Npbfx 2025 Review: Everything You Need to Know

Executive Summary

NPBFX is a forex broker that started in 1996. It has built a strong reputation through its STP/NDD business model and has received positive feedback from clients for almost thirty years. This Npbfx review looks at a broker that stands out in the competitive forex market through steady performance and recognition from the industry.

The broker's best features include its complete MT4 trading platform and well-respected copy trading through NPB Invest. Industry sources show that NPBFX has won over 20 awards, proving its commitment to excellent service and trading conditions. The broker gives access to more than 30 forex currency pairs plus precious metals like gold and silver, along with energy products including oil and natural gas.

NPBFX focuses on intermediate to advanced traders who want diverse asset exposure and advanced trading tools. The broker's copy trading feature gets especially positive feedback from users, with traders praising how well it works and how easy it is to use. The mix of established market presence, award recognition, and positive user reviews makes NPBFX a notable choice for serious forex traders who want a reliable trading partner with a proven track record and complete trading solutions.

Important Notice

Regional Entity Differences: NPBFX does not fully share its regulatory information in available materials. Users should carefully check the legal environment and regulatory protections available in their specific areas before working with the broker.

Review Methodology: This evaluation uses comprehensive analysis of user feedback, industry data, and information from the broker. Our assessment looks at multiple sources to give a balanced view of NPBFX's services and performance.

Rating Framework

Broker Overview

NPBFX started in the forex market in 1996, marking almost three decades of continuous operation in financial services. The company uses an STP/NDD business model, providing direct market access services designed to offer clients efficient trading without dealing desk interference. This approach aims to reduce conflicts of interest while ensuring transparent price discovery for traders.

The broker has built its reputation on consistent service and innovation in trading technology. Industry reports show that NPBFX has earned recognition through more than 20 industry awards, showing its commitment to maintaining high standards in client service and trading conditions. This level of industry recognition suggests sustained performance and peer acknowledgment within the competitive forex brokerage landscape.

NPBFX offers complete trading solutions through its MT4 platform alongside mobile trading capabilities. The broker provides access to over 30 forex currency pairs, letting traders engage with major, minor, and exotic currency combinations. Beyond traditional forex offerings, NPBFX extends its asset coverage to include precious metals such as gold and silver, plus energy commodities including oil and natural gas, allowing for portfolio diversification across multiple asset classes.

Regulatory Jurisdictions: Specific regulatory authority information is not detailed in available source materials, requiring traders to verify regulatory status independently.

Deposit and Withdrawal Methods: Available source materials do not specify the deposit and withdrawal options that NPBFX offers.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in the available information sources.

Bonus and Promotions: Details about promotional activities and bonus offerings are not provided in the source materials.

Tradeable Assets: NPBFX offers access to more than 30 forex currency pairs, gold, silver, oil, and natural gas, providing diverse trading opportunities across multiple asset classes.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not detailed in the available materials, requiring direct inquiry with the broker.

Leverage Ratios: Available sources do not specify the maximum leverage ratios that NPBFX offers.

Platform Options: The broker provides MT4 trading platform and mobile trading applications for client access.

Geographic Restrictions: Information about geographic trading restrictions is not specified in available materials.

Customer Support Languages: Available source materials do not detail the languages that NPBFX customer service teams support.

This Npbfx review highlights the need for potential clients to communicate directly with the broker to get comprehensive details on trading conditions and service specifications.

Detailed Rating Analysis

Account Conditions Analysis

The available source materials do not provide comprehensive details about NPBFX's account structure and conditions, making it challenging to deliver a thorough assessment of this critical aspect. Account type variety, minimum deposit requirements, and specific account features remain unspecified in the accessible information sources.

Without detailed information about account opening procedures, verification requirements, or special account options such as Islamic accounts, potential traders would need to engage directly with NPBFX to understand the full scope of account offerings. The absence of specific account condition details in available materials represents a significant information gap that affects the ability to provide a complete evaluation.

The lack of transparent account information in publicly available sources may concern traders who prefer comprehensive upfront disclosure of trading conditions. Industry best practices typically involve clear presentation of account types, minimum deposits, and associated features to enable informed decision-making.

This Npbfx review must note that account condition evaluation requires additional information gathering directly from the broker to provide meaningful analysis for potential clients considering NPBFX services.

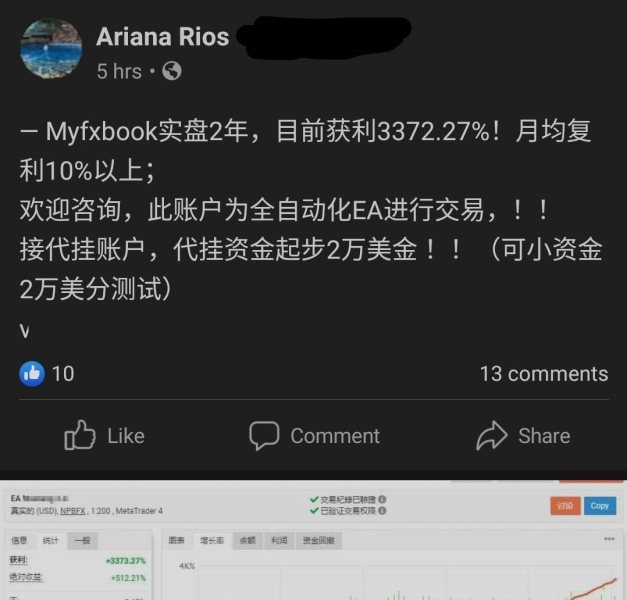

NPBFX shows strength in its trading tools and resources offering, particularly through its MT4 platform implementation and copy trading functionality. User feedback referenced in available sources shows that the broker's copy trading feature, NPB Invest, receives positive evaluation from clients who describe it as a "game-changer" in their trading experience.

The MT4 platform provides traders with industry-standard charting tools, technical indicators, and automated trading capabilities that support various trading strategies. The platform's widespread adoption across the industry ensures that most traders can quickly adapt to NPBFX's trading environment without significant learning curves.

User testimonials highlight the effectiveness of the copy trading system, suggesting that NPBFX has invested in developing robust social trading infrastructure. This feature allows less experienced traders to follow and replicate the strategies of successful traders, potentially improving their trading outcomes while learning from experienced market participants.

However, available materials do not detail additional research resources, educational content, or advanced analytical tools that might complement the basic platform offerings. The absence of information about market analysis, economic calendars, or educational resources represents areas where additional clarification would benefit potential clients.

Customer Service and Support Analysis

Available source materials do not provide specific information about NPBFX's customer service infrastructure, response times, or support quality metrics. The absence of detailed customer service information makes it impossible to evaluate this crucial aspect of broker operations effectively.

Industry-standard customer service typically includes multiple communication channels such as live chat, email support, and telephone assistance, along with specified operating hours and multilingual support capabilities. Without access to this information for NPBFX, potential clients cannot assess whether the broker's support structure meets their specific needs.

The lack of customer service details in available materials may indicate either insufficient public disclosure or limited availability of comprehensive service information. Professional forex brokers typically provide transparent information about their support capabilities to build client confidence.

Response time expectations, problem resolution procedures, and escalation processes remain unspecified in the accessible information sources. This information gap affects the ability to provide meaningful guidance to potential clients about the quality and accessibility of NPBFX customer support services.

Trading Experience Analysis

The trading experience evaluation for NPBFX faces limitations due to insufficient detailed information in available source materials about platform stability, execution speeds, and order processing quality. While the broker offers MT4 platform access, specific performance metrics and user experience data are not comprehensively detailed.

User feedback indicates positive reception of the copy trading functionality, suggesting that at least this aspect of the trading experience meets client expectations. The MT4 platform's industry-standard features provide familiar trading environment for experienced traders, potentially contributing to positive user experience.

However, critical trading experience factors such as slippage rates, execution speeds during high-volatility periods, and platform stability during market stress remain unspecified in available materials. These technical performance aspects significantly impact trader satisfaction and profitability.

Mobile trading experience details are also limited in the source materials, despite mobile platform availability being mentioned. Modern traders increasingly rely on mobile access for position management and market monitoring, making mobile platform quality a crucial consideration.

This Npbfx review must acknowledge that comprehensive trading experience assessment requires additional technical performance data and user feedback that extends beyond the currently available information sources.

Trust and Reliability Analysis

NPBFX's trust and reliability assessment reveals both positive indicators and areas requiring additional clarification. The broker's establishment in 1996 shows longevity in the forex market, suggesting operational stability over nearly three decades. This extended operational history provides some confidence in the broker's ability to maintain consistent service delivery.

The achievement of over 20 industry awards represents significant third-party recognition and suggests peer acknowledgment of NPBFX's service quality and operational standards. Industry awards typically require rigorous evaluation processes, indicating that NPBFX has met various performance and service criteria over time.

However, specific regulatory information is not comprehensively detailed in available materials, creating uncertainty about the regulatory protections and oversight applicable to NPBFX operations. Regulatory transparency is crucial for trader confidence and legal protection, making this information gap a significant concern for potential clients.

The absence of detailed information about fund safety measures, segregation policies, and insurance coverage further limits the ability to assess the broker's trustworthiness comprehensively. These factors are essential considerations for traders evaluating broker reliability and fund security.

User Experience Analysis

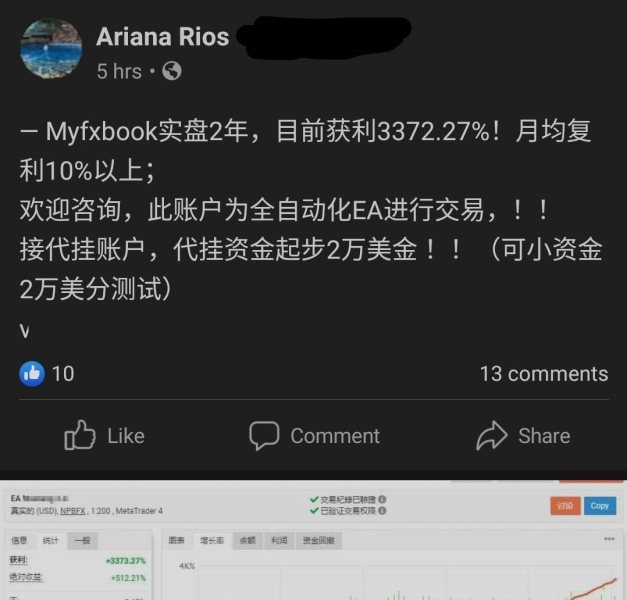

User experience evaluation for NPBFX shows positive indicators in specific areas while lacking comprehensive feedback across all service aspects. Available user testimonials particularly praise the copy trading functionality, with clients describing NPB Invest as highly effective and user-friendly.

The positive reception of the copy trading feature suggests that NPBFX has successfully implemented intuitive interface design and functionality that meets user needs. This aspect of user experience appears to exceed client expectations based on available feedback.

However, broader user experience aspects including account registration processes, verification procedures, and fund management operations are not detailed in available source materials. These operational touchpoints significantly impact overall user satisfaction and require evaluation for comprehensive user experience assessment.

Interface design quality, navigation ease, and overall platform usability beyond the copy trading feature remain unspecified in accessible information sources. The absence of comprehensive user feedback across all service areas limits the ability to provide complete user experience evaluation for potential NPBFX clients.

Conclusion

NPBFX presents itself as an established forex broker with nearly three decades of market presence and notable industry recognition through over 20 awards. The broker's STP/NDD operational model and positive user feedback about its copy trading functionality show competency in key service areas.

The broker appears well-suited for intermediate to advanced traders seeking diverse asset exposure across forex, precious metals, and energy commodities. The positive user reception of the copy trading feature particularly benefits traders interested in social trading strategies.

However, this Npbfx review identifies significant information gaps about regulatory transparency, detailed trading conditions, and comprehensive service specifications. Potential clients should conduct thorough due diligence and direct communication with NPBFX to get complete information before making trading decisions.