for complex transactions rather than standard retail trading. However, specific details about execution quality, market access, or trading environment characteristics are not provided in available materials.

This obex review acknowledges that comprehensive trading experience evaluation would require direct platform demonstration and detailed technical specifications from the firm itself.

Trust and Regulation Analysis

The trust and regulatory assessment for OBEX Securities & Investments reveals significant concerns due to the absence of detailed regulatory information in publicly available materials. Specific regulatory licenses, supervisory authorities, and compliance frameworks are not clearly disclosed, representing a substantial transparency gap for potential clients.

Fund safety measures, segregated account structures, and client asset protection protocols are not detailed in accessible documentation. Without clear information about regulatory oversight, capital adequacy requirements, or dispute resolution mechanisms, clients cannot adequately assess the security of their potential investments.

The company's claimed 30-year industry presence suggests operational longevity, but without verifiable regulatory credentials or third-party auditing information, the assessment of institutional credibility remains incomplete. Industry reputation indicators, regulatory compliance history, and handling of any potential regulatory issues are not addressed in available materials.

For the high-net-worth individuals and institutional clients that the firm targets, regulatory transparency and fund security typically represent paramount concerns that require comprehensive documentation and verification.

User Experience Analysis

User experience evaluation for OBEX Securities & Investments cannot be comprehensively completed due to limited feedback data and user testimonials in publicly available sources. Overall client satisfaction metrics, interface usability assessments, and user journey evaluations are not documented in accessible materials.

The registration process, account verification procedures, and onboarding experience details are not specified in current company disclosures. Without information about client portal functionality, account management interfaces, or user interaction design, potential clients cannot evaluate the practical aspects of engaging with the firm's services.

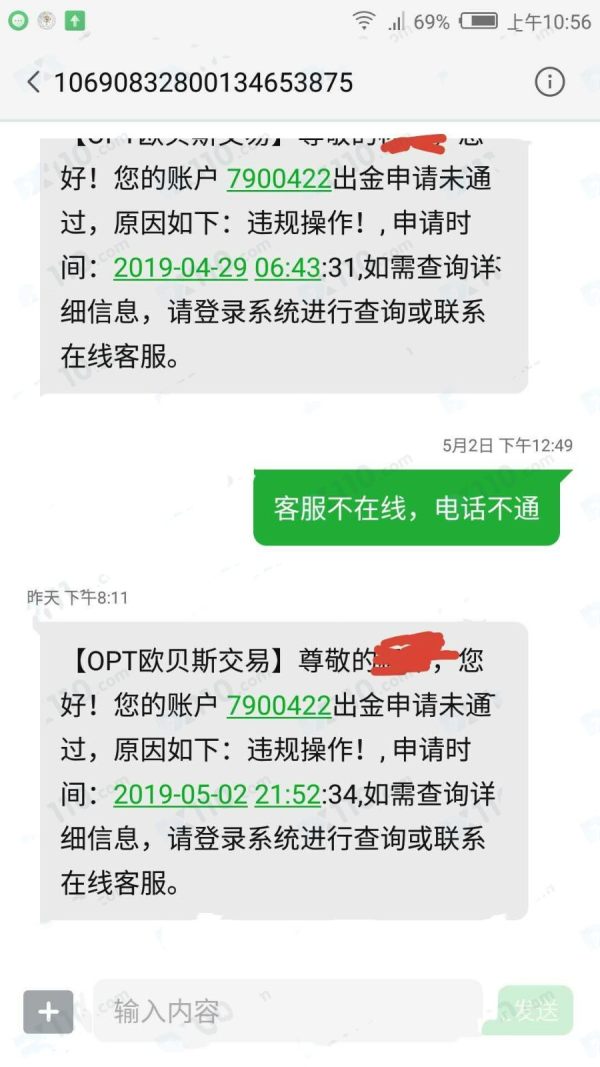

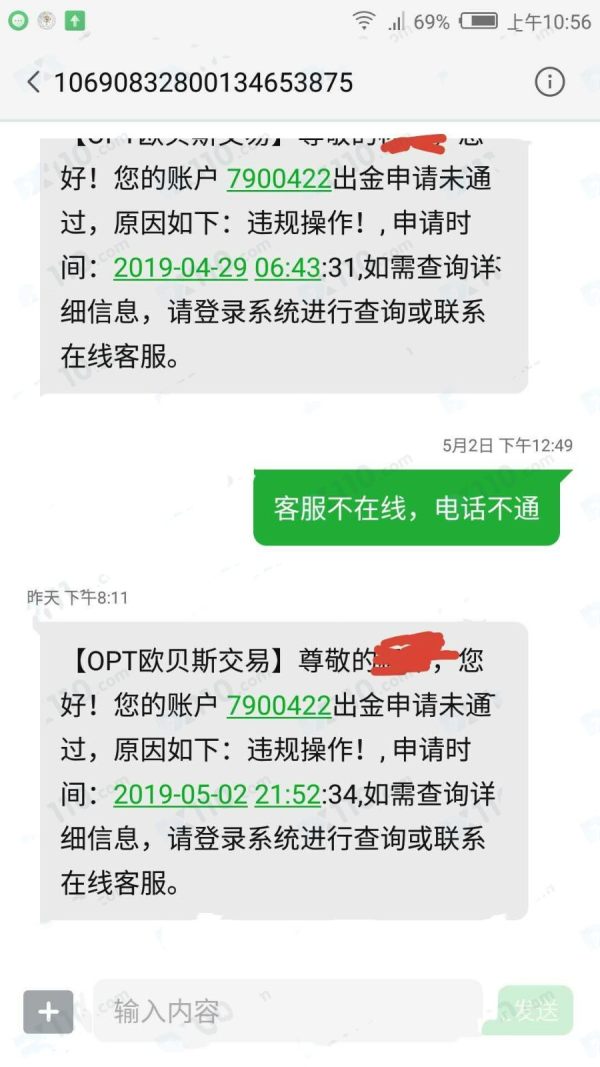

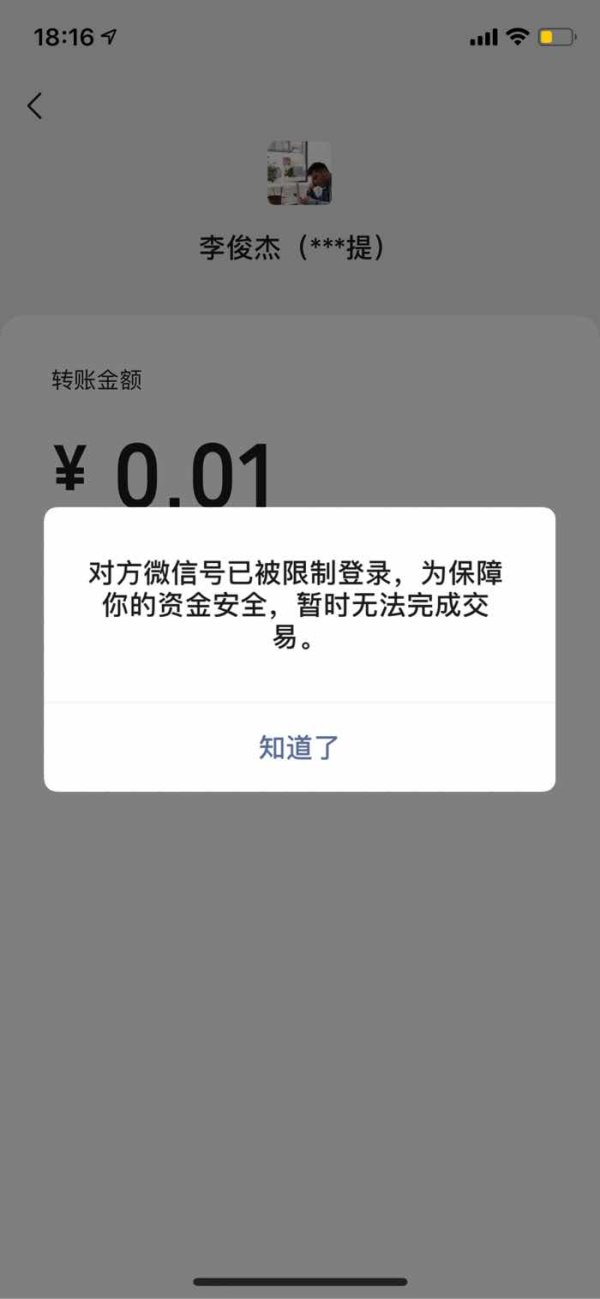

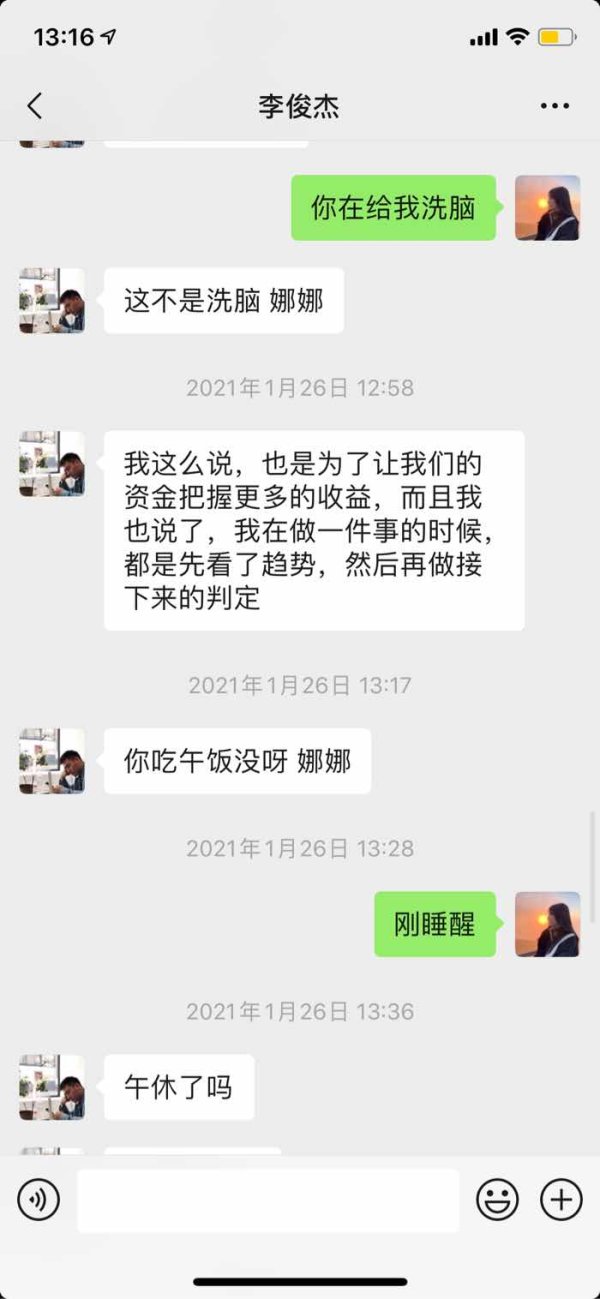

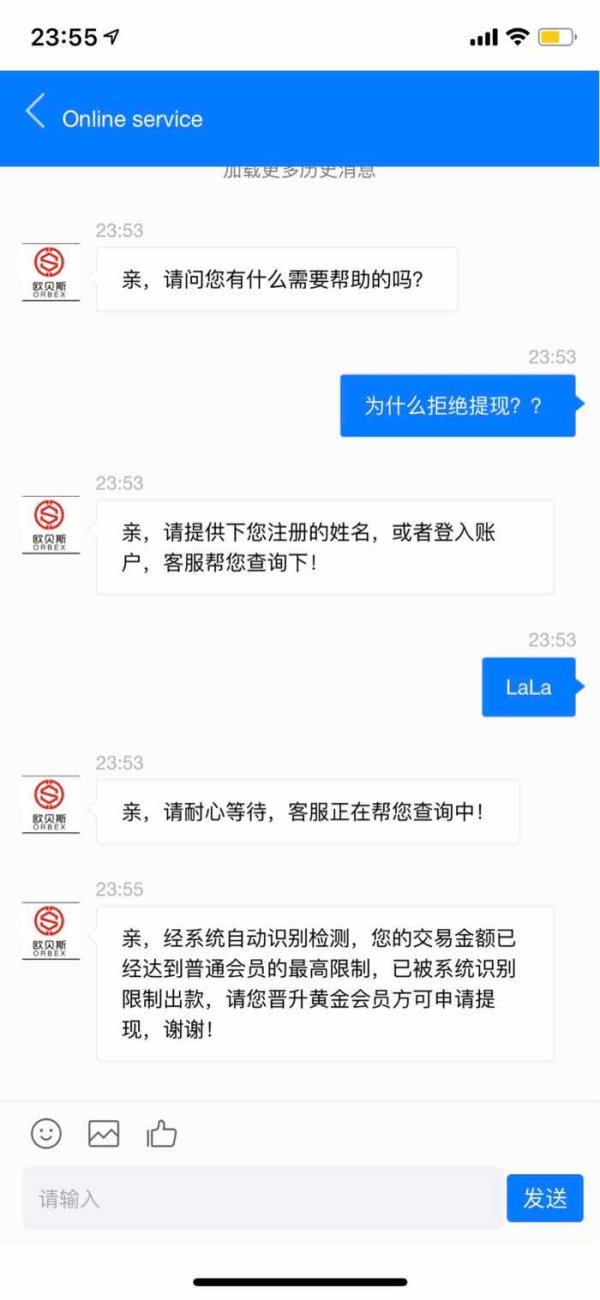

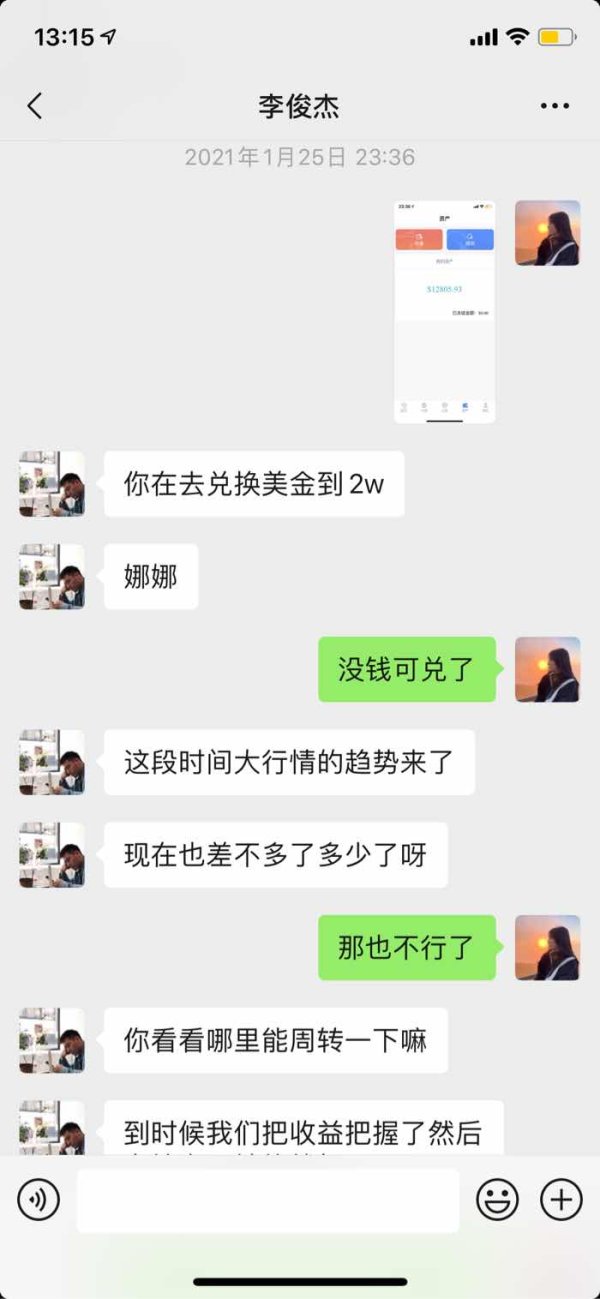

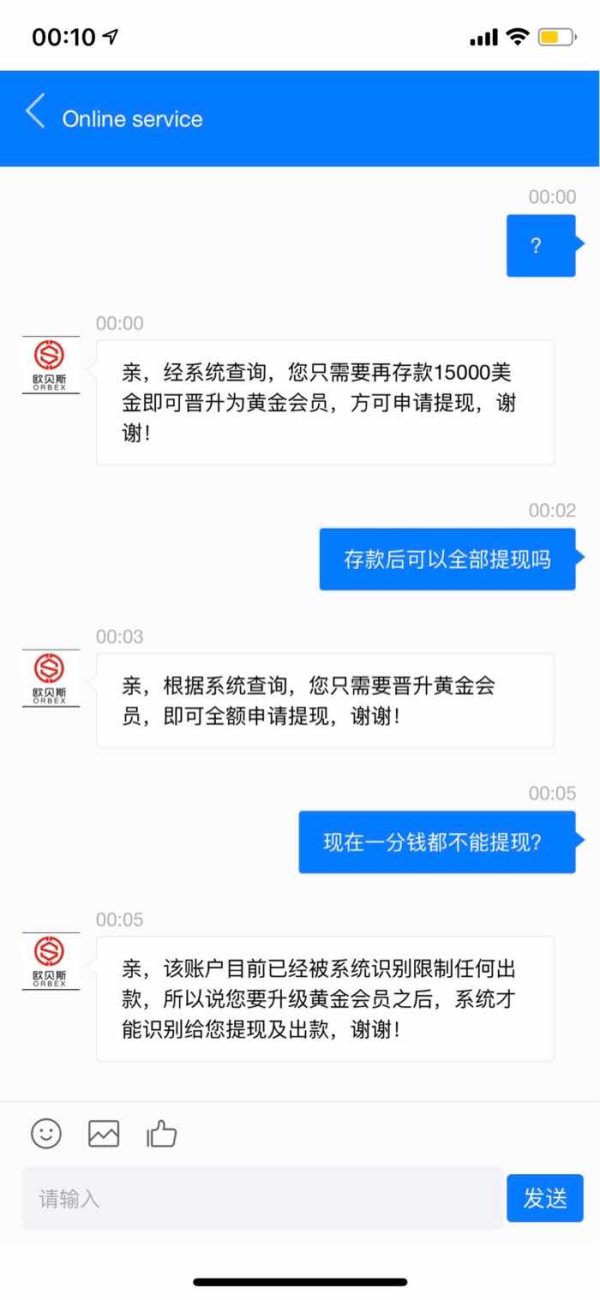

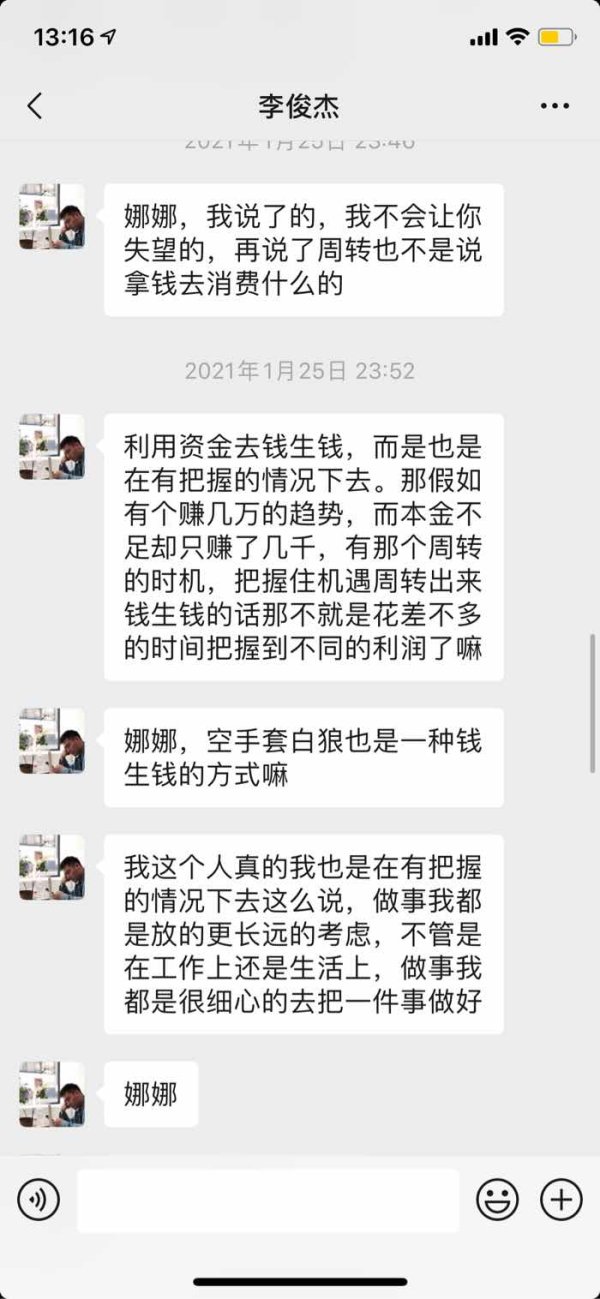

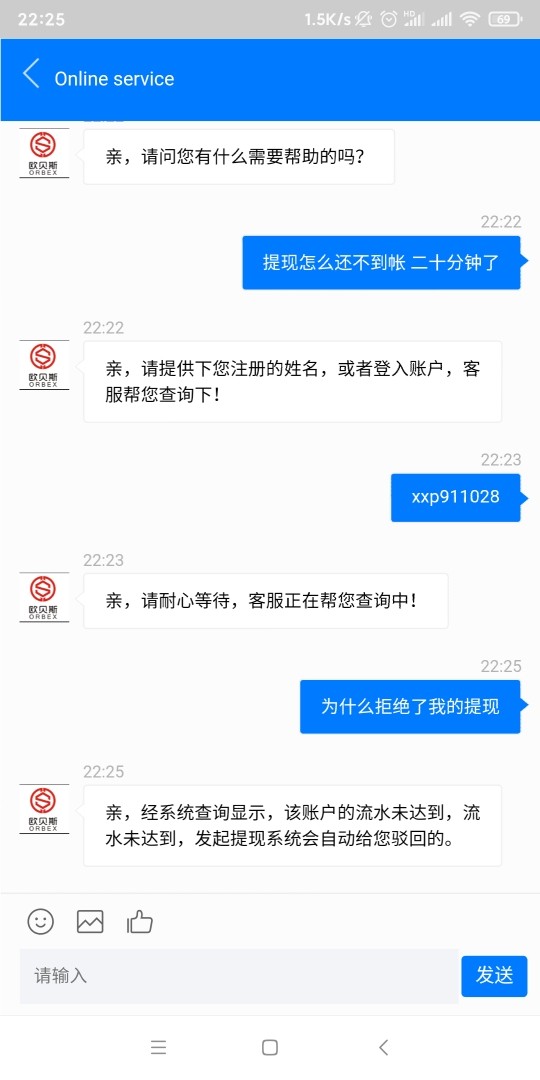

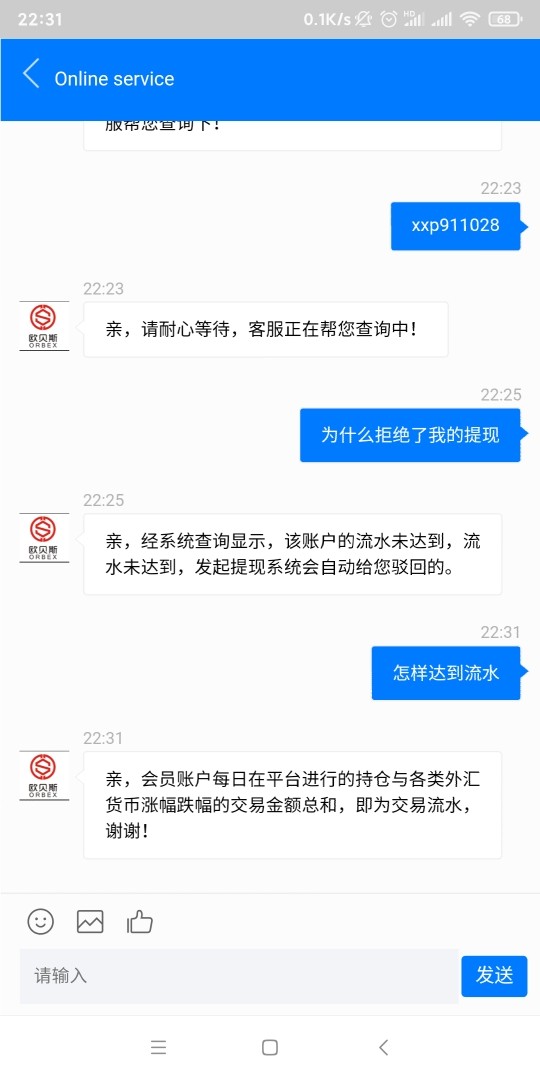

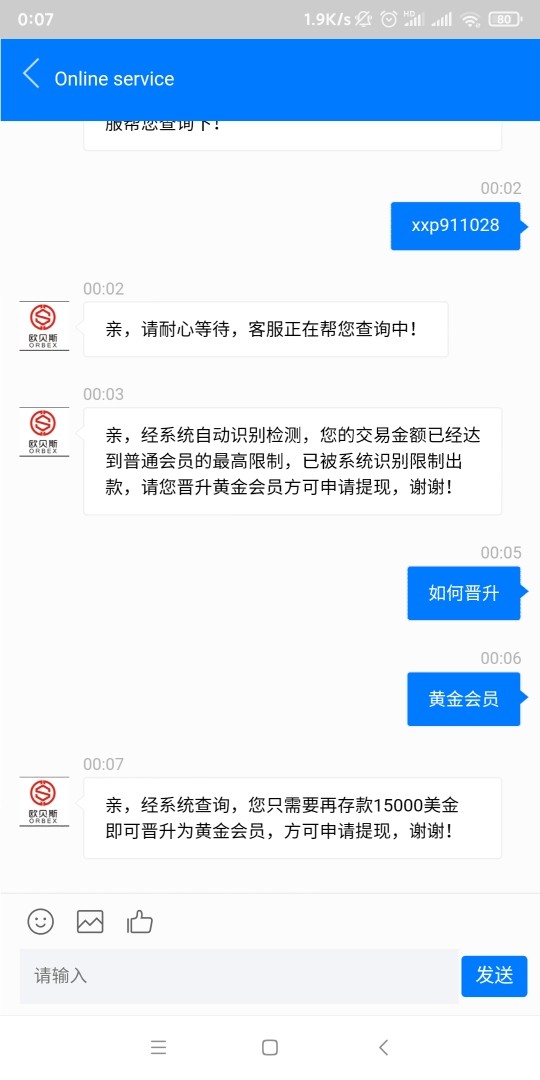

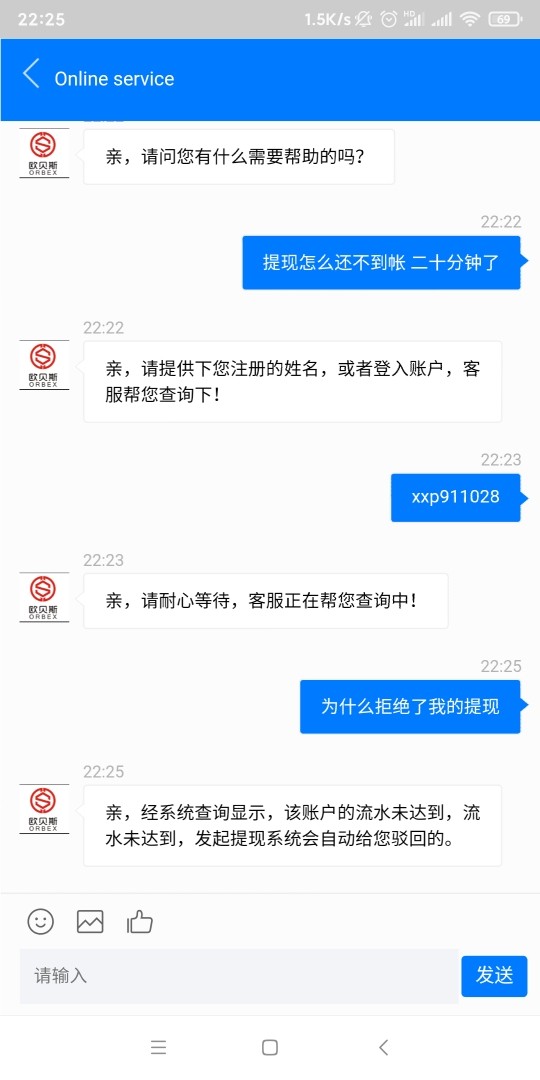

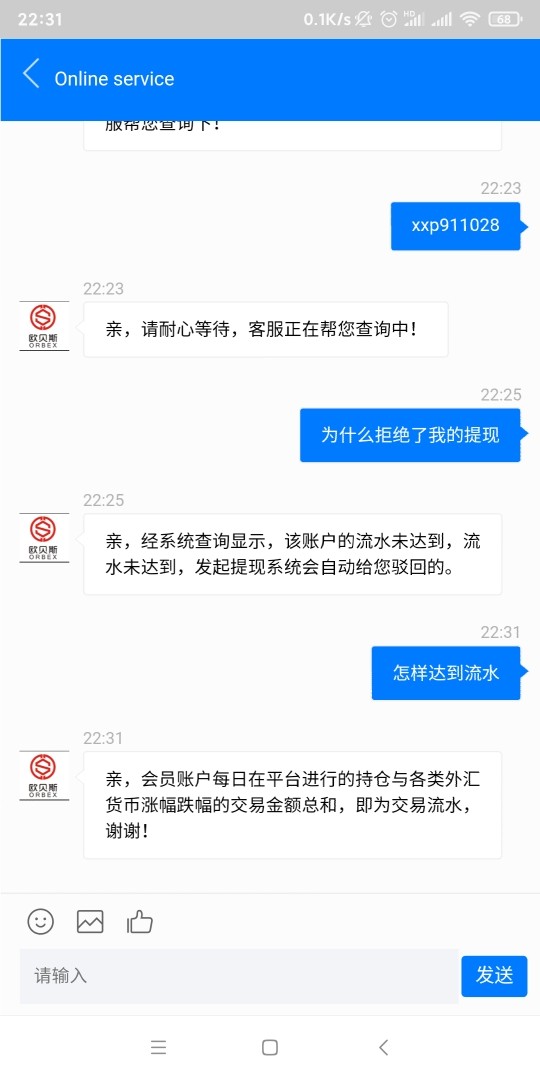

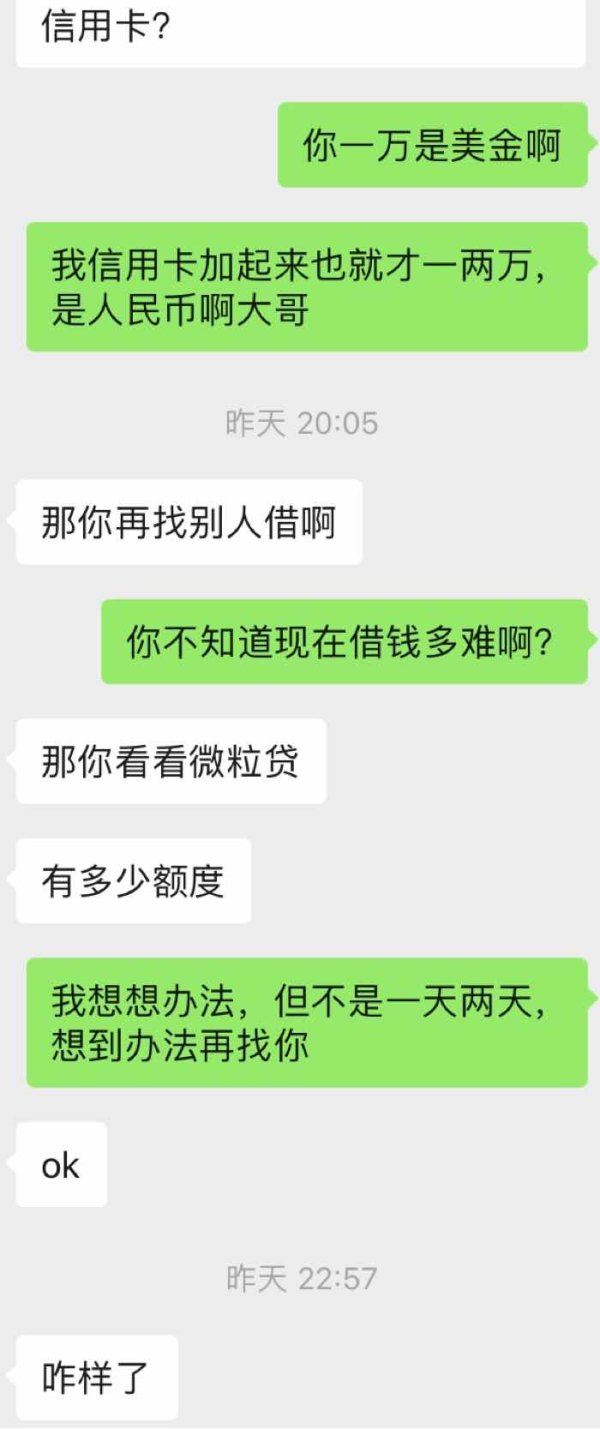

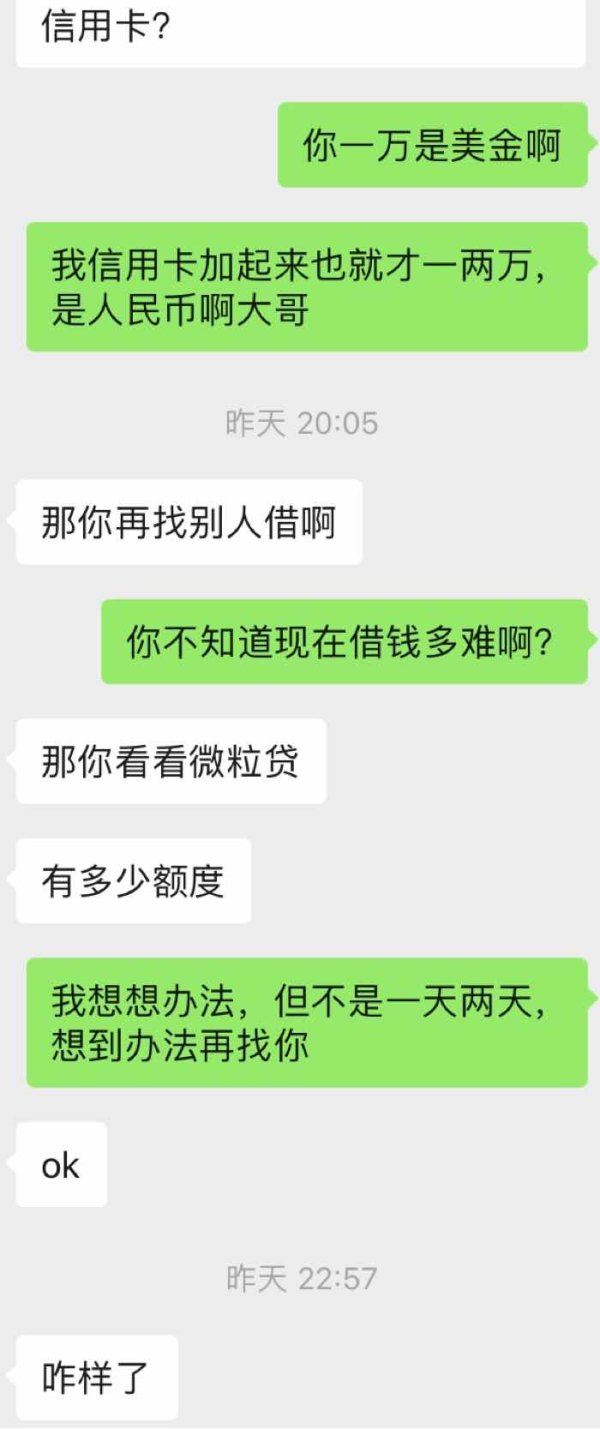

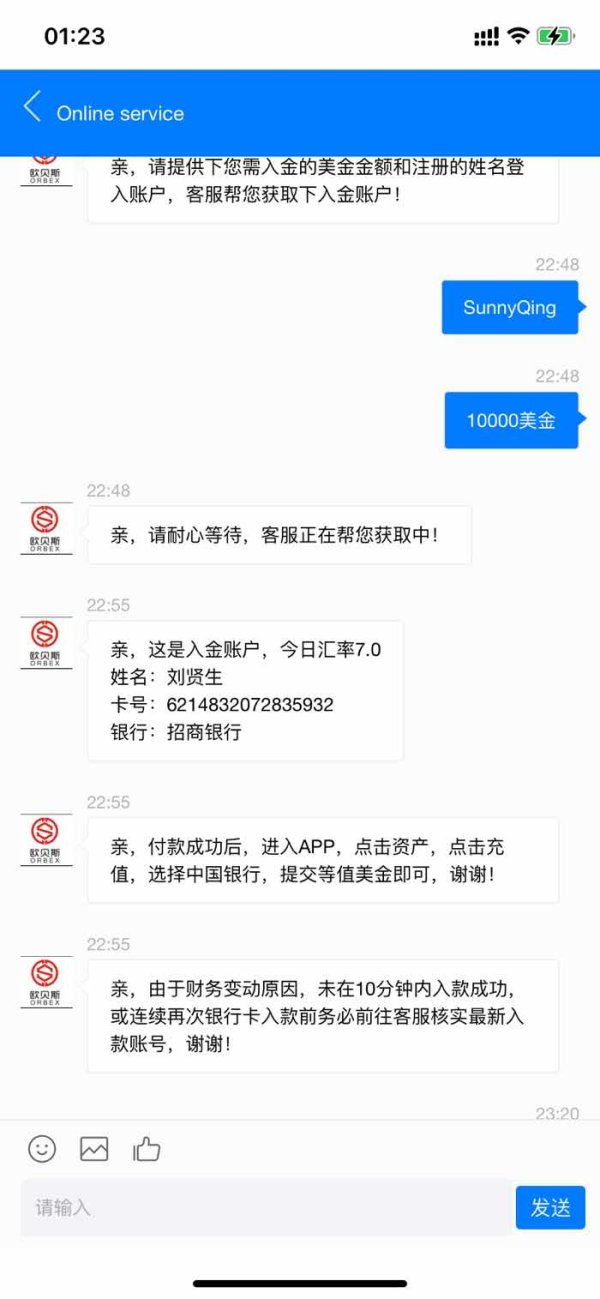

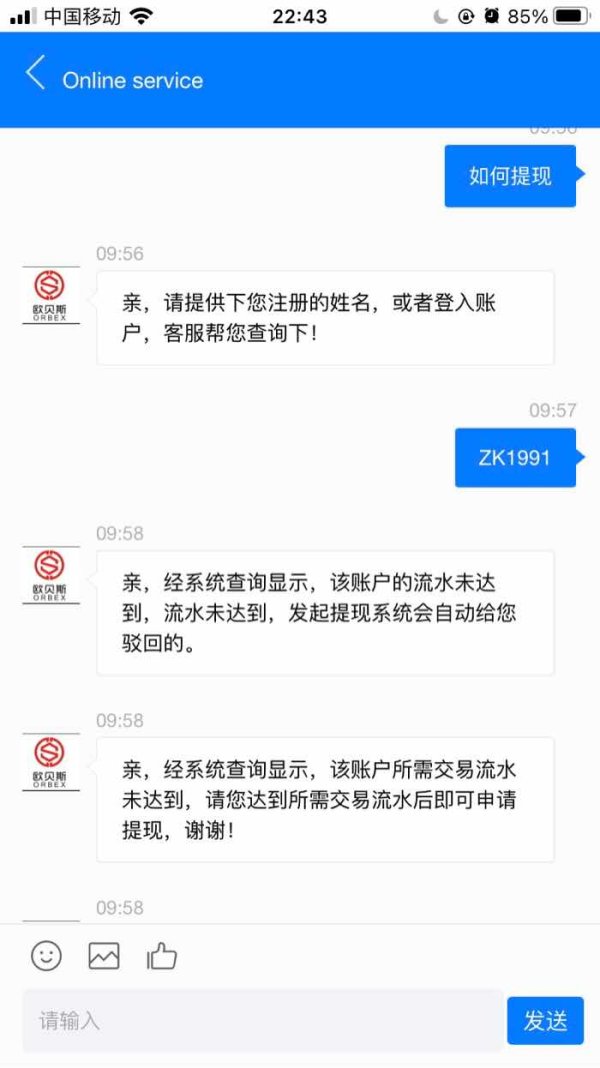

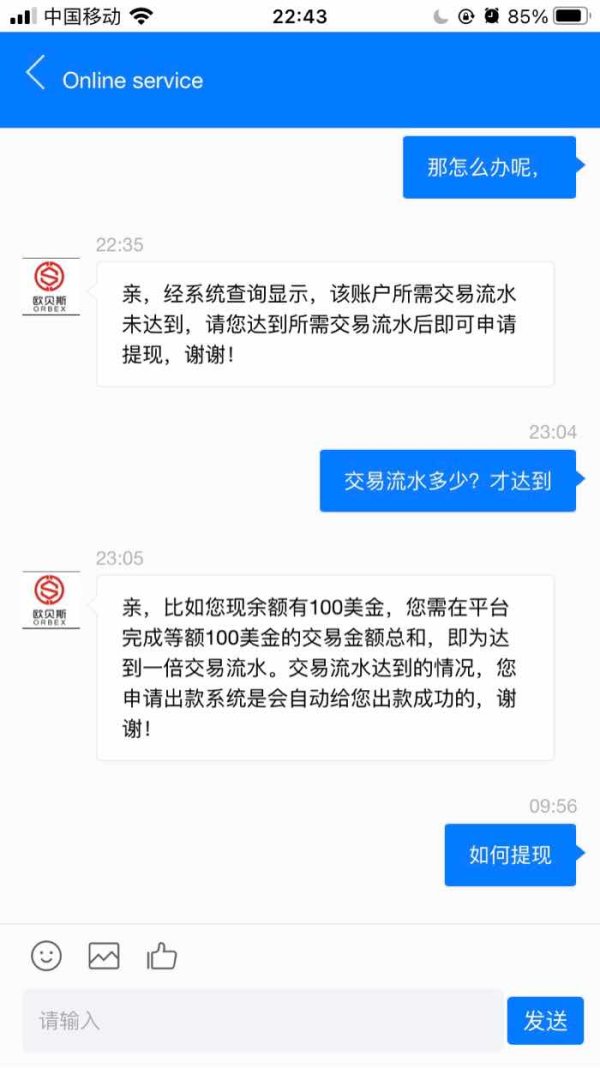

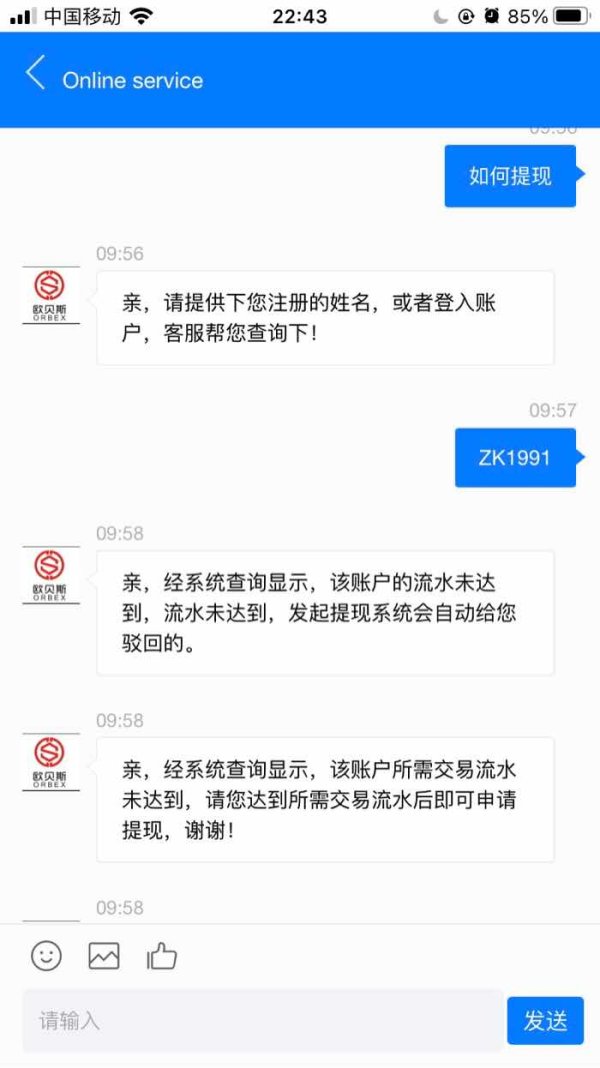

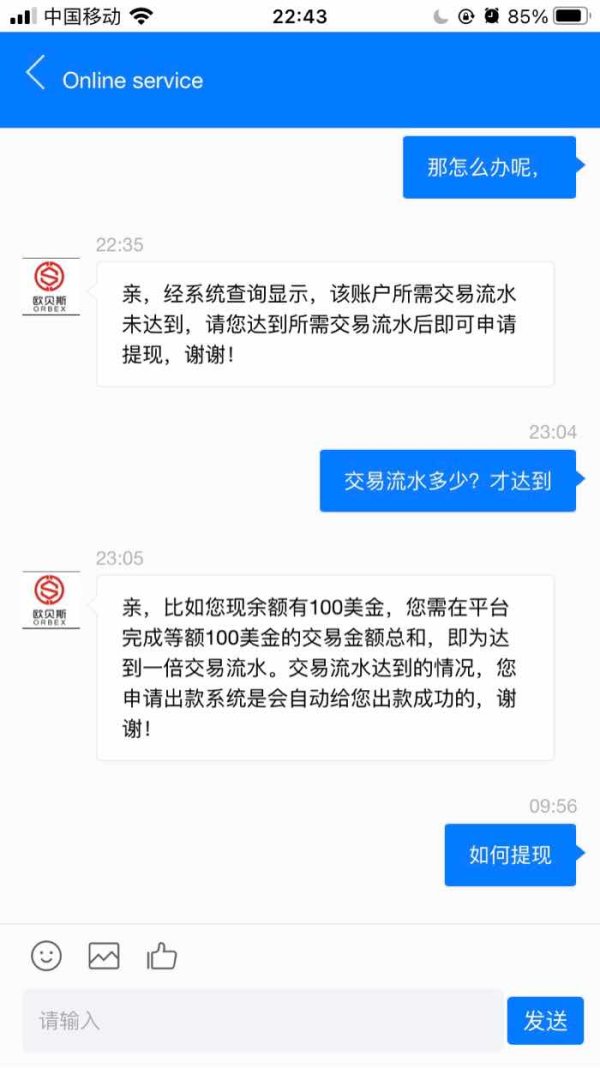

Fund management experiences, withdrawal processes, and day-to-day operational interactions remain undocumented in available materials. The absence of user reviews, satisfaction surveys, or client testimonials limits the ability to assess real-world service delivery quality and client experience outcomes.

Given the firm's focus on high-net-worth and institutional clients, user experience expectations likely differ from standard retail trading requirements, but specific service delivery approaches and client interaction protocols are not detailed in accessible information.

Conclusion

This comprehensive obex review reveals a financial services provider that positions itself as a specialized firm serving sophisticated clients but lacks the transparency typically expected in today's financial services environment. While OBEX Securities & Investments presents itself as an experienced organization with over 30 years in the securities industry, the substantial information gaps regarding regulatory oversight, trading conditions, and service specifications create significant evaluation challenges.

The firm appears most suitable for high-net-worth individuals and institutional clients seeking customized financial solutions rather than retail traders requiring standard forex services. However, the absence of detailed regulatory information, platform specifications, and transparent pricing structures necessitates thorough due diligence through direct consultation with the firm before making any investment decisions.

Potential clients should prioritize obtaining comprehensive regulatory documentation, detailed service specifications, and clear fee structures before proceeding with any business relationship.