mina group fx 2025 Review: Everything You Need to Know

1. Summary

Mina Group Fx LTD is a new forex broker. This company has raised big concerns among professional traders and investors who work in the financial markets. The broker was founded in September 2023 and has its headquarters in Saint Lucia. It offers services in forex, cryptocurrency, and precious metals trading to customers around the world. However, the overall evaluation shows negative results because the company lacks clear regulatory oversight and has received several user complaints about whether it is legitimate. The firm registered in Saint Lucia, which is known for having relaxed rules for financial companies. This location makes the concerns even bigger because no reputable regulatory body has certified its operations. While Mina Group Fx wants to attract both forex and digital asset traders, potential users should be very careful because there are risks of scams and unclear trading conditions. This mina group fx review shows that people need to do thorough research before working with this broker because it has a short operational history and growing controversies.

2. Considerations

Mina Group Fx LTD is registered in Saint Lucia. Users should know that this region has less strict regulatory standards compared to other major places where financial companies operate. This creates risks, especially when it comes to protecting your money and preventing fraud. It is important to know that this review uses only the available information summary, and no direct checks have been done on the company itself. Potential clients should understand that without recognized regulatory oversight, they could face problems getting their money back or solving disputes when market conditions turn bad. The lack of proper regulation in this broker's structure is a major red flag for investors who want to avoid risks.

3. Rating Framework

4. Broker Overview

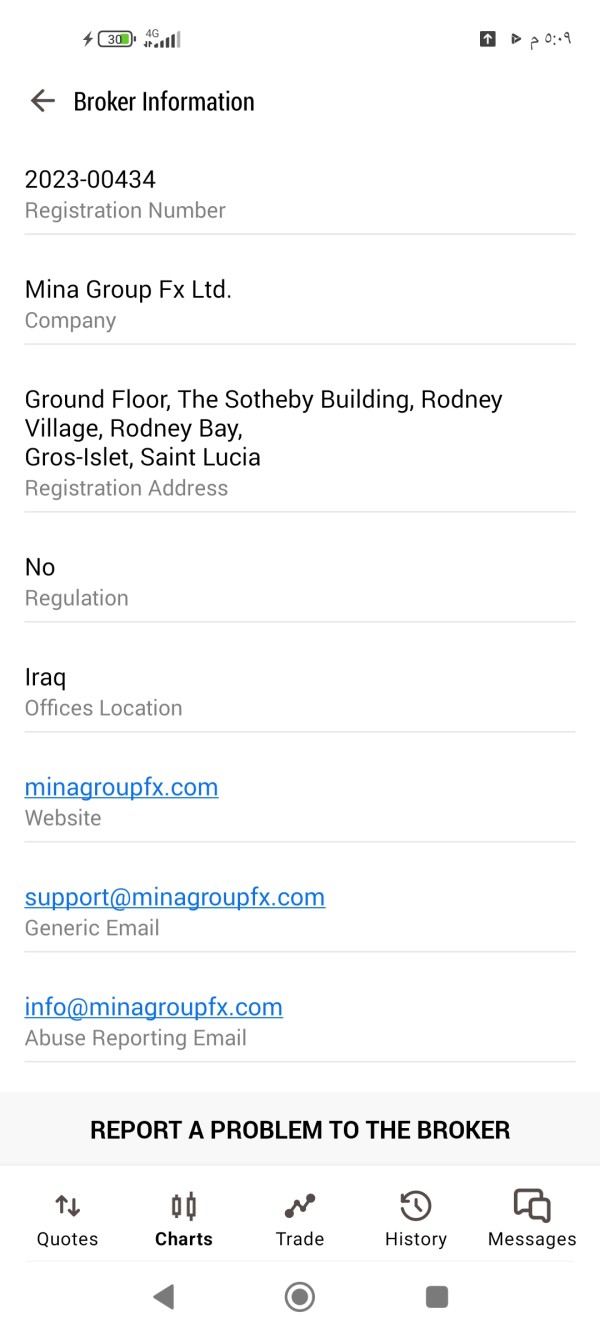

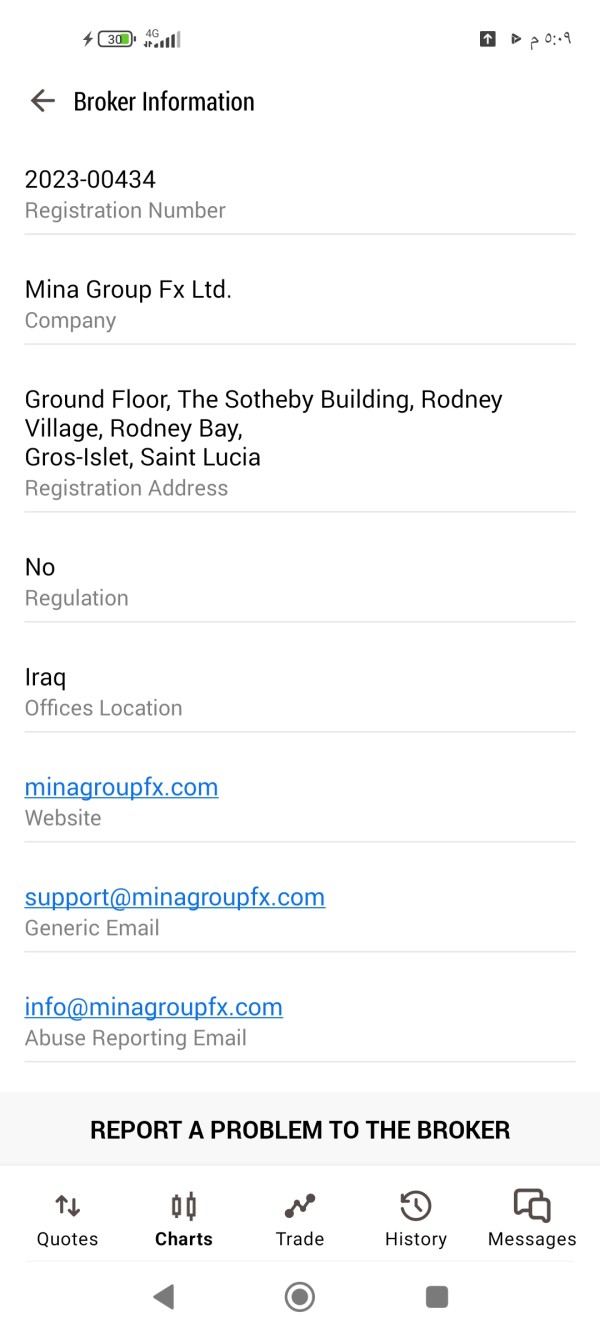

Mina Group Fx LTD started on September 7, 2023. This marked its entry into a market that has lots of competition from other trading companies. The company has its headquarters in Saint Lucia at Rodney Bay in Gros-Islet, in The Sotheby building, and it mainly focuses on forex trading services. The company also offers cryptocurrency and precious metals trading, which means it targets many different types of financial instruments. Even though the broker offers different types of trading, its short operational history and lack of strong regulatory backing have made market participants worried. This review shows that while the broker's young age might mean it has new approaches, the basic concerns about trust and following regulations are still not solved.

The trading platform information does not give details about the specific types or features of the trading technology used. This leaves potential clients without knowledge about user interface quality and platform stability. The asset classes available include forex, cryptocurrencies, and precious metals, which provide many trading opportunities. However, the lack of information about regulatory oversight remains the biggest problem with Mina Group Fx LTD. Without confirmation from reputable regulatory institutions, users must be extremely careful when using this broker. This mina group fx review reminds us that while having different types of assets might seem good, the clear problems with transparency cannot be ignored, especially regarding platform technology and account conditions.

-

Regulatory Region:

Mina Group Fx LTD is registered in Saint Lucia. The provided summary shows no mention of connection with any recognized financial regulatory authority, which puts its operations under serious scrutiny.

Deposit and Withdrawal Methods:

The available information does not describe specific deposit and withdrawal methods. This lack of detail about payment channels adds more uncertainty about the broker's operational transparency.

Minimum Deposit Requirement:

The summary does not include information about the minimum deposit requirement. Potential investors do not have clarity on the initial capital needed to open an account.

Bonuses and Promotions:

No details about bonus structures or promotional offers have been shared. Investors looking for additional value through promotions will not find any proven benefits here.

Tradable Assets:

The broker offers different asset classes including forex, cryptocurrencies, and precious metals. While the range of assets is wide, the specific instruments and trading conditions in these markets remain unclear.

Cost Structure:

There is no information about spreads, commission fees, and other transaction costs. This lack of disclosure creates a big concern about the true cost of trading and may hurt trading strategies.

Leverage Ratios:

No clear details about available leverage ratios are provided. The absence of such important risk management information adds more uncertainty for investors.

Platform Selection:

Even though the broker offers multiple asset classes, the information does not specify which trading platform is used for desktop or mobile trading. The absence of platform details leaves investors uncertain about the trading interface quality.

Regional Restrictions:

No information is available about geographical limitations or restrictions on client participation. This leaves a gap in understanding which regions might face more operational risks.

Customer Service Languages:

There is no disclosure about which languages the customer service supports. This may make it harder for non-English speaking traders to get support and affects overall service quality.

This section of the mina group fx review shows several uncertainties and areas that lack transparency. Investors must consider that many aspects important for making informed decisions are not clearly outlined, leaving a big information gap in judging the broker's true value and reliability.

6. Detailed Scoring Analysis

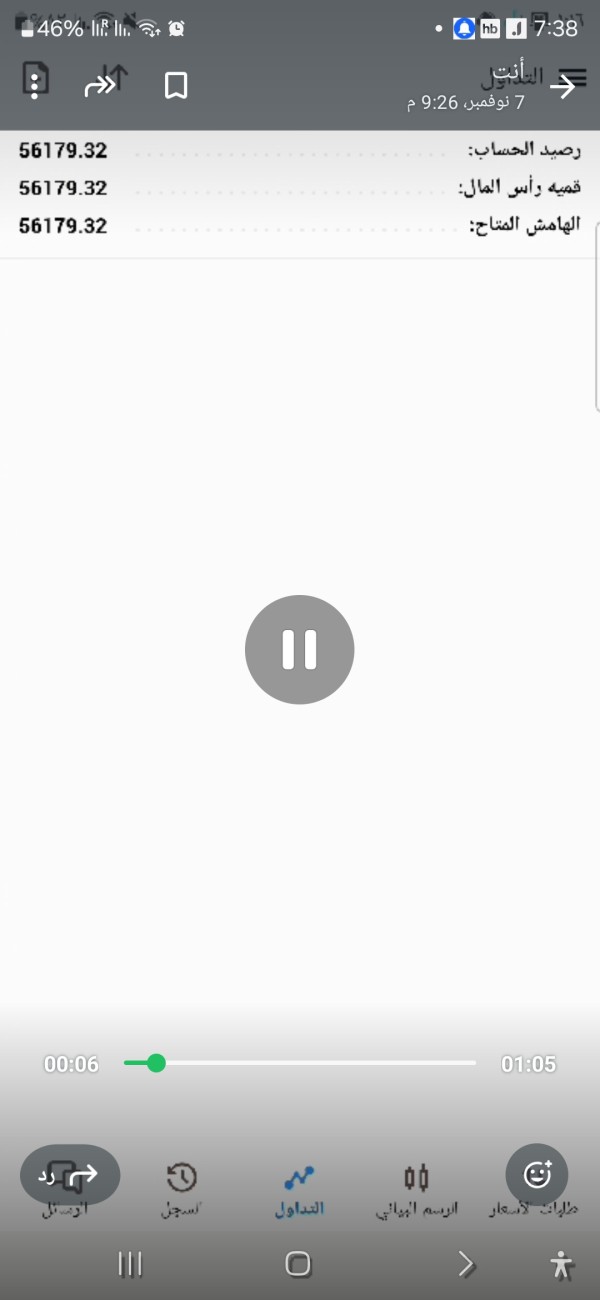

6.1 Account Conditions Analysis

Account conditions at Mina Group Fx LTD are unclear because there is no detailed information about spreads, commissions, or minimum deposit requirements. The review finds that without clear disclosures, investors cannot easily judge whether the trading costs are competitive or if there might be hidden fees. The account opening process remains unspecified, and there is no clear outline if specialized account types, such as Islamic accounts, are available. The limited details provided have made users express concerns about the overall transparency and trustworthiness of the broker. Comparisons with established brokers show that Mina Group Fx LTD falls short in clear communication of account conditions. Given the unclear standards, potential users face big uncertainty about the actual costs and risks involved in making trades. This lack of important information is a major reason for the low account conditions rating in this mina group fx review.

The evaluation of trading tools and resources shows that Mina Group Fx LTD does not offer enough clarity about the quality or range of its trading platforms. There is no specification of the types of trading tools, technical indicators, or charting software available to traders. The review does not identify any comprehensive research or educational resources that could help inexperienced traders develop their strategies. The absence of any mention of automated trading support makes the overall offering worse, particularly for algorithmic traders looking for advanced features. Compared with more established brokers, this lack of detail suggests that the broker may not be investing enough in technology and support tools. As a result, the scoring for tools and resources remains low, showing the potential difficulty in accessing strong trading systems. These problems together contribute to a poor user experience and a critical gap in what one expects from a modern forex broker in this mina group fx review.

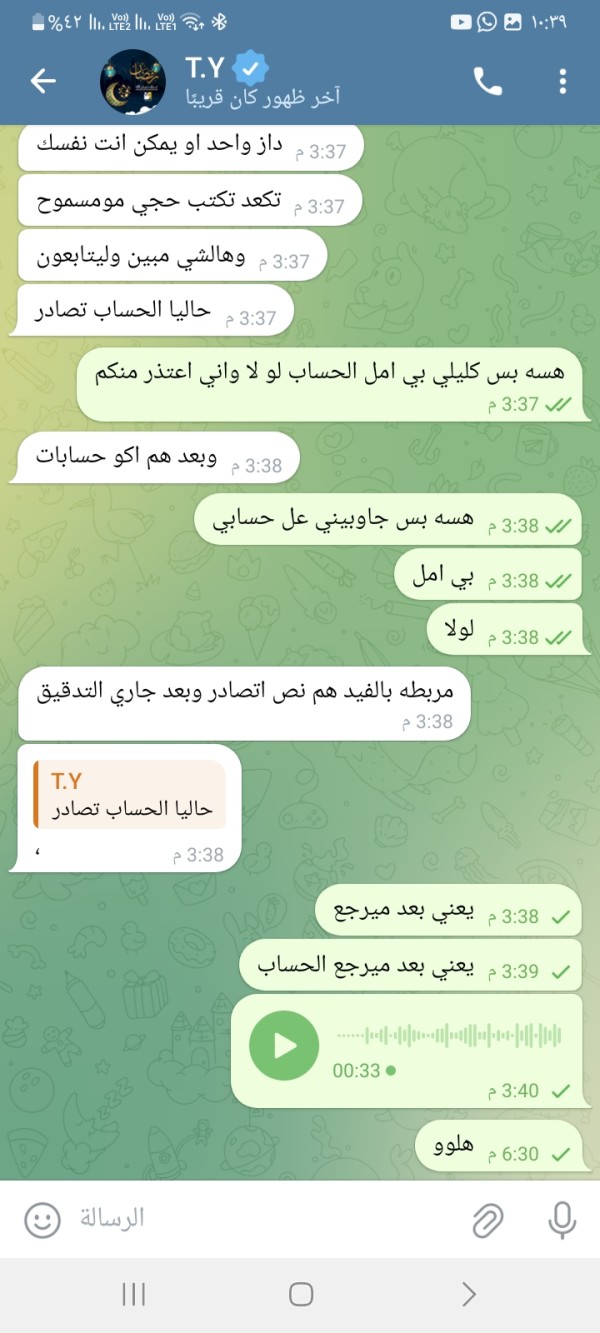

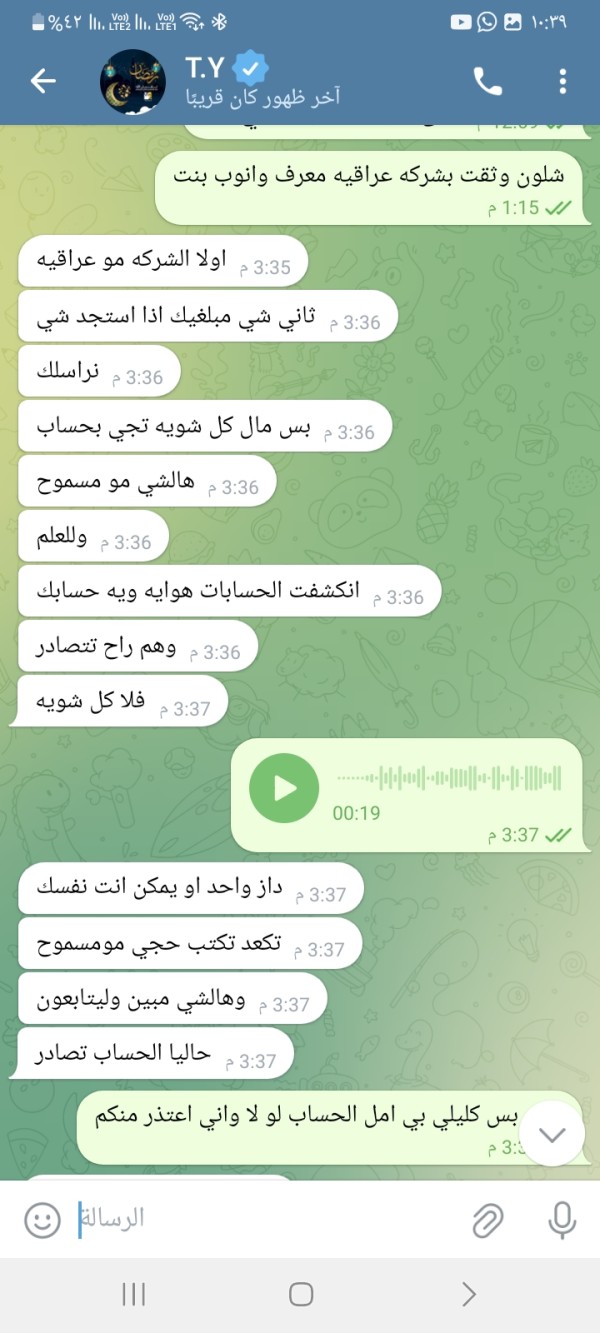

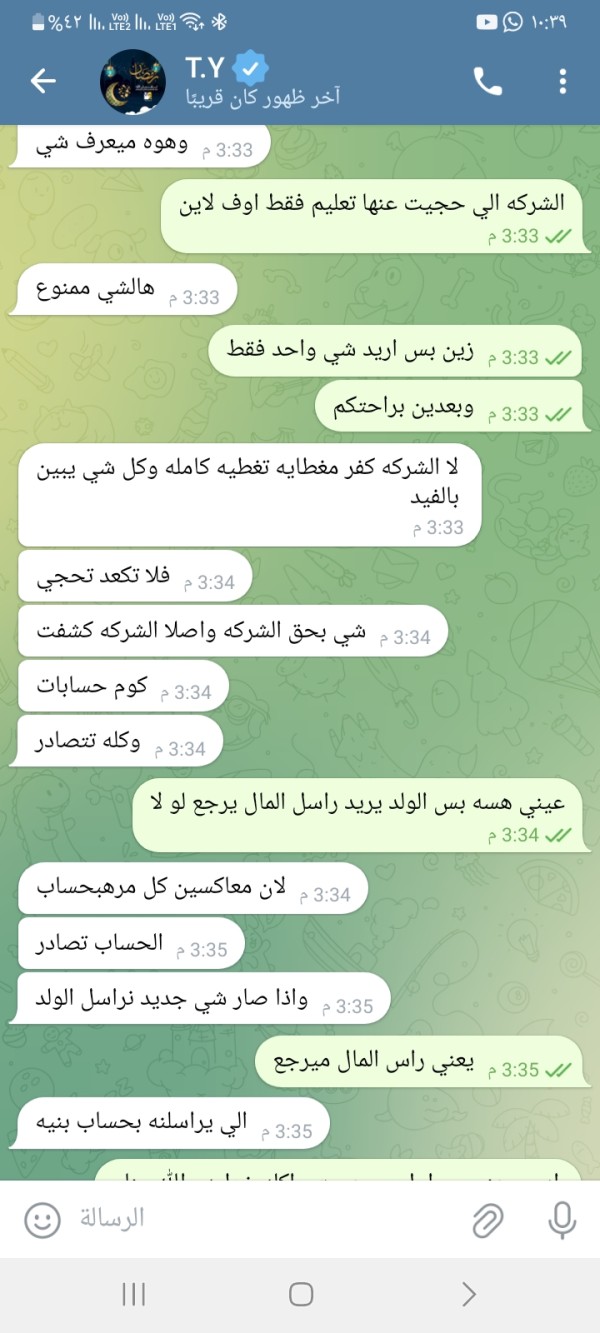

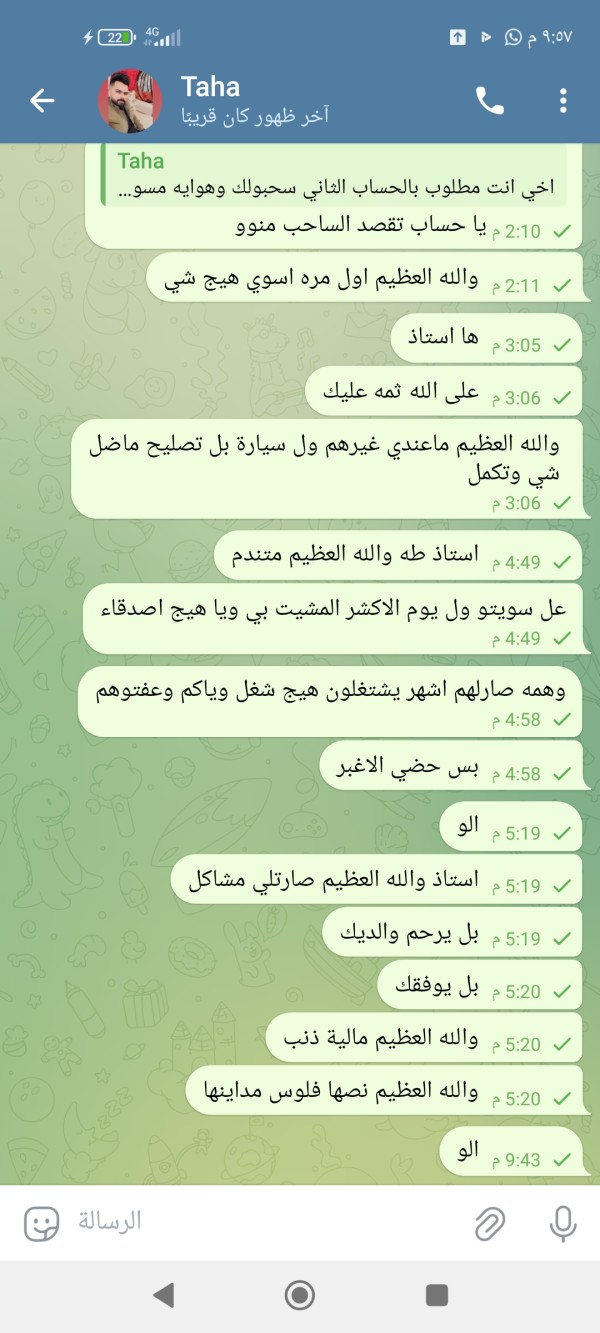

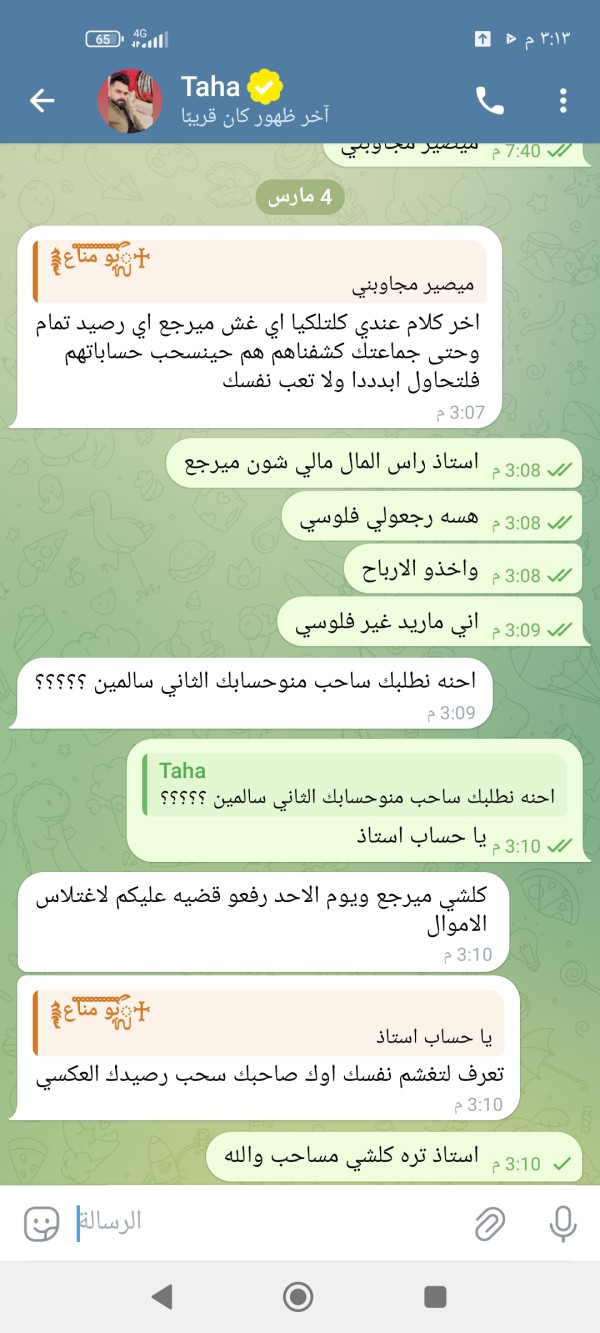

6.3 Customer Service and Support Analysis

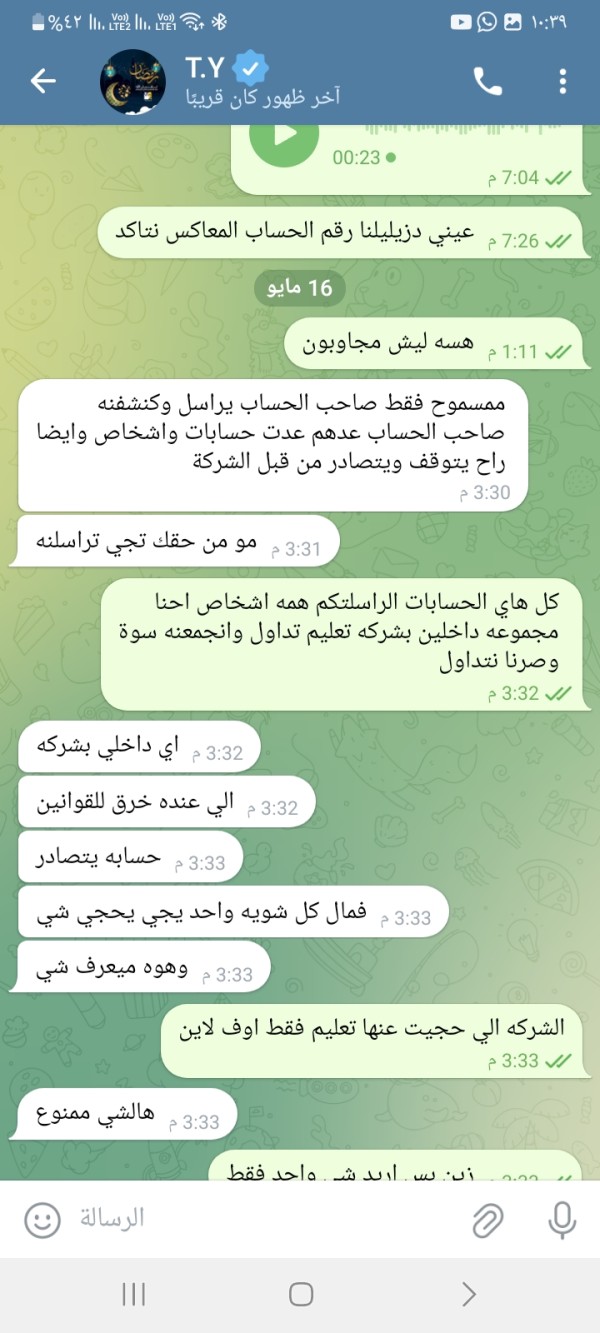

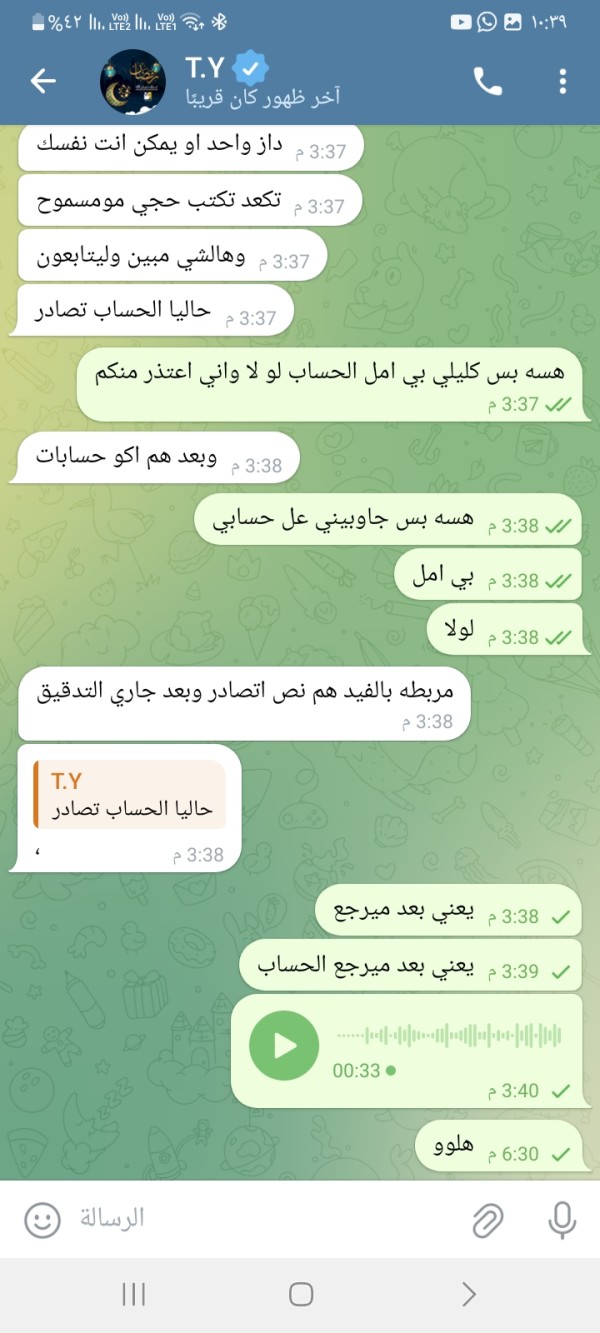

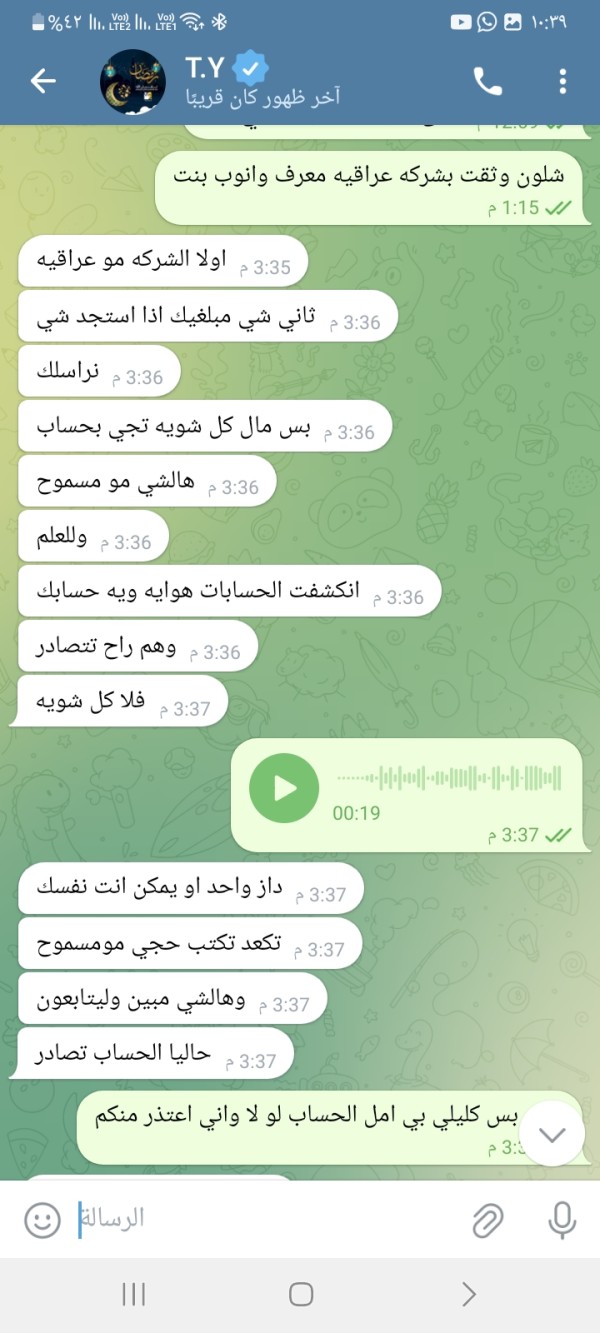

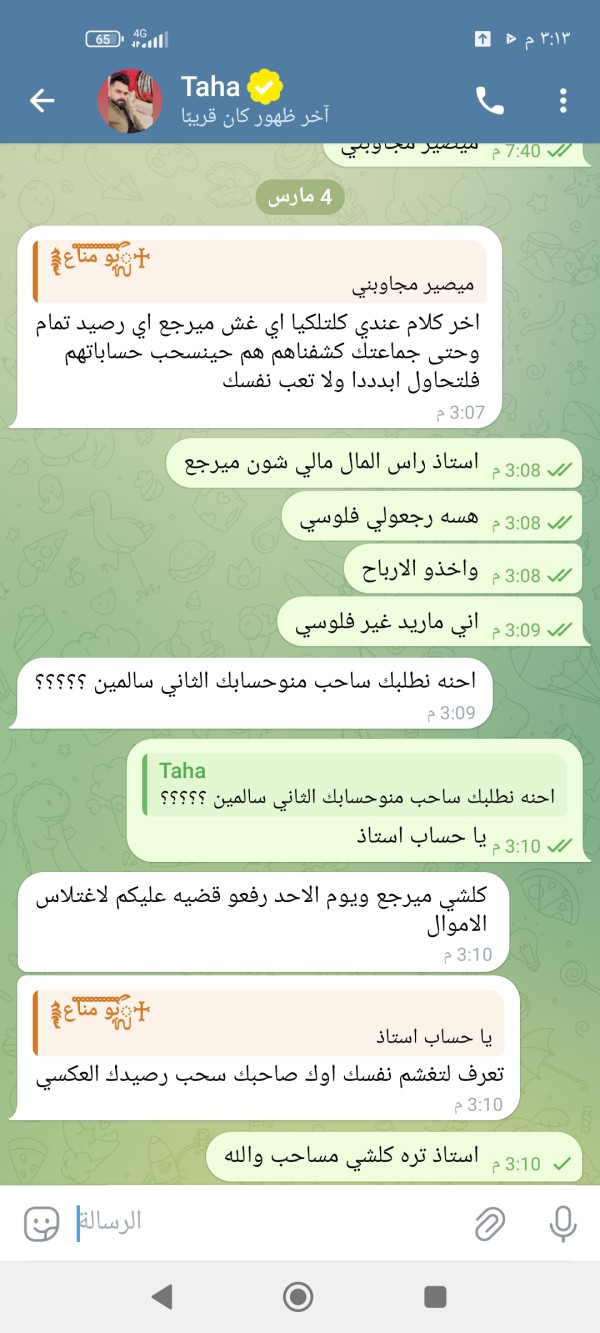

Customer service and support represent an important aspect where Mina Group Fx LTD appears to fail significantly. The available information suggests that users have reported negative experiences related to responsiveness and the overall effectiveness of the customer care team. Specific customer service channels, such as live chat, telephone, or email support, have not been clearly highlighted and may not be strong enough to handle user inquiries or issues. The reported feedback shows that response times are slower than industry standards, which makes traders more frustrated when they need timely help in volatile trading conditions. There is no mention of multilingual support, which further limits accessibility for non-native English speakers. The overall service quality has led to many user complaints, reinforcing the idea that the broker's support infrastructure is underdeveloped. This factor, emphasized by the negative feedback and the lack of detailed customer service information, results in a notably poor rating for customer support in this mina group fx review.

6.4 Trading Experience Analysis

The trading experience at Mina Group Fx LTD is hurt mainly by a lack of concrete information about platform performance and functionality. There is no detailed disclosure about platform stability, execution speed, or the range of available order types, which leaves traders uncertain about the quality of their trading environment. Without insights into whether mobile trading or desktop options offer smooth integration, investors risk experiencing frustration during critical market movements. The absence of specific platform features—such as advanced charting tools, one-click trading, or algorithmic support—suggests that the trading experience might be significantly disappointing compared to more technologically advanced brokers. The unknown factor of platform reliability negatively impacts overall trader confidence, leading to lower satisfaction and increased user complaints. This problem in operational clarity justifies a modest score in the trading experience category within the context of this mina group fx review, and potential clients are advised to proceed with caution.

6.5 Trustworthiness Analysis

In the area of trustworthiness, Mina Group Fx LTD faces severe criticism mainly because of its lack of clear regulatory credentials. The broker's registration in Saint Lucia, without disclosure of any internationally respected regulatory body, creates major doubts about its operational integrity. Investors cannot verify whether the broker follows standard practices for financial transparency and capital protection. There is no information about the measures taken to secure client funds, leading to further concerns about the safety of deposits and overall fraud prevention. The many user complaints and skepticism about the broker's legitimacy only make these doubts stronger, positioning Mina Group Fx LTD among less-trusted entities in the forex market. Compared to more established brokers that show strong regulatory compliance and clear safety protocols, this broker's position is even more dangerous. Such critical feedback from the market has resulted in an extremely low score for trustworthiness in this mina group fx review, urging traders to be very cautious before engaging with the platform.

6.6 User Experience Analysis

User experience at Mina Group Fx LTD is notably damaged due to multiple reported issues and insufficient operational details. The absence of a detailed explanation about the registration process, account verification steps, and intuitive design elements contribute to a frustrating overall user journey. Users have voiced complaints about a lack of transparency regarding fees and the difficult nature of account management processes. The poor feedback about customer service and the absence of clear instructions or readily available support make the negative experience worse. Compared to more established platforms known for their streamlined interfaces and user-focused designs, Mina Group Fx LTD falls short. The combined impact of these unresolved concerns has led to a generally low satisfaction rating from users. This segment of the mina group fx review further emphasizes that without significant improvements in user interface and service delivery, prospective traders may find the overall experience substandard and poorly managed.

7. Conclusion

In summary, Mina Group Fx LTD faces big challenges that significantly affect its overall rating. The absence of recognized regulatory oversight combined with multiple user complaints creates an environment of uncertainty and potential risk. While the broker offers a varied range of asset classes—including forex, cryptocurrencies, and precious metals—the lack of transparent information about account conditions, trading platforms, and customer support severely hurts its credibility. This platform is not recommended for investors with low risk tolerance. The key problems far outweigh the limited potential benefits, and caution is advised when considering this broker.